If you’re a big believer in Silver, as we are at BullMarketRun.com, there’s one company you must familiarize with and that’s Kootenay Silver (KTN, TSX-V) which executed flawlessly at the bottom of the market cycle at the beginning of this year to secure a leading position in the Mexican Silver sector. Its market cap has soared more than 300% since the end of December – probably just the start of what’s ahead for a company with rapidly growing resources that has attracted the keen interest of 3 producers.

KTN is part of the BMRTop 50 Opportunities List which has posted a staggering 221% annualized return.

In this feature piece, we examine the “4 Factors” that position KTN as a prolific junior “growth” stock – then find out how you can leverage this opportunity in a unique way:

1. Silver – Early Stages Of A Powerful New Bull Market

2. The Proven Blueprint

3. Endorsed By The Architect

4. Harnessing The Power Of High-Quality Properties

[1] Banking On Silver, A Metal Our World Can’t Live Without

According to

“Silver Institute.org”, there has been a physical supply deficit in the metal in

4 of the last

5 years. Between

2011 and

2015, mined production averaged

825.4 million ounces per year versus

1.1 million ounces of physical demand. Defying the economic laws of “supply and demand”, Silver declined in price each of those years – an unsustainable trend.

When commodities (corn, wheat, Oil, etc.) sell near or below production costs for too long, eventually some of that production gets curtailed significantly. Essentially, the cure for low prices is low prices. Demand remains and supply slows or shrinks, leaving only one direction for prices to go – northbound.

Given that Silver production is largely a byproduct of Copper, Gold, Lead and Zinc, BMR sees a perfect storm gathering on the horizon. The growth in overall global Silver mine production has been slowing, thanks to a combination of low Silver prices and less industrial metal production due to weaker global growth, while overall demand keeps increasing thanks in part to physical investment.

One would be wise not to forget that Silver has been used as “money” and a “disinfectant” for thousands of years. Hospitals use Silver-coated filters to purify water. It’s also the best known reflector of visible light. Every solar panel worldwide uses up to 20 grams of Silver! In addition, thanks to its electrical conductive properties, Silver has widespread usages in fast-growing areas like computer circuit boards and nanotechnology wires – to name just a few demand drivers going forward.

Since its founding in 2006, Kootenay Silver has worked smartly and aggressively to amass over a Silver resource of 144 million ounces. The company’s strategic land positions in the most prolific regions of Mexico all but ensures its bankable Silver ounces will grow rapidly over the next couple of years and beyond.

[2] Kootenay Silver Is Executing On A Proven Blueprint

Mr. Ross Beaty, a geologist and lawyer, founded Pan American Silver (PAA, TSX) in 1994 with the aim of giving investors leveraged exposure to higher Silver prices. Via acquisition and good old-fashioned exploration, he and his team methodically accumulated quality Silver projects while metal prices were low. As Silver appreciated through the 2000‘s, Pan American’s stock went with it, except more dramatically – gaining over 1000% from low to high.

Led by CEO James McDonald, the Kootenay of today resembles Pan American back then. Via acquisition and good old-fashioned exploration, KTN’s current property portfolio is highlighted by Promontorio, La Negra and La Cigarra, and some very promising earlier stage opportunities.

The “timing” component of this plan cannot be understated. For it to work, acquirers cannot overpay for assets. Kootenay paid just 21 cents for each ounce of known Silver in the ground when it acquired Northair Silver earlier this year at the bottom of the market cycle. This compares favorably to Kootenay’s per-ounce “discovery cost”, roughly 45–50 cents (a respectable number in its own right).

Kootenay’s timing was impeccable as far as the Northair acquisition was concerned. Therefore, the price was right.

McDonald has plenty of experience in the industry and has been able to recruit impressive “bench strength” at Kootenay. He co-founded and successfully developed National Gold, a company that later merged with Alamos Minerals to form Alamos Gold for which he was a director and served on numerous committees until 2012.

[3] Endorsed By The Architect

Kootenay is executing on a proven blueprint endorsed by Beaty (net worth >100 million) and Pan AmericanSilver (market value +$3 billion CDN)!

How’s that for evidence?

Each is a large KTN shareholder, mine development partner, or both. Prospective investors and current shareholders should be emboldened by that fact. Recognize the end of the bear market for what it is – a tremendous opportunity to buy low and accumulate a stock that could skyrocket in the good times ahead.

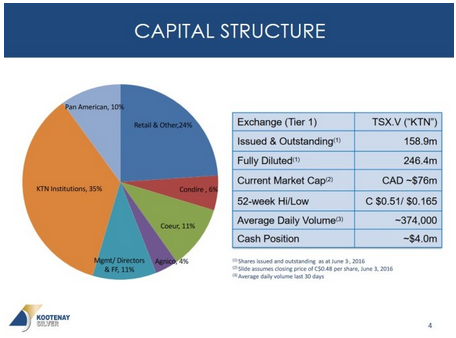

Look at Kootenay’s share structure: management, directors, friends/family, Agnico Eagle, Couer Mining, Pan American Silver and Ross Beaty collectively own over 35%.

…you are the company you keep.

[4] Property Power = $

As per the agreement February 16, Pan American will invest $8 million (U.S.) into the Promontorio mineral belt properties. Additionally, it will make cash payments to Kootenay totaling $8 million (U.S.) over a 4-year period.

