The Dollar managed to stay above the technically important 92.50 level, causing gold to drop in price four out of the five days this week. Gold did rally on Friday, following what was widely regarded as disappointing job numbers: nonfarm payrolls increased by 160,000 (below the consensus of 200, 000). This, and the drop in the participation rate to 62.8% from 63.0%, convinced the gold market that the FED was definitely NOT going to raise rates anytime soon and so the party resumed. Even so, gold was unable to recover the $1300 level, and closed down for the week.

Even though the job numbers printed lower than was expected, it seems to us that more attention should be paid to wage growth, which came in at 2.5% year over year. For the last five years, average hourly earnings growth has been more or less flat, averaging 2.1% year-over-year, but has averaged 2.5% since last December.

This is more important than most people realize since increased wages should lead to;

* More consumer spending

* More business profits

* More tax revenues

* Less government borrowing

* Positive data for the FED to use as justification for a rate hike

That last point, will have a positive effect on the Dollar, and a negative effect on the price of gold in the next few months. We doubt that the FED will raise rates in June, but it could raise as early as July.

This week, gold started to trade divergently with the 30-year bond (pink circles on the chart below) which leaves the door open to a change in direction and, therefore, more upside. But since the divergence has just started, there is a fair chance that the bond will start to drop and take gold down with it before gold has a chance to change direction.

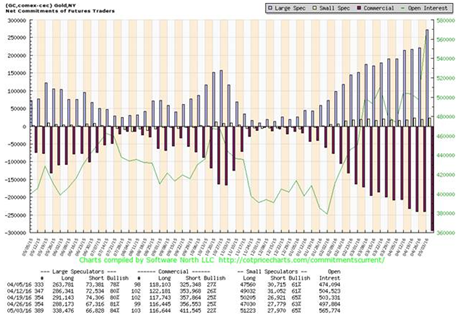

The commitment of gold futures traders took a quantum leap during the week ending last Tuesday; commercial traders backed up the truck and dumped their load, while the large speculators scooped it all up. We now have two VERY crowded rooms. The fact that gold continued to drop in price on Wednesday and Thursday, implies that the increase in the commitments is even greater than the reported numbers.

Considering the fact that the FED is likely to raise rates at least once in the next six months, chances are that the Dollar will continue to strengthen, causing panic among the speculators in the long room. We think that in the near term, the fundamentals will keep the commercials comfortably in the short room.

ANG Traders

Join us at www.angtraders.com and replicate our trades and profits.