The Gold Report: Would you talk a little bit about your investing philosophy?

Bruce Campbell: StoneCastle invests primarily in Canada, and a number of different things fit into our portfolio. We always look at the world and try to figure out whether or not we're on offense or defense; that's the first step of our investment process. When we are on offense, we're fully invested. If we're on defense, we're less than fully invested and can have substantial amounts of cash.

We're pretty tactical with that. We'll move from cash to being invested over a fairly quick period. So as we see a number of different indicators that we follow move one way or the other, we either bring our risk up or bring our risk down in the portfolio. And when I talk about substantial amounts of cash, it's not unheard of for us to have 40%-plus cash in a portfolio. Certainly in 2016 there have been times when we had that much cash. We're not there right now; we're actually fully invested.

Looking at the bottom-up side, we're all-caps so we'll scour the universe to find companies that meet our criteria. We're generalists, so we really go anywhere and everywhere.

Typically, we're looking for companies that have some type of catalyst that's going to be driving their earnings, revenue and cash-flow profile either now or in the immediate future. And again, that's anything in Canada, whether a small cap, a midcap or a large cap.

"One of the companies that we find particularly interesting is Red Eagle Mining Corp."

The second part of our process on the bottom up is that we also like to invest in companies that have been rewarded by the market and the market is seeing the same type of thing that we are. We're typically looking for relative strength. In the Canadian market specifically, relative strength is a very investable discipline. Most investors are taught the opposite—buy low, sell high—but in reality, with Canada being a little bit narrower, we find that if we're looking at companies that have already made a substantial move and have earnings momentum and improvement in their fundamentals behind them, they tend to continue along that path for a lot longer than most investors give them credit. So we're not afraid to be buying stocks that have relative strength and have momentum from a price perspective.

We often have names that aren't typical household names in most Canadian institutional portfolios. A lot of times we're flying under the radar in that we have companies that most people haven't heard of or are, in some cases, too small for a lot of the investment managers in Canada to own because the market tends to be dominated by large-cap value managers who are domiciled in one of the banks' firms.

TGR: At this point, how are you feeling about resources in general?

BC: If you go back 36 months, we would have had a fair weighting in resources, both energy and materials, in our portfolios. And then about 24 months ago, we really started to see the materials side drop out of the portfolios, and we were left with only energy. Around 12 months ago, we lost all of our energy exposure as well and really didn't have any energy or materials in our portfolios until the first part of this year.

We started to see more of the names in the materials space show up into our screening process. Initially it was the gold mining stocks, followed by base metals and energy. We now have holdings in gold, which we haven't had for 36 months, and we have holdings in base metals, which we haven't had for 24 months, and we have energy exposure as well. We have a smattering of other sectors, too, some technology, some industrials, a little bit of healthcare.

TGR: Is there a gold company that you'd like to tell us about that you're invested in?

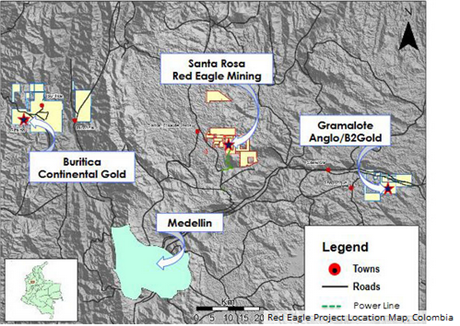

BC: One of the companies that we find particularly interesting is Red Eagle Mining Corp. (RD:TSX.V; RDEMF:OTCQX), which is just finishing its mine build-out and should start its pre-commercial production probably in Q4/16. I mentioned that we're typically looking for companies that have a catalyst to their business that will drive revenue, cash flow and earnings. Red Eagle really fits that profile in that it's a company that was financed by management. It hasn't relied on brokers and The Street to finance it. As a result, there's no analyst coverage on the stock.

The company did the initial drilling on its project, and the numbers came in quite good. It continued to do infill drilling, which showed that the numbers in its feasibility and economic assessment are actually better than the numbers that it originally looked at. It's going into production here fairly soon. Typically, these companies, when they first make their discoveries, have a huge run-up in their share prices and then a lag in between when they find the discovery and when they move forward with getting a mine built. Moving up into the production phase, we typically see the stock price start to come up again. Then the analysts start to look at it on a cash-flow basis of where they're going to be at.

When we look at Red Eagle compared to a peer group and where we think its production and cash flow will be, the valuation is about half of what we think the peer group is at.

TGR: What other companies do you particularly like at this moment?