Here’s what Pan American’s CEO Michael Steinmann had to say about the deal:

“Kootenay has done an excellent job exploring their large land package in the Promontorio mineral belt, located just 190 km NW of our Alamo Dorado mine. La Negra is an exciting, high-grade, potentially open pitable deposit, and Promontorio is a large, lower grade Silver resource, which will likely require higher metal prices or better grades to move forward. Kootenay has already defined mineral resources at Promontorio and both deposits retain excellent exploration potential. This is an ideal entry point for Pan American into a highly prospective mineral belt located in a preferred jurisdiction, which will allow us to add value by utilizing our proven expertise in exploration and project development.”

As he indicated, La Negra is a robust deposit ideally suited for open-pit mining. In his statement the Pan American CEO also reminded investors that La Negra, in effect, could become the next Alamo Dorado which is nearing the end of its mine life.

Pan American is ultimately going to need ore from La Negra to replace Alamo Dorado. And there are some interesting parallels between the two that Pan American should find helpful. Alamo Dorado’s dominant Silver minerals are reportedly AgCl (chlorargyrite) and AgS (acanthite) – the same minerals are seen at La Negra, indicating potential for leach extraction.

The depth extent at La Negra could also be tremendous. Lending credibility to depth potential, drill hole LN-21 intersected 156 g/t Ag over 200 m with the bottom 50 m grading 420 g/t including 6 meters of 1,337 g/t. Kootenay has found higher grades on the way down, a high-class problem to have.

There could be a Gold system just a few km from the La Negra deposit, as well. Regional exploration carried out by Kootenay has identified a belt of highly anomalous Gold, Copper and Silver mineralization over a 4+ km area with impressive alteration, coined the Cameron-Vania Trend. So new discoveries could easily enter the picture – another compelling reason Pan American entered into a deal with KTN.

Kootenay Catalysts For 2nd Half Of 2016

What catalysts could move KTN higher in the months ahead?

Pan American will be drilling at both La Negra and the surrounding Promontorio mineral belt. As part of its option agreement for Year 1, Pan American is obligated to spend at least $1 million (U.S.) at La Negra and at least $2 million (U.S.) on other exploration and development targets in the Promontorio mineral belt other than La Negra and Promontorio.

In addition, Kootenay has a 3,000 m targeted drill program planned for Q3 at its 100%-owned La Cigarra Project. La Cigarra is located in the prolific “Parral” district in Chihuahua State, Mexico. Silver has been mined successfully in Parral for more than 400 years. In another coup for Kootenay, the company acquired Coeur Mining’s (CDE, NYSE) 2.5% NSR on future production at La Cigarra (through subsidiary Coeur Capital) in exchange for $500,000 U.S. cash and 9.6 million KTN shares

Kootenay’s McDonald stated to BMR, “We are literally just scratching the surface at La Cigarra.”

Click on the arrow below to hear more from McDonald regarding the potential of La Cigarra:

Between drilling at and around La Negra and at La Cigarra, Kootenay will have no shortage of news to report back to investors. As it moves into 2017 and 2018, the company will also have a clearer line of sight toward cash flow.

Technically, Speaking – What A Chart!

Kootenay has recently backed off from Fib. resistance at 50 cents to support at the top of a long-term downtrend line and previous Fib. resistance (new support) at 38 cents, so now is an ideal time for accumulation. The trend remains solidly bullish with the rising 50-day moving average (SMA) currently at 42 cents. There’s every reason to believe KTN will continue to advance toward the measured Fib. resistance indicated on this 3-year weekly chart.

KTN’s bullish technical posture and its powerful fundamentals point to an exciting 2nd half of 2016!

About the writer: Daniel T. Cook, the newest member of the BMR team, is from the great state of Texas. Daniel has a strong passion for the junior resource sector and has followed the Venture and broader markets with great interest since he bought his first stock 18 years ago at the age of 12. He’s also a licensed investment professional who was a Bright Future’s Scholar at the University of Central Florida, graduating in 2010 with a major in Finance. We know our readers will enjoy his material and benefit from his wisdom and insight. We welcome him aboard!

KTN And The Power Of Leverage!

Learn more re: KTN:Maximizing Your Leverage And A Company’s Growing Resources

Note: Dan and John do not hold share positions in KTN. Jon does hold a share position in KTN.

Disclaimer:

BullMarketRun.com (BMR) is reader-funded as a subscriber service and completely independent from any companies it covers. We accept no advertising either. No compensation was paid by Kootenay Silver for the above article or its distribution. Our stock coverage is for informational and entertainment purposes only and must not be viewed or interpreted as “buy”, “sell” or “hold” recommendations. No investment opinion or other advice is being rendered on any stock or company. We strongly recommend that you consult with a qualified investment adviser, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research before making any investment decisions. The stocks we cover, by definition, are highly speculative and potentially very volatile. Investors are cautioned that they may lose all or a portion of their investment if they make a purchase or short sale in these speculative stocks. We are not Registered Securities Advisers.Our opinions can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Adviser operating in accordance with the appropriate regulation in your area of jurisdiction. It should be assumed that BMR personnel, writers and their associates may hold or dispose of or trade in positions in any securities mentioned herein at any time. Owner/Publisher of BullMarketRun.com is Terry Dyer of Langley, British Columbia.

Forward Looking Statements:

All statements in BMR’s reports, other than statements of historical fact, may be forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often but not always identified by the use of words such a “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions.