The Energy Report: What happened to the Fission Uranium Corp. (FCU:TSX)-Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT) deal? Why did investors reject it and what does it mean for the junior uranium mining landscape?

Marin Katusa: Ross McElroy and his team have done a great job growing the Patterson Lake South (PLS) resource, which is turning out to be a world-class deposit. It is clear the majority of the Fission shareholders wanted the company to stay focused on its PLS project and didn't believe the benefits of diversification, including access to a mill, the Lundin group and Wheeler River, outweighed the potential of the PLS deposit.

I had a great run early on with Fission. We tripled our money, and we sold, albeit a bit too early, but a profit is a profit. I think both Fission and Denison are still interesting opportunities, because both are much cheaper than they were before the deal was offered. I own neither currently.

TER: What's next for Fission? It isn't going to try to take Patterson Lake to production, is it? Are there other suitors in the wings?

"I think Fission Uranium Corp. will keep drilling fantastic numbers."

MK: It is difficult for an exploration company to take something like PLS to production; it rarely works. A completely different skill set is required. PLS will have a permitting hurdle, not to mention there's no mill that could take their feed currently, so the company would have to build one, and that could cost as much as $1 billion ($1B).

Fission could become an acquirer of other projects on the east or west side of the basin, or it too could become a takeout target by larger company, or perhaps even become a target of a hostile take out by someone like NexGen Energy Ltd. (NXE:TSX.V; NXGEF:OTCQX). That would be a very interesting result to the Fission saga. In a bear market, anything is possible. Perhaps the board changes at Fission, and the new board sees the benefits of merging with NexGen and a merger happens on friendly terms with NexGen. Anything is possible. In early 2014, we participated in the NexGen private placement, and the team at NexGen has done an incredible job. Tim Young, who is on my Top Ten Under 40 list, had incredible vision when he staked the properties NexGen holds today. It's great to see young resource entrepreneurs doing so well.

I actually think the two should merge, but I don't think the current Fission board would like that to happen. The two management teams might not be a good fit. But if it did happen, it would make for a very interesting story. If that happened, the region could get very hot, and the other juniors could do quite well, such as Skyharbour Resources Ltd. (SYH:TSX.V). I currently do not own Fission or NexGen, so I don't have any skin in this potential fight. I own a lot of Skyharbour.

Now, if Fission and NexGen did merge, the pounds between the two justify a mill of their own. Then it might use Asian money or Cameco Corp. (CCO:TSX; CCJ:NYSE) dollars. But in the near term, I think both companies will keep drilling fantastic numbers and move both projects forward. Building a uranium mine is not an easy task. Very few groups have the experience.

TER: Will Denison try to buy another Athabascan company?

MK: Definitely a possibility, or it could be bought out. Denison's pattern has always been to look to increase shareholder value. The Lundin group is that rare breed that understands exploration and production. Very few groups have that level of power, ability and financial resources. One thing I've learned in 15 years of this business is never underestimate a Lundin group company. I definitely expect big things in Denison's future.

TER: What is the uranium landscape looking like now? Where should investors look for value?

MK: The U.S. consumes just under 50 million pounds (50 Mlb) of uranium annually, and it produces less than 5 Mlb. So it's importing over 90% of what it consumes. When one in five homes in the U.S. are powered by nuclear energy, that's not a good formula for national safety. Half the uranium in the U.S. came from Russia for the last 20 years. Now only 25% can come from Russia by U.S. federal law. Sadly for the U.S., the difference is being made up not from Canada, not from Australia, not from U.S. production, but from Kazakhstan. That is going from a bad situation to an even worse one. In 2014 alone, the U.S. increased the Kazakh imports of uranium by over 80%. I think the U.S. has positioned itself in a tough situation here. The U.S. is still the largest consumer of uranium globally, and that's not going to change. We are going to have a rude awakening shortly. Will it change in the next few months? No. But this is something that you'll see getting a lot of media attention by 2019.

I have a whole chapter in my book, "The Colder War," about the smart way to play uranium opportunities. Speculators and investors who want exposure to uranium should focus in North America. I'd avoid projects in Africa. South America has a few areas that I like. Paraguay has great potential. But, really, the value is in North America. It's very difficult for a Western company or a Canadian publicly traded company to compete with what Russia and China are doing internationally, especially in Africa. So I would focus on the Athabasca Basin, where the grade is the highest in the world, and the rule of law protects shareholders. I am also a big supporter of the in-situ recovery (ISR) production in the U.S. I think the lowest-cost producers in the U.S. are a great place to be invested right now. If you have a long-term perspective, you want to have exposure to North American reserves, resources and production.

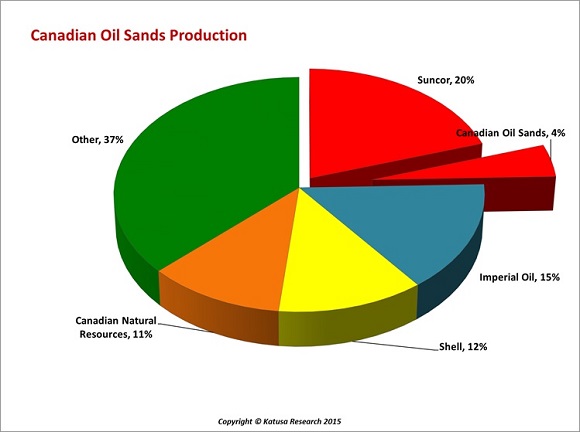

TER: While we're talking about mergers and acquisitions, what does the possible Suncor Energy Inc. (SU:TSX; SU:NYSE) hostile takeover of Canadian Oil Sands Ltd.(COS:TSX)mean for the other players in the Canadian oil sands?

