DeepMarkit (MKT.V) Opportunity

.png)

DeepMarkit is revolutionizing advertising and promotional campaigns using Gamification. The company is in pre-launch development of its DIY/self-serve platform, Fetchbot, for the creation, customization, and operation of these campaigns. At the heart of the platform are highly customizable device-agnostic games supported by a sophisticated promotions engine, enabling campaigns with multiple prize-award models, including instant win, scheduled win and giveaways. DeepMarkit uses disruptive gamification techniques to increase the engagement rate with customers and increase long-term loyalty. The company presents a

tremendous growth-to-value opportunity with a market capitalization of $11.5m.

According to Issues and Trends in an Online World Report:

“The explosive growth of digital advertising raises questions about the

role of advertising agencies in the future. Online advertising, as compared to traditional ad campaigns, is more data-driven, based on information drawn from users‘ Internet activity about consumer preferences, website popularity, and clicks per ad.

Gartner found that over 70% of the Forbes Global 200 say they planned to use gamification for marketing purposes by the end of 2014.”

.png) Shopify (TSX: SH

Shopify (TSX: SH) paved the way for Canadian tech companies offering internet-based subscription software services. The company has a Market Capitilazation of

$2.42B. Given the timing and uniqueness of Shopify’s services, 165,000 stores used Shopify in May, 2015.

DeepMarkit (MKT.V) presents a similar scalable opportunity. As mentioned prior, Fetchbot offers a unique platform for many businesses to create promotional campaigns, which produce much higher results than traditional marketing strategies.

Management’s past Experience Includes an Acquisition by Amaya Gaming Group:

DeepMarkit's management grew Chartwell (TSX: CWH) until its takeover in 2011 by Amaya Gaming (TSX: AYA). This acquisition by Amaya was a key early catalyst in their explosive growth to a multibillion dollar company.

The deal represented a

69% premium to the weighted avg. price of the CWH shares for the 30 days ended May 11, 2011. At time of sale, CWH had $15m cash & short-term inv., with zero debt.

The New Trend of Marketing: Gamification

The New Trend of Marketing: Gamification

Gamification arises from truly understanding consumer behavior. Game mechanics are used to connect to the consumer, and provide a sense of achievement. For example, a customer plays a short puzzle-like game with the potential to win a coupon to a store. This fun process, combined with the intrigue of what can be won is a more fun and engaging way to connect to the consumer than other traditional means of advertisements. This ensures user ‘stickiness’ to any gamification application.

Current marketing strategies are losing fashion at an alarming rate. There is plenty of competition for consumer attention, and many traditional marketing tactics are ineffective in capturing it. Today’s consumer has plenty of bargaining power. They decide what to listen to and see on social media channels for instance. ‘Stickiness’ is an important metric for marketers regarding attention, which gamification allows for. It is a metric of loyalty and measures the relationship between time spent on a site and the number of a customer’s annual visits. Social networking sites and gaming sites enjoy the highest level of stickiness, and with a flexible platform of gaming promotions, DeepMarkit is well positioned to increase engagement and loyalty.

People enjoy competing, playing games and winning. After all, basic human impulses call for status and achievement: the company wants the consumer to feel special and provide an opportunity to achieve a great prize. The ROI of this type of promotion is realized over a longer period of time through customer retention, loyalty, and engagement. Other success metrics are increased engagement, increasing consumer influence, loyalty through rewards programs, consumer generated content, time spent and virality.

A Gartner study predicted that by 2015, a gamified service for consumer goods marketing and customer retention will become as important as Facebook, eBay, or Amazon, and more than 70% of Global 2000 organizations will have at least one gamified application. The gamification market is growing in North America, as customer and enterprise-based strategies are driving the market. The main companies taking advantage of Gamification are small to Medium-sized businesses, which DeepMarkit is targeting.

Statistical Analysis of Gamification Market

Generation G & Millennials Generation ‘G’ represent the 20m children born between 1998 and 2000, and represent the greatest game playing demographic in history. This generation is experiencing technologies and social networks which previous generations never experienced. There is lots of social media interaction and mobile phones are used greatly to play games and communicate. This is important because Generation G is not as reactive to traditional messages as older generations. They demand more interaction, engagement, and fun. This makes DeepMarkit’s value proposition very interesting, especially for those companies targeting this age group.

Millennials require rich media, using HTML5, which DeepMarkit uses for brand-building customizable promotion-based games. Brands must go beyond the banner to leverage unique applications and features such as gamification, and other rich media. The click-through rate is much higher for such media. According to IAB, consumer goods advertisers tend to use video and interactive games to drive brand awareness.

