Angkor Gold is the first North American-listed company with mineral assets in Cambodia and will be among

the first to realize the value of this new and untapped region.

The Kingdom of Cambodia, which is bordered by Thailand, Laos, and Vietnam, is a country with rich history and culture, most notably known for its Angkor Wat temples, the largest religious monument in the world. While mining is probably the last thing that comes to mind when thinking of this country, Cambodia does indeed have a developed mining industry, with its primary products being crushed stone, limestone, sand, and gravel.

Precious metals are not well represented. Most of the mines are small-scale, artisanal operations. The first soon-to-be-operating gold mine, Phum Syarung, is a product of collaboration between Mesco Gold Cambodia and Angkor Gold. In fact, on September 12, 2016, Phum Syarung received its commercial mining permit—the first of its kind in Cambodia.

Investors will take notice of this development. Historically, Cambodia has been an afterthought in the minds of even the gutsiest of investors. That was the truth, but things will change now.

The current government is providing much needed stability to the country’s political system, and has been integral in the development and maintenance of investment ties to the outside world. The country has slowly been integrating foreign expertise into many sectors, and this openness for cooperation with foreign investors has led to a strong inflow in capital, something we predict will grow exponentially. The granting of the Phum Syarung mining license was a step in the right direction.

The government of Cambodia continues to work towards improving its national platform, yet most mining companies still prefer to explore elsewhere. While the recent recession has been tough on the global resource sector, the emerging-market jurisdictions offer incredible exploration potential that has been lately ignored in favour of the more established ones, like Nevada or Canada’s provinces.

We agree that a measure of conservatism is healthy when it comes to global mining investment, however, the markets are now warming up to greenfield projects located in contrarian locations.

One reason for that is there are simply very few discoveries to be made in the established mining regions. Unless companies are looking for projects that were not feasible in the past or employ innovative methods of exploration, the odds are stacked against them.

Investors looking for opportunities exclusively in well-known jurisdictions ignore hidden value elsewhere. Companies that work in areas that investors are comfortable with trade at high multiples because of a safety premium. On the other hand, markets like Cambodia are still discounted due to investor inertia, and offer extremely profitable opportunities.

In short, this is the logic that makes us look favorably at Angkor Gold. As news about the country’s improving investment climate for mining spreads, new money will pour in. Furthermore, Angkor Gold has had an incredible head start in cherry-picking some of the best assets in Cambodia.

The Company – A Prospect Generator On The Cusp Of Cash Flow

Angkor follows a prospect-generator business model; the company strikes joint venture agreements with companies willing to commit capital to explore its portfolio of properties. In exchange, Angkor retains an ownership interest and/or a share of future mining revenue (net smelter return, or NSR).

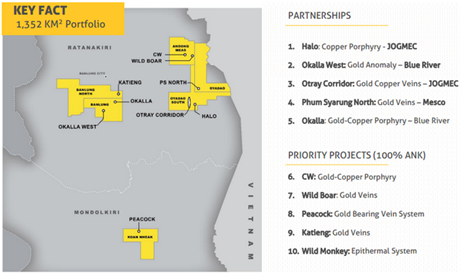

Angkor has been working in Cambodia since 2009, and had their IPO in 2011. As of September 2016, Angkor has five flagship projects and five earlier-stage targets:

The latest developments at the Mesco Gold’s Phum Syarung mine has put it in the spotlight. Angkor entered into a sale agreement with India-based, Mesco Gold, on a small portion of its Oyadao South concession, which is home to the soon-to-be-operating Phum Syarung gold mine. Under the terms of the agreement, initially established in January of 2013, Mesco purchased the mineral rights on 12 square kilometres of the license. Angkor will receive a 2.0% NSR (Net Smelter Return) while the price of gold is less than $1,000 and will increase 0.25% for every $50 that the gold price exceeds $1,000 to a maximum of 7.5%. Angkor maintains no carried interest in the property or operations.

According to Angkor’s CEO, Mike Weeks, the mine was approved in record time; it only took just over five years to get from exploration to licensing. For comparison, the same amount of work in other more established jurisdictions may take up to 15-20 years. But make no mistake about it, the Ministry of Environment and some-20 workers pulled no punches. Mesco was required to submit a 750-page Environmental and Social Impact Assessment study that considered all the potential impacts of the proposed mine; a further 60-page addendum addressing tailings and rehabilitation; and covered the development plan for affected communities, environmental innovations, mine closure, and social impacts throughout the mine life.

Phum Syarung is anticipated to begin production in 2017, and describes its ramped-up volumes to reach 150,000 tonnes of ore per year. According to Mesco, the current life of mine is nine years, with each tonne of ore averaging 3.5 grams of gold. That, according to research and analysis, is on the overly conservative side. Lastly, Phum Syarung is just the beginning, with Oyadao North containing potential extensions of the mineralization and the area south of the mine yet to be defined for additional ore across the remainder of the 12 square kilometres. Mesco indicates its plan to expand the quantity and supply of ore from several targets that will add years to the mine life.

We need to note that the mine does not have a NI 43-101-compliant resource North American investors are used to seeing in production-ready properties. The Cambodian government greenlighted it with a UNFC (United Nations Framework Classification) and with further notes on a JORC report standard. The quality and quantity of gold ore was established based on drilling, testing, metallurgy, and assays conducted by the gold-focused subsidiary of the $4 billion India-based, Mesco Group.

Underground mining is of a nature that the resource generally increases once the miners are underground, allowing them to chase the veins as they swell and narrow through the bedrock. Of note and greater importance is the precedent established with this first commercial license. This provides the entire country with a model of a royalty paid to the government, which can be replicated by other companies in the sector. Mesco’s ability to self-finance the entire project and their flexibility to increase volume add further advantage.

Besides net smelter return arrangements from producing properties, Angkor’s business model involves a series of exploration partnerships designed to mitigate the risk of exploration and develop its multiple properties at the same time.

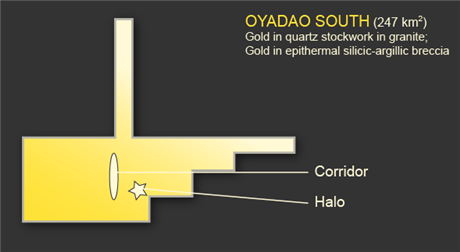

One of the most recent exploration deals it reached was the agreement with the state-owned, Japan Oil, Gas and Metals National Corporation (JOGMEC) to explore Angkor’s 100% owned Oyadao South license. Oyadao South is a multimetallic, copper-gold-molybdenum property and within it, the company is focused on the Halo prospect, a hydrothermal-porphyry system.

The entire 247 square kilometer license has already been subject to intensive geophysical work, including an aeromagnetic and airborne radiometric survey. Reconnaissance has already delineated several specific targets. Historically, small-scale and artisanal mining has been witnessed across this and most of Angkor’s licenses.

JOGMEC has committed to spending US$3 million over the next three years on exploration to earn a 51% interest, with Angkor conducting all of the work. As mentioned earlier, the Halo prospect within Oyadao South is considered one of Angkor’s top prospects, discovered by geological field mapping, geochemical and aeromagnetic surveys, and samples yielding over 0.7% copper and 0.15% of molybdenum in rocks and 0.1% copper in soil. Oyadao South is now home to three porphyry systems with JOGMEC as the ideal partner, as Angkor would rather concentrate on gold-bearing epithermal deposits. IP is scheduled for November, and drilling in Q1 2017.

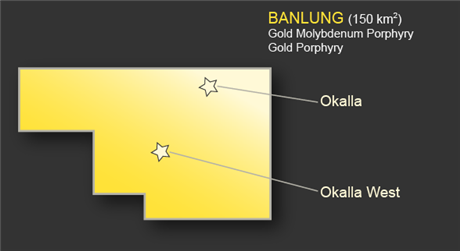

Angkor’s last option agreement is with Blue River Resources on Angkor’s Banlung tenement in Ratanakiri Province. Blue River can earn up to a 50% interest after the completion of a total investment of US$3.5 million in exploration over a 4 year period. Once satisfied, Blue River may then exercise their option on an additional 20% interest with the completion of a bankable feasibility study on the property.

Banlung is home to multi-element prospects in Okalla and Okalla West. The entire license has already been subject to an extensive geophysical campaign, with reconnaissance field truth mapping and a multi-element stream sediment geochemical survey. In May 2016, Angkor and Blue River doubled Banlung’s gold surface anomaly from two square kilometres to over 4.3 square kilometres. The JV subsequently has begun shallow drilling, and samples will be reported when received.

The last asset we want to mention is another prize target in the Andong Meas license. Angkor acquired this license in 2012 and has identified five gold prospects within its bounds with grab samples containing gold values ranging from 0.5 g/t Au to +20 g/t Au.

Both small and medium-scale mining have historically occurred within the bounds of the license area and naturally the company’s exploration will be close to these existing infrastructures. Having artisanal miners working within the boundaries of an exploration-stage property presents an enormous advantage as most of the exploration reconnaissance has been done. Many of the mines we see today are located in prolific artisanal mining sites.

In the 2016-2017 season, the company plans to conduct various types of exploration activities, from early-stage mapping and gravity exploration to drilling.

Angkor’s exploration efforts are focused on adding value through de-risking its projects. The company says that one of the key goals it keeps in mind when looking for and working at properties are value-generating deals. As a prospect generator, Angkor can only do that by securing partnerships with major companies with the bankroll to fund significant exploration programs. The fact that Angkor has been able to establish partnerships with $7.5 billion JOGMEC and $4 billion Mesco is an enormous reassurance that more blockbuster deals are in the pipe.

Share Capital – Supportive Shareholders And Cash In The Jeans

The company’s investors are to a large extent a closely-knit group. More than two-thirds of the shares outstanding are in the hands of insiders and investors close to them.

Angkor has about 96 million shares outstanding. It’s quite a lot for a company most of whose projects are at the earlier stages of exploration but given that Angkor holds multiple licenses, each with multiple prospects, and has been actively exploring for more than seven years, we’re not concerned about it.

Dilution is also low, the company has about 3 million options and approximately 1.5 million warrants out. We need to note that this is quite rare for a junior to have so few options and warrants outstanding. Normally a company that has been active for more than five years would have significantly more, which is testament to the company’s conservative stance toward its capital structure.

Most of the outstanding warrants came from the financing it conducted in July 2016. Angkor raised С$1.25 million by selling its units at C$0.40 per unit plus one ½ warrant at C$0.50 good for 12 months.

In August 2016, the company announced another financing. It now plans to attract C$1.5 million by selling units priced at C$0.43. When the financing goes through, the company will add 3.5 million shares and another 3.5 million of warrants exercisable at C$0.50. For this financing, Angkor has engaged the services of Gravitas Securities, who come with an enormous strategic network and a tremendous track record with mining companies.

The People –Social Development And Mining

The company’s CEO is Mike Weeks. He has over 25 years of engineering and project management experience and over 15 of those years, participated in natural resource concession negotiations with foreign governments – a skill vital when it comes to operating in an emerging market.

Working with local governments and communities is a critical factor in Angkor progressing. All resource investors need to recognize the geo-political risks involved when it comes to third-world countries. We have seen mining projects shut down due to opposition from local residents and politicians. Negotiations experience is just as important for a company like Angkor as technical expertise. The VP of Social Development, Delayne Weeks, puts it best:

“Setting examples of how to make ethical change to improve the lives of people is an important part of educating everyone and building healthy communities and strong countries. We believe this should be done in every industry, not just the mineral sector.”

Another key member of the company’s team is John-Paul Dau, its VP of Operations. He lives and works in Phnom Penh, Cambodia and specializes in project management, financing, and development. Lastly, junior mining companies need to bring their story to the market in the most efficient way so having an experienced VP of Corporate Development is important. Stephen Burega is in charge of Corporate Development at Angkor; he brings to the company over 10 years of relevant experience.

Overall, the company’s management team has the experience to manage its natural resource projects as well as its relationships with the local government and communities. This is seen with the calibre of Angkor’s portfolio of assets, and with the progress over the past few years on several platforms that established precedents for the entire sector in Cambodia.

Conclusion – Why We Are Buyers

It takes time to build expertise in a jurisdiction that causes hesitation for the most traditional investors. However, when it comes to making discoveries and working on greenfield projects, time is on the side of the company that has worked the longest to understand the geology, the culture, the government, and then build relationships and realistic expectations for all parties.

With Angkor, investors get a unique chance to enjoy an opportunity to diversify their resource-focused portfolio into a country that has just signaled it is ready to become a major mining jurisdiction. With the issuance of its first commercial mining permit, Cambodia has opened its doors for more investment capital to explore the country’s untapped natural endowment.

Angkor plans to spend the next several months actively exploring its multiple licenses, in anticipation of the first NSR payments to come from its first production milestone. When the money starts coming in, investors will realize that Angkor has a sustainable, long-term business model that is capable of financing future exploration work without going to the market to raise funds. This self-sustainability will be a major catalyst, and investors will be right to take a closer look at this company before its upside potential is realized, as we think it will.

Palisade Global Investments Limited holds shares of Angkor Gold. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.