Report #11

Today, ALX Uranium Corp. announced a definitive agreement with Denison Mines Corp. to sell an immediate 80% ownership of the Hook-Carter Property in exchange for 7.5 million Denison shares to be issued to ALX.

With a current market capitalization of $320 million CAD, Denison trades at $0.60 CAD/share at the moment. The current value of 7.5 million Denison shares stands at $4.5 million CAD, whereas ALX’s market capitalization stands at $4.9 million. Jon Armes (President and CEO of ALX) commented in today’s press-release:

“We are pleased to welcome Denison to the Hook-Carter Property as project operator and are excited to see the next $12 million in exploration on the Property funded without having to further dilute ALX’s shareholders. Denison has made a number of world class uranium discoveries within the Athabasca Basin, and given their experience, believe that they will advance the project diligently and methodically. Knowing that Hook-Carter Property will see considerable exploration efforts over the next 36 months, the company will focus on exploration at its other high-quality exploration projects in and around the shallow margins of the Athabasca Basin, which include Gorilla Lake, Newnham Lake, Gibbons Creek and Lazy Edward Bay.”

It’s great to see a “major” associating its name with ALX. Deals like this have shown in the past to provide shareholders with outstanding growth potential. ALX will retain a 20% interest in the Hook-Carter Project and Denison agreed to fund ALX’s share of the first $12 million CAD in expenditures. Significant exploration activities will be conducted by operator Denison over the next months.

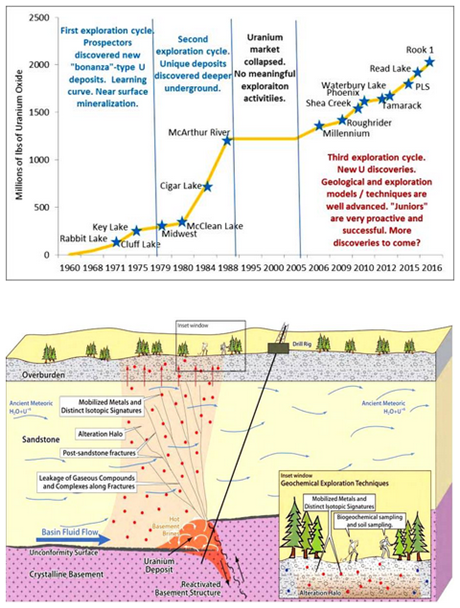

In May 2016, Rockstone presented “discovery-style drill targets” on the Hook-Carter Property, showing the outstanding potential to discover another major uranium deposit in the prolific PLS (Patterson Lake South) area of the Athabasca Basin, where several high-grade uranium discoveries have been made over the last few years.

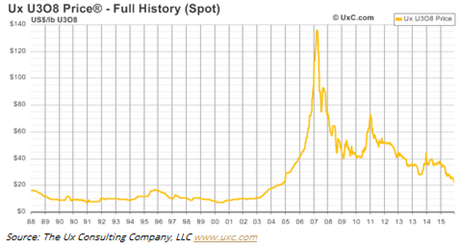

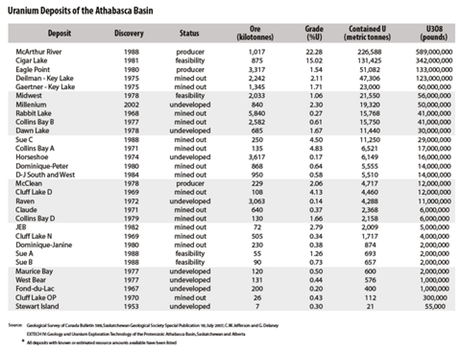

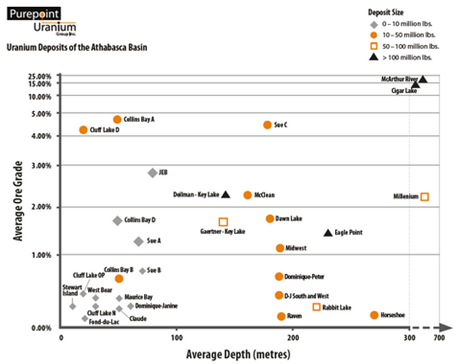

In April 2016, Rockstone presented 40 pages that answered the questions why more large and high-grade uranium discoveries are likely in the Athabasca Basin and why higher uranium prices in the next few years are forecasted.

