After overwhelming feedback from both our previous articles on rare earth deposits, I decided to make this a trilogy and address some more of the many comments received from our newsletter subscribers. Moreover, I would like to take a step back and explain, on a more comparative level, how I arrived at Commerce Resources Corp.’s (TSX: V.CCE, Stock Forum) Ashram Deposit as my top pick for success in the rare earth element (REE) space.

Herein, I have ranked 15 REE deposits that are well-known in the space and/or subject to our reader’s comments. This rating is based on 6 criteria of evaluation (discussed below) and largely subjective in nature as there is no precise way to compare multiple REE projects in a definitive manner. As such, I have based my ranking on a comparison of deposit attributes, and on discussions with experts in the REE space. Please take this ranking as a guide that is subject to change based on a project’s internal developments.

The following 15 REE companies were mentioned in the research report:

#1: Commerce Resources Corp.

#2: Peak Resources Ltd.

#3: Frontier Rare Earths Ltd.

#4: Rare Element Resources Ltd.

#5: Tasman Metals Ltd.

#6: Great Western Minerals Group Ltd.

#7: Greenland Minerals & Energy Ltd.

#8: Arafura Resources Ltd.

#9: Matamec Exploration Inc.

#10: Namibia Rare Earths Inc.

#11: Quest Rare Minerals Inc.

#12: Avalon Rare Metals Inc.

#13: Ucore Rare Metals Inc.

#14: Texas Rare Earth Resources Corp.

#15: Geomega Resources Inc.

A listing of these 15 projects and their ranking can be found in Table 1 at the end of this article as well as a detailed project attribute listing in Table 2. The ranking of the 15 REE companies evaluated herein (Table 1 and Table 2) can be found in the full research report that is available as a PDF here.

Commerce Resources Corp.’s Ashram Deposit is at the top of my list due to its proven REE mineralogy and demonstrated mineral processing (>40% TREO mineral concentrate achieved), good grade, high tonnage, well-balanced REO distribution focused on the CREEs (critical rare earth elements), favourable economics, good jurisdiction, and a reasonable infrastructure development plan. I consider the Ashram Deposit to be the most balanced of any REE deposit in development, an overall quality I feel will be critical to the successful advancement of the project. Therefore, the Ashram Deposit receives the highest score of 27 points out of a possible total of 33.

However, before we begin our detailing of ‘The Criteria’, allow me to mention some macro fundamentals first.

Anyone looking into the REE space in-depth may come to the same conclusion that this industry is more complicated than typical commodities like gold, silver, copper, or iron ore. Although the overall market is less than 200,000 tonnes of total rare earth oxide (TREO) per year, the need is critical in just about every facet of our technological (‘high-tech’, ‘clean-tech’) savvy lives, and therefore, is important to understand.

Regarding the comparison of REEs to other commodities, one aspect that never seems to be discussed is, what effect would a new producer in the REE space likely have on the overall supply picture, and on the other projects in the sector?

A new copper or gold mine, for example, will increase global mine production by a relatively small amount, percentage-wise, and thus, have a negligible effect on the commodity price. However, a new REE mine which produces 20,000 tonnes REO/year, for example, could add ~10% to global production. This relatively large increase in supply will clearly have a negative impact on REE prices, unless the market is undersupplied with that specific element(s). This factor is also then exacerbated by the specificity of whatever the new REE producer is producing.

This is the reason that an assessment of a deposit’s REE distribution is needed; which is to say that depending upon how many and which element(s) a project is enriched in, will determine whether or not the project is still economic after another project begins production in one or more of the same element(s).

Correspondingly, this is also the reason that REE deposits cannot decrease their unit costs of production through large increases in mine output, as opposed to porphyry copper deposits for example. Large increases in mine output would cause even larger increases in supply, further increasing negative pressures on REE prices.

The fundamentals of light rare earth elements (LREEs), heavy rare earth elements (HREEs), and critical rare earth elements (CREEs), with respect to supply/demand, are further discussed under the criteria of ‘REE Distribution’ as noted below.

THE CRITERIA

The vast majority of present production is from China (>90%), and no major non-Chinese operations have existed in recent years with the exception of Molycorp Inc., and to some degree Lynas Corp. The REEs are not like iron ore, gold, or copper deposits where the metrics are easier to understand and comparative evaluation is more straightforward. There are factors that are comparative between all mining projects, but there are several additional factors that are specific to REEs and that play a dominant role in a comparative evaluation.

Thus, this article will endeavour to layout some basic metrics and criteria for comparative evaluation of any REE deposit for the retail or institutional investor.

As with any commodity, basic criteria exist for evaluating a project’s potential and comparing to one’s peers. For an REE project, a simple method of evaluation may follow the logic of assessing the following criteria in order of decreasing importance:

1. Mineralogy, Mineral Processing, and Metallurgy

Does the primary REE mineral(s) have a history of processing/recovery (present or past), and has a >30% TREO mineral concentrate been achieved?

2. Tonnage and Grade

Is there sufficient tonnage present with appreciable grade to support a reasonable mine-life and production scenario? Is there a consistency of mineralization in terms of TREO grade, as well as ore and gangue mineralogy?

3. REE Distribution

Is there a favourable and balanced REE distribution present and dominated by the 5 critical rare earth elements (CREE) that are in the highest demand, yet shortest supply; namely, neodymium (Nd), europium (Eu), terbium (Tb), dysprosium (Dy), and yttrium (Y)?

4. Economics

Has an economic evaluation been completed on the project and were the findings robust based on demonstrated data results and reasonable assumptions?

5. Infrastructure

Is the project reasonably close to power, water, and road access and/or is its infrastructure development plan practical?

6. Jurisdiction

Is the deposit located in a favourable jurisdiction?

If a project ranks highly in all these criteria (i.e. well-balanced across each), then it is immediately at the forefront of the space, at least to my way of judgement.

- MINERALOGY, MINERAL PROCESSING, AND METALLURGY

Mineralogy, and subsequent costs of mineral processing and metallurgy, will either stop you in your tracks or allow you to move forward and advance your REE project. This is the paramount criteria in assessing if a REE project has a reasonable chance of success.

As has been discussed in detail in our last articles, simple mineralogy (REE bearing and gangue minerals), and relatively low-cost demonstrated mineral processing and metallurgy is the foundation of success.

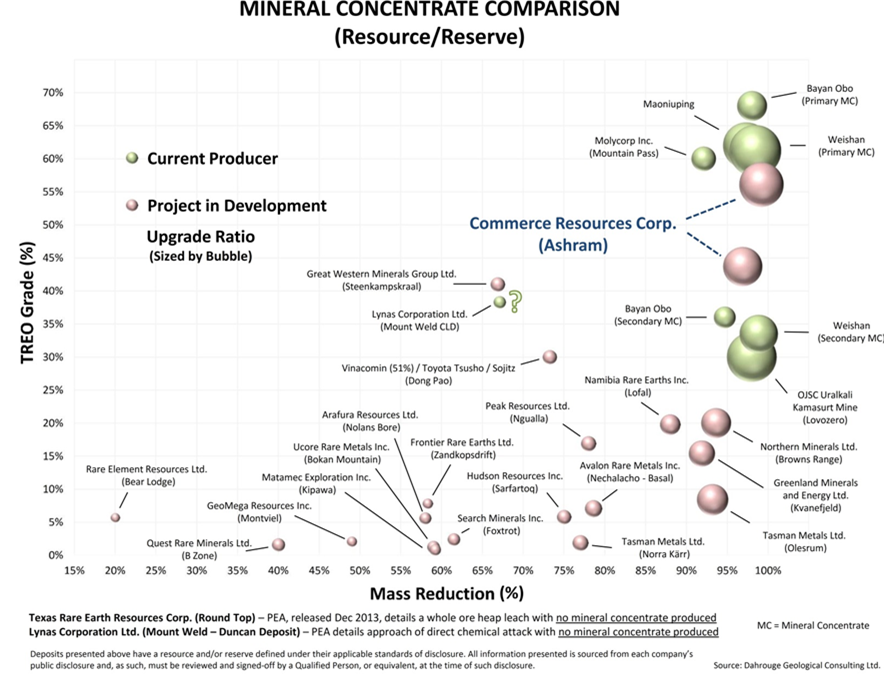

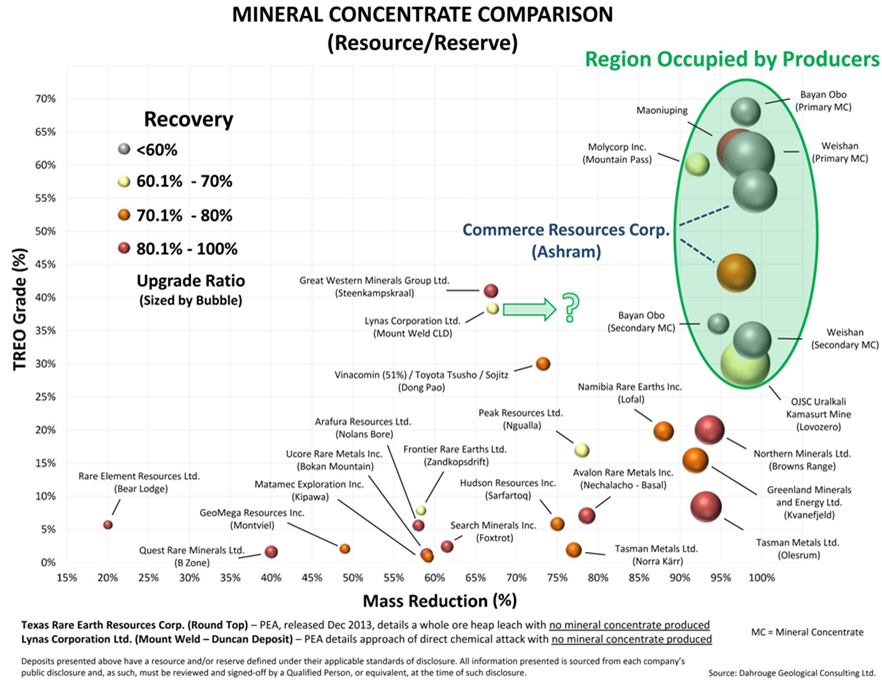

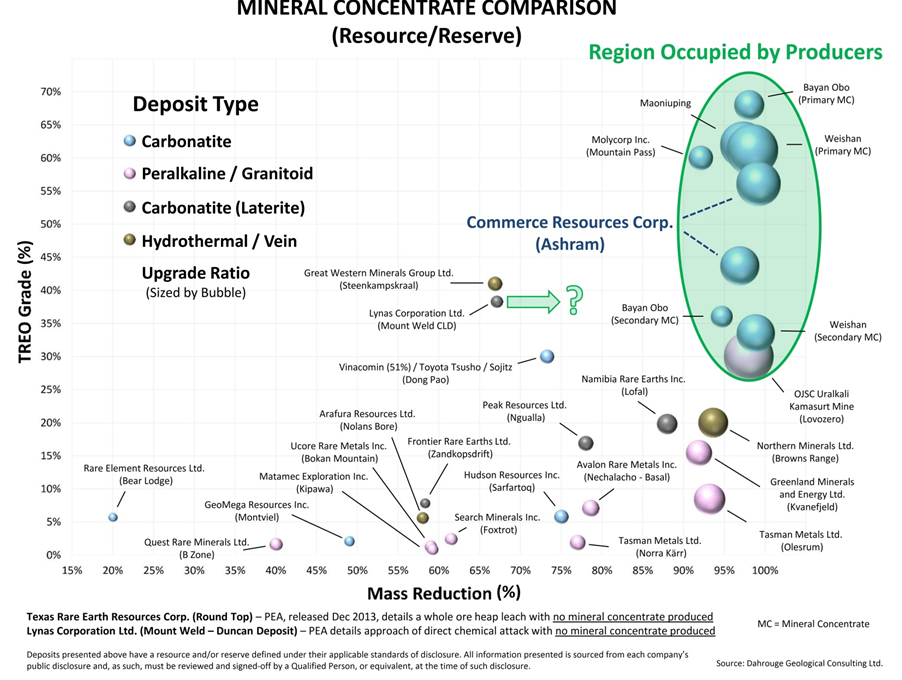

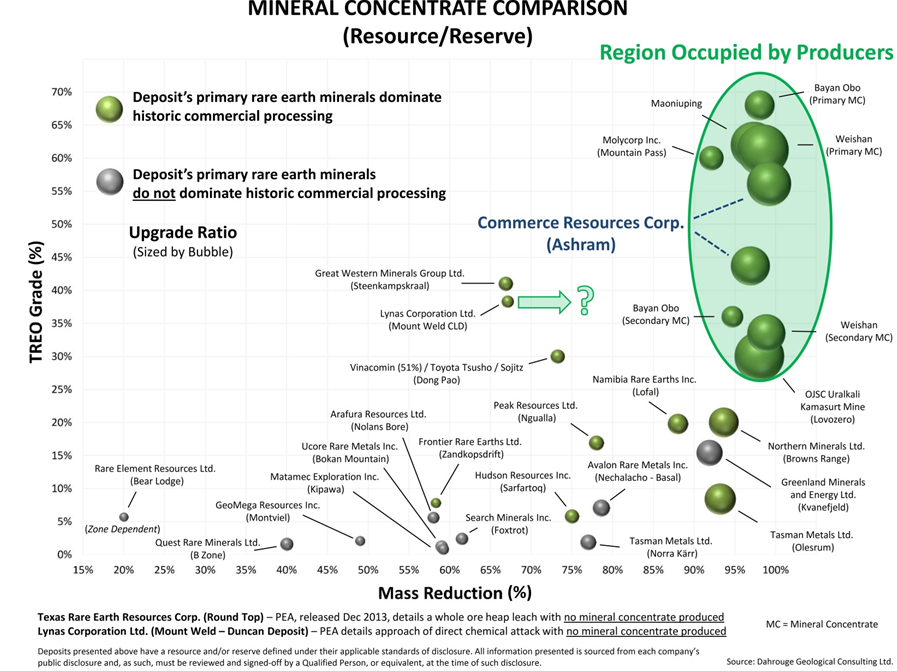

All currently producing hard rock REE deposits utilize a minimum 30% TREO mineral concentrate to operate (see following bubble charts). This not only requires a deposit that is amenable to low-cost physical upgrading to a mineral concentrate of sufficient grade, but also that the REE-bearing minerals present in the deposit contain high concentrations of REEs in their structure.

For example, if the REE mineral in a deposit contains only 10% TREO in its structure, it would be impossible to produce a 30% TREO mineral concentrate, even if the concentration process was perfect. It is important to understand that there are very few minerals that contain these high concentrations of REEs; the chief ones being monazite, bastnaesite, and xenotime, which are the same minerals that dominate commercial processing from hard rock deposits today, and historically.

It is also important to note that in many REE deposits, often more than one REE mineral contributes to a deposit’s TREO grade. In these cases, all of these minerals have to be separated to achieve an acceptable REE recovery and concentrate grade. However, they often do not all behave the same during physical processing. This is complicated further if co-products are also targeted (e.g. Nb, Ta, Zr). This is a fundamental reason why simple mineralogy is essential, if you have this then it is just easier, and cheaper, to separate and upgrade the ore to a mineral concentrate.

A good example of co-products complicating a flow-sheet is illustrated by Quest Rare Minerals Ltd.’s (Quest) recent release of a Preliminary Economic Assessment (PEA) on April 9, 2014, on the B-Zone that now replaces the Feasibility Study released on December 6, 2013.

I think Quest recognised that their project description (scenario) needed a very material revision for the project to be advanced; that being, production of a mineral concentrate. Although the PEA itself only lists design criteria essentially with limited actual test data, it is clear that Quest has made some improvements by achieving a mineral concentrate of about ~2.5% at reasonable recoveries I calculate (about a 2.5 times upgrade). However, in order to achieve this, the process flow-sheet had to be dramatically simplified by treating previous considered co-products (Nb and Zr) as waste, illustrating how a flow-sheet can be detrimentally complicated through co-products that require different process flow-sheets than the REE minerals. It is not easy to take a step back after so much effort has gone into to a mineral process flow-sheet, and I give Quest credit for starting anew in an attempt to simplify. In the end, I am far more interested in investing in a company that has simple mineralogy as this will more likely equate to simple processing.

Examples of deposits with complex or simple REE mineralogy are outlined in Table 2 at the end of this article. The B-Zone Deposit (Quest), Nechalacho Deposit (Avalon Rare Metals Inc.) and Bokan Mountain Deposit (Ucore Rare Metals Inc.) are good examples of complex, unusual, and unproven REE mineralogy, which leads to exceedingly difficult mineral processing and metallurgy. Now this does not mean that these companies will not succeed, it simply means that, for them to do so, the road ahead may be long, arduous, and more difficult than in comparison to peers that have simple and well-known mineralogy and that have demonstrated low-cost metallurgical successes, first and foremost the Ashram Deposit (Commerce Resources Corp.), the Steenkampskraal Deposit (Great Western Minerals Group Ltd.), and the Lofdal Deposit (Namibia Rare Earths Inc.).

We can also divide REE deposits into groups based on whether the host rock type has been a historic producing source of REEs or not. Apart from placer beach sands and the South China ion-absorption type clay deposits, only carbonatites have provided any significant source of REEs to the market so far.

I would like to comment further on this last statement with a quick note on the loparite mine(s) of the Kola Peninsula (Russia) and the Kutessay II Mine (Kyrgyzstan). I am not aware of any project in development that hosts loparite (REE, Ta, Nb) as its ore mineral and Kutessay II is a past-producing polymetallic mine (Pb, Mo, Ag, Bi) with REEs; a very unusual occurrence that had little impact on the world market during its mine-life (approximately 22,000 tonnes REO produced over 33 years). Neither of these occurrences are/were pure REE mines and arguably could not sustain (Kamasurt) or have sustained (Kutessay II) themselves without government subsidization or without the economic benefit of the other non-REE commodities present.

With respect to carbonatite laterites, this host deposit type illustrates that favourable REE mineralogy is only the first step, as it must also be demonstrated that it can be economically separated from the host rock with an acceptable recovery.

This is evidenced by the technical difficulties of Lynas trying to put the high-grade, world-class Mount Weld Central Lanthanide Deposit into production, a carbonatite laterite, which has not yet approached the targeted production capacity.

The subsequent series of bubble charts illustrate how vitally important it is for an REE exploration and development company to fulfill the following prerequisites:

1) A mineral concentrate of appreciable grade (ideally >30% TREO as is achieved by current hard rock producers).

2) A deposit type that has been a source of historic production.

3) A primary REE mineralogy that has dominated commercially processing historically, and proven to be easily broken down to release the contained REE.

As is clearly evident, the number of companies that fulfill these prerequisites is limited.

Bottom-line:

Simple, proven mineralogy that is amenable to low-cost mineral processing is the path of least resistance to production. From an economic perspective, there are far less unknowns in the processing requirements and costs involving proven minerals when compared to those that have never been commercially processed before. Sooner or later, the market will realize that complex mineralogy, along with unproven mineral processing and metallurgy, face significant challenges in terms of costs, which may turn out to be the cause of death of most REE development projects that many still consider promising.

For this criterion, the Ashram and Steenkampskraal deposits score the highest with a considerable gap following. The B-Zone and Round-Top deposits score the lowest as they have not produced a viable mineral concentrate.

2. TONNAGE & GRADE

If an REE deposit has the ‘right’ mineralogy, then it’s best to next take a look at its currently defined tonnage potential, associated grade, and potential by-product credits. If the tonnage is too low, providing only a limited mine-life or yearly production potential, then everything else is irrelevant, including metallurgy, as the project could only supply the market for a limited time which may outweigh the capital expenditure to bring the mine into production. If the grade is too low, then tonnage may not matter as the project would be very sensitive to decreases in commodity prices or cost increases.

Under either situation, the project would have much difficulty being financed and provide too little to the market over a limited time for any meaningful impact, regardless of how easy the mineral processing may be. The deposit is then forever limited to a ‘band-aid’ effect and would be far from a meaningful long-term supply solution.

Do not be misled by reading what appears to be a “reasonable mine-life” for a project. This is all a function of the throughput per day (tonnes or ore processed per day) and relates directly to the volume of REO produced per year; lowering annual REO production would extend the mine-life. In the end, low-tonnage, short mine-life projects will have a difficult time achieving production, let alone having a material contribution to the market in the medium and long-term, I would argue. Therefore, if one of these deposits were to get into production it would not prevent a larger player, which might make a meaningful market contribution, from getting into production as well.

The Steenkampskraal Deposit of Great Western Minerals Group Ltd. (GWG) is the best example of a deposit with a top-notch grade; but, with far too little tonnage to ever make a meaningful contribution to the market. The Bokan Mountain Deposit of Ucore Rare Metals Inc. is another example of a deposit with small tonnage, and relatively low grade, and is further burdened with complex mineralogy that has never been commercially processed. The Round-Top Deposit of Texas Rare Earth Resources Corp. is a prime example of a hard rock deposit with a large tonnage but a grade (around 0.06% TREO) that is lower than even some South China clay REE deposits. Coupled with its highly unusual ““REE” mineralogy, unconventional REE processing approach, and high total CAPEX (capital expenditure), this project faces considerable challenges, if you ask me.

Some may argue that low-tonnage operations with lower CAPEX may be first to be mined, and thus, first to achieve cash flow to fund new acquisitions. However, in reality this is very unlikely to occur as cash flow will be funneled back into the operation as sustaining CAPEX, OPEX (operating expenditure), and moreover, to paying back the debt that brought them into production. If Lynas has taught us anything, it is that achieving production is tremendously difficult for some deposits, let alone achieving full-scale production.