Growth & Market Size

According to the Gamification Market Report published by MarketsandMarkets, the market is expected to reach US$11B by 2020, with a 46.3% CAGR. Gamification is a great method to elicit desired consumer behaviors and to derive the desired actions. As gamification allows companies to gain a competitive edge, an increase in their investments will amplify market growth during this period.

North America is expected to hold the largest market share and dominate the gamification market from 2015 to 2020. The higher adoption rates are expected to streamline business operations in North America. Asia-Pacific (APAC) offers potential growth opportunities, as there is a rise in the adoption of Bring Your Own Device (BYOD) among small and medium enterprises (SME’s) to enhance employee satisfaction and consumer retention. The overall promotions Market is $80B in North America.

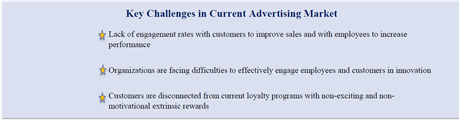

Key Opportunities & Challenges for Gamification

The increasing ROI and enhancement of overall user experience is encouraging growth in this market. Secondly enhancing user engagement. Social media, Bring-your-own-device (BYOD), & increasing digitization are all growth factors.

The other factor driving the growth of the gamification market is the increased need for gamification solutions as well application across enterprises and consumer brands. Furthermore, the market is expected to be driven by opportunities, such as the growth of social media, increasing digitization, and growth of BYOD penetration. Restraints and challenges are low level of awareness and lack of game design improvements which may hinder gamification growth Digitization and BYOD penetration also facilitates growth.

Companies, such as DeepMarkit, are using the cloud for a cost-effective promotions solution. Enterprises are adopting these solutions rapidly as they are low-cost and are easy to deploy.

SaaS Digital Ad Industry

SaaS Digital Ad Industry

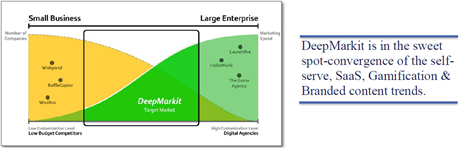

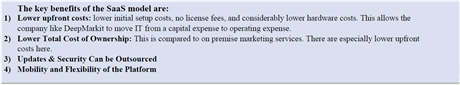

The digital ad SaaS and self-serve models have revolutionized online business and represent multi-billion dollar revenues and high growth patterns. DeepMarkit is aiming to strategically position its FetchBot brand in the mid-market where demand for such a solution is expected to be the strongest.

eMarketer estimates that digital ad spending will total $140.15 billion in 2014, accounting for approximately one quarter of all paid media spending worldwide. eMarketer projects that online ad spending may total $61 billion by 2017

A recently released report from independent consulting firm Technology Business Research projects that ad tech revenue will increase from $30B in 2015 to $100B in 2020 — a 300%+ increase over a 5-year span.

According to MediaPost, this rapid boost in revenue is a clear reflection of “advertisers’ continued shift toward digital formats and the rise of self-serve platform offerings.” End users are ramping up ad tech investments to maximize media performance, improve operational efficiencies and leverage big data.

According to clickz.com, 76 percent of the 17 largest SaaS companies in the world use marketing automation, and 100 percent use some basic form of website tracking.

“Marketers and agencies are shifting to ad tech to plan, execute and optimize multichannel digital campaigns. Increased digital ad spending, programmatic technologies and SaaS fuel ad tech market growth.” -TBR Senior Analyst Seth Ulinski.

*Important:

*Important: SaaS companies usually spend approximately 40% of revenues on sales and marketing to reach scale. Another important consideration is that the Customer Acquisition Cost (CAC), such as DeepMarkit’s assumed $47.25 CAC is spent up-front to acquire the customer, but sales are recognized over the Lifetime of the Customer. In reality, the faster a SaaS company grows, the more money it loses because of the direct costs associated with acquiring customers, until scale is reached.

* SaaS companies are typically given a stock price premium because predictable nature of cash flows.

Drivers of Digital Ad Industry

Mobile

Drivers of Digital Ad Industry

Mobile

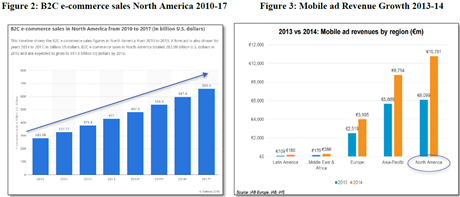

Currently, more than 9 out of 10 adults in US own a mobile device. Mobile Advertising revenues have increased from $251M in 2007 to $4.75B in 2014. Currently 81% of Generation ‘X’ use mobile devices. This number is expected to grow.

