Equity real estate investment trust (REIT) exchange traded funds (ETFs) are an easy way for investors to allocate a portion of their portfolios to the institutional-quality commercial real estate asset class.

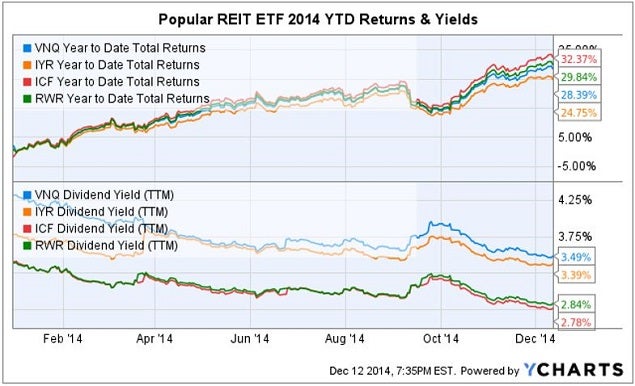

According to Forbes, the four most popular funds are Vanguard REIT Index Fund (NYSEARCA:VNQ), iShares Dow Jones US Real Estate (ETF)(NYSEARCA:IYR), iShares Cohen & Steers Realty Maj. (ETF)(NYSEARCA: ICF), and SPDR Dow Jones REIT ETF (NYSEARCA:RWR).

The ETFs each own a basket of REIT shares in an attempt to mirror the performance of a published REIT.

In the aggregate, these four REIT ETFs account for almost 94 percent of the total REIT ETF market.

Do REITs Really Help Diversify A Portfolio?

The short answer is yes.

Owning shares of REITs in addition to bonds, stocks, CDs or money market funds, has been shown by numerous studies to result in a more diversified portfolio.

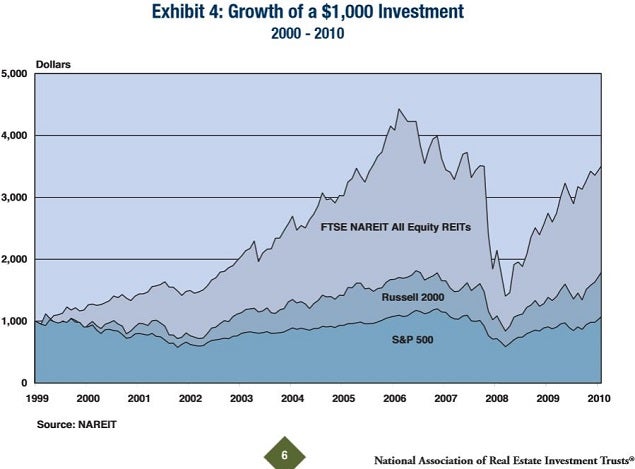

Source: NAREIT

REIT Relative Outperformance

Equity REITs outperformed the broader market post dot-com bubble, and of course during the go-go real estate bubble which burst in 2008.

However, it is notable that even during financial crises, and through the Great Recession, equity REITs outperformed both the S&P 500 and Russell 2000 indices.

All 4 REIT ETFs Performed Well This Year

Still, there was a broad range of performance due to the differences in the underlying basket of stocks that comprise the particular index being closely tracked.

Very Efficient ...

/www.benzinga.com/general/education/14/12/5078858/4-popular-equity-reit-etfs-should-the-average-investor-take-a-look alt=4 Popular Equity REIT ETFs: Should The Average Investor Take A Look?>Full story available on Benzinga.com

More...

More...