The digital advertising market is set to reach $185.4 billion by 2017, according to research by the “Global Entertainment and Media Outlook 2013-2017” report by PwC. Some interesting points to note in the report include:

- Strongest growth in developing markets – Most of the growth is being seen in developing markets, but with developed countries still witnessing some growth, albeit at a much slower pace.

- Besides the fact that the market shall be worth $185.4 billion by 2017, it will account for 29% of the global advertising market. It is now the second biggest segment after TV.

- Search shall account for almost 50% of the market.

- Video advertising and mobile advertising are set to witness exponential growth, with each posting average annual growth rates of 26% and 15%, respectively.

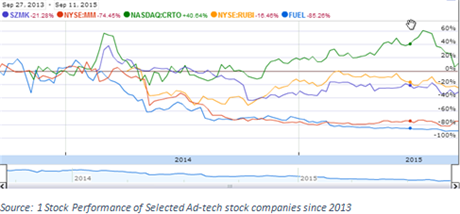

These impressive research statistics should spell great news for investors in digital advertising (ad-tech) stocks. However, judging by the general performance of most stocks in this field,

investors seem to be sceptical. A look at the stock performance of some companies in the industry, such as Sizmek, Inc. (NASDAQ:SZMK), Millennial Media, Inc. (NYSE:MM), Criteo SA (ADR) (NASDAQ:CRTO) and Rocket Fuel, Inc. (NASDAQ:FUEL), shows a general downward trend in the stock price of these companies, with some trading below their initial listing price. So what could be exactly happening? This is a very complex question, with a number of possible answers. Questions about the business models of some companies, customers opting to work with only a select number of companies, products being too complex for customers to understand, and lack of features to effectively measure results are just a few reasons. Nonetheless, there are some opportunity areas in this field and these require a great deal of savviness.

The ad-tech industry is quite complex

There are many products and solutions offered by vendors, and one definition of a certain product offered by one player may not apply to one offered by the other. Take, for instance, two companies that offer mobile video advertising services. Although they may each claim to offer the same product, the type of delivery (cross platform), targeting, and systems used may differ. This creates a dilemma for customers seeking to find a solution that meets their needs. Additionally, with reports of alleged advertiser fraud, especially with pay per click ads and seo, the stakes have never been higher. The involvement of intermediaries and layers of tech add to the complexity. For investors, this makes it difficult for them to differentiate the solid stocks from the weak ones, and hence you see a focus on just a few stocks who are showing a great level of growth while others remain stagnant.

Market conditions forcing consolidation

Recall the tech bubble burst of 2000. What is playing out in the ad-tech industry seems to resemble this volatile phase. A number of companies, which had catchy start-up stories, witnessed enormous growth in the initial days and went on to list on the stock market, are beginning to struggle as they face increased competition. Today, they are trading well below their IPO prices, with a perfect case being Millennial Media, Inc. (NYSE:MM), which is trading at a $1.74 (Sep 14, 4:00PM EDT), compared to $25 on the day it first listed.

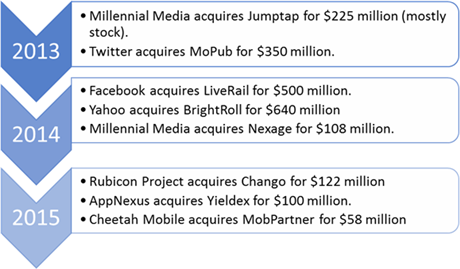

Other players have seen falls, which are almost similar. Could this be a sign that the euphoria of these kinds of stocks is long gone? We are likely to see consolidation in the industry, with some small players fading away into oblivion. However, we are likely to see industry giants, such as Google, Inc. (NASDAQ: GOOG), and Facebook, Inc. (NASDAQ: FB), establishing their dominance in the sector, as they have the resources to invest in new technologies in a dynamic and fast changing sector. Actually, this has already been happening as evidenced by the number of prolific acquisitions we have seen in the last two years (see chart). As customers look for much more differentiated solutions that address their unique needs, most companies are offering generic services, which in most cases are mini-versions of solutions offered by the larger players.

The performers

The performers

After the chaos characterized by buyouts, bankruptcies, mergers, etc., there shall emerge a breed of stocks that will dominate the industry for the near future. Besides the industry giants who stand in a better position to weather any storm, some small-medium sized players represent a great deal of promise. The stocks of the large players are already overbought, and the real opportunity lies in the small-medium cap companies in this space. Based on various market analysts’ reports that I have been following over the last few months, the following will be in the top industry of performers, and I give my explanation under each.