Social Networks

67% of online adults in the U.S. use social networking sites.

E-Commerce

E-Commerce sales in US represent approximately 93% of total sales, according to eMarketer. The research agency expects US online sales to grow to US $548B in 2019 from $349B in 2015. Monica Peart, forecasting director for eMarketer, says the biggest trend she’s found from analyzing the U.S. market data consumers’ willingness to spend big online:

“Frequency of purchases and higher-value transactions are really growing online, as a more mature market, we’re seeing sales continue to grow because of that. People are more willing to buy big-ticket items online.” Monica Peart, forecasting director for eMarketer

Growth Opportunities

Strategic Partnerships/Acquisition

Analysis of Acquisition of Management Team’s past Company:

The CEO & Management’s past experience involves growing Chartwell Technology (TSX: CWH) until its takeover by Amaya Gaming Group (TSX: AYA). Chartwell is a leading provider of games, gaming systems and platform for the regulated online casino gaming industry, and Amaya is an entertainment solutions provider for the regulated gaming industry.

Early stage Chartwell investors had several opportunities to have good returns.

Early stage Chartwell investors had several opportunities to have good returns. The stock traded in a range between 0.25 to CDN $12 during its 10 year trading history. The investors who retained their shares through the merger with Amaya in 2011 were generously rewarded had they held on to them until today since the Amaya shares received at the time were priced at around CDN $3 and are approximately CDN $30 today.

On July 31, 2015 Amaya successfully sold Chartwell and Cryptologic to NYX Gaming Corp. for $150M, creating considerable value for shareholders. Chartwell was a considerable portion of the combined sale.

What excites me currently about DeepMarkit is that they are penetrating a marketing promotions space which has been largely untapped. This is the DIY/self-serve area for the creation, customization, and operation of promotional campaigns. Fetchbot is the only gamification DIY platform with the robustness it has. Just like Amaya believed that acquisition was the smartest move for its shareholders for the long-term,

I also predict larger marketing agencies and e-commerce giants can consider acquisition of a company like DeepMarkit to be the most ideal way to enter into this new promotions space, from the more bureaucratic space of large marketing agencies.

Integrations

Successful integrations with E-commerce platforms such as Shopify and other big companies in the space can provide a large value add to DeepMarkit. This allows companies already on those e-commerce platforms to integrate their sales with a highly developed campaign platform from DeepMarkit. Integrations with website-building companies, and physical POS are other forms of growth integrations.

Partnerships

I believe this is where the management teams past experiences can provide great value. The key is to secure contracts with partners that can benefit from their customer’s benefiting from the partnership. This works for credit card companies, big website domains such as GoDaddy, coupon companies such as Retail Me Not, and other big e-commerce wholesale-like platforms such as Shopify and others.

*Partnerships are expected to be paid for until equal value is provided. Typically the way this works is partners promote Fetchbot to their customer base and MKT.V receives the promotion through a plug-in.

Current Operations

DeepMarkit has entered into an agreement with its first third-party beta test customer and has begun beta testing. The public launch is expected in Q2 2016. "We are very pleased to be nearing the end of our development phase and to being able to zero in on operations," stated Darold H. Parken, CEO. "Our concept, our business model and our product are very unique and we are excited to bring this powerful new technology to marketers and business operators of all types."

Forecast Analysis:

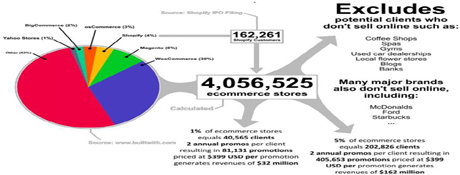

MKT.V predicts there are 4,056,525 suitable companies that sell products online for Fetchbot’s promotional campaigns. If MKT.V can secure a 1% market share in the first fiscal year, this amounts to servicing 40,465 companies, and if each has two annuals promos this results in 81,131 promotions priced at $399 USD (min. price) per promotion.

Altogether, 1% market share results in $32m in annual revenues, and with a 5% market share, the company can hit $162m in annual revenues.*

Additional Assumptions:

Additional Assumptions:

This is based on 4m e-commerce merchants who use third-party applications to build their online stores and a base $399 per campaign with no premium add-ons and no discounted sales. Overestimation is also avoided for repeat business. For every four new clients, it is assumed only one will purchase a third campaign. Another assumption is that only 50% of clients will purchase a second campaign. Of those remaining clients, it is assumed that only 50% of those will purchase a third campaign. Assumption acquisition cost is $47.25. $1.39 CAD/USD exchange rate. I am impressed by the conservative nature of these projections.

