The nice thing about the micro-cap space is the lack of readily available information to retail investors and the amount of information arbitrage around little followed names.

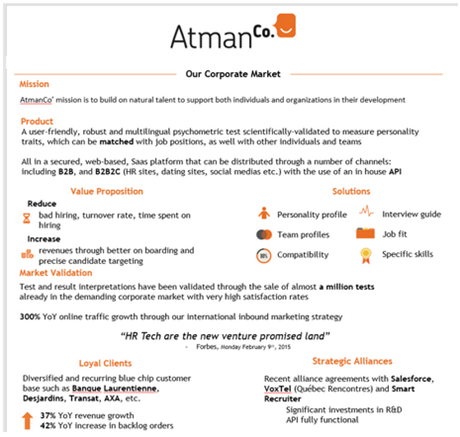

On the surface, AtmanCo (ATW.V) looks confusing and ugly. The company sells psychometric tests to help companies identify the right type of employees, build better teams, better resolve employee conflict, etc, as you can see below:

You can read more about it here: https://atmanco.com/psychometric-test/

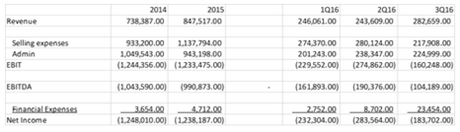

The company spent many years on the science behind the tests and they are scientifically validated by numerous outlets. Yet just looking the financials is plenty enough to deter investors, with the company burning through about $1.2mm of cash last year. Even with EBITDA burn likely dropping to -$550k this year, the company still seems quite far away from profitability.

What grabbed my attention was the company’s acquisition of a Telecom company VoxTel which it made a few months ago. But why?

There is little to no information on VoxTel readily available.

There’s no investor presentation listed on the company website.

An investor would really have to dig or talk to management to figure out what the company is going to look like post the transaction. So, I did just that.

Now what if I told you the combined company is actually profitable to breakeven after the transaction and on the verge of exponential growth? If you dug into the company, that’s exactly what you’d see. The best part? The market has no clue yet.

Opportunity #1) The Information Arbitrage

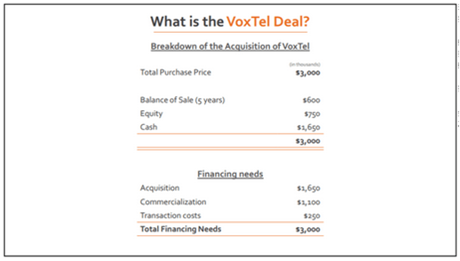

A few months ago, AtmanCo made the surprising move to acquired VoxTel for $3mm or 4.3x 2015 EBITDA.

AtmanCo financed the acquisition with $2mm of convertible debt which converts at .085 the first year and .10 a share after, along with equity raises at .085 a share.

My first questions were: Why a telecom company like VoxTel, and how did they get it so cheap?

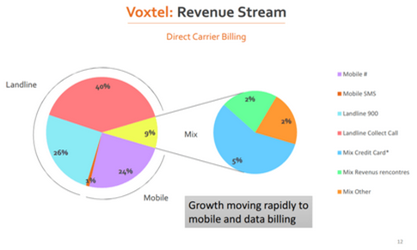

VoxTel’s previous owner treated the business like a cash cow. Too busy to bother reinvesting in the business and care about growing the business further. On the surface, VoxTel is a boring business as well. The majority of its ~$13mm in revenue come from services like billing phone carriers for like landline collect call billing, 900 numbers, mobile numbers, etc. Notably, most of its segments are in declining businesses, which is likely why AtmanCo was able to acquire VoxTel so cheap.

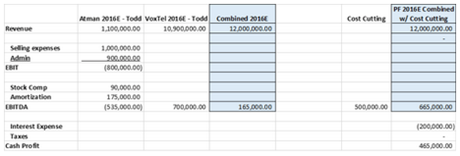

So what do they look like together? Surprisingly, the combined business is actually EBITDA positive.