BC: A company that we like and have for some time now is called Sleep Country Canada Holdings Inc. (ZZZ:TSX). Sleep Country is a mattress retailer in Canada. The company was public a number of years ago. It was taken private and then went public again about 16 or 17 months ago. It has had phenomenal sales growth, 12 consecutive quarters of same-store sales growth. The last quarter it reported was actually 12% same-store sales growth.

At the same time, it has also been building out its store count. So if you look at peers in the U.S., its population density is about half of what it would be in the U.S. The average store in the U.S. is one store per about 100,000 people, and Sleep Country has about one store per 180,000 people right now. It has lots of room to go growing out its stores, and at the same time its same-store sales have been really strong.

Sleep Country has a distinct and unique process that it uses for selling. It's almost impossible to compare mattresses on a price perspective because it seems that no two retailers have the exact same mattresses. Once people go into its store, Sleep Country tracks the ratio of people who come in versus the sales, and it is always working on converting those people who come into the store to actually buy something. Sleep Country has also been focused on accessories and finds that is a higher-margin business than the straight mattress business.

One of its big competitors is Sears Canada, which has been struggling from a sales and cash flow perspective, so it's actually been shutting stores. That works to Sleep Country's advantage. The stock's not super cheap but this is a case where you're paying out for solid growth.

TGR: Would you like to go on to another company?

BC: Another company that we like—another off-the-radar company—is Pacific Insight Electronics Corp. (PIH:TSX). It's in the auto business and assembles components for different manufacturers. The two big areas that it focuses on are interior LED lighting and gauges and instrumentation. Ford Motor Co. (F:NYSE) is one of its big clients. From what we understand, the F-150 truck has a lot of its LED lighting in it.

The company isn't an overnight success but has been 25 years in the making, in that it has really seen a ramp-up in its sales over the last two years and in profitability. The stock has gone from where it was a microcap to where it's now starting to show up on the radar screens of a lot of institutions just based on its market cap. And it trades at quite attractive valuations. It's been growing its earnings at 20%-plus per year over the last three years, and the stock is still trading at less than 10 times earnings. So compared to its comparable companies, it's fairly cheap here.

The company recently reported its Q4 earnings. It seems the market was a little surprised by the earnings and the stock has sold off, creating an opportunity to buy the shares cheaper. In the company's MD&A they also made mention of working with Tesla on a new project. This will diversity the company and also get it into the fast–growing electric car segment.

TGR: Are there other companies that you'd like to tell us about?

BC: Another one that I'll throw out there is a diversified real estate company, with one division that is growing a lot faster than the rest. The company is called Altus Group Ltd. (AIF:TSX). It has three divisions: two real estate divisions and a surveying division. Of the two real estate divisions, one does consulting for large commercial real estate portfolios.

It also has Altus Analytics, which is a software service division; we think this is the real hidden gem in that the division has been growing at about 30% per year over the last three years and flying under the radar. The division has very strong recurring revenue because when somebody signs on, they stay on. And then it has tons of runway. It really dominates in Canada and has exposure in the U.S., but it has a global market that it can sell into.

Its third part is a survey division called Geomatics. It's been struggling here of late. A lot of its business is tied to Alberta, specifically with the oil and gas sector. With the slowdown in that sector, that division has actually been losing money. But with the move up in crude over the last several months, I think we could be coming to the end of that division losing money and no longer being a drag; it would actually start contributing to the overall profitability of the company.

I think with the results that we're seeing from the Altus Analytics and the headwind of the Geomatics business behind it, this would certainly open up the opportunity for increased earnings going forward from that company as well.

TGR: Bruce, thanks for talking about this very eclectic group of companies.

Founder and portfolio manager of StoneCastle Investment Management Inc. and a former portfolio manager for some of the largest investment dealers in Canada and the U.S., Bruce Campbell brings more than 23 years of experience to fund management. A graduate of the University of Alberta with a bachelor of commerce degree specializing in finance, Campbell has earned multiple designations in investment management, including the Chartered Alternative Investment Analyst (CAIA) and the Chartered Financial Analyst (CFA) designation, one of the most prestigious designations in the financial industry. Campbell is a past president of the Okanagan CFA society.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC. She provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this interview: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this interview: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Red Eagle Mining Corp. The companies mentioned in this article were not involved in any aspect of the interview. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Bruce Campbell: I own, or members of my immediate household or family own, shares of the following companies mentioned in this interview: None. I am, or members of my immediate household or family are, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. Funds controlled by StoneCastle Investment Management hold shares of the following companies mentioned in this interview: Red Eagle Mining Corp., Pacific Insight Electronics Corp., Sleep Country Canada Holdings Inc. and Altus Group Ltd. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

5) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview or article until after it publishes.