The Power Of Optionality II

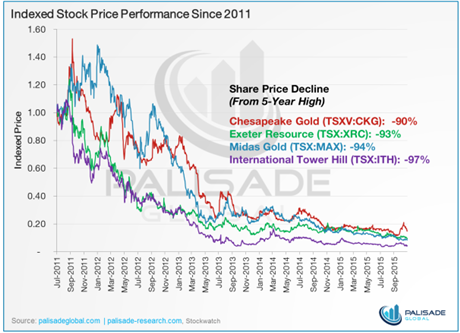

Let’s revisit this article from November 18, 2015, where we explored the concept of optionality and the tremendous upside it can offer in a beaten down market. More specifically, we highlighted the idea of identifying companies that own large-scale projects, with a proven resources in the ground, but not economic at depressed gold prices. With that concept in mind, we highlighted four ‘dirt-cheap’ optionality plays: Chesapeake Gold (CHPGF, TSXV:CKG), Exeter Resource (XRA, TSX:XRC), Midas Gold (MDRPF, TSX:MAX), and International Tower Hill Mines (THM, TSX:ITH). Below is a chart showing their performances up until our write up.

Rick Rule describes optionality as a strategy of buying into deposits that are currently out of the money, but that are likely to be worth many multiples in a higher commodity price environment. Let’s use this concept in a very simply example.

Mining is a finite business – a mine has a limited reserve and once that is depleted, the cash flow stops. This is very different from other industries where management can change and adapt, and theoretically maintain cash flow infinitely. Thus, when a mining company is valued, an astute analyst values the net present value of cash flow, versus looking at the traditional price-to-earnings ratio or other metrics that assume an unlimited life.

Cash flow in mining is derived after many different factors are accounted for, including but not limited to: capital costs (development and sustaining), operating costs, exploration costs, and miscellaneous G&A. Once a suitable cash flow model is determined, the future stream is discounted at a rate that takes into account geological, political, financial, and other risks.

Now that the NPV has been calculated, an investor can determine if the company is undervalued. This is when the concept of optionality arises; mining companies are leveraged to the commodity they are producing.

Take a gold company that produces gold at an all-in sustaining cost of $1,200 per ounce. If gold prices are $1,250 per ounce, the NPV would be calculated on a margin of $50 per ounce. Now let’s assume gold prices increase to $1,300 per ounce. This increase in gold is only a 4% bump, but increases margins from $50 per ounce to $100 per ounce; a 100% increase.

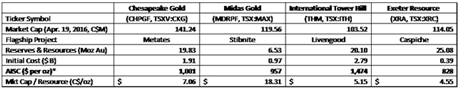

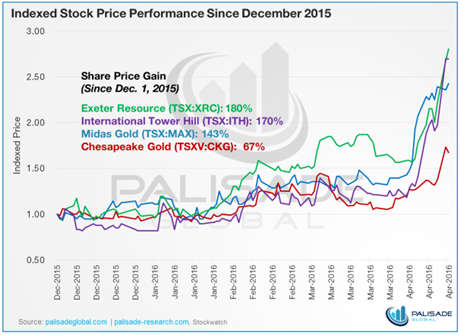

Let’s revisit the four ‘optionality’ companies:

None of these companies are in production, but estimate all-in sustaining cash (AISC) costs ranging $828 to $1,474 per ounce, and initial capital expenditures of $390 million to $2.79 billion, it’s no wonder these projects were deemed uneconomic in depressed gold environments. However, with gold prices rebounding this year, many models were tweaked with higher prices, and valuations increased accordingly.

Voila – optionality!

Now let’s go one step further, applying the concept of optionality to early-stage exploration companies that have ounces in the ground. Out of favor companies that have fallen through the cracks on the basis that its gold will never be extracted. These companies will experience the same exponential increases, however, will follow in the steps of producers and more advanced companies.

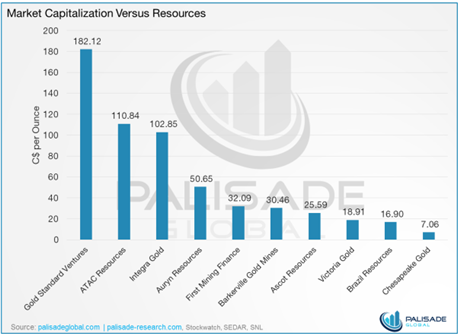

With this concept in mind, we looked at some of the early to mid-stage gold exploration companies listed on the TSX Venture with over 500,000 ounces in resources. Here are some of the largest companies in order of highest C$ per ounce.

There is definite variability in terms of C$ per ounce. However, further analysis reveals a greater premium is awarded to projects that are further along the development chain or part of a significantly larger land package, where there is a higher than average chance more ounces will be discovered.

The average of the entire TSX Venture of companies with 500,000 ounces (outliers removed) is C$20.98 per ounce, thus we dedicated our efforts to the lowest quartile to find extremely undervalued companies. Obviously not all ounces in the ground were created equal, we simply used this metric as an initial screening tool to find potential investments. In the end, two companies filled our mandate and we made substantial investments in each company.

