In 2013 I wrote about an interesting company named Canada Zinc (CZX-V) with a giant zinc deposit in Northern British Columbia that had $6 billion worth of silver, lead and zinc in the ground. The company had an absurd market cap of $31 million while they had $15 million in cash. They were $0.22 a share. Yawn, yawn.

I covered them again a year later as they climbed to $0.38 a share. Nothing much had changed in a year but Teck and Korea Zinc did option three of Canada Zinc's projects. The big zinc companies have been saying for years that there was a big shortage of zinc production right around the corner. Yawn, yawn.

So why should you consider buying a stock that has done little for three years? Actually that's exactly why you should buy them.

The company slowed down, preserved capital and slowly moved the premier project, the Akie property, forward. The stock did collapse with the rest of the resource world as commodities in general cratered in early 2016 at 5,000-year lows. Starting in April of 2016 the company began to climb out of the hole at $0.095 to a high of $0.48 in November as the market began to take the actual shortage of zinc production seriously.

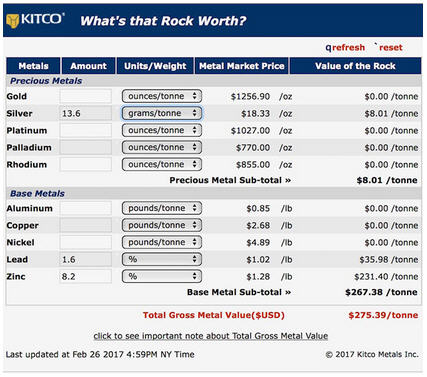

Canada Zinc is as close to a zero brainer as you will find in the resource world. They tout an 8.1 million ton inferred resource of $225.48 rock. That's USD not the Canadian pesos.

If you multiply the tons in the ground by value of the rock and adjust it for the Canadian currency that's $2.4 billion dollars worth of rock in the ground for a company with a $55 million market cap. It works out to $14.94 in metal per share of Canada Zinc. But it gets worse.

The company has 19.6 tons of $275.39 rock USD in the indicated category. That has a gross metal value in the ground of $7.01 billion and $44.16 CAD per share of CZX.

Now granted, nobody can mine every ounce of any resource in any deposit. There are always constraints. But having almost $60 gross metal value for every share and only pricing it at $0.36 is pretty close to absurd. A one percent valuation would give you a $0.60 stock. And given that the company is working hard to increase their visibility, I think shareholders will see that soon enough.

Canada Zinc is mobilizing for an aggressive 2017 exploration program at the Cardiac Creek deposit that is part of the Akie project. The deposit has seen 139 drill holes totaling 59,260 meters but only 104 of those holes were used in the existing 43-101. There are another 35 holes consisting of about 12,500 meters of core that will be factored in the next 43-101. This year's program consists of two rigs doing a total of 7,500 meters of drilling. The program will begin in early June and continue through September. Results will be released on a regular basis.

While focused on Zinc in Northern BC, Canada Zinc is hardly a one trick pony. In September of 2013 they optioned properties nearby to Akie they call the Pie, Yuen and Cirque East projects. Teck and Korea Zinc agreed to spend $8.5 million in combined exploration to acquire a 70% interest in the three deposits. So far the partnership has spent about $3.2 million. They have until the end of December 2019 to complete their earn-in to get the 70%.

In the past year zinc has been a star performer, moving over 100% higher from just over $0.60 in December of 2015 to $1.33 two weeks ago. While interest in zinc has increased, the share price of CZX has yet to even match their peer group. According to a study done by TD Securities, the average zinc stock gets $0.026 per pound of zinc equivalent in the ground while Canada zinc gets less than 1/3 of that at $0.008 per pound of zinc equivalent.

With $7 million in cash in the bank and three major zinc-mining groups as shareholders, Canada Zinc looks very attractive. Their story is compelling. I think they are an easy triple and higher as the market gets it.

Canada Zinc is an advertiser and I have bought shares in the open market. Their presentation is excellent and I highly suggest anyone interested in zinc to download it and read. Do your own due diligence.

Canada Zinc Metals

CZX-V $0.36 (Feb 24, 2017)

CZXMF-OTCBB 155.2 million shares

Canada Zinc website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Canada Zinc. Canada Zinc is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview/article until after it publishes.

Charts supplied by Bob Moriarty.