Another important aspect of REE deposit evaluation is the consistency of the mineralization in terms of grade, as well as ore and gangue mineralogy. This metric is critical to keeping costs in line and unknowns to a minimum. Inconsistency is a detrimental attribute to have in a deposit that is being mined as it adds unknowns that can be very costly, in that processing may have to be altered to accommodate these differences. Potential partners or off-takers look for one main thing in developing an REE project into a mine, and that is ‘simplicity’. The more simple a deposit is, the more predictable the mining and the processing is and, most importantly, the more predictable the economics are. Such information is often hidden deep in the project disclosure; however, it is crucial in evaluating an REE deposit.

One may argue that ore blending may be used to overcome non-uniform mineralization; however, this is an extra processing step that may present additional problems if the mineralization varies too widely. Therefore, it is best to be minimized or avoided.

Finally, tonnage and grade must be evaluated with REE distribution for a complete picture of any deposit’s production scenario. A deposit’s REE distribution is discussed in detail as the next criteria as it is also a critical attribute on its own. However, in terms of production scenario and absolute grade, this is determined by TREO grade multiplied by the REE distributions and summed together. When this is done, it becomes clear that Ashram’s MHREO Zone boasts a higher Dy grade (155 ppm Dy2O3 measured + indicated resources) than Kipawa (147 ppm Dy2O3 mineral reserves), and would produce more Dy per year than Bokan Mountain (106 tonnes vs 81 tonnes Dy2O3).

Bottom-line:

In the end, tonnage and grade are arguably the main factors that determine a long-term production scenario. Thus, although deposits like Steenkampskraal, Bokan Mountain, Lofdal, and Kipawa are trying hard to extend their resources/reserves into a reasonable mine-life, they are limited to how much actual REO they can produce per annum for a significant period of time to justify the high CAPEX such a project typically requires.

Finally, consistency in grade and mineralogy (ore and gangue) will add considerably to the simplicity of production and, in turn, economics.

For this criterion, the Ashram and Ngualla deposits score the highest with Steenkampskraal, Lofdal, Round-Top, and Bokan Mountain deposits scoring the lowest. For Steenkampskraal, the high-grade is dwarfed by the extremely low tonnage (<1 million tonnes) and vice versa, the Round-Top tonnage is dwarfed by the extremely low grade (~0.06% TREO).

3. REE DISTRIBUTION

Assuming that a project has proven mineralogy, has demonstrated low-cost mineral processing and metallurgy, and has a sufficient tonnage and grade to allow for a reasonable mine-life and production scenario, then REE distribution is the next criteria to evaluate.

REE distribution is defined as the proportion of each REE relative to all the REEs combined (15 elements in total, namely La through Lu plus Y) and is commonly quoted as LREE (La, Ce, Pr, Nd, Sm, Eu, Gd) and HREE (Tb, Dy, Ho, Er, Tm, Yb, Lu, + Y).

It is commonly thought that deposits with a distribution more enriched in the HREEs are more valuable than those enriched in the LREEs. This is because traditional evaluators of the REE space have given higher evaluations to HREE deposits, as these heavy elements (specifically Tb, Dy, and Y) are in short supply. Additionally, it has been argued that an increase in production of these heavy elements will not cause the same negative pressure on prices as the potential increased production of Ce and La, for example; which, one could argue, may be in oversupply at the present time and increased production via a new producer could put serious downward pressure on prices.

However, an evaluation focused on only the HREEs (Tb, Dy, and Y) is incomplete as it inherently ignores the 2 LREEs, Nd and Eu, that are also in short supply. Following the lead of the US Department of Energy, industry has categorized the short supply LREEs and HREEs (Nd, Eu, Tb, Dy, and Y) as the critical rare earth elements (CREEs).Therefore, the importance of an REE distribution is best represented by enrichment in the CREEs, i.e. those REEs in the shortest supply, yet highest demand (Nd, Eu, Tb, Dy, and Y). Thus, when evaluating a deposit’s REE distribution, one should focus on the CREEs and not the HREEs, and moreover, on the balance across the CREEs so as not to be entirely weighted in only one or two.

For example: Nd (an LREE) is anticipated to be 24% of the overall REE market demand by 2015 (Roskill 2011), and is currently a larger market than all the HREEs combined. Furthermore, Eu (also an LREE) has the highest dollar value per kg of any REE. This is one reason why Commerce’s Ashram Deposit is at the top of my list, because it has a well-balanced distribution that hosts significant Nd and Eu, as well as appreciable amounts of Tb, Dy, and Y. This means a more balanced weighting of the primary pay elements (CREEs) that act as an internal hedge to a price drop of one or more of those elements (see our previous article“Knocking out misleading statements in the REE space” for more details on this argumentation).

Thus, an important factor in the evaluation of potential new REE producers is the ratio of the basket price of CREE/tonne of ore to TREE/tonne of ore (i.e. $/kg CREE divided by $/kg TREE). The more the relative value of the CREE to the total REE basket price, the less effect the increase in supply will have on the realized REE price. However, this does not distinguish the weighting (i.e. distribution) of each CREE amongst themselves, and therefore, should not be evaluated independently.

Bottom-line:

When it comes to REE distribution, the CREE distribution is a better evaluation metric compared to the HREE distribution. However, for REE distribution to matter at all, it must be coupled with other demonstrated criteria required to advance the project, potentially to production. If the deposit has unproven mineralogy and metallurgy the road is exceedingly difficult and perhaps insurmountable. Moreover, if the project has insufficient tonnage and grade to merit a reasonable production scenario, then the deposit’s REE distribution becomes irrelevant, no matter how favourable.

For this criterion, I argue the Nechalacho Deposit scores the highest with the most well-balanced CREE distribution with Ashram close behind and on par with the B-Zone, Norra Kärr, Bokan Mountain, and Kipawa; yet the latter 4 being very low in Nd and Eu and overly weighted in Ty, Dy, and Y. The Montviel and Ngualla deposits score the lowest.

