Current Price: C$0.225

Shares Outstanding: ~113.9 million

Market Capitalization: C$25.6 million

52-Week Range: C$0.02 – C$0.35

Cash: ~C$2.5 million

RCG has just reached a game-changing milestone – it has proved that its flagship project is not only profitable, but excessively so.

To recap, the latest press release stated that RCG’s Dufferin mine has the following economics:

-

Post-tax NPV-5: C$89.2 million (vs. company’s market cap of just C$25.6 million)

-

Post-tax IRR: 121%

-

Payback: 1.3 years

These numbers are based on $1,250 per ounce gold price, grades of 6.8 g/t Au at East Dufferin and 5.5 g/t Au at West Dufferin, 95% recovery rate, with cash costs of $617 per ounce.

We could stop right here and suggest that you buy this stock now. But let’s backtrack and see what people and assets made these numbers possible.

People – Billion-Dollar Company Builders

Resource Capital has a highly experienced team of underground mining professionals that have a record of turning around underground mining operations, including the Lucky Friday mine in Idaho, the Giant mine in the Northwest Territories and the Pamour mine in Ontario.

The company’s CEO, President, and Chairman is George Young. He has over 35 years of experience in engineering, law, and management. He raised over $9 billion in equity and debt financings. He was the co-founder of MAG Silver Corp. (TSX:MAG, Mkt Cap: C$1.4 billion) and International Royalty Corp. (acquired by Royal Gold for C$750 million in 2010).

Also on the leadership team is Gary Lewis, the founder and a major shareholder of RCG. Mr. Lewis brings 30 years of capital markets and business and strategy development experience. He has invested and/or operated resource projects or assets over the past ten years valued at more than US$350 million, including the acquisition and selling of high-value, multi-commodity resource projects.

Michael Gross is RCG’s boots on the ground representative and serves as the COO. He brings over 45 years of experience in mine operations and managements, including mine turnarounds. He has led major improvements at multiple mines, resulting in decreased costs, improved productivity, and higher earnings. We expect Mr. Gross to be fine tuning Dufferin and continually extracting more value for his shareholders.

The company’s team has experience in a variety of fields. Three stand out: mining engineering, operations, and finance. For what RCG is looking to achieve, this will be critical and the company is well equipped to tackle its next challenge.

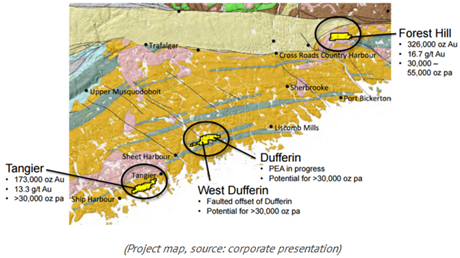

The Assets – Roll-Up To Win, In Nova Scotia

The company’s main value proposition is its Dufferin mine. The mine was actually in production in 2014; however, the previous owners lacked experience in operating an underground mining and ultimately went bankrupt. As mentioned earlier, RCG has put together a proven team of underground miners that have a history of turning around mines. Management has stated there are numerous ways to improve the mine and mill, including improvements to dilution and grade, and lowering production costs.

The mine is on care and maintenance but is almost back in production. RCG has just completed a preliminary economic assessment and plans to start processing stockpiles beginning January 2017. The mine should achieve full production in 2017, and the company believes that it can achieve full 300 tonne-per-day capacity earlier than the PEA suggests (end of Year 1). It definitely helps that both the mine and the gravity flotation mill are fully permitted.

The deposit itself is faulted into two: East and West. The East portion has seen production with head grades of 13.4 g/t Au, while its West counterpart has similar historical grades of 11.9 g/t Au. Both parts have multiple vein system (18 at East and 17 at West) with a total strike length of over 3 kilometers. The project is open to the east, west, and at depth.

Because the mine has already been operating, it has excellent infrastructure in place. It is accessible by gravel road and is located just 135 kilometers from Halifax, Nova Scotia’s capital city.

Under the terms of the agreement, the company has 90% ownership of this mine. It will pay a total of US$9.5 million for it over 5 years. After that, it will owe its counterparty a 1% NSR.