MK: Suncor has been a partner in Canadian Oil Sands' project and would know it better than anyone else. It believes that Suncor can operate it better and, more importantly, it has the balance sheet to make the changes that are required. That's why it's going to get involved. What does it mean for the other players? The market took it initially as a positive, and now it's selling off. The reality is that these oil sand projects are not low-cost production projects. They are very expensive projects. Building these massive cokers and other infrastructure takes billions of dollars. In the sub-$50 barrel of oil world where Canadian oil sands are discounted to West Texas Intermediate because it is heavy oil, investors have to be very cautious. If you want to play it, Suncor probably is the safest way. That's why Berkshire Hathaway Inc. (BRK:NYSE.A) and Warren Buffett are invested in Suncor. Canadian Oil Sands popped big time on the news, but some of the other producers have not enjoyed the same attention. Suncor is not going to pay more for these other assets because it has its hands full right now.

TER: If, as you wrote in the article on your web site, Suncor becomes the OPEC of domestic Canadian oil, how might it use that power position to its advantage?

MK: Suncor becomes the OPEC of Canada by controlling the large infrastructure in the oil sands. Suncor merged with Petro-Canada some years ago, which was a child of Pierre Trudeau's national energy program. That gives Suncor an advantage over the other companies because of the vertical integration of upstream and downstream. Plus, Suncor is Warren Buffet's largest oil play. He was against the Keystone pipeline that would have taken oil to the U.S. refiners because Canada hasn't built the alternative pipelines east or west that it should have. That leaves Burlington Northern Santa Fe, which is owned by Buffet's company, Berkshire Hathaway, to transport all that oil. Coincidence?

TER: Staying on oil, you recently returned from visiting Africa Oil Corp. (AOI:TSX.V). What got you interested in that story again?

MK: I was in it very early, going back to the private company Turkana Energy in 2007. I was involved in a sale of the 10BB Block to Africa Oil back in late 2008. We were very large shareholders. We had over 300% gains, but it turns out I sold a little too early. We got out around the $3/share range, and then within nine weeks it went to $12/share. Then I waited years. I'm very close to the management team. I think the world of Keith Hill and Lukas Lundin. Let me be very clear here, Africa Oil has a world-class oil deposit. This is going to be a multibillion-barrel oil basin. There are fewer than 100 oil basins of that size in the world. It has multiple deposits within its basin. If you look at the money raised in the last 18 months for oil exploration by TSX-listed companies, Africa Oil alone has raised more money than all of the exploration-focused companies combined. It put $1B into the ground to derisk these assets. Because the price of oil has fallen so low, the price of Africa Oil's shares have gone down as well, so it is a great deal right now. Ironically, if you're a big oil company like Exxon Mobil Corp. (XOM:NYSE) or ConocoPhillips (COP:NYSE) or Chevron Corp. (CVX:NYSE), the assets of Africa Oil are more appealing at sub-$50 oil because they are such low-cost production assets. They are world-class assets and they're not controlled by the OPEC nations. This type of asset becomes very appealing to large international oil companies. I believe within the next 12–18 months, Africa Oil will be able to attract a joint venture partner to fund the capital cost to put these assets into production.

TER: You are helping to produce the Silver Summit & Resource Expo in San Francisco at the end of November. What can energy investors learn from that conference?

MK: A few producing uranium companies we think are great opportunities will be on hand. Ross Beaty will be there with Alterra Power Corp. (AXY:TSX). Also, Ross Beaty will be inducted into the Hall of Fame on the Sunday night—a great tribute for a great man. I asked Ross to come down and speak at the conference, because investors focused on silver and gold will also likely see the opportunity in Alterra and, more importantly, learn from Ross, as he is one of the greatest Canadian resource entrepreneurs of all time. He will also be participating in an energy panel I am moderating with Amir Adnani from Uranium Energy Corp. (UEC:NYSE.MKT) and Frank Curzio from Disruptors & Dominators. Not to mention, there will be many fund managers and brokers in the Institutional portion of the conference. I am really looking forward to this conference.

TER: Marin, thank you for your time.

Read Marin Katusa's thoughts on the metals mining space here.

Marin Katusa is the author of the New York Times bestseller, "The Colder War." Over the last decade, he has become one of the most successful portfolio managers in the resource sector, such as his 2009 Fund Partnership (KC50 Fund LLC), which has outperformed the comparable index, the TSX.V by over 500% post fees. Katusa has been involved in raising more than $1 billion in financing for resource companies. He has visited over 400 resource projects in more than 100 countries. Katusa publishes his thoughts and research at www.katusaresearch.com.

DISCLOSURE:

1) JT Long conducted this interview for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: none.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Fission Uranium Corp., NexGen Energy Ltd. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Marin Katusa: I own, or my family owns, shares of the following companies mentioned in this interview: Alterra Power Corp., Africa Oil Corp., Skyharbour Resources Ltd. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legaldisclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.