Of all of these deposits, Ashram is the only one with proven REE minerals, demonstrated mineral processing, and a deposit type that has produced REEs historically and still does today.

4. ECONOMICS

You could ask why economics are not the first criteria to be looked at when evaluating an REE deposit. This is a valid question as, in all cases, evaluation comes down to the overall economics of the project in relation to the product to be produced. That being said, I have intentionally focussed on the individual fundamentals of a project (“The Criteria”) that underpin the overall economic picture, and as having outlined these, it now leads us to a more practical discussion of economics.

It is important to note that most REE projects do not have their economics well constrained, or under control, even at the Feasibility level. No entity has built and operated a sizable REE mine in quite some time, so costs are still more of a question mark than not – and especially for those with host rock types and ore minerals that have never been commercially processed before. Therefore, attention should be used when evaluating the economics of a project with the focus directed at the attributes that would allow for costs to be minimised. For example, underground versus open-pit (strip ratio?) mining, simple versus complex mineral processing, which all relates directly to infrastructure and consumable requirements, etc. Let’s discuss in more detail.

There are 3 basic levels of evaluation; Preliminary Economic Assessment (PEA), Preliminary Feasibility Study (PFS), and Feasibility Study (FS). Each stage serves to further de-risk the project through increasing levels of scrutiny and study. A PEA evaluates the potential of economic viability, whereas the PFS and FS stages indicate if the project is actually economically viable under a base case scenario. Deliverables include Internal Rate of Return (IRR), Net Present Value (NPV), and payback. These, in turn, are essentially snapshots in time of a valuation, and subject to internal massage via the pricing applied to the pay elements (REEs), i.e. the ‘REE Price Deck’ (a price deck is an assumption on the future price of a commodity; similar to a forecast but intended more for internal use than to be made public).

There is wide variability in REE price decks used in these economic studies, making direct economic project comparison difficult. Therefore, at the end of the day, it may be best to simply note strong economics when derived from conservative price decks, or to compare projects by using identical price decks.

The CAPEX and OPEX of a project always need to be put into context with respect to the production scenario (tonnage and mine-life). Further, OPEX needs to be considered with respect to the end-product produced, and similarly CAPEX as well. This is because companies planning on going to separated oxide end-products will have a considerably higher CAPEX and OPEX relative to their peers that are choosing to just go to an intermediate end-product (e.g. mixed REO, mixed REC etc.). This is the result of additional processing facilities, extra technical staff, and extra consumables to achieve the more refined end-products. However, a more refined product, such as individually separated REOs, will provide higher revenues and may be the incentive to commit to such separation challenges. Essentially, it is a pure economic decision whether to sell a mixed REO, toll separate, or construct and operate an REE separation facility.

One economic aspect that is commonly overlooked is ‘sustaining CAPEX’. CAPEX is really expressed in 3 ways: ‘initial’ (capital required to attain production), ‘sustaining’ (capital required to remain in production over the mine-life, including production ramp-ups), and ‘total’ (initial capital + sustaining capital).

Often the CAPEX quoted by companies is the initial CAPEX as this is what will bring the deposit into production. This is a fair reasoning for quoting this number above the others as initial production yields cash flow that can be used to cover sustaining CAPEX. However, often a review of sustaining CAPEX in conjunction with initial CAPEX will illustrate a much clearer picture of the project’s financeability and economic robustness over time.

Let’s take Texas Rare Earth’s Round-Top Deposit as an example. Their updated PEA, released in December 2013, lists a relatively low initial CAPEX of $292 million, but with a whopping $553 million in sustaining CAPEX, bringing the total CAPEX to $845 million. This sustaining CAPEX is nearly double the initial CAPEX needed to get into production. I interpret 2 main reasons for this. First, the company may have decided to defer the majority of the capital expenditures until free cash flow is achieved yielding a lower initial CAPEX for start-up (this is also a method of increasing the NPV); and/or second, the mine is simply a capital intensive operation, i.e. relatively complicated operation, requiring large levels of cash infusions to remain operational. Either way, this project is modeled to require far more capital than most may realize and is why a good comparative evaluation puts this into perspective.

Quest is another example of a project with a relatively large sustaining CAPEX ($529 million) compared to its initial CAPEX ($1.63 billion). With a total CAPEX of $2.16 billion over the life-of-mine, a capital intensive operation is illustrated. I believe that this is a result of one fundamental issue: complex mineralogy resulting in very difficult mineral processing and metallurgy. Quest’s B-Zone Deposit has many positive attributes including a good REE distribution, great tonnage, good jurisdiction, and acceptable grade; however, all these attributes have to be weighed against CAPEX and OPEX in the end, because without financing, production cannot occur.

Several projects outlined in Table 2 (e.g. Norra Kärr, Bokan Mountain, Steenkampskraal, and Ngualla) may be noted as having relatively high sustaining CAPEX compared to initial CAPEX. This may either be a result of deferring start-up capital, through possibly incorporating a ramp-up in production over time, or capital intensive operations above basic operating costs.

It is also important to ask if a project with a relatively low CAPEX has a reasonable mine-life and production scenario. Many projects that are anticipated to be on the lower end for CAPEX requirements are also the same projects that have a limited mine-life and low production scenario, and thus, likely to have a limited contribution to the market.