Also, the initial cost is starting at only $399 USD, which is quite revolutionary. Big agencies can cost thousands of dollar dollars, easily. This is what makes the space so interesting for many businesses looking to ramp up promotional work

Core functionality of the platform has been completed and DeepMarkit is now focused on completion of the e-commerce and administrative components of the platform as well as building out the creative library of the elements used in building and customizing promotional campaigns.

Fetchbot can easily be scaled up or down based on load. With more consumers, there will automatically be more servers added.

Revenue Model:

Base Campaign: US $399 per promotion + $199 per add-on package. Range: $399-$1,394 per client per campaign.

Processing Charge: $16.38 CAD per campaign

Timeline of Operations:

Capital Markets Info – DeepMarkit (MKT.V)

Basic Shares Outstanding: 62M

Warrants: 32M

Options: 5M

Stock Price (Feb 29, 2016): $0.17

Market Cap: $10.6M

Fully Diluted: ~100M Shares Outstanding

*82% of Warrants owned by company management

*72% of Basic Shares owned by directors, employees, insiders & close associates.

DeepMarkit has flown under the radar here, making the shares significantly cheaper than just a few months ago. This is also in a transition stage where the company is gearing up for a full-scale launch coming in late Q2 2016. During November 2015 the company completed its Change of Business (COB) into a listed company controlled by the CEO and another Director, Ranjeet Sundher. It is a clean shareholder structure with some experienced key shareholders.

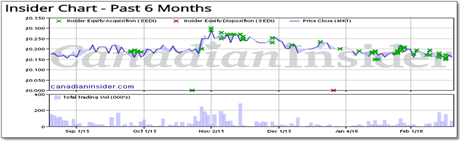

To further illustrate management’s commitment and belief in DeepMarkit, the following chart shows insider buying:

In order to fund its near-term operations, the Corporation has entered into a secured Debenture financing with Rupertsland Investment Corp, a private company controlled by Ranjeet Sundher, an insider of the Corporation. Pursuant to the Debenture financing the Lender has agreed to advance $500,000 of an up to $1-million Debenture financing, bearing an interest rate of ten percent per annum. The proceeds of the Debenture financing will be used for continuing working capital requirements of the Corporation and will remain in place while the Corporation explores longer-term financing options to support and expand its business. The Debenture will have an 18 month term and may be repaid at any time without penalty.

Management Team

CEO: Darold Parken

Darold Parken has extensive experience in creating, funding and managing public companies. He is the founder and was CEO of Chartwell Technology Inc. from its inception in 1998 to its sale to Amaya Gaming Group in 2011. Chartwell developed an industry-leading online gaming software system which continues to power some of the largest gaming companies in the world.

COO: Kevin Kraft

Kevin has over 13 years of experience in delivering custom ecommerce solutions across a multitude of industries. He has a proven track record of building effective teams, comprehensive business strategies, and optimizing operations. Previously, Kevin was a key contributor at Chartwell Technology, Global Cash Access Inc. and Optimal Payments PLC.

CMO: Nichole Desrosiers

Nichole is a recognized marketing thought leader with 17+ years’ experience building global brands and delivering multi-channel, innovative and profitable marketing and brand strategies. She has extensive expertise in omni-channel strategic planning for Fortune 500 companies focused on brand building, customer acquisition and customer retention.

Head Server Architect: Nolan Mack

Noland has over 15 years in gaming system development, he was the former Software Architect, Head of Architecture, at Amaya Gaming. Nolan was also a previous key employee in Chartwell's development until the takeover by Amaya.

Head Client Architect: Jason Saelhof

Jason has over 15 years of experience as a graphic designer, developer and client architect in the online gaming industry. Jason was the Lead Client Architect at Amaya Gaming. Jason was also a previous employee at Chartwell until the Amaya takeover.

Appendix

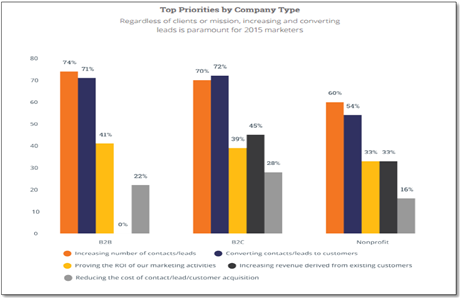

Figure 1: Top Marketing Priorities by Company Type

*State of Inbound Report

Disclaimer: the material presented in this article is intended for informational purposes only and not a recommendation to buy or sell securities. The authors have presented the information with an objective viewpoint. At time of publication, the publishers have held stock in the company and may receive reimbursement for dissemination.