The mine has potential to produce up to 30,000 ounces of gold per year. In addition, the company says that Dufferin will become its central processing mill. It will operate a ‘hub-and-spoke strategy’, utilizing its cash flow to pay for exploration and development at the company’s other assets, namely, Tangier and Forest Hill, as well as further development at West Dufferin.

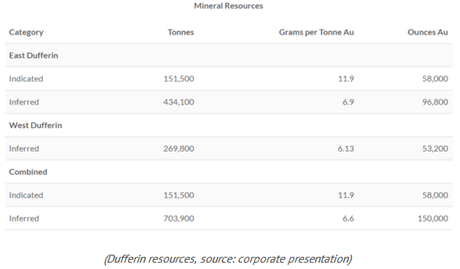

As of November 2016, the two Dufferin projects hosted over 200,000 ounces of gold in resources. Average grades ranged from 6.6 g/t Au (Inferred) to 11.9 g/t Au (Indicated):

RCG acquired West Dufferin towards the end of November 2016, and the company says that even though resource modeling took place over just 600 meters in strike length, the mineralized system extends for over 1.3 kilometers. This adds to the 1.4 kilometers expansion of the main Dufferin mine for a total of 2.7 kilometers of extra identified mineralization.

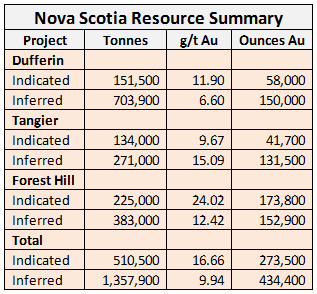

The purchase of West Dufferin not only increased mining potential of the Dufferin project, but also expanded the company’s total resource base. RCG’s Nova Scotia projects now host a total of 273,500 ounces in the Indicated category and 434,400 ounces in the Inferred category.

The Dufferin mine is the company’s main asset, but besides it (and the West expansion) there are three other projects that show incredible promise.

The Tangier project is located within trucking distance from Dufferin. It’s an advance-stage project with 41,700 ounces of gold in the Indicated category (134,000 tonnes grading 9.67 g/t Au) and 131,500 ounces of gold in the Inferred category (271,000 tonnes at 15.09 g/t Au).

There are 3,300 meters of underground workings available on the project with veins going down to 300 meters in depth, and so far, drilling has indicated over 70 gold-bearing veins. Importantly, the Tangier system is similar to the one of Dufferin gold mine, and this should make it possible to use the same equipment to mine both projects, resulting in cost efficiencies.

At 225 tpd, the company estimates mining potential of this project at 32,000 ounces of gold per year for up to six years. Exploration and development activities that may expand the resource base will increase these numbers.

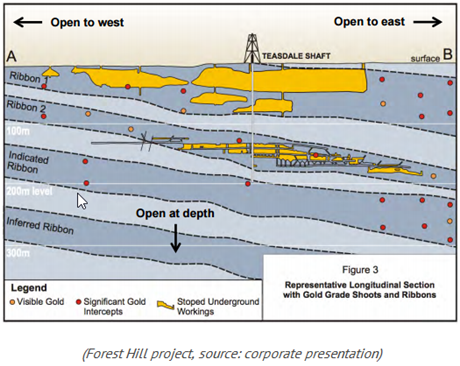

The last high-grade gold project that RCG holds in Nova Scotia is Forest Hill. The company plans to fast-track this project toward a production decision based on the excellent grades present in its mineral resource.

Forest Hill has a resource base of 225,000 tonnes grading 24.02 g/t Au for a total of 173,800 ounces of gold in the Indicated category and a further 383,000 tonnes grading 12.42 g/t Au for a total of 152,900 ounces of gold in the Inferred category.

Historical mining activities resulted in over 10 kilometers of workings accessible to the company. The project’s grades support underground mining scenarios in the current gold price environment. In other words, the grades are very high, averaging 16.7 g/t Au for the current resource. Some of the drill intercepts reached grades of 315 g/t Au.

In addition to high grades, the project has potential to increase volume through exploration. The company says that Forest Hill is open to the east, west, and at depth.