Finally, I wish to comment on the economics of my top pick in the REE space, Commerce Resources Corp.’s Ashram Deposit. Although only a PEA has been released, it has detailed compellingly robust economics at a sizable production scenario. Commerce has chosen to quote its total CAPEX ($763 million) and not its initial CAPEX ($728 million), perhaps as this approach further highlights the project’s overall robustness that is second-to-none in my judgement. At only $35 million, the sustaining CAPEX for Ashram is the lowest of any REE project (listed above in Table 2) and is clearly among the lowest in the entire REE space. This relates to Ashram’s simple and straightforward nature (mining methods, consistency in mineralization, mineral processing, etc.).

Bottom-line:

In the REE space, simple mining methods coupled with consistent, well-known mineralogy, mineralization, and grade equates to a far more reasonable mining project to advance in terms of CAPEX and OPEX requirements (assuming technical challenges have been overcome; in most cases CAPEX will be the main factor for determining if a project may enter production). Finally, economics should never be ignored; however, it must always be evaluated with perspective and in context. Moreover, when evaluating one must relate the various CAPEX costs (initial, sustaining, and total), and the OPEX in relation to the end-product produced.

For this criterion, the Norra Kärr Deposit scores the highest with positive economics using a relatively conservative price deck, whereas the Ashram and Bear Lodge deposits follow closely behind. The Nechalacho and B-Zone deposits score the lowest with the B-Zone having the highest CAPEX of any project in our ranking.

5. INFRASTRUCTURE

All projects in development will require some form of additional infrastructure to attain production. This may include power, water, transportation (road/port), as well as processing and accommodation facilities. Therefore, infrastructure requirements for a project of any commodity, including those in the REE space, should not be ignored as they cannot be avoided.

In most cases, if the project is strong enough based on its fundamental attributes, regardless of the commodity, then infrastructure limitations may be overcome through increased CAPEX and OPEX. This is a balance that needs to be assessed on a project by project basis as more often than not, the most promising deposits are not located near ready infrastructure (i.e. power, road access, water, port, etc.).

Typically, the most capital intensive part of any REE project is the mineral processing and hydromet infrastructure. Therefore, it is an important aspect to evaluate which deposits will have simpler processing requirements as those are the ones likely to have lower capital costs in that regards. However, it is clear that projects closer to the required base infrastructure (power, water, and transportation) will benefit from a lower CAPEX in that particular area. Projects that lack some of those base infrastructure needs may still be advanced economically if a practical and reasonable development plan is outlined.

For example, Commerce’s Ashram Deposit requires a road of approximately 165-185 km and a relatively small docking facility. This is not ideal; however, their development plan is simple, practical, and reasonable with CAPEX partially offset by the simplicity of the mining methods and mineral processing; resulting in smaller, lower cost facilities required at the mine site. Commerce does not try to hide any of these costs through ‘wishful thinking’ of Government financial support. Instead, they chose to assume 100% of the construction and maintenance costs for the road in their PEA. I consider this a truly conservative approach as the Government, and exploration companies operating in the area, will almost certainly provide financial support for construction and/or maintenance. This is because the route would make the region much more accessible for exploration, and much more attractive for developing other projects into mines, and because it also forms part of “Plan Nord”, the Quebec Government’s northern development plan that coincides with some of Commerce’s infrastructure requirements.

In addition, the region where Ashram is located is host to a large number of promising exploration projects. This puts added pressure on the Quebec Government to collaborate with operators in the area to advance development of the entire region, as outlined in Plan Nord, as this would benefit greatly many projects in addition to Ashram.

Bottom-line:

Mineral processing, metallurgical, and related facilities are often the most capital intensive part of an REE project. However, projects close to base infrastructure (power, water, transportation) will benefit from a lower CAPEX in that area. It is also important to assess a project’s infrastructure requirement in relation to their overall location, but perhaps more importantly, how practical and reasonable the projects infrastructure development plan is. At the end of the day, it is always better to be close to good infrastructure than not; however, this is rarely the decisive factor in an REE projects evaluation.

For this criterion, the Ashram Deposit ranks low, although it does have a reasonable infrastructure development plan that may benefit from the potential of Plan Nord. The Norra Kärr and Bear Lodge deposits rank the highest with well-established infrastructure in close proximity. The Nechalacho Deposit ranks the lowest as their infrastructure plan remains unclear due to modifications to their project scenario after the release of their FS.

6. JURISDICTION

If an REE deposit has successfully navigated the first 5 criteria of evaluation, then I suggest a macro view of jurisdiction be considered next. Not all mining jurisdictions are equal, and although many may be navigated successfully in due course, several are downright project killers. However, as most exploration companies wisely aim to stay away from difficult jurisdictions, the issue is generally not a big one, and if so, is typically easy to identify early on.

Probably one of the easiest guides available to the general public is the Fraser Institute’s “Annual Survey of Mining Companies” that ranks global mining jurisdictions based on feedback from the mining and exploration industry. The Fraser Institute takes into account a number of policy factors including social acceptability, permitting, skilled workforce, legal system, environmental regulation, tax regime, etc. and is widely accepted by the industry as a good measure of “mining friendliness”. Most projects are doing okay in this category although in general, Africa, South America, and Asia are more difficult jurisdictions than North America, Australia, and parts of Europe.

The situations of Stans Energy Corp.’s Kutessay II Project in the Kyrgyz Republic (last at #112/112 in the 2013 Fraser ranking) and Pacific Wildcat Resources Corp.’s Mrima Hill Project in Kenya (#79/112 in the 2013 Fraser ranking) illustrate that being located in a favourable jurisdiction should not be ignored.

Bottom-line:

Jurisdiction matters in terms of revenue/profit from production (tax regime, etc.), approval time to production (permitting, etc.), and ownership of the basic mineral and mining rights (administration, etc.). For any project, regardless of commodity, it is worth understanding the risks.

