A Note From the Editorial Director: A question came into our Mailbag for Sean Brodrick recently that broke my heart. We don't know how much the author has lost on the stock he's asking about. But it's clear he's not followed Oxford Club advice about when to sell losing positions. Here's what he sent, with Sean's response below:

I hope that you can help me [understand] the situation at gold miner Allied Nevada Gold Corp.(TSX: T.ANV, Stock Forum). There is a lot of trouble in the stock. And a lot of investigation against ANV. Before all of this news, it was one of my favorite picks for the "coming" bull in the gold sector. I still have a bunch of stocks from the company, but for now there is a little doubt. I hope you will give your opinion and what's on your mind about ANV. - N.H.

I have stayed away from Allied Nevada for quite some time. The company has a market cap of $414 million. It currently operates only one mine.

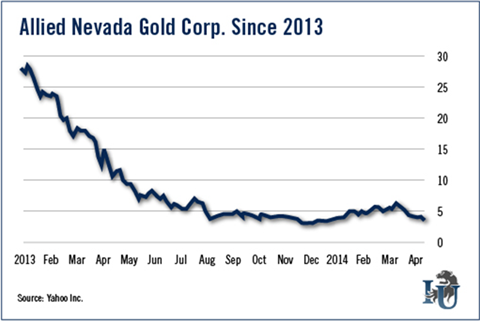

Recently, the stock was down 90% from highs it hit back in 2012.

By some metrics, like price-to-book value, this stock looks cheap. But it's also going through the legal wringer of a class action lawsuit.

The lawsuit is a drag on a company that's already under pressure.

The suit was filed in Nevada on April 4 on behalf of anyone who purchased (or otherwise acquired) Allied Nevada stock from Jan. 18 to Aug. 5, 2013, a period when shares declined by 77%.

Other lawyers have piled on, like sharks circling a wounded whale.

The complaint alleges that the company failed to disclose operating defects concerning its Lewis Leach Pad. In August, the company revealed that production costs had soared because of systemic operating defects there.

Why is that a problem? Because for months before the disclosure, the company didn't mention the problems while it talked up Lewis Leach's processing capacity, an expansion of the mill at its Hycroft Mine, expectations for gold and silver production, and potentially higher operating income and cash flows.

In the view of the plaintiffs, those actions were "false and misleading."

Also, in the weeks before the adverse revelations, the company sold $150.5 million shares in a secondary public offering.

I hate to comment on a pending court case. But generally speaking, I want management to be as forthcoming as possible about any problems. If they don't disclose potential problems, that really burns my buns.

In this business, communication and trust are crucial. That's why I'm in the field as often as possible.

But maybe Allied Nevada's management is just afraid of igniting more lawsuits.

We'll have to leave it to the court to decide if the company made proper disclosure of the problems with the leach pad.

As far as I know, no one at The Oxford Club (Investment U's publisher) ever recommended Allied Nevada. But it is worth noting that if investors who bought shares of it on January 18 had employed the Club's advice of placing a 25% trailing stop under every equity position, they would have ditched the stock by late February, and protected most of their principal.

There are other lessons we can learn from this. Allied Nevada is an example of...

- How a producing gold miner can trade at a discount to book value (0.54) and yet may get cheaper.

- How mechanical issues can have more impact on a mining company than the actual gold deposit.

- How trouble can lead to more trouble. That other trouble was the rumor of a Chinese buyout offer in January that made the stock pop... then turned out to be just a rumor.

Another reason for concern is that Allied Nevada has a high debt-to-equity ratio. It has lower cash flow than you'd like with all that debt.

But there are two sides to every story. Why are some investors quite vocal in their support of Allied Nevada? Because...

- The big loss in the most recent quarter was mostly due to year-end accounting write-downs.

- The company does have a new crusher coming online that should boost production and cut costs.

- It has increased its production guidance for both gold and silver in 2014.

All in all, I could understand why someone would buy Allied Nevada as an extreme value play. Heck, as the saying goes, "a higher gold price cures all sorts of problems."

However, at the end of the day, there is the lawsuit hanging over the company. I can think of other stocks trading at book value or below that I would rather buy now.

A better strategy might be to wait until a settlement from the lawsuit is announced or you think it's close to being announced. The stock is likely to pop once a settlement is announced. They usually do.

Good investing,

Sean

P.S. Do you have a question for me about mining stocks or hard-asset investing? Just use the comment link below, or send it to

mailbag@investmentu.com. I may answer it in a future column