Graphite One Resources (TSXV:GPH) is Positioning Itself to Become the Biggest Graphite Play in 2016, Here's How:

Follow us on

Facebook:

www.facebook.com/alphastox

Follow us on

Twitter:

https://twitter.com/AlphaStox_com

Dear Alphastox Subscribers,

It’s funny how so many of us, including myself, have been complaining about how bad the resource markets have been, and yet, some of the biggest wins we’ve had recently have been with resource stocks!

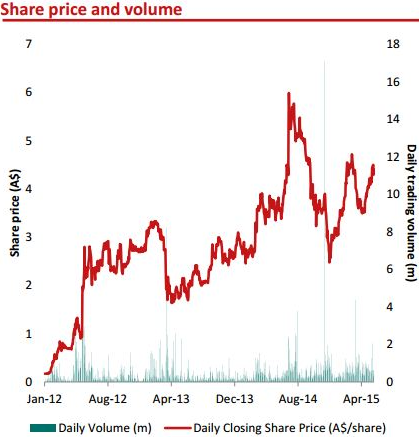

Pure Energy (TSXV:PE) is a great example of a small penny stock that became a huge success. PE.V went from $0.10/share to over $1 in short order and it’s not the only one returning investors substantial profits. Australian listed Syrah Resources (ASX:SYR) has been a huge win for many, going from $0.30/share to over a $700 million market cap based on the growth and development of their Balama Graphite Project in Mozambique. Take a look at their three year chart below:

Source: Syrah Resources investor presentation: https://bit.ly/1QtbFDA

Source: Syrah Resources investor presentation: https://bit.ly/1QtbFDA

Syrah moved to $100 million market cap based on their PEA and over $600 million once an offtake agreement was signed. Looking at Syrah’s success, I wanted to find a comparable company that I thought could have a similar run in the future. Out of all the ones I looked through, I came to the conclusion that

Graphite One Resources (TSXV:GPH) is the one I wanted to focus on for a few very specific reasons which I will hihglight shortly.

With the electric car market growing substantially, Tesla and others in the market are constantly on the lookout for high quality supply of graphite, lithium and cobalt. That’s why these high quality deposits are flying even in this market! And the demand for these commodities should continue to rise as consumers seek longer ranging electric vehicles. For example, Tesla’s Model S has a market leading battery range of over 420 km but requires 170 kg of

spherical graphite. As the market continues to grow, the demand for spherical graphite (battery grade graphite) should continue to rise alongside it. With so many juniors looking to become Tesla’s only supplier, Graphite One (TSXV:GPH) definitely stands a very good chance of doing exactly that and in doing so, could easily have a similar run to Syrah.

According to an article published by Stockhouse.com, Tesla will need 126,000 tonnes of flake graphite and 50,000 tonnes of spherical graphite (battery grade) to supply its growth plan and it can’t all come from one source, so for a few juniors with a substantial graphite resource, there’s a massive opportunity on the table. Currently, the only supply is being imported from China, but with taxes skyrocketing and their low grade not standing up to par, the market is desperate for an alternative. One of the main challenges that many of these companies face is the type of graphite that Tesla and others are looking for. Natural graphite straight out of the ground needs to be processed into spherical graphite to be “battery ready”, which means an extra expense to process it. Not only that, but there’s only a small amount of graphite that is actually worthy of production. With this in mind, a major graphite producer recently estimated that the spherical graphite demand could reach 133,000 tonnes per annum by 2020. Finding a graphite producer isn’t the hardest thing, it’s finding one that produces spherical graphite…that’s where the real opportunity is, and believe it or not, GPH might be onto it. With only a few spherical graphite deposits in the world, once a new one is discovered, you can be sure its value should skyrocket astronomically.

But before we get into

GPH, who hosts the largest flake graphite deposit in North America, I wanted to touch on Syrah’s Balama Project. Even though Syrah’s deposit is very similar to GPH’s, its market cap is 50X greater than theirs. Syrah’s project hosts the largest graphite ore reserves in the world but is currently a non-producer. The company recently completed an Internal Economic Assessment (IEA) on the economics of the world’s largest Coated Spherical Graphite Facility in the United States. Syrah’s market cap is around $800 million with a production rate of 25,000 tonnes of coated spherical graphite and 25,000 tonnes of recarburiser by-product. They’re looking to penetrate the US graphite market, and will be shipping their rock all the way to the US to process it into spherical graphite. One of the best things I love about GPH is the fact that their asset is already in the US! The Americans are and will continue to be the largest consumers of spherical graphite in the world and having an asset in their own backyard makes Graphite Creek an even more lucrative play.

Similar to Syrah but in Alaska, Graphite One’s Graphite Creek Project definitely has my attention, and is slowly starting to gain the attention of everyone else. Based in Vancouver, the company operates in Alaska on the Seward Peninsula near Nome and has invested over $15 million into the project already. GPH’s jurisdiction is second to none in my opinion. The project is currently moving from the exploration phase to development and has the highest grading and largest known deposit (287 million tonnes) in North America – the resources at the surface alone (9.8 million tonnes) is valued at more than $11 billion. Because most of the resource is at surface, it’s one of the lowest cost production properties.

What sets Graphite One apart from their competitors is what they’re calling STAX Graphite (trademark-pending), which stands for Spheroidal, Thin, Aggregate, and extended flakes which sells for $3500- $9700 a tonne. The most significant thing about their graphite is its spherical quality – like I mentioned above, usually there is a process into making regular graphite into battery grade- spherical form, but GPH is sitting on a deposit that is already largely spheroidal, thin, and naturally expanded so no extra processing is needed! Graphite One can provide significant cost savings to lithium-ion battery producers and could potentially be Tesla’s favorite supplier.

Production is planned for 2018, leaving plenty of time for Anthony Huston and his team to finalize an offtake agreement with Tesla, Panasonic, LG, GE or anyone else in the space. The possibilities are endless for GPH so make sure you keep it on watch now. With a mine life of at least 100 years and a market cap that is growing steadily, this is the time to follow this name. With so many companies in need of long-term supply, GPH could easily be a perfect fit. With a PEA on its way (should be completed sometime next year) and initial metallurgical work suggesting signs of spherical qualities, this could easily be one of the most exciting stories of 2016!

I should have a lot more updates to come so stay tuned! As always, if you have any questions, please do not hesitate to get in touch with me anytime. I look forward to hearing from you.

Best,

Etienne

Disclosure: Transcend Capital Inc. has been paid a fee for conducting an independent review of the company