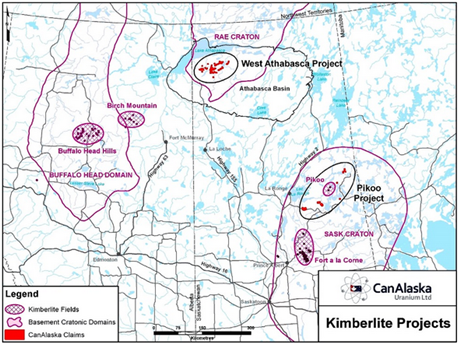

Today, Arctic Star Exploration Corp. has announced the 100% acquisition of the Diamond Dune Project in the Athabasca Basin, Saskatchewan. The new exploration project consists of 2 separate claim blocks totaling 40,832 hectares, located southwest and southeast of properties currently being explored for diamonds by DeBeers Canada Inc. and Canalska Uranium Ltd. Both have announced a $20.4 million CAD option agreement to explore 75 kimberlite-style magnetic targets identified by Canalaska from an airborne geophysical survey by the Saskatchewan Geological Survey. DeBeers recently completed esker sampling for kimberlite indicator minerals in the area and has commenced detailed magnetic mapping of geophysical anomalies. Canalaska’s stock is up +1,100% since February, when it announced the staking of its properties, and currently enjoys a market capitalization of nearly $30 million CAD.

Today, Arctic Star Exploration Corp. has announced the 100% acquisition of the Diamond Dune Project in the Athabasca Basin, Saskatchewan. The new exploration project consists of 2 separate claim blocks totaling 40,832 hectares, located southwest and southeast of properties currently being explored for diamonds by DeBeers Canada Inc. and Canalska Uranium Ltd. Both have announced a $20.4 million CAD option agreement to explore 75 kimberlite-style magnetic targets identified by Canalaska from an airborne geophysical survey by the Saskatchewan Geological Survey. DeBeers recently completed esker sampling for kimberlite indicator minerals in the area and has commenced detailed magnetic mapping of geophysical anomalies. Canalaska’s stock is up +1,100% since February, when it announced the staking of its properties, and currently enjoys a market capitalization of nearly $30 million CAD.

Most interestingly, Fjordland Exploration Inc. announced the acquisition of a neighboring property in March at a similar share price level as Arctic Star today (both around 100 million issued and outstanding). On the day Fjordland announced the property acquisition, its share price jumped by +250% on massive volume and 4 months later it‘s trading at $0.09 CAD today (+800%) and enjoys a market capitalization of $9 million CAD.

Arctic Star has a current market value of less than $3 million CAD and a similar performance is anticipated. As Canalaska and Fjordland have demonstrated over the last months, the Athabasca Basin is one of the world‘s hottest diamond exploration spots at the moment, attracting highly increased investors‘ interest.

As of today, Arctic Star has become one of the largest land holders in this prospective diamond territory and Rockstone is looking forward to the start of an exploration program, potentially creating vast shareholder value. Earlier this year, Chris Berry laid out the positive diamond market fundamentals going forward..

In April, John Kaiser from Kaiser Research Online reported as follows on Canalaska‘s property acquisition, which supports Rockstone‘s assumption that Arctic Star has acquired highly prospective ground with potentially yet to be discovered diamondiferous kimberlite pipes:

“It is a uranium exploration dead zone. In 2011 the Saskatchewan Geological Survey conducted a 400 m spaced airborne magnetic survey whose results were published in 2012. Nobody took much notice, but Canalaska‘s Peter Dasler and Karl Schimann, not having much to do after Fukushima crimped the spending activity of Canalaska‘s Asian partners, pulled the dataset and crunched it to see if anything encouraging for uranium targets was present. They were disappointed, but noted a cluster of discrete near-surface magnetic anomalies that made no sense given the monotonous nature of the basin‘s Proterozoic sandstone cover. The only plausible explanation was an igneous intrusion, and the only intrusion that would create such a circular magnetic feature would be a kimberlite style intrusion...

But the intrusions that make up these targets do represent meaningful tonnage, with few alternative explanations, so if indeed Canalaska has snagged most of a new diamondiferous kimberlite field, a major exploration play will emerge. I use the word „most“ because not everybody believes that the 400 m spacing of the geophysical grid flown by the SGS had sufficient resolution to highlight all kimberlite targets. While the sandstone is magnetically quiet, a magnetic geophysical anomaly merely measures relative magnetic difference. A kimberlite pipe need not have a prominent magnetic signature that shows up on a 400 m grid survey. More subtle magnetic signatures might only show up on a survey flown on 100 metre lines.