Click on the charts to view 15 min. delayed versions

Technically, both ALX and Denison are nearing the apex of triangular price formations which have been formed in 2016. A technical breakout could occur anytime, whereas ALX has also been forming a triangle relative to Denison‘s share price performance, i.e. ALX may perform better than Denison in case a thrust to the upside can be accomplished. As ALX will own 7.5 million shares of Denison, ALX will be somewhat leveraged to the Denison‘s performance going forward.

Denison is believed to be the perfect partner for ALX to advance the highly prospective Hook-Carter Property. Today’s property transaction allows Denison to get into one of the world’s hottest uranium exploration and development districts, where other majors like Cameco, AREVA, NexGen and Fission are already advancing significant uranium discoveries.

Denison is a uranium exploration and development company with interests focused in the Athabasca Basin region. Including its 60% owned Wheeler River Project, which hosts the high-grade Phoenix and Gryphon Uranium Deposits, Denison’s exploration portfolio consists of numerous projects covering over 350,000 hectares in the infrastructure-rich eastern Athabasca Basin. Denison’s interests in Saskatchewan also include a 22.5% ownership interest in the McClean Lake Joint Venture, which includes several uranium deposits and the McClean Lake Uranium Mill, which is currently processing ore from the Cigar Lake Mine under a toll milling agreement, plus a 25.17% interest in the Midwest Deposit and a 63.01% interest in the J Zone Deposit on the Waterbury Lake Property.

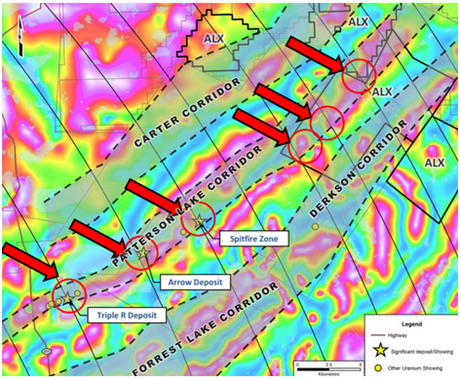

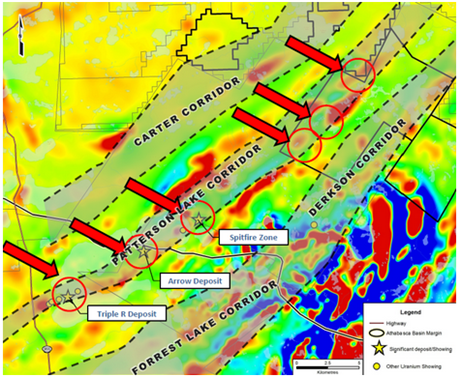

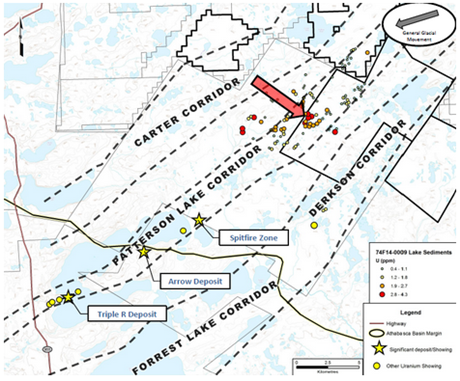

The Hook-Carter Property (116,461 hectares: 100% ALX Uranium Corp.) is located at the northern end of 3 distinct structural trends: Patterson Lake Corridor, Derkson Corridor and Carter Corridor. The Patterson Lake Corridor is host to numerous new and expanding discoveries including the Triple R / PLS Deposit (01/2015 indicated: 80 million lbs @ 1.58% U3O8; inferred: 26 million lbs @ 1.3% U3O8); Arrow Deposit (03/2016 inferred: 202 million lbs @ 2.63% U3O8); and Spitfire Zone (04/2016: 10 m @ 10.3% U3O8 incl. 1.3 m @ 53.5% U3O8).

Local phase of the residual total magnetic field:

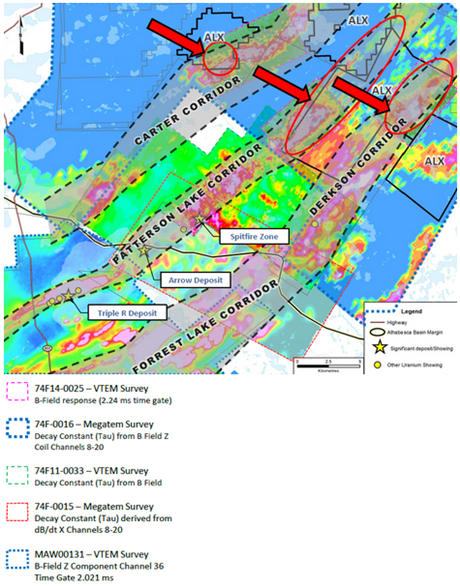

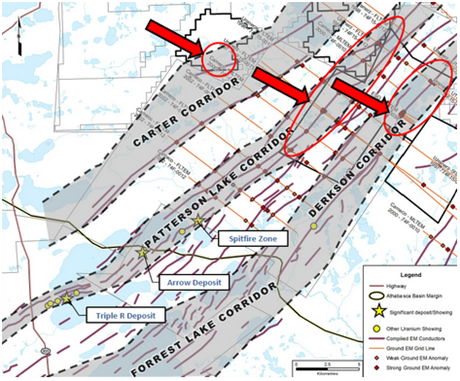

Geophysics have already defined 3 top-notch, drill-ready targets on the Hook-Carter Property. Below figures are from ALX’s Technical Presentation showing details about the Hook-Carter targets and the similarities to the near-by Spitfire Zone (39.5% Cameco; 39.5% AREVA; 21% Purepoint), Arrow Deposit (100% NexGen) and Triple R / PLS Deposit (100% Fission). The figures show that these 3 high-grade uranium discoveries are located on the Patterson Lake Corridor, a geological trend which also runs through the Hook-Carter Property to the north. However most interestingly, an observation has been made that the already discovered deposits in the PLS district fulfill a second crucial criteria of being located at major cross-cutting structures (e.g. faults; see black curves running through below figure every 5-8 km). Similar disruptions in the regional scale magnetics is also observed on ALX’s property along the Patterson Lake Corridor. ALX has identified 3 targets, fully on trend, yet to be defined more precisely for a drill program.

The most interesting drill hole on or beside ALX’s Hook-Carter Property is HK-003 (see red arrow on below left map) drilled by Uranerz in 1999, which was described as follows:

“Excellent sandsone and basement structure and alteration. Hole ended in moderately altered and disrupted graphitic interval. This hole was very encouraging and should be followed up when possible.”

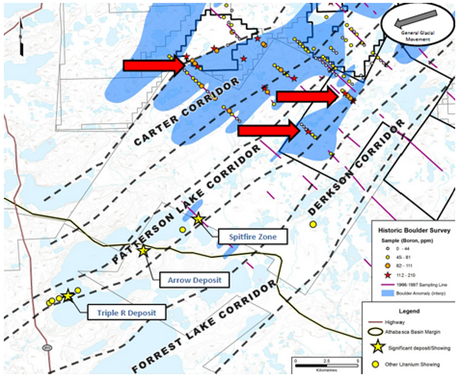

Geochemical sampling assayed a 50 cm faulted zone in the sandstone with 1,170 ppm boron (180 m above the unconformity). Another 20 cm sample in clay gauge/fault in the sandstone assayed 26,100 ppm boron (70 m above the unconformity). Boron is a common pathfinder element associated with unconformity-style uranium deposits.

Targets on Hook-Carter

There are large gaps in the historic drilling on the Hook-Carter Property, up to 4 km between holes along the Patterson Lake Corridor (see red arrow on below right map). Several target areas were defined by a 2014 Condor Consulting interpretation report. The study utilized data from the following exploration methods: 2006 Airborne EM (MegaTEM and VTEM). Additional information has been incorporated to refine these targets, including:

• 1997-2003 historic ground EM

• 2006 Ground Resistivity Survey

• 2007 Ground EM Survey

• 1996-1997 Historic Boulder survey

First Vertical derivative of the magnetic field:

The Hook-Carter Property is located approximately 25 km east of Highway 955 in the southwestern portion of the Athabasca Basin region. The Property is accessible year round by utilizing a combination of vehicular and helicopter and/or fixed wing aircraft. The Property comprises 3 blocks of contiguous claims, namely the Carter West Claims, Carter East Claims and Orphan East Claim. The Property consists of 28 claims, totaling 16,805 hectares, and is located near the southwestern margin of the Athabasca Basin, in northern Saskatchewan. The property is highlighted by 15 km of strike potential along the prolific Patterson Lake Corridor – host to the recently discovered Triple R Deposit (Fission Uranium Corp.), Arrow Deposit (NexGen Energy Ltd.), and Spitfire Discovery (Purepoint Uranium Group Inc., Cameco Corp., and AREVA Resources Canada Inc.) which occur within 8 to 20 km of the Property. The Property is located within the Athabasca Basin and features between 250 and 700 m of Athabasca Group sandstone cover overlying the basement rocks that define the prospective geological trends or corridors. As a result, the property offers both basement- and unconformity-hosted uranium deposit potential.

