After massive moves in Lithium (“Li”) juniors last year, will history repeat? Who knows, there will be big winners in 2017, but far fewer. Investors learned a lot about which stories have a chance and which likely don’t. For example, if one is invested in an Esmeralda County, Nevada (

host of the Clayton Valley basin) Li play, it might be time to take a closer look. Why? The superpower in the area,

Albemarle Corp.,

[NYSE: ALB] believes it has a senior claim on

ALL water rights in the basin.

Water rights and/or lack of scale will be the downfall of dozens of hopefuls in western States. This is also true (

for the same and other reasons) in many jurisdictions of Canada, Australia & Argentina (“ARG”). Investors looking for good ideas should pay particular attention to ARG. For some, that might mean development-stage companies like

Lithium Americas [TSX: LAC] which owns 45.75% of a very strong project,

Cauchari-Olaroz, (

along with 45.75% partner SQM [NYSE: SQM]) in Jujuy Province. Or, ASX-listed

Galaxy Resources [ASX: GXY], owner of the very promising

Sal de Vida project on the western side of the

Salar del Hombre Muerto.

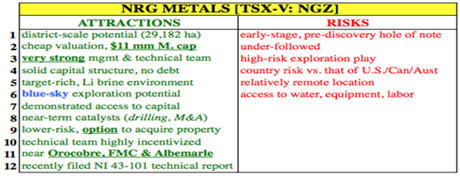

Cheap valuation, world-class team, sizable Li brine option in Argentina

I’m looking for juniors with

cheap valuationsPLUS 1) strong management, 2) access to capital and 3) potential projects of scale.

NRG Metals Inc. [

TSX-V: NGZ] [

OTC: GPOFF] stands out for its valuation (

2nd lowest market cap of 15 ARG Li juniors I track)

Note: {

Valuation is more important than ever. Dozens of Li stocks are up hundreds or thousand(s) of percent, even after meaningful pullbacks from 52-week highs}. NRG has a world-class management / technical team, and has gained control (

through a low-cost option) of nearly 30,000 ha in the

Salar de Carachi Pampa.

I asked the following questions of President, CEO & DirectorAdrian Hobkrik.

There are ~20 junior lithium companies with property or project interests in Argentina. Why should readers care about NRG Metals?

That’s a great question. Since there are many juniors competing for scarce resources, we strongly believe that controlling a basin will be critical. We have optioned 29,182 hectares (~72,100 acres) in the Carachi Pampa basin (in the Salar de Catamarca), a position we consider district-scale. Size matters, but even more important, vitally important, is having a strong technical team including people with direct Li brine experience in South America We’re funded through our upcoming drill program and believe our ability to raise capital is strong.

You spoke of the vital importance of management, how does your team compare to that of peers that have larger market caps?

In a country like Argentina, boots on the ground is a pre-requisite for success. Six team members have mining experience in S. America, (4 fluent or native speaking, 3 with direct Li experience) offering a range of valuable skills. José Gustavo de Castro is a chemical engineer, an expert in evaluating and advancing of projects, including 5 years as Country Manager at producer Orocobre Ltd., responsible for the development of the Salar de Olaroz project. José also held senior positions with the Argentine subsidiary of FMC Lithium [NYSE: FMC], operator of S. America’s largest lithium operation. Note: {Avg. market cap of 15 ARG-focused Li juniors = ~C$50 million, ~5x that of NRG’s C$ 9 million market cap 3/22/17}.

Fernando Villarroel has 12 years’ experience in the mining industry in Argentina focusing on lithium process development. From 2009 to 2013 he worked with Lithium Americas as Project Manager responsible for construction management & commissioning of the initial pilot evaporation facilities and lab at Cauchari Olaroz. José Louis Martín is a Phd in Geology with 35 years’ experience. Dr. Martín served as the Catamarca representative for Galaxy Lithium from 2010 to 2013, and participated in the development of the Feasibility Study for Galaxy’s Sal De Vida. Note: {See more detailed bios below}

How did you find the Carachi property, and how were you able to quadruple NRG’s initial land position to 29,182 hectares (72,100 acres)?

Initially we had 3,004 ha, (~7,420 acres), then we optioned an additional 3,383 ha (~8,360 acres) and announced the transaction. After a successful VES survey, which formed the basis of the NI 43-101 report (done by Novaldo Rojas, the QP for Milllennial Lithium (TSX-V: ML), we decided to go after a dominant position in the basin. So, we re-negotiated with five parties and came up with a deal requiring a cash payment of only US$173k, for an option on, as you said, 29,182 ha (~72,100 acres). No further payments are due unless we like upcoming drill results. We believe, consultants believe, salars in this area are related to the Galan Caldera. Given the depth of the basin, if we hit decent Li values without chemical issues, we could be off to the races.

Please explain why you think your Carachi Pampa property is an attractive prospect.

Based on a recent geophysical survey, there’s a zone of very low resistivity / high conductivity that looks like it could be a zone of saturated brines. It begins at 70 m depth, dips to 300 m, is about 150 m thick, and is open at depth and in all directions. At low cost, we can drill a few holes and see what we find. Our technical team can explore multiple targets at once until we find project(s) we like. Access to capital is key, we’re in good shape on that front.

Might NRG be interested in other technology metals? In other provinces or other countries?

Our clear focus is on Carachi Pampa. That said, we’re in discussions about Li brine properties/projects in nearby salars. Our in-house expertise allows us to review multiple prospects brought to our attention. We’re in no rush, Carachi Pampa will keep us busy as we contemplate exercising that option. Regarding other metals, other countries, we would possibly look in Chile, but our skill set is geared towards Li brine deposits.

Management team bios

Conclusion

Readers be warned (or reminded), Li juniors are highly speculative, all of them. NRG Metals Inc. [TSX-V: NGZ] [OTC: GPOFF] is no different, but at least its valuation is much lower than that of (the average) Li junior with property/project(s) in Argentina. Less downside risk may be found in the shares of giant companies like Tianqi Lithium Industries [China-listed: 002466.SZ],Jiangxi Ganfeng Lithium [China-listed: 002460.SZ], FMC, Albemarle and SQM, or with development / producing companies like Galaxy, Lithium Americas and Orocobre Ltd. [ASX: ORE]. But, to have a possibility of out-sized returns, one has to accept incremental risk.

NRG has a very experienced Li team and is actively looking to diversity its portfolio with assets from neighboring salars. The Company prudently locked down dominant position of nearly 30,000 ha for under US$200k to take a shot at a potentially significant discovery. Make no mistake, this is an educated guess, not a sure thing. However, a technical team of this caliber would serve investors well by making as many low-cost educated guesses as they possibly can.

Disclosures: The content of this article is for illustrative and informational purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered, in any way whatsoever, implicit or explicit investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. The content contained herein is not directed at any individual or group. Mr. Epstein and [ER] are not responsible, under any circumstances whatsoever, for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of NRG Metals are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in NRG Metals and the Company was a sponsor of[ER]. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.