NRG Metals (TSXV:NGZ)

Current Price: C$0.14

Shares Outstanding: 33.20 million

Market Capitalization: C$4.65 million

Resource: 1.59 Moz Au

C$ / Ounce: 2.92

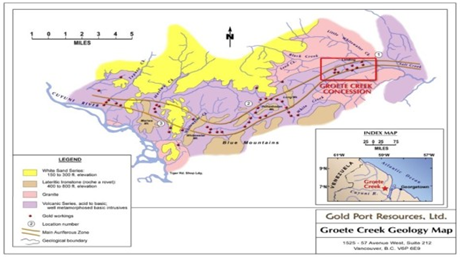

NRG Metals is currently concentrating on its graphite asset in Quebec, however, also owns the Groete Gold-Copper project in Guyana. Most of the work on Groete occurred between 1994 and 1996, and then again in 2012, where a total of 26 diamond drill holes and 4,903 meters were drilled. In the beginning of 2013, the company released its initial resource estimate: an in-pit inferred resource of 1.59 million ounces at 0.66 g/t AuEq, including 0.49 g/t Au and 0.12% copper (Cu) contained in 74.8 million tonnes.

The Groete Gold-Copper project is located in Cuyuni Mining District 4, approximately 60 kilometers southwest of the Capital of Guyana, Georgetown. The project is one of the most easily accessed resources in Guyana, having both deep water and electrical power infrastructure within 30 kilometers.

The project is defined with 4 kilometers of known strike east to west, and is still open to the west, east, and north. Metallurgical test-work has already been conducted by SGS Laboratories in Canada, and shows 82% Au and 96% Cu recovery by floatation, with improvement in gold recovery through addition of gravity separation.

Most of the fieldwork to expand the resource has been targeted in the Eastern zone, where geo-probe surface evaluation was completed over 52 deep soil holes of up to 8.75 meters in depth. Of the 52 holes, 47 tested for gold with an average of 0.10 g/t and with 23 testing greater than 0.50 g/t. There is strong indication of potential bedrock mineralization 200 meters east of the last area drilled.

In any other gold market, Groete would be a flagship asset, which it has been in the companies preceding NRG Metals. With the rebound of gold prices, we expect management to seriously look towards progressing the project towards a Preliminary Economic Analysis. The next step would be more drilling, to infill existing holes and to step-out in the efforts to define a limit. We expect proving up the resource to be priority number one.

CEO and President, Adrian Hobkirk, maintains that the L.A.B. Graphite project in Quebec will remain the priority in the near future, but we expect Groete to emerge from hibernation sooner than later. Maybe a spin-off is in order, or another financing more geared towards Groete’s drilling. We do not expect a fast turnaround in stock price, and invested solely due to the C$2.92 per ounce price tag and the gold optionality. That being said, we believe there are a lot of merits in the graphite project and are treating as a free call option.

Northern Freegold (TSXV:NFR)

Current Price: C$0.12

Shares Outstanding: 39.04 million

Market Capitalization: C$4.69 million

Resource: 3.25 Moz Au

C$ / Ounce: 1.37

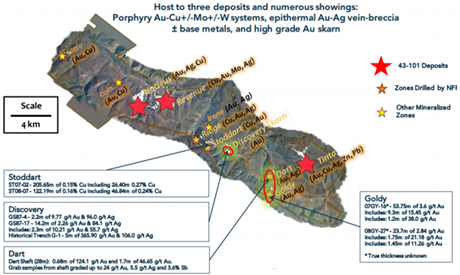

Northern Freegold is the cheapest TSX Venture stock in terms of C$ per ounce. NFR’s flagship asset is the Mountain Gold-Copper Project is located in very mining-friendly Yukon.

In the short time that the company has explored the project, NFR has identified more than 20 mineralized zones, delineated a NI 43-101 million ounce gold-copper at the Nucleus Deposit, a NI 43-101 million ounce gold-copper-moly resource at the Revenue Deposit and a high grade poly metallic NI 43-101 resource (gold-copper-silver-lead-zinc) at the Tinta Deposit. In total, the company has 1.31 million ounces of indicated resources, and another 1.94 million in inferred.

As we stated earlier, a premium is awarded to the ounces in the ground that are part of district scale potential. In the case of Northern Freegold, there is over 200 kilometres to work with!

The mineralization of the Freegold Mountain project occurs within basement and younger intrusive rocks, controlled by both structure and favorable geologic unites. The new discovery at Irene showcases the potential for high-grade gold mineralization at surface in an underexplored area of the property, situated in a fertile structural corridor. There is significant potential to develop the other highly prospective targets on the property including continued expansion of the three defined deposits. Both the Nucleus and Revenue remain open in all directions and at depth, and the Tinta Hill vein system open along strike and to depth.

In all honesty, we expect Northern Freegold to be acquired. We have done our due diligence and are scratching our heads at the current valuation of C$1.37 per ounce. The Yukon is a red-hot area right now and NFR has simply been flying under the radar.

Palisade Global Investments Limited and/or its employees holds shares of ITH, NGZ, and NFR. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information.