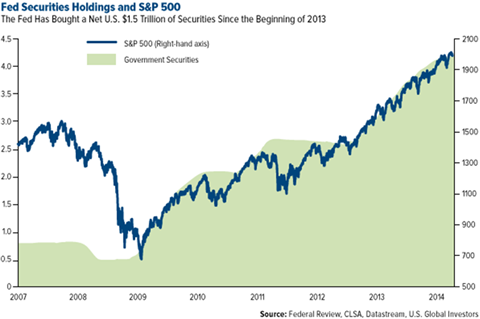

One of the greatest fears this October—possibly the most volatile month of the year—has been the correlation between the S&P 500 Index’s ascent in the first three quarters of the year and the possible ramifications of the end of quantitative easing (QE).

It’s well known that Japan and Singapore have been buying their countries’ blue chip stocks with their excessive money printing. Today, about 1.8 percent of the Japanese market is owned by the Bank of Japan. American investors fear the Federal Reserve might do the same and take away the punch bowl, so to speak.

As you can see, the S&P 500 Index has been rising in tandem with government securities, and it’s uncertain what will happen when QE ends.

The Ebola epidemic has also contributed toward moving the needle to the fear side of the spectrum and driven investors to seek shelter not in gold necessarily but in so-called “Ebola stocks.” For every negative, as tragic as they often are, there is a positive. When a major hurricane hits Florida, for instance, insurance stocks fall while real estate stocks rise.

The deadly Ebola virus, on top of an aging demographic, has helped make health care and biotechnology pop this year. The Daily Reckoning’s Paul Mampilly, in fact, calls this rally “the biggest biotech market ever.”

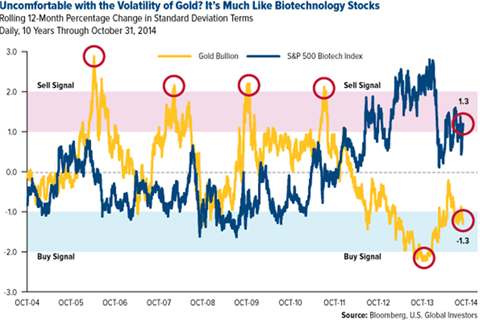

Possibly. Before we get too excited, let’s look at the numbers. Over the last 10 years, the S&P 500 Biotechnology Index has had a rolling 12-month percentage change of ±23. As of this writing, the index is up 32 percent, meaning it’s up by only 1.3 standard deviation. In other words, biotech is behaving approximately within its expected range.

Gold bullion, over the same period, has had a percentage change of ±19—not so dramatically different from biotech—and is down by 1.3 standard deviation. Again, this is “normal” behavior.

As you can see, biotech corrected and then rallied firmly into the sell zone. Seventy percent of the time, it’s normal for the asset class to rise and fall one standard deviation. Each asset class has had its own DNA of volatility over the last 10 years. Knowing this helps you manage your expectations of how they perform.

Asset Class Standard Deviation

WTI Crude Oil 34%

Gold Stocks 34%

Emerging Markets 29%

S&P 500 Index 17%

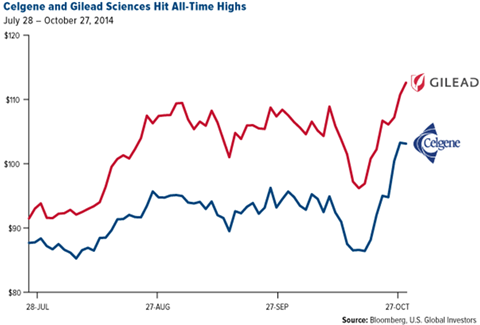

Even health care and biotech companies not actively working toward finding treatments and vaccines for the virus seem to have incidentally benefited from the rally. California-based Gilead Sciences and New Jersey-based Celgene, for instance—both of which we own in our All American Equity Fund (GBTFX) and Holmes Macro Trends Fund (MEGAX) and were named by Motley Fool as two of the four most important stocks of the last 16 years—have hit all-time highs.

Gilead Sciences concentrates mostly on drug therapies for HIV and hepatitis B, while Celgene conducts similar work for cancer and inflammatory disorders.

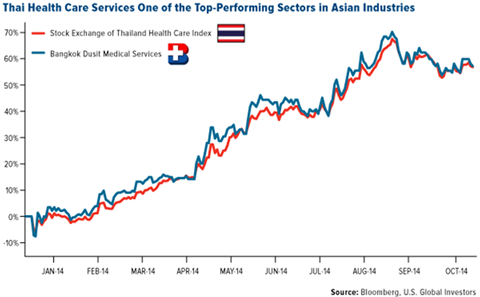

And it’s not just American health care stocks that are doing well. We’ve been impressed lately with the performance of the Stock Exchange of Thailand Health Care Index and Bangkok Dusit Medical Services, Thailand’s largest private hospital operator, which we hold in our China Region Fund (USCOX). Both the index and the equity have excelled year-to-date, delivering 57 percent.

Bullion and Gold Stocks

As for gold, between mid-August and October 3, the precious metal completely ignored the fact that September is historically its best-performing month, tumbling 9 percent from $1,310 to $1,190. It soon rebounded in the days leading up to Diwali.

Gold stocks, on the other hand, have yet to recover. Since the end of August, the NYSE Arca Gold BUGS Index has plunged 25 percent to lows we haven’t seen since April 2005. The Market Vectors Junior Gold Miners ETF has lost nearly 30 percent; the Philadelphia Gold and Silver Index (XAU), 25 percent.

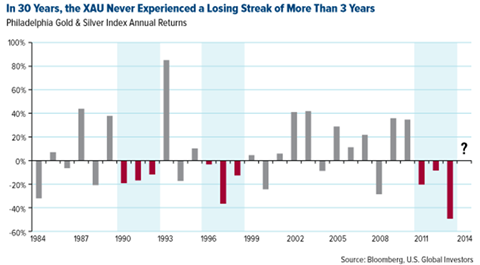

On a few occasions I’ve pointed out that in the last 30 years, the XAU has never experienced a losing streak of more than three years. As of this writing, it’s lost close to 17 percent, with only two months left. The cards are definitely stacked against the XAU, but I remain optimistic it can continue the trend.

Many investors are understandably concerned that mining companies in West Africa will suffer because of Ebola. Several companies operating in the three hardest-hit countries have indeed been hurt by the virus, some of them being forced to halt production. However, none of our funds has any direct exposure to them.

Three companies that we own in our Gold and Precious Metals Fund (USERX) and World Precious Minerals Fund (UNWPX)—Iamgold Corp. (TSX: T.IMG, Stock Forum), Newmont Mining Corp. (NYSE: NEM, Stock Forum) and Randgold Resources Ltd. (NASDAQ: GOLD, Stock Forum) —continue to operate normally in the region.

Here I must remind investors that we recommend 10-percent holding in gold: 5 percent in bullion, 5 percent in stocks.

Rebalance every year.

Looking Past Ebola

One of our most important tenets at U.S. Global is to always stay curious. That includes being familiar with world events and determining how they might affect our funds. Ebola certainly falls into this category, but that doesn’t necessarily mean our funds will undergo any significant changes based on this unfortunate event. Again, other factors have contributed, including the so-called October effect. We remain committed to our fundaments and pick stocks because they’ve been well-screened and fit in our results-oriented models.

If the markets seem too volatile for you right now,

we’re proud to offer investors a “no-drama” alternative. Check out our Near-Term Tax Free Fund (NEARX), which has delivered positive returns for the past 13 years.

Happy investing, and stay safe!

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

Past performance does not guarantee future results.

Bond funds are subject to interest-rate risk; their value declines as interest rates rise. Tax-exempt income is federal income tax free. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. The Near-Term Tax Free Fund may invest up to 20% of its assets in securities that pay taxable interest. Income or fund distributions attributable to capital gains are usually subject to both state and federal income taxes. The Near-Term Tax Free Fund may be exposed to risks related to a concentration of investments in a particular state or geographic area. These investments present risks resulting from changes in economic conditions of the region or issuer.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, a regional fund’s returns and share price may be more volatile than those of a less concentrated portfolio.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Stock markets can be volatile and can fluctuate in response to sector-related or foreign-market developments. For details about these and other risks the Holmes Macro Trends Fund may face, please refer to the fund’s prospectus.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The S&P 500 Biotechnology Index is a capitalization-weighted index. The index is comprised of six stocks whose primary function is technology based on biology, used in agriculture, food science and medicine. The Stock Exchange of Thailand Health Care Services Index is capitalization-weighted index of all stocks of the Stock Exchange of Thailand Index that are involved in the health care service sector.

The index was developed with a base value of 100 on April 30, 1975 with parent index SET. The NASDAQ Biotechnology Index contains securities of NASDAQ-listed companies classified according to the Industry Classification Benchmark as either Biotechnology or Pharmaceuticals which also meet other eligibility criteria. The NASDAQ Biotechnology Index is calculated under a modified capitalization-weighted methodology.

The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The Market Vectors Junior Gold Miners Index is a market-capitalization-weighted index. It covers the largest and most liquid companies that derive at least 50 percent from gold or silver mining or have properties to do so. The Philadelphia Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. Holdings in the funds mentioned as a percentage of net assets as of 9/4/2014: Gilead Sciences Inc. 1.84% in All American Equity Fund, 1.93% in Holmes Macros Trends Fund; JPMorgan Chase & Co. 0.00%; Celgene Corp.

1.23% in All American Equity Fund, 1.14% in Holmes Macros Trends Fund; Bangkok Dusit Medical Services 0.00%; IAMGOLD Corp. 0.90% in Gold and Precious Metals Fund, 0.19% in World Precious Minerals Fund; Newmont Mining Corp. 1.11% in Gold and Precious Metals Fund, 0.26% in World Precious Minerals Fund; Randgold Resources, Ltd. 1.92% in Gold and Precious Metals Fund, 1.17% in World Precious Minerals Fund; Market Vectors Junior Gold Miners ETF 0.16% in Gold and Precious Metals Fund, 0.17% in World Precious Minerals Fund.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.