Source: Thibaut Lepouttre of

Caesars Report exclusively for Streetwise Reports (4/4/16)

https://www.streetwisereports.com/pub/na/bonterra-resources-delivers-its-own-march-madness

BonTerra Resources stock is up just over 70% in March and 146% in 2016. In March, BonTerra acquired nearly 1 Moz of gold at the Larder project and released great drill results on the Gladiator project, and there is more to come.

Caesar's Report's Thibaut Lepouttre discusses the merits and effects of such a busy month.

It's remarkable to see how larger companies are falling back to safer regions to explore for and to mine gold. Kinross, for instance, spent billions and billions of dollars on gold projects in second-tier countries, and the acquisition of Aurelian Resources and Red Back Mining aren't really successes. Keeping that in mind, the company's most recent $610 million ($610M) acquisition was the Bald Mountain and 50% of the Round Mountain mine in Nevada. This shows how even the companies that weren't afraid to take some geopolitical risks are now trying to do business in first-tier mining countries again.

The new ultra-high-grade intervals might boost the average grade of the resource toward the 10 g/t mark or even higher.

But, of course, the acquisition targets will have to come from somewhere, and senior producers are still pretty much depending on exploration-focused companies to discover new gold deposits in those safe regions. One of those companies that definitely deserves to be highlighted is

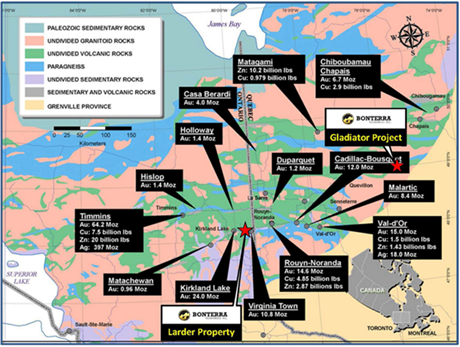

BonTerra Resources Inc. (BTR:TSX.V, BONXF:OTCMKTS, 9BR1:FSE) with ounces in the ground in both Québec and Ontario, Canada. Today, BonTerra no longer is the BonTerra it used to be, as not only is it continuously enjoying exploration successes at Gladiator, it also acquired almost 1 million ounces in the ground for a total consideration of less than CA$5M. This resulted in renewed investor interest and the average daily trading volume have been edging up in the past few trading days and weeks.

One-third of the fully funded 25,000-meter drill program has now been completed

BonTerra has owned the Gladiator gold project for quite a while now, and back in 2012 it became clear the company was sitting on a high-grade gold project. Unfortunately, BonTerra was also hit by the turmoil on the gold market, and the company switched into 'hibernation' mode from 2013 until late 2014.

Most companies would have suffered a tragic death, but BonTerra Resources surprised the market and did the opposite of what other junior exploration companies were doing: It was investing in its human capital. BonTerra appointed Dale Ginn (ex-Harmony Gold Mining Co., HudBay Minerals Inc. and the founder of San Gold Corp.) to its board of directors in 2015, followed by an 'upgrade' to vice president of exploration.

BonTerra didn't waste any time, and after a successful summer drill program where the assay results returned almost 8 meters (8m) of 7+ grams/tonne (7+ g/t) gold, several other high-grade gold intercepts confirmed that the mineralized zones were still expanding.

The company was extremely encouraged by this and after tapping the market to raise CA$3.4M in an oversubscribed financing (adding Delbrook Resource Opportunities Fund to the list of insiders), BonTerra announced it would complete at least 25,000m of drilling at Gladiator, making it one of the largest exploration programs in Québec these days. And the nicest thing of all? The entire drill program is fully funded!

As of the date of the most recent update from Gladiator, BonTerra has already completed 8,300m of the anticipated 25,000m in 19 holes. And we dare say the drill program is already a huge success, as no less than 16 of the 19 completed holes have intersected visible gold!

Assay results are confirming Gladiator's high-grade nature

It's great to have visible gold in the drill core but a company obviously has to wait for the assay results to really know how good an intercept is. Earlier this week, BonTerra released a batch of five drill holes to the market, and the lab results are confirming the visual inspection of the drill core.

How does 5m of almost half an ounce of gold per tonne of rock at a downhole depth of just 80m sound? Or 3.3m at 29 g/t (yes, that's almost an entire ounce!)? Indeed, that's pretty amazing and this will have a positive impact on two different fronts.

First of all, it's not unlikely the average grade of the resources will increase. BonTerra already has completed an Inferred resource estimate for the Gladiator project, and using the base case cut-off grade of 4 g/t, Gladiator contains 273,000 ounces (273,000 oz) at an average grade of 9.37 g/t. That's great, but the new ultra-high-grade intervals might boost the average grade of the resource toward the 10 g/t mark or even higher. This could also allow BonTerra to rethink the cutoff grade it will use in the next resource estimate.

There's very little doubt the Gladiator resource estimate could easily be doubled.

A higher average grade is nice, but what the market will really care about is resource expansion. Sitting on 273,000 oz gold in the mining-friendly Québec is obviously very nice, but the critical mass-level hadn't been reached yet. A resource of 273,000 oz was too small to be developed independently and in the best-case scenario, BonTerra's Gladiator zone would have acted as a satellite deposit from where the nearby Windfall project could source additional ore.

But that's the past, as the 2015 and 2016 drill programs have been real game changers and eye-openers. The company has been able to increase the size of the deposit at depth and toward the west, and there's very little doubt the resource estimate could easily be doubled, and very likely will end up anywhere between 700,000 oz and 1 million ounces.

Et voilà, there is your critical mass. Of course, a lot more work will have to be done to complete the viability of Gladiator as a standalone project, but the company will be in a much better position with 750,000 ounces of gold rather than the 273,000 ounces it was sitting on. And don't discount BonTerra's large (and expanding) land package. The total size of the broader Gladiator project is almost 76 square kilometers (after having increased the size by 170% in the past weeks and months) and BonTerra has an inventory of exploration targets it will want to follow up on.

The acquisition of Larder: the next stepping stone

Owning an exciting exploration project is very nice, but thanks to the connections of Dale Ginn, BonTerra was able to negotiate and sign a deal with Kerr Mines Inc. to acquire Kerr's Larder property in Ontario.

This is a major step forward for BonTerra, as not only is this project located close to existing infrastructure (there's a powerline and a highway running through the property), it also comes with an existing (historical) resource estimate containing almost 1 million ounces of the yellow metal at this past-producing mine that is located just a few kilometers from the well-known Kerr-Addison mine, which produced in excess of 10 million ounces of gold.

Acquiring Kerr's Larder property in Ontario is a major step forward for BonTerra.

And the total consideration for these 950,000 ounces (with the potential to increase the resource estimate)? Just CA$1.15M in cash and 10 million shares of BonTerra, which will make Kerr Mines a 15% owner. Based on the share price right before this deal was announced, the total cost per ounce is less than CA$6/oz, a true bargain! No shareholder is approved on either side, and both companies are now just waiting for the exchange to sign off on the deal before closing it. And you shouldn't worry about the overhang either, as Kerr has entered into a voting lock-up agreement with BonTerra Resources whereby Kerr will be voted with the BonTerra management team in the next 24 months.

The acquisition of Larder isn't just adding cheap ounces to the inventory, it also provides BonTerra with 'optionality.' Instead of 'having' to focus on Gladiator, BonTerra now has two exciting exploration projects where it could add more ounces rapidly and cheaply.

Conclusion

Just one year ago, BonTerra was one of the so many Québec-focused exploration companies with a small resource estimate. A lot can change in just six months, and BonTerra's recent high-grade exploration results at the Gladiator project have put this company on a lot of radar screens.

And if that isn't enough, with the acquisition of the Larder gold property from Kerr Mines, BonTerra is now also providing optionality with two gold projects with NI-101-43-compliant resource estimates for a total of in excess of 1.2 million ounces (with more ounces to be added!).

Thibaut Lepouttre is the editor of the Caesars Report,

a newsletter and mining portal based in Belgium that covers several junior mining companies with a special focus on precious metals and base metals. Lepouttre has a Bachelor of Law degree and two economics masters degrees that have forged his analytical approach to the mining sector. Considered a number cruncher, Lepouttre focuses on the valuations of companies and is consistently on the lookout for the next undervalued mining company.

Want to read more

Gold Report articles like this?

Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our

Streetwise Interviews page.

DISCLOSURE:

1) Thibaut Lepouttre wrote this article for Streetwise Reports LLC, publisher of

The Gold Report, The Energy Report and

The Life Sciences Report. He owns, or his family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services.

3) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal

disclaimer.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Streetwise -

The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in

The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

Email:

jluther@streetwisereports.com