Note: 2016 VoxTel projections based of off talks with management, the company’s investor presentation, and my own adjustments

Taking into account the growth and cost reductions on the AtmanCo side, they are likely going to end up with between -$500k to -$600k of EBITDA in 2016. After talking with AtmanCo’s CFO, VoxTel is on track to be about flat year-over-year or about $700k of EBITDA for 2016, leaving the combined entity at about $165k in EBITDA for 2016, on a pro forma basis.

With every acquisition, there’s always a good amount of cost cutting that can be done, and VoxTel is no exception. The company estimated about $500k of pure costs can be cut out of the combined entity, as you can see below:

Note: 2016 VoxTel and PF combined projections based of off talks with management, the company’s investor presentation, and my own adjustments

On a pro-forma basis, taking into account the cost cutting and the interest expense from the convertible debt issued for the acquisition, the combined company is actually profitable on a cash flow basis, and should be able to offset taxes thanks to $10mm of NOLs from AtmanCo.

Because of the lack of readily available information on VoxTel, there’s a very strong possibility the market has no idea the new AtmanCo is actually EBITDA positive and profitable. For those diligent investors out there, this is opportunity #1.

Obviously there’s a few more questions we have to answer here:

How quickly will the landline business of VoxTel decline?

Why did they bother acquiring a telecom company?

Where is the company’s future growth going to come from?

Opportunity #2) The Bloomed Platform & Reaching the Mass Market

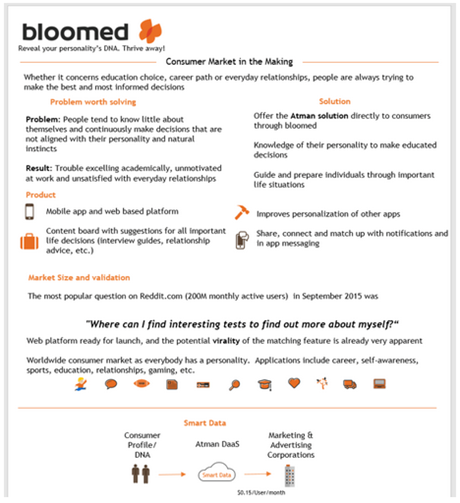

Historically, AtmanCo has sold its psychometric tests to businesses. What most investors don’t know is the company is actually building out a platform for the mass market. Why?

Everyone wants to learn more about themselves.

Meet Bloomed, the company’s platform for the mass market which has yet to be even mentioned in any of the company’s filing so far.

How does it work? Essentially, users take a version of one of AtmanCo’s personality-based tests that pairs users with similar users. The idea is to continue to build out the platform and help people make better decisions in terms of jobs, dating, activities, etc. Even more interesting, AtmanCo wants to take Bloomed and use it as an API to connect with other apps to help with personalization.

Think of how the Facebook login works for random websites but instead you use a Bloomed login to customize each app specifically to you. Clever, right?

This data also becomes very, very valuable to marketers as well. There is a very huge DaaS component of Bloomed as the platform grows. AtmanCo plans to invest a significant amount of resources commercializing the platform. While the VoxTel transaction cost $3mm, the company only had to pay $1.65mm in cash upfront (plus $600mm paid over five years) and the majority of the excess cash will go to the commercialization of Bloomed.

You can check it out and take the test at www.bloomed.com. It’s still in the very, very early stages though.

While it’s easy to see the growth potential of a platform like Bloomed, this was something the company was working on even before the VoxTel acquisition.

Besides from the immediate EBITDA boost and shift to profitability, why did they acquire VoxTel?

VoxTel isn’t just a telecom company. They actually own a dating site, Quebec Rencontre, which is what made the acquisition so appealing to AtmanCo.

Prior to the acquisition, AtmanCo had entered into a 3-year agreement with Quebec Rencontre to serve as the testing lab for the AtmanCo/Bloomed API. As I mentioned before, VoxTel’s previous owner didn’t care much about the business. AtmanCo’s CFO told me the primary issue was that testing different things with Quebec Rencontre was extremely hard to do because how slow it took the team at Quebec Rencontre to get things done, mainly because of a lack of interest and resources. Now that they own the entire business, that problem is finally gone.