The sandstone thicknesses are similar to those at Denison’s 60% owned Wheeler River Property in the eastern Athabasca Basin where Denison has developed proven exploration methodologies which have resulted in the discovery of the high-grade unconformity-hosted Phoenix Deposit in 2008 and the high-grade basement-hosted Gryphon Deposit in 2014. The Property is significantly underexplored compared with other properties along this trend with only 8 historic drill holes, including only 5 holes over the 15 km of Patterson Lake Corridor strike length. Results from historic holes (including sandstone alteration, geochemistry and basement geology and structure) suggest favorable environments for the presence of unconformity-related uranium deposits. The Property also covers significant portions of the Derkson and Carter Corridors which provide additional priority target areas.

Previous exploration work has been dominated by geophysical surveys dating back to 1997. Airborne surveying has included property-wide electromagnetics (including a VTEMTM survey on the Patterson Lake Corridor), a property-wide medium-resolution magnetic survey and limited Falcon Airborne Gravity Gradiometry and HeliSAM TEM surveying. These data sets provide an excellent repository for the interpretation of basement geology and area selection for further targeting. Ground geophysical surveying has included property-wide electromagnetic surveys on a reconnaissance spacing. The airborne and ground electromagnetic survey results indicate the prospective corridors on the Property are comprised of multiple conductors suggesting numerous graphitic target horizons arepresent. Surficial surveys completed include lake sediment sampling, radiometric sampling, and boulder sampling. Anomalies produced by boulder and lake geochemistry along the Patterson Lake corridor provide further encouragement for mineralization.

Boulder Sampling

• Completed in 1996 to 1997 by Uranerz (now Cameco; Report 75F15-0011);

• Follow-up work was completed by ESO Uranium Corp. in 2006.

• A group of anomalous samples with elevated boron are located along the Patterson Lake andCarter Corridors. Boron is a common pathfinder element associated with unconformity-style uranium deposits

Lake Sediment Sampling

• Completed in 1978 by SMDC (now Cameco; Report 75F14-0009).

• A cluster of anomalous samples are located on the Patterson Lake Corridor on ALX’s property.

• Lake sediment sampling is often a first-pass exploration method.

Airborne EM

Airborne electromagnetic (EM) surveys are often the first-pass exploration tool to define graphitic conductors that are often associated with uranium mineralization.

Ground EM

Ground EM surveys are used to refine the location of airborne conductors.

Several ground EM surveys have defined these conductors on the Hook-Carter Property by historic operators (Cameco and predecessors Uranerz) between 1997 and 2003.

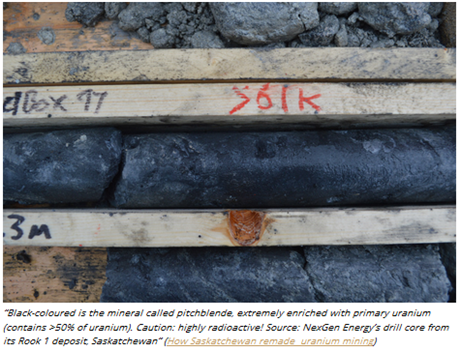

Arrow (NexGen Energy)

Arrow is proving to be a world-class, high-grade mineralized zone. Many assays from the 2014 and 2015 drilling seasons have reported grades ranging between 0.13% and 67% U3O8 with grades between 1.5% and 5% U3O8 intersected regularly across substantial intervals.

• Global average resource grades are approximately 0.1% U3O8, according to the World Nuclear Association.

• 1% U3O8 is the equivalent of 23.5 g/t gold on a dollar per tonne basis (using $45/lb U3O8 and $1,300/oz gold).

Basement-hosted deposits are some of the most technically simple and economical mines in the uranium sector. Triple R is basement-hosted deposit (positive), however it is located under a lake (negative). In contrast to the Triple R Deposit from Fission, the Arrow Deposit in on land. Not only is drilling on land much cheaper than on lakes but permitting requires less time. Mining under a lake is a much riskier undertaking.

