Peter Epstein, CFA, MBA epstein.peter4@gmail.com (New York) 845-304-7386

Brief History — Huldra Silver Inc. & Name Change to Nicola Mining

By 2014, predecessor company

Huldra Silver Inc. (Huldra) had accumulated a portfolio of valuable assets, but had incurred a high level of debt. Further complicating its ability to function as a going concern, Huldra encountered a perfect storm of falling commodity prices, production delays, and diminished access to capital markets. As a result, a new management team, Board and Shareholder base at

Nicola Mining Inc. (TSX-V: NIM) / (OTC: HUSIF) is the beneficiary. Nicola changed its name because its 4 new Mining & Milling Profit Share Agreements, (MPSAs) are gold focused and its crown jewel assets are located in the Nicola region of British Columbia, (BC) Canada.

Despite $51 million having been sunk into Nicola’s assets, the Company’s market cap is approximately C$7.5 million, (

at market close 2/12/16). Essential to understanding the full story is the expert debt restructuring executed by

CEO, Peter Espig. The process enabled management to restructure and reduce $25.2 million in debt & payables by ~75% to $6.5 million. Most important, the remaining debt profile is far less onerous. [

Note: Details of

Debt Restructuring on Page six]

Mining & Milling Profit Share Agreements (MPSAs)

The

Merritt Mill & Tailings Facility, (

the Mill) is new, fully permitted & operational. It’s a large, state-of-the-art facility with crushing capacity of 500 Metric tonnes (Mt) per day (tpd) and current nameplate capacity of 300 tpd.

Nicola has already signed four gold MPSAs, and is negotiating others. MPSAs entail local partners extracting and transporting (

at their own expense) run-of-mine ore to the Mill. Nicola is responsible for all milling costs. Upon the sale of recovered concentrate, profits are to be split 50% / 50%.

Stockpiles are already on site at the Mill and management expects operations to commence in April. Throughput is planned to ramp up via existing and new MPSAs. A conservative scenario in which Nicola takes a methodical approach to sourcing and processing ore (

to address potential supply / logistics issues), could result in the Company exiting the year at 125-150 tpd, i.e. at 50% capacity. [

Note:

Estimates assume the Mill is fully operational.

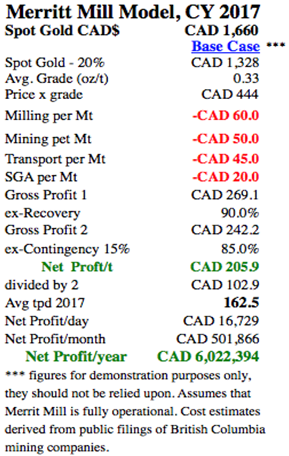

Please review (on page 2) my base case Merritt Mill performance

estimate for CY 2017. From the top, the current C$ gold price, (

recently at C$1,660/oz), is discounted by 20% to determine a CY 2017 gold price assumption. Next is the average annual ore-grade assumption measured in oz/Mt. I believe 0.333 oz/Mt is reasonable given the terms of three existing 10k Mt agreements averaging 0.417 oz/Mt (

see below). The items listed in red are fixed costs per Mt. A 15% contingency is deducted for added conservatism to obtain an estimated net profit/Mt. That figure is halved (

50% / 50% partnership split) to reflect Nicola’s share. The bottom line shows an estimated net profit to the Company of

$6 million. [

Note:

this is an estimate only, not a forecast by the Company or the author]

An illustrative MPSA is the, “

Siwash Agreement,” with

Siwash Minerals Inc., see

press release. Under this MPSA, the mining partner is required to deliver ore with a minimum grade of 0.25 oz/Mt. Siwash already has a stockpile of 3k Mt, with plans to double it and then ship 6k Mt to the Mill. Assuming Nicola were to process 6k Mt over 60 days that would equate to one-third of the Mill’s stated capacity. Siwash hopes to apply for a 10k Mt bulk sample permit which, if received, would represent ~ 167 tpd over a subsequent 60 day period. Given the recent increase in the price of gold, timing for both parties could prove to be fortuitous.

In my opinion, each input in the financial model is fairly conservative. Therefore, taken together, the inputs should produce a conservative bottom line estimate. While there’s downside to any financial metric, I believe there’s upside to the Mill utilization estimate of 162.5 tpd. This figure was derived from the average of a 4-quarter ramp up from 100 tpd in q1 2017 to 150 tpd in q2 and 200 tpd in 3q & 4q. That would place the Mill at two-thirds capacity by year-end 2017. Given nameplate capacity of 300 tpd, 175 – 225 tpd in 2017 is not a stretch.