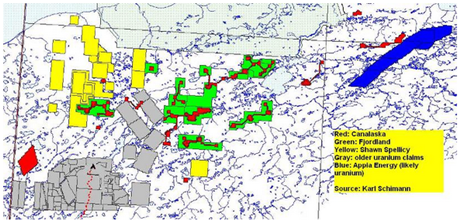

On March 16, 2016 Fjordland Explorations Inc announced that it had staked 26,223 hectares in the same area as Canalaska‘s claims on the premise that Canalaska did not get it all. I contacted Fjordland‘s CEO Dick (DA) Atkinson and discovered that Fjordland‘s claims surround Canalaska‘s „postage stamp“ claims. The rationale is that any field of kimberlites will have clusters of closely spaced kimberlites, of which the Renard and Gahcho Kue clusters are good examples. A staking strategy that places just enough claims to cover distinct magnetic anomalies could miss nearby kimberlites with geophysical signatures that do not show up on the scale of the government survey. The snapshot below from the Saskatchewan MARS claims system enhanced by Canalaska‘s Karl Schimann shows the extent of current area play staking.

At this stage of the Athabasca Kimberlite play Fjordland‘s Dick Atkinson is grasping at straws, but the situation reminds me in many ways of 1992 when Dia Met Minerals announced that it had discovered a diamondiferous kimberlite at Point Lake in a god-forsaken part of the Northwest Territories called the Slave Craton where very few juniors had ever dared to tread and which a Canadian subsidiary of De Beers called Monopros had sampled without any luck that led to a kimberlite discovery.

At the time the juniors were stuck in a bad bear market, a bear market so bad my brokerage firm employer decided a window office was wasted space when occupied by research analysts and moved the research department into a windowless former storage space in the middle of our floor. Although we knew nothing about diamonds, my research associate Andrew Muir and I recognized that the Dia Met discovery was significant, and initiated detailed coverage of the emerging area play. Chris Jennings helped us up the learning curve with his collection of diamond slides he had assembled during his career as a diamond explorer (yes, the old fashioned physical kind). We adopted the simple premise that Fipke did not “get it all“, and focused on a rag-tag bunch of juniors with names like Aber, Commonwealth, Southernera, Tyler, Fibre-Klad, Kettle River, Dentonia, Horseshoe, Almaden, Williams Creek and Troymin and recommended clients build a portfolio of these juniors surrounding Dia Met on the speculation that important pipes would be found outside the Dia Met-BHP property boundaries. In 1993 this prediction became reality, and proximity juniors which increased ten-fold from pennies during 1992, increased another 10-20 fold in 1993. I remember one of the banker partners hustling back an forth between his window office and the trading desk with blue buy tickets muttering over and over again „unbelievable“. By 1994 the research department had been moved into a windowed corner office. That this could ever repeat itself today seems unbelievable to me.

But what really triggered this flashback memory was my conversation with Dick Atkinson, now in his seventies, who was a big star in past decades. He decided to become CEO of Fjordland a couple years ago when Tom Schroeter retired after a valiant exploration effort to discover new copper-gold deposits in British Columbia. Atkinson, who steered Fjordland into a potential revival of the South Voisey‘s Bay nickel play, quickly discovered that this bear market was the mother of all bear markets that humbled all superstars without infinitely deep pockets to self fund a junior. When I spoke with him he was sitting in Fjordland‘s new office, a windowless former storage space in an office floor whose window offices were occupied by juniors that generally still had positive working capital. He had decorated the walls with his art collection; Andrew and I decorated our walls in 1992 with maps.

Atkinson lamented that he would have staked more ground, but there was not enough money, and he was having trouble in light of his two cent stock price persuading the holders of five cent warrants to exercise them. For now he owns 100% and has not resorted to a DHK style syndicate. It may be that a year from now Peter Dasler has demonstrated his targets to be nothing more than another field of barren kimberlites, in which case this will be nothing more than a sad anecdote. However, I mention this story because it has a textbook resemblance to other great discovery stories that erupted from a bear market abyss with the help of desperate entrepreneurs as was the case with the Lac de Gras diamond play.“

Company Details

Arctic Star Exploration Corp.

1111 West Georgia Street

Vancouver, B.C. V6E 4M3, Canada

Phone: +1 604 689 1799

Email: info@arcticstar.ca

www.arcticstar.ca

Shares Issued & Outstanding: 96,363,073

Canadian Symbol (TSX.V): ADD

Current Price: $0.025 CAD (July 20, 2016)

Market Capitalization: $2 million CAD

German Symbol / WKN (Frankfurt): 82A / A1JCQC

Current Price: €0.015 EUR (July 20, 2016)

Market Capitalization: €1 million EUR

Disclaimer: Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist.