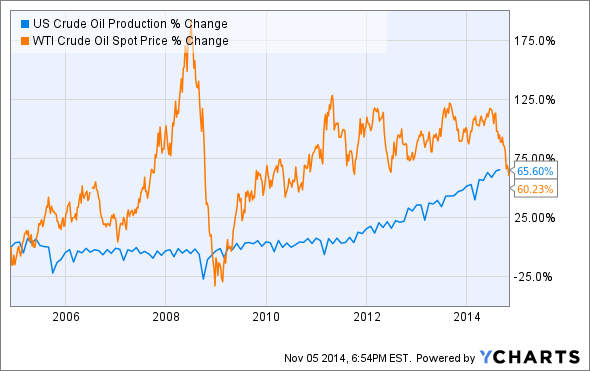

The W&T Offshore, Inc. (NYSE: WTI) "WTI crude oil" spot price is down more than 43 percent this year due to a glut in oil supply worldwide. As new fracking and horizontal drilling technology has spearheaded the energy boom in the United States, oil production has grown at a staggering rate.

The current worldwide supply of oil surpasses the demand by 300,000 barrels per day. Such an imbalance cannot be maintained for long before price or production levels must fall, and so far price has taken the hit.

Impact On Wall Street

The dip in oil prices has sent waves through the stock market as well. The United States Oil Fund LP (ETF) (NYSE: USO) is down 16.56 percent year-to-date. Stocks of offshore drillers have been hammered in 2014, as Seadrill Ltd (NYSE: SDRL) and Transocean Ltd (NYSE: RIG) are both down by at least 40 percent for the year.

Major oil players like Exxon Mobile Corporation (NYSE: XOM) and Chevron Corporation (NYSE: CVX) have been able to tread water so far this year, even reporting increases in profits. However, if oil prices remain low, both companies could see a 7 percent drop in earnings in 2015.

Full story available on Benzinga.com

More...

More...