Estimated cash flow is

before growth & maintenance cap-ex. Given the Company’s operating losses, it will not pay taxes in 2016-17. A very conservative 50% haircut from the estimated $6 million (

to account for growth / maintenance cap-ex & “other”) would leave $3 million in

free cash flow. That implies Nicola (

assuming the Mill is fully operational) is trading at just a 2.5x 2017e free cash flow multiple. Royalty & milling companies characterized by long-term, annuity-like income streams, typically command a premium valuation in the market.

Mining & Milling Profit Share Agreement Terms

Mining & Milling Profit Share Agreement Terms

10,000 Mt bulk sample permit grading > 15.552g/Mt (> 0.5 oz/Mt

10,000 Mt bulk sample permit grading > 15.552g/Mt (> 0.5 oz /Mt)

168 Mt of > 47.6g/Mt (> 1.68 oz/Mt)

10,000 Mt bulk sample permit grading > 7.78g/Mt (> 0.25 oz/Mt)

Final permitting on two mining projects is underway, therefore Nicola cannot accurately predict milling commencement dates.

A vital component in Nicola’s MPSAs is the Company’s success in getting exclusivity on each. It’s a win / win as Nicola unlocks the value of its partners’ properties by providing an opportunity for them to monetize their ore. Without Nicola, these miners would likely not be mining. It`s very difficult to get a milling permit, it would cost $10s of millions and take years to design & build. Therefore, barriers to entry are high, the Merritt Mill is protected from competition by capital & regulatory constraints. Not to mention that the Mill is the only operable mill in the region.

$51 million has been spent on Nicola’s assets over 30 years, of which about $31 million was for acquiring land & building the Mill and associated tailings facility.

Chairman of the Board and 2nd largest shareholder Frank Högel had this to say, quote,

“Nicola Mining has a powerful combination of valuable assets, strong financial backing and a world-class team. We at my firm CCM, are thrilled to be part of what we believe will be a highly successful investment. As Chairman, I speak for the entire Board when I say that we will do our best to provide frequent updates on what we hope will be very exciting news this year.”

Epic Downturn Creates Buying Opportunity of a Lifetime

In light of the severe economic downturn and disappearance of investment capital in BC, Nicola’s management & Board is actively screening acquisitions in the region. In fact, the Company is currently evaluating two opportunities. The plan to acquire deeply distressed assets has moved a lot higher on the list of corporate initiatives.

Today’s M&A market offers tremendously attractive opportunities — assets literally available at pennies on the dollar and (very substantially below) capital invested. As a former M&A banker and distressed turnaround specialist, CEO Espig understands how to purchase assets and structure transactions. The Company is pursuing properties that can be acquired: I) without the use of much cash or debt II) with permits largely in place III) that have simple mine plans IV) that are able to commence operations quickly, and V) that require modest additional capital. Why, you might ask, would Nicola utilize its undervalued shares as currency for acquisitions? Simple, the targets are decisively MORE undervalued.

Not only is it a buyer’s market, the number of distressed opportunities is growing and valuations continue to fall.

Conclusion

Nicola Mining is an active natural resource junior in an otherwise morbid sector. In addition to a potential near-term catalyst from gold milling, there are other situations under careful consideration, most notably the future of the Company’s other valuable assets — Thule Copper and Treasure Mountain. However, Nicola’s existing and future MPSAs alone could be a company maker. With a market cap of C$7.5 million and the possibility of millions of dollars in free cash flow next year, the upside in the stock price could be spectacular. On the flipside, the downside on the stock is protected by $51 million of historical invested capital, $31 million of which invested in a vital hard asset (The Mill).

Key to the investment proposition is that an investor in Nicola Mining (TSX-V: NIM) / (OTC: HUSIF), should know within just a few months if the Company is on track for generating cash… or not. It seems reasonable that demonstrating profitable milling operations this year, would attract a great deal of interest, possibly leading to a meaningful uptick in Nicola’s valuation.

Disclosures: Nicola Mining has a very small market cap. Small market cap stocks are highly speculative, not suitable for all investors. I, Peter Epstein, own shares and stock options of Nicola Mining. Mr. Epstein, CFA, MBA is not a licensed financial advisor. Readers should take that fact into careful consideration before buying or selling any stocks referenced herein.

Readers are encouraged to consult with their own investment advisors before buying or selling any stock, especially speculative ones like Nicola Mining. At the time this article was posted, Nicola Mining was a sponsor of: https://EpsteinResearch.com. Please consider visiting: https://EpsteinResearch.com for free updates on Nicola Mining and others across a range of sectors. While at https://EpsteinResearch.com, please enter an email for instant delivery of my work. Thank you for supporting my articles & interviews.