Many Athabasca Basin mines have encountered technical challenges which are a result of the deposits being directly associated with the Athabasca Group Sandstone and/or the unconformity (the contact between the Athabasca Group sandstone and the basement rock). Mining these types of deposits typically requires freezing the surrounding rock underground in order to stabilize the ore body for extraction. This can add significantly to CAPEX, OPEX and diminish overall returns. Current operating mines, Cigar Lake and McArthur River (both unconformity-hosted) have mineralization at depths of 480 and 600 m, respectively, that is beneath Athabasca Group sandstone.

There is only a thin layer of Athabasca Group sandstone at Arrow ranging from 10 to 20 m within 80 m of surface, which means that any potential development of Arrow should not encounter costly and technically challenging freezing like unconformity-hosted uranium deposits.

Eagle Point (Cameco)

Arrow is an analogy of the Eagle Point deposits located on the eastern edge of the Athabasca Basin, which are part of the Rabbit Lake Uranium District (>202 million lbs of uranium concentrates since production began in 1975). In 1987, a “total ore reserve” (historical; non-NI43-101 compliant) for the Eagle Point deposits comprised 140 million pounds (64,000 tonnes) at an average grade of about 2% U3O8. Production commenced in 1994. The Eagle Point underground mine is in production today, and as of December 2013 has:

• proven and probable reserves:

1.6 million tonnes at 0.56% U3O8

(20 million lbs U3O8)

• indicated resources:

1.2 million tonnes at 0.8% U3O8

(20 million lbs U3O8)

• inferred resources:

708,500 tonnes at 0.58% U3O8

(9 million lbs U3O8)

Eagle Point was initially discovered in 1980 by Gulf Minerals Canada Ltd. while drill testing geophysical and geochemical anomalies northeast along strike from the Collins Bay Uranium deposits. The Eagle Point deposits are a series of moderately to steeply dipping tabular veins and lenses, which are concordant and discordant to variably graphitic Wollaston Group metasediments and underlying Archean granitoid gneiss.

Hook Carter (ALX Uranium)

Potentially host to a basement-hosted deposit (at relatively shallow depths), or only with a thin layer of the Athabasca Sandstone, as being the case with Arrow 15 km southeast (Triple R 20 km southeast). Similar style of mineralization (steeply dipping but extremely high-grade and large veins and lenses; i.e. Triple R, Eagle Point, Arrow) possible at cross-cutting structures on Hook-Carter as well.

About ALX Uranium Corp.

ALX Uranium Corp. was formed as the result of a business combination between Lakeland Resources Inc. and Alpha Exploration Inc. ALX Uranium Corp. is a uranium and mineral exploration company focused on the Athabasca Basin in Saskatchewan, Canada; a leading district in global production for 40 years, and home to some of the world´s largest and richest high-grade uranium deposits. ALX continually and proactively reviews opportunities for new properties, whether by staking, joint venture or acquisition. The newly combined Boardof Directors and management of ALX brings to the junior exploration sector an unusual depth of expertise and track record of success.

Company Details

ALX Uranium Corp.

1450 - 789 W Pender Street

Vancouver, BC, Canada V6C 1H2

Phone: +1 604 681 1568

Email: rleschuk@alxuranium.com

www.alxuranium.com

Shares Issued & Outstanding: 65,151,422

Canadian Symbol (TSX.V): AL

Current Price: $0.075 CAD (10/12/2016)

Market Capitalization: $5 million CAD

German Symbol / WKN (Frankfurt): 6LLN / A1402P

Current Price: €0.042 EUR (10/13/2016)

Market Capitalization: €3 million EUR

Previous Coverage

Research #10 “Discovery-style drill targets in the Athabasca Basin“ (May 31, 2016)

Research #9 “ALX Uranium: Right Next“ (April 29, 2016)

Research #8 “Emergence of the most prospective explorer in the Athabasca Uranium Basin“ (October 8, 2016)

Research #7 “Lakeland Resources and Alpha Exploration Propose Strategic Merger“ (July 23, 2015)

Research #6 “Historic Turnaround in Uranium Prices and Equities in the Making“ (incl. interview with geologist Neil McCallum; November 27, 2014)

Research #5 “Gibbons is getting drilled finally“ (November 5, 2014)

Research #4 “Bright Stars in the Athabasca Basin Uranium Hunt“ (incl. interview with geologist Neil McCallum; February 27, 2014)

Research #3 “Highest Radon Values Ever Detected in the Athabasca Basin“ (January 9, 2014)

Research #2 “No Dead-Cat Bounce: A Dead-Serious Warning From Uranium“ (December 5, 2013)

Research #1 “Athabasca Basin: The Place To Be For The Upcoming Uranium Boom“ (November 4, 2013)