A Transformational Deal In The Potash Sector

A C$2.5 million acquisition could be the deal of the century in the slow-moving, Saskatchewan potash industry, a sector that saw its last mine come on-line almost fifty years ago.

To preface, last October, we wrote about Gensource Potash (TSXV:GSP), a small potash-developer based in sleepy Saskatoon, looking to rejuvenate the potash sector with proven, disruptive technology. Gensource is led by Mike Ferguson, the man behind the development of Potash One’s Legacy Project, which was eventually acquired by K+S in 2010 for US$427 million.

We compared potash in Saskatchewan to oil in Saudi Arabia, abundant, but controlled by a select few. Potash reserves are normally trapped 3,000 to 3,500 feet underground, thus, mines come with enormous price tags – it would cost US$3.2 billion to build a conventional two million tonne mine and mill.

Enter Gensource Potash, which plans on utilizing selective dissolution versus the traditional conventional underground mining and solution mining. To read more about the methods, click here for the original write-up; but to summarize, selective dissolution evolved from solution mining and features some key differences by employing newer technology that eliminates a lot of unnecessary layers and steps. Thus, a company can return profits on smaller scale operations – a game changer in the potash sector.

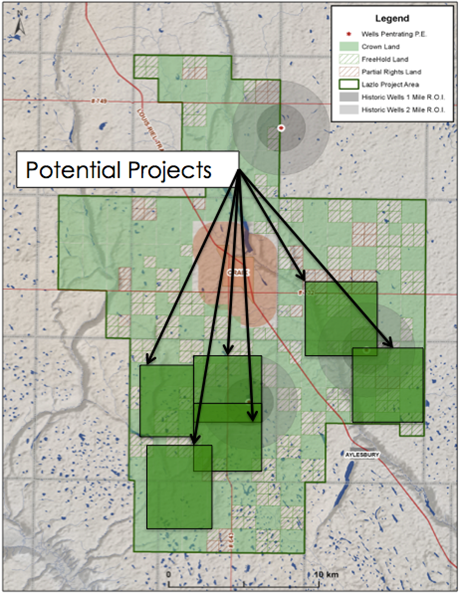

Gensource’s Lazlo Project is the textbook example of where to employ selective dissolution. The property sits in the Davidson Sub-Basin, where the Legacy Project is located – obviously an area that Mike and his team are intimately familiar with. The Lazlo Area can support several projects, but Gensource’s initial project will have a design capacity of 250,000 tonnes per annum. Once a plant site is built, ‘satellite’ deposits can be easily integrated into the project at a fraction of start-up costs, meaning the company will be able to expand operations using existing cash flow.

Gensource Leapfrogs Its Way To Production

On April 6, 2016, Gensource Potash Corp (TSXV:GSP), announced the signing of an asset purchase agreement and off-take term sheet with Yancoal Canada Resources, a wholly-owned subsidiary of Yanzou Coal Mining Company (YZC), a US$6.4 billion company and majority owned by state-owned Yankuang Group. Through its businesses, Yankuang is involved in coal production, engineering, manufacturing, transportation and electricity. Yankuang is a deep-pocketed conglomerate, and the off-take will allow Gensource to shop around for project financing.

The asset purchase agreement defines the terms for the purchase of two potash mining leases that make up some 63,800 acres of land adjacent to our existing Lazlo Project (the resource is all part of the same basin). There has been over C$4 million in field work completed on the leases, including: two drilled wells, cored, logged and assayed for potash; 110 kilometers of 2D seismic, extensive geological and engineering work.

Most importantly, Gensource will be able to use the acquired data to release a NI 43-101 report to define a formal resource, which will back-in to an already completed scoping study to produce the all-important PEA. Thus, Gensource will have a construction decision within 12 months, all for a small price tag. To put this into perspective, Gensource spent C$5 million to get to where they are, while other potash juniors have spent northwards of C$70 million.

Historically, as a potash developer crosses important hurdles and de-risks, the value is immediately recognized in share price. When Karnalyte Resources (TSX:KRN) announced its US$700 million financing for the first 625,000 tonnes of its Wynyard project, its stock jumped 280% over three days. Encanto Potash (TSXV:EPO) recently announced an MOU with Metals and Minerals Trading Company of India (MMTC) for a US$600 million off-take – its stock jumped 100% in one day. Encanto has a great asset in Muskowekwan and we respect its great partnership with the First Nations, however, we have some qualms about the ~US$3 billion price tag.

Western Potash is the only other company that is looking to utilize selective solution mining. The company’s original project, Milestone project, was not able to secure any sort of financing for the original US$2.9 billion project, and was forced to take a step back to re-scope the project. A pilot study was released on a portion of the mine, scaling back production from 2,000,000 tpy to 146,000 tpy, but also lowering capex to US$63 million. Western Potash has around the same amount of cash on the books from an investment from a Chinese group, and the group is currently in talks with technical advisors for construction plans.

We believe revamping Milestone was the smart thing to do, however, the scaled down project’s after-tax NPV is CA$56.7 million and Western Potash’s current market capitalization CA$95.8 million, leading us to believe there is limited upside until the financing environment greatly improves. Furthermore, the Chinese involvement means a lot of shuffling around of personnel, especially in the operational and technical front. This needs to be resolved before the company can move forward at all.

This brings us back to Gensource, whose US$195 million project has been flying under the radar. Mike and Rob wouldn’t want it any other way, being Prairie boys and letting their actions speak for them. This may be why the news of the C$500 million off-take was hidden in the last press release, but we have done our analysis and believe Lazlo will be the next producing mine in Saskatchewan. Gensource is deeply undervalued; the company has a paltry market cap of C$8.5 million, but this will soon change as the market digests the recently released news.

An updated resource is first on the horizon. Then another well needs to be drilled and seismic shot to get to a PEA. Gensource recently raised enough flow-through dollar to fully fund the well! At the same time we expect construction financing obtained and construction to begin in December 2016. Production is set for Q1 2018 – not bad for a sleepy company. Let’s go.

Palisade Global Investments Limited and/or its employees holds shares of Gensource Potash. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information.