The nice thing about an online dating site? Extremely high margins. Quebec Rencontre’s gross margins average between 80% – 85%, whereas the VoxTel Carrier Billing Segment only has gross margins between 10% – 12%. AtmanCo believes there’s a significant opportunity to grow Quebec Rencontre, which would have a massive impact on the bottom line.

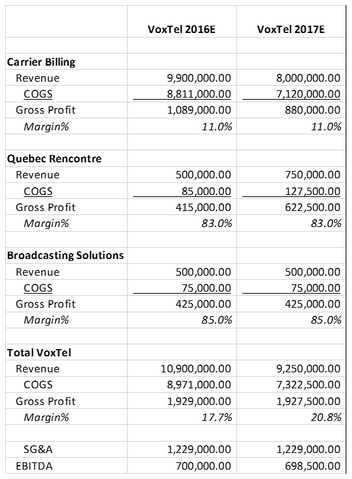

Let’s take a look at Voxtel’s segments:

Note: 2016 estimates are based on my discussions with the company and their projections

VoxTel has three different segments we can focus on: Carrier Billing, Quebec Rencontre, and Broadcasting Solutions.

Like I mentioned before, Carrier Billing is bound to decline over time since it derives a good deal of revenue from the landline business. AtmanCo’s CFO told me VoxTel hasn’t tryied to acquire new business in the Carrier Billing segment in a few years. While AtmanCo may be able to spark new sales, it will be hard to offset the decline.

Now Quebec Rencontre is a different story. Two years ago, it was a $1mm business, but after a lack of investment, its revenues are down 50% since. AtmanCo thinks this is a big area for growth, and with 80% – 85% gross margins, just having revenues grow back to $750k in 2017 is enough to offset a decline in the Carrier Billing segment.

Last up we have the Broadcasting Solutions segment. Ever voted on The Voice for your favorite contestants? This segment does the billing for that. A couple years ago, this segment was pulling in close to $5mm in revenue. After one of the shows they worked for got cancelled, revenue substantially dropped off. Again, AtmanCo believes this is a big area for growth. With 80% to 90% gross margins, this also has a huge impact on the bottom line.

So while Carrier Billing may be declining, growth from the other two segments should be enough to, at a minimum, keep VoxTel’s bottom line flat over the next few years.

Another massive outlet for AtmanCo is the ability to cross sell their tests to some of VoxTel’s other large customers. VoxTel has some very notable, large customers, and the revenue synergies here could be quite substantial.

Valuation

AtmanCo is currently aiming for about $1mm in EBITDA in 2017, pretty reasonable considering how quickly the AtmanCo business is growing and reducing its EBITDA loss. Assuming $200k in interest expense from the convertible debt (10% interest rate) and the ability to offset taxes from AtmanCo’s NOLs, the new AtmanCo can earn about $800k in cash profits. For a business that can seriously start growing once Bloomed is fully commercialized, it’s pretty fair and conservative to put a 20x profit multiple on the business, which would value the company at about $15mm, or about a triple from the current stock price.

Conclusion

Why do I think AtmanCo is so attractive now?

#1) The lack of information on VoxTel, and how it’s turned AtmanCo EBITDA positive and profitable. Over the next quarter or two, the market is bound to notice when it shows up in the financials.

#2) The lack of information on Bloomed and it’s potential. I’m really, really surprised the company isn’t touting this like crazy yet. Not much help on the IR side though.

#3) My personal favorite and the real kicker for investors: the company essentially gets to use VoxTel’s cash flow to offset the cash burn from the old AtmanCo and use the leftovers to fund its growth, whether it’s through Bloomed, Quebec Rencontre, etc. That’s the kind of free call option I like to see.

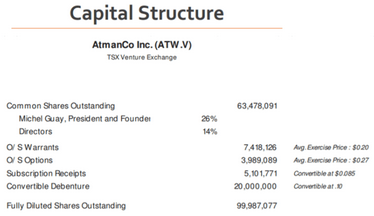

Share Structure

Key things to note:

Very high insider ownership by the CEO and directors of the company, and they’ve been buying recently on the dip.

Good chance the convertible debt gets converted into equity over the next year or two. That will remove a $200k cash outflow every year that the company is currently paying in interest expense.