For this criterion, all projects in our ranking are located in jurisdictions that should allow for advancement to production, albeit at differing levels of “red-tape”. Of note are the Nechalacho and B-Zone deposits, both of which cross 2 independent jurisdictions in their project scenarios, adding a level of bureaucracy that may increase time to production and subsequent costs.

The Ashram Deposit is located in Quebec and is considered a very favourable jurisdiction, ranking equivalent to Bokan Mountain (Alaska), Kipawa (Quebec), and Geomega (Quebec).

A SIDE NOTE ON ‘PROPRIETARY TECHNOLOGY’

In the REE space, the word ‘proprietary’ is typically code for “a forced, unconventional route of mineral processing and metallurgy”. In my opinion, this represents a large red flag and I best advise investors to at least proceed with caution.

Given the material change in stock price related to the proprietary REE separation technology recently disclosed by Geomega Resources Inc. (see new releases dated January 15 and February 25, 2014), I would like to break down exactly what this news really means in my opinion:

1. It is proprietary technology and in the REE space that typically means you have no alternative, and that puts you at a large disadvantage out of the gate.

2. Free flow electrophoresis is the name of the general technique being used here, even if the current variance is “proprietary”, and owned by Geomega and the operator Dr. Pouya Hajiani. It is generally thought that electrophoresis is an expensive technique and so, as all things come down to costs, it will be of interest to see exactly what the costs of this process might be.

3. Test results are based on synthetic mixtures using only a couple REEs, meaning only an ideal mixture is being tested as opposed to actual mineralized material from a deposit. Further, as only a couple REEs are in the synthetic mixture tested, it means the rest of the REEs (that would naturally be present as well) have theoretically already been removed (i.e. partial REE separation is inferred to be required prior).

4. Prototype laboratory equipment is used, which means that it is not only bench scale but a larger scale is not even possible at this point as the equipment does not exist (prototype = time to develop into commercial scale use). Therefore, this technology could not be included in an economic study until it is developed and Geomega has stated it will not be included in its PEA base case (sees news release dated January 15, 2014).

5. This final point may be the “coup de grâce”, in that if this technique does work (i.e. a process that is effective and economic), there is a significant potential that it will be licenced and proven successful when applied to other ore bodies. Simply put, it really makes no sense at all to suggest that this specific ore body (Montviel) is the only feed stock that would benefit from this technique. As such, this may then make the process, as it applies to Geomega, moot. Thus, all that has been done is to detail a technique that will arguably work better and more economically with any deposit that has higher grades, better distribution and larger tonnage.

In conclusion, this technology will most likely not aid in the development of Geomega’s Montviel Deposit. Although the technology could potentially benefit the entire REE space, this would likely be decades away, and the question is raised why after all Montviel – and not other, better deposits – will use this technology first. In other words: This may be a breakthrough in technology; however, it is likely decades away from being commercialized – if even possible at all.

Further, several readers have commented on why the Montviel Deposit, located in Quebec, with access via logging roads, has not been discussed in our past series of articles on the REE space. No doubt, the Montviel Deposit in an interesting deposit with several positive attributes; however, it is not far-advanced with no economic studies yet completed. Although appreciable Nb is present, it is also an LREE enriched deposit with what appears to be a heavy component separate from the main ore body without a defined resource, and is thus best described as only an occurrence. Until a PEA is completed, the implications of the considerable overburden present over the deposit remain unclear, and further, it remains to be seen how the unusual REE mineralogy will process. Additional information on Geomega can be seen in the above bubble charts, as well as Table 1 and 2.

CONCLUSION

As is evidenced above, the evaluation of an REE development project is more complicated than evaluations of projects in more “typical” commodities.

The simple lack of expertise in the space, due to the small number of producing mines globally, coupled with the up to 15 pay elements + co-products (each with their own supply-demand fundamentals) and misconceptions about what are the most important factors to be considered – accompanied with “excellent” marketing and the significant variance in the REE price decks used – makes comparative evaluations a truly daunting task unless put into the proper context.

In a space that is so poorly understood and so technically challenging it is essential to stick to a simple method of comparison that relies on tangible data and historically proven methods.

All this being said, no single criteria should be taken solely on its own when evaluating the merits of any particular REE deposit, as there exists an interdependency that should not be ignored.

The ideal deposit will have favourable attributes in each criteria (i.e. well-balanced) of mineralogy, tonnage, grade, REE distribution, economics, jurisdiction, and infrastructure; and although an ‘ideal’ deposit may not exist in the REE space, there are some promising candidates in the space.

Commerce Resources Corp.’s Ashram Deposit sticks out clearly as the best candidate to me, and is thus my top pick in the entire REE space at this point of time and, as laid out above, in the foreseeable future.

Below is a summary ranking (Table 1) of the 15 REE deposits evaluated herein, with a detailed attribute breakdown outlined in Table 2 following. As discussed earlier, these rankings are largely subjective, and based on qualitative data through the criteria discussed herein. I invite our readers to review in detail Tables 1 and 2, and other available information, and arrive at your own conclusions accordingly.

However, it is clear to me that Commerce Resources’ Ashram Deposit is the most well-balanced of any REE project and is thus by far the most attractive REE investment opportunity in the space, which is also thanks to the market for not (yet) having recognized it.

The ranking of the 15 REE companies evaluated herein (Table 1 and Table 2) can be found in the full research report that is available as a PDF here.

Link to live chart (15 min. delayed): here

Link to live chart (15 min. delayed): here

Disclaimer: The author of this report holds stock companies mentioned and was paid for the report by a shareholder of Commerce Resources. Please read the full disclaimer on

www.rockstone-research.com and within the PDF of the above mentioned research report.