Castle Silver Resources Inc (TSX-V: CSR OTC:TAKRF FRANKFURT:4T9B) is a silver-cobalt company aiming to resume mining at the Castle Silver and Beaver properties in Ontario Canada. The company is run by Mr. Frank Basa, a Metallurgical Engineer who worked for Agnico Eagle back in the 80’s when they were actively mining the properties in Castle Silver’s portfolio. Castle Silver (CSR) is a spinout of three properties from Basa’s other company, Granada Gold Mine Inc., a development company with a high grade gold mine close to production near Rouyn-Noranda,Quebec. CSR’s silver and cobalt projects warranted a new vehicle to take them to the next level. The market cap for this Venture microcap is currently only $7.5 million.

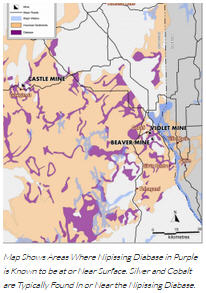

Castle’s philosophy is to acquire previously producing mines in politically safe and pro-mining jurisdictions, then systematically and efficiently explore with the goal of defining a viable resource as a first step on the road to production. “Potential for Ontario’s Cobalt Camp is huge, it’s the largest single location of cobalt in the world, and no one knows about it,” Basa commented when we spoke with him about upcoming plans for CSR.

Why Silver and Cobalt?

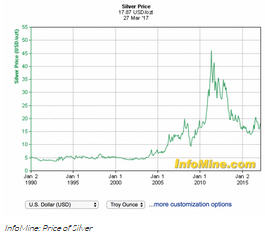

David Morgan, a well known newsletter writer in the silver space has this to say about Ag:

“It’s only a matter of time before the debt and derivative markets crash, catapulting precious metals prices exponentially higher. There’s going to be a run to gold unlike anything in the history of mankind. The spillover into silver will be phenomenal, as well, because once it (debt markets) starts down, everyone that understands what’s going on, which will be very few, will be running to precious metals to protect their wealth.

Silver is going higher, there is no doubt.”

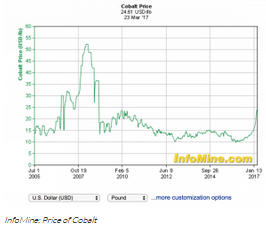

Silver and cobalt are both essential metals for renewable energy. Silver is used in 90% of crystalline silicon photovoltaic cells in solar panels, and cobalt is used in three of the four main lithium-based electric car batteries. Cobalt is a strategic and critical metal often used for superalloys to make gas turbine aircraft engine parts. Most cobalt is a byproduct of copper or nickel, and the Democratic Republic of Congo (DRC) is where over 58% of the world’s cobalt comes from.

Tesla is driving the demand for lithium and cobalt for electric car batteries, and they have a mandate to source cobalt locally to avoid ethical issues and political instability arising from mines in the DRC. Elon Musk has even approached Robert Friedland of Ivanhoe Mines on the subject of cobalt. From Rockstone Research’s Cobalt Crunch Time:

“Elon came to me because we have a nickel sulphate and cobalt sulphate operation in Australia, not the Congo,” he said. “And Elon said ‘I’ve got the world’s biggest battery factory, so I want to buy your nickel and your cobalt at the current metal price for 10 years, because I’m the biggest buyer.’ “So we told Elon Musk, you know, Elon, that’s interesting. We’ll think about it. And then two months later we went back to him and said “Elon, you’re totally screwed. The Germans are building a gigafactory twice as big as yours, the Chinese are building four of them bigger than yours, the Japanese are building two and the Koreans are building one. So unless you’re willing to pay to buy our cobalt and our nickel at whatever the price may be in the future, you’re not going to be able to build any batteries in your own gigafactory and your whole company is going out of business, and we’re going to make money shorting your stock.” ~ James West Conversation with Robert Friedland.

Visual Capitalist lays out the investment case for Co in this infographic on the “Top 10 Reasons Investors Should Look at Cobalt”. Cobalt helps to extend battery life, relevant to cell phones, electric cars, laptops and solar and wind energy as well. By 2020, around 75% of lithium-ion batteries are predicted to contain cobalt.

Pala Investments Ltd, a Switzerland-based mining fund and one of the smartest institutions in mining finance, has been buying and stockpiling physical cobalt. “Fund manager Anthony Milewski figures one of the best payoffs from a global boom in electric vehicles will be a hard, grey metal that so far has drawn little interest from investors. That’s why he’s stockpiling it.” And they are not the only fund out there doing this. The industry supplies around 100,000 tonnes annually, but “supplies are tightening because the electric-vehicle boom is set to boost demand 16 per cent annually on average through 2022, according to commodity researcher CRU Group.” Only 35,000 tonnes a year is produced in a metal form preferred by investors, and there is very little trading, and therefore increased volatility, in futures on the London Metals Exchange. So buying physical cobalt was the only real solution for the go big or go home game.

Cobalt’s glory days are here as we have previously noted in this article on CobalTech, also a contender in the Ontario’s cobalt camp. Now, Castle Silver is giving the rest a run for their money, capitalizing on the cobalt craze by raising just shy of a million to explore and drill a very prospective project. Wait until you see the brag-able grade they got going on.

Basa saw firsthand the high grade material, both silver and cobalt, coming out of the Castle mine back in the 80’s. Now, Agnico was not that interested in the cobalt, and as a matter of fact, they practically gave away the cobalt, what they considered waste rock, for what would be worth over $50 million in today’s prices. But Basa remembered well from his Agnico days that the mine did not close due to lack of ore, it was due to the low price of silver. Now he’s returned to explore this high grade opportunity again, with modern technology and much better commodity prices.

Flagship Project

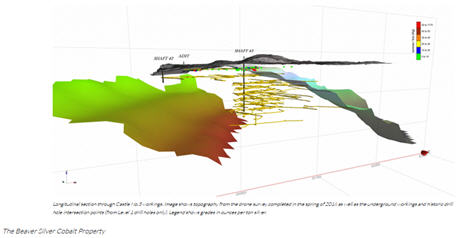

The Castle Silver property is a few kilometres