- Criteo SA (ADR) (NASDAQ:CRTO)

Headquartered in Paris, France, this company is currently one of the best performing ad-tech stocks this year, with shares having increased by 40% year on year. This is a rare performance in an industry that is marked by a great deal of gloom. Investors seem upbeat about this stock for a number of reasons. Revenues continue growing along with earnings, although they have been below analysts’ estimates. The Paris-based company reported earnings of €0.15 per share in the quarter ended August 2015, whilst revenues grew by 64%.

The ad-blocking feature, which comes with the

release of the latest iOS 9 installation, has not yet had any impact on the company’s earnings, at least for now. According to an analyst note released by JPMorgan, the expected impact the ad-blocking feature has on a key platform, such as mobile, has largely been overblown. It cites low penetration of ad-blocking software in key market segments, advertisers’ ability to quickly devise methods to circumvent them, among other factors. So far, Criteo SA’s business model built on selling ads on the web, embedding to cookies to track user habits, and pay-per click seems to be weathering the industry storm quite well. As one of the few performing companies in the industry, we are likely to see this stock being overbought, which would push its price higher. Strong revenue growth, a solid financial position and a low debt to equity ratio by most measures and steady earnings per share growth are the company’s core strengths. However, against these strengths, the company's net profit margins have been poor overall."

2. Sizmek, Inc. (NASDAQ:SZMK)

Shares of Sizmek, Inc., have been trading lower after the company released its

Q2 earnings report, which showed a decline in revenues and earnings. Projected revenues for rest of the year are expected to be 5% lower than the previous year, with the company blaming exchange rate fluctuations for these results. While in the short term, things appear gloomy – Sizmek, Inc., is one of the strongest emerging ad-tech stocks. The company is not carrying any debts on its balance and is trading at three times net cash. Although a share buyback is unlikely, as happened in 2014, the company is likely to invest its cash in developing its platform and reorganize its business to counter its key rival, Alphabet, Inc. Class C (NASDAQ: GOOG). Customers are looking for all-in-one packages instead of relying on several service providers for their digital marketing campaigns. Sizmek, Inc., offers customers an integrated platform and end-to-end solutions – key competencies that make the company well positioned to capture a large slice of the burgeoning ad-tech market. In addition, the company counts big brand names, such as Toyota, IKEA, Tommy Hilfiger and others as its customers, which is a testimony of the strength of the company’s business model.

3. Alliance Data Systems Corporation (NYSE: ADS)

An industry giant, and currently one of the few that are profitable, Alliance Data Systems Corporation is one of the safest high-growth stocks in the ad-tech industry to invest in. Over the last five years, the company has experienced growth revenues at a CAGR of 20%. Hence, its shares are currently trading at a premium, as reflected by a P/E (ttm) ratio of 33.56. However, the company’s stocks seem to be meeting some resistance at $300.

The fast growth has come at a price. The company is saddled with $14.65 billion of debt, which is not a problem as long as it maintains its growth rate and continues generating healthy cash flows. Over the last two years, it has been taking over small rivals in the industry, which bodes well for its long-term future growth. As for now, there are no red flags pointing to any tapering in the company’s positive future prospects. It will be best to purchase this stock during a dip, as it is known to be quite volatile.

Small Players, specializing in niche market segments

As the industry becomes less fragmented, small but agile players stand to gain, as they focus on niche value market segments. Some notable names in this space include: Adaptive Medias, Inc. (OTCMKTS:ADTM) and QuinStreet, Inc. (NASDAQ:QNST). The former (Adaptive Medias, Inc.) provides a comprehensive mobile video technology platform for the delivery and monetization of video content and high-impact rich media ads across multiple devices. It has developed an in-house, proprietary technology, which seeks to capture the mobile and video ad market. QuinStreet, Inc., shares have held steady over the last twelve months and is a good stock to watch, as it can spring a surprise anytime.

There is lots of opportunity in the ad-tech industry for companies with business models that deliver a unique value proposition for clients and are able to differentiate themselves from the rest. More acquisitions are likely, with bigger players likely to increase their dominance of the industry. At the same time, small players specializing in niche market segment stand to gain, as they offer solutions that are tailored to meet unique customer needs.

Author Profile

Khangelani Hlongwane is a freelance business writer and consultant. He has experience writing investment ideas, business plans, whitepapers, and research reports on the next disruptive innovations. Having lived in more than four countries, across two continents, he approaches issues with a great deal of open-mindedness and is able to quickly spot interesting patterns. Feel free to contact him about this article on:

bizwritingexperts@gmail.com