Recent dramatic declines in gold prices and strong redemptions from physical ETFs (such as the GLD) have been interpreted by the financial press as indicating the end of the gold bull market. Conversely, our analysis of the supply and demand dynamics underlying the gold market does not support this interpretation. Many major buyers of gold are adding to their stocks, while at the same time supply is flat or even decreasing, compounding an already vast imbalance.

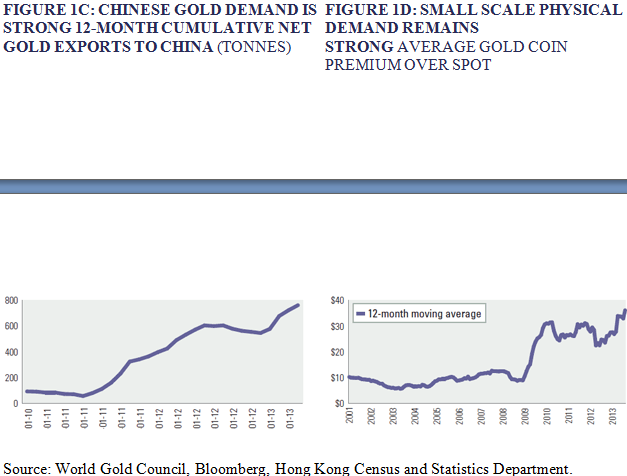

For example, central banks from the rest of the world (i.e. Non-Western Central Banks) have been increasing their holdings of gold at a very rapid pace, going from 6,300 tonnes in Q1 2009 to more than 8,200 tonnes at the end of Q1 2013 (Figure 1a). At the same time, physical inventories have declined rapidly since the beginning of 2013 (Figure 1b) (or have been raided, as we argued in the May 2013 Markets at a Glance)

1 and physical demand from large (Figure 1c) and small (Figure 1d) scale buyers remains solid.

As we have shown in previous articles, the past decade has seen a large discrepancy between the available gold supply and sales.

2 The conclusion we have reached is that this gold has been supplied by Central Banks, who have replaced their holdings of physical gold with claims on gold (paper gold).

Many recent events suggest that the Central Banks are getting close to the end of their supplies and that the physical market for gold is becoming increasingly tight.

Average premium calculated as the average premium for the following 1 oz. coins, as reported by the Certified Coin Exchange (CCEX): American Eagle, Maple Leaf, Krugerrand, Philharmonic, Panda, Isle of Man and Kangaroo.

Supply & demand factors

First, in January, the German Bundesbank (the second largest gold reserve in the world according to the International Monetary Fund (IMF) data), announced that they would repatriate their gold from the New York Fed’s vaults.

3 In total, 300 tonnes out of the 6,200 tonnes the New York Fed claims to hold should be relatively easy to transfer.

4 But the Bundesbank also announced that it would take about seven years to do so. If the gold is really there, it should not take much time to transfer a paltry 4.8% of the New York Fed’s vault.

Next, in March, there was the leaked letter from ABN Amro (a large Dutch bank) telling its bullion customers that redemption of physical gold from their allocated accounts would now be impossible.

5 Then, in April, we heard reports that UBS and Scotiabank were experiencing a “bullion depositor run”, where customers were lining up to withdraw their gold.

6 Finally, a few days later, we heard from Jim Sinclair that allocated gold deposits held in Swiss banks could not be withdrawn on the basis of directives from the central bank.

7

Why would a bank do that if it indeed had their customer’s gold in the vaults?

Lastly, on July 1st we learned that delivery times at the London Metals Exchange were as high as 100 days.

8 All these events strongly support the thesis that the strong physical demand we have seen over the past few years is putting ever increasing strains on the Central and bullion banks.

Reaction from central planners

Against all odds, the price of gold has experienced a large decline over the past few months, only slightly recovering over the past two weeks or so. Given the strong physical demand and the lack of available supply,

we think that this decline was engineered by central and bullion banks to increase available supply and decrease demand. They flooded the COMEX (paper market), only to then free-up physical gold from the various available sources at depressed prices (see our discussion of this topic in the May 2013 Markets at a Glance).

This has been manifested in the GLD trust and the COMEX inventories (see Figure 1b). Since the beginning of the year, and well before the April crash, one of the largest repositories of physical gold, the GLD trust, has seen redemptions of more than 300 tonnes of gold (Figure 2), while world mine production (excluding Russia and China) is approximately 2,300 tonnes a year.

9

If our thesis is correct, the Central Banks are running out of gold. What would happen if the world found out? This can’t be allowed, so the only option left for central planners is to try to tame the demand for gold.

These events have been met with some concerted reactions from the authorities.

First, in early April, the large commercial banks, who are also active participants in the various gold markets, started recommending that their clients sell gold, saying the metal was overpriced, while at the same time covering their own shorts in record amounts (Figure 3). Simultaneously, we have also seen a record amount of short interest from speculators (non-commercial participants) (Figure 3). More recently there was the talk of tapering by Fed officials that further precipitated the remaining long speculators to sell their positions. Finally, the Indian Central Bank decided, supposedly to reduce their trade deficit, to increase the gold import duty to 8% to try to tame demand (the third increase in 18 months).

10,11 Then, they imposed further restrictions, such as a tightening of bank credit for bullion importers and limitations on credit card purchases of gold.

12,13Those restrictions were interpreted as negative for gold, even though Indians will certainly exploit non-official channels to get their hands on the precious metal (see our Sprott’s Thoughts article on the subject: “Silver is winning India’s “War on Gold””).