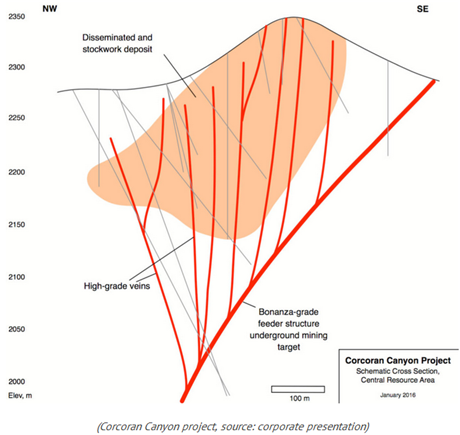

Finally, the company has a project in Nevada. Corcoran Canyon is the highest-grade bulk-tonnage open-pittable project in North America. RCG believes that this project has near-term cash flow potential.

There is a historical (non-NI43-101 compliant) resource available at Corcoran. It includes a Measured and Indicated resource of 1.5 million tonnes at 195.6 g/t Ag and 0.37 g/t Au and an Inferred resource of 2.2 million tonnes grading 300 g/t Ag and 0.27 g/t Au.

Bulk-tonnage projects tend to have high strip ratios due to their significant size. However, Corcoran’s Silver Reef zone, where most of the historical resource is located, crops out on surface in a hill. This can potentially decrease the strip-ratio and thus operating expenses should be lower than otherwise.

This is clearly visible on the picture below. Note also that the company also believes there is a high-grade underground vein system that can be mined in addition to the open-pittable portion. Past drilling delivered silver grades in excess of 2,616 g/t Ag from the areas where underground mining could take place in the future.

The company is evaluating two scenarios for Corcoran, heap-leach and milling. Either one produces an NPV of at least US$115.1 million (C$150 million) on the lower end, and US$257.6 million (C$340 million) on the higher end.

The four projects RCG has (counting East and West Dufferin as one) represent one of the strongest portfolios we have seen in a while. They all have excellent grades, expansion potential, and have already begun to show their great economics, not to mention, all are operating in very mining-friendly jurisdictions.

Finance – Enter Eric Sprott, The Validator

RCG currently has ~C$2.5 million in cash. Its share count is surprisingly low for a company nearing production with only 113.9 million shares outstanding. Incredibly, RCG has kept an airtight share structure; it was not until recently the company issued its first warrants. The company recently closed a C$5.0 million private placement, with Eric Sprott personally taking C$3.0 million of it. Post-financing, there are now 26.5 million warrants outstanding, for a total of 140.4 million fully diluted shares outstanding. We were fortunate to be involved throughout Eric’s investment process, and his team’s due diligence verified what we found. His involvement is a huge validation of RCG’s asset and team.

Talking to management, there is enough cash to get to production and to all-important cash flow. Afterwards, we expect RCG will tap into the debt markets to fund expansion and to continue rolling up the area.

Dufferin – What’s Different This Time Around

We were pleasantly surprised by the company’s portfolio, people, clarity of vision, and financial structure. It is poised to become a gold producer with one of the strongest set of properties we’ve ever seen. As we mentioned earlier, the previous owners of Dufferin were not underground operators.

This is definitely not the case for RCG. Its technical team has a proven history of successfully turning around underground mining operations and subsequently optimizing them to extract as much value as possible. At the Lucky Friday Silver Mine in Idaho, the team improved productivity by 62% while decreasing costs by 50%. At the Giant Gold Mine in the Northwest Territories, the team was able to decrease costs by 25%. And lastly, at the Pamour Gold Mine in Ontario, RCG’s technical decreased mining costs by 30%, while lowering milling costs by 58%.

The team has done a lot of due diligence before stepping into Dufferin, and believe they will be able to address all the issues the previous owners could not. First, the initial mine design did not develop enough faces to feed the mill. Second, incredibly the mine was built without a 3D model, meaning there was a lack of survey control. Third, the utilization of the equipment was less than optimal, having less than 60% of it available at a time. Fourth, the mill head grade was lower than the diluted resource. And lastly, the mill had a bottleneck in that was only 10 tonne fine ore bin.

We do not doubt Resource Capital Gold will be a premier mid-tier gold producer. This is one of the best teams we have come across with top-tier assets to boot, and due to the company’s lack of marketing, it is greatly undervalued. While its total NPV is around C$240 million, the company’s total market capitalization is just a little over C$25 million. This stock is a multi-bagger.

Palisade Global Investments Limited holds shares of Resource Capital Gold Corp. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.