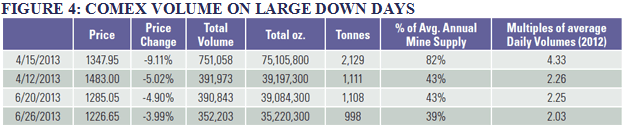

Suddenly, in a very short period of time, all the stars got aligned by the central planners to depress the price of gold. All that was needed was a few big moves in the paper market to finish the job. As Figure 4 shows, the enormous volume experienced on the largest down days have been highly suspect and unusual. For example, when gold declined more than 9% in April, the total amount of paper gold traded that day was 82% of average annual mine supply and more than 4.3 times the average volume of a normal day. A closer analysis of the tape for those days shows that what drove the price down was a few, very large sell orders on the COMEX. This further hints at price manipulation since a normal trader wanting to close a position would never send the whole order all at once, for fear of moving the market.

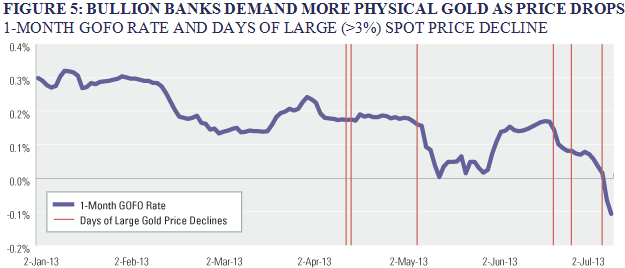

To further support our price manipulation hypothesis, we overlay the one-month GOFO rate (Gold Forward Offered Rate, the interest rate on a loan collateralized by gold) with days where the gold price suffered significant declines (more than 3%) in Figure 5. Unless it is the actual price drop that sparks all this increased demand, it seems counterintuitive that the gold price would decline precipitously before large declines in the GOFO rate, which implies increased demand for physical gold from bullion dealers.

It now seems that bullion banks are in desperate need of bullion, as evidenced by the increasingly negative GOFO rates we are seeing (Figure 5) and the backwardation in the futures market (future gold is sold to a discount to current gold).

Remember that a negative GOFO rate signifies that the bullion banks are ready to pay holders of physical to lease their gold, in this case for a month. Historically, negative GOFO rates have happened in very few occurrences. The last one was in November 2008, at the height of the financial crisis and after which gold rose 156% from through-to-peak. Before that, we saw negative GOFO rates in March of 2001 (about the start of the bull market) and September of 1999 (for a thorough discussion of these issues, see the Sprott’s Thoughts article: “Central Banks, Bullion Banks and the Physical Gold Market Conundrum”).

Summary

To recap, we believe that the central planners have engineered the recent gold drawdown in the following way:

Brokers recommend their clients to sell gold,

The same brokers cover their short positions on the COMEX,

While the GLD and the COMEX inventories suffer large redemptions/deliveries,

Taper talk crashes the gold price,

And India cooperates with other central planners to decrease physical demand.

Result:

Record speculator (i.e. hedge funds) short positions,

The GOFO rate goes negative,

Futures markets go into backwardation,

Physical inventories stand at record lows,

And a recant on taper.

Conclusion:

This was all orchestrated to increase supply and tame demand. We believe that central planners are now running out of options to suppress the gold price. After taking a pause, the secular gold bull market is set to continue.

1

https://www.sprott.com/markets-at-a-glance/redemptions-in-the-gld-are,-oddlyenough,- bullish-for-gold/

2

https://www.sprott.com/markets-at-a-glance/do-western-central-banks-haveany- gold-left/

https://www.sprott.com/markets-at-a-glance/do-western-central-banks-haveany- gold-left-part-ii/

3

https://www.bloomberg.com/news/2013-01-16/bundesbank-to-repatriate-674- tons-of-gold-to-germany-by-2020.html

4

https://www.federalreserve.gov/econresdata/releases/intlsumm/ forassets20130630.htm

5

https://www.silverdoctors.com/dutch-bank-abn-amro-halts-physical-gold-delivery/

6

https://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/17_ Massive_Run_On_Physical_Gold_%26_Silver_At_UBS_%26_Scotiabank.html

7

https://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/4/23_ Sinclair_-_Swiss_Bank_Just_Refused_To_Give_My_Friend_His_Gold.html

8

https://www.bloomberg.com/news/2013-07-01/lme-seeks-to-reduce-lines-atwarehouses- where-wait-is-100-days.html

9 Mine supply estimate supplied by World Gold Council; YTD gold mine production data suggests that total 2012 gold mine supply will come in lower around 2,300 tonnes, ex Russia and China production. In addition, Frank Veneroso has recently published a new report that warns that the supply of recycled scrap gold could drop significantly going forward due to the depletion of the inventories of industrial scrap and long held jewelry over the past decade. See June 2013 Markets at a Glance:

https://www.sprott.com/markets-at-a-glance/do-westerncentral- banks-have-any-gold-left/

10

https://www.forbes.com/sites/kitconews/2013/07/08/indian-gold-importsslump- in-june-analysts-expected-recovery/

11

https://online.wsj.com/article/SB100014241278873238448045785285026245427 88.html

12

https://stream.wsj.com/story/markets/SS-2-5/SS-2-275498/

13

https://www.mining.com/latest-indian-gold-buying-ban-credit-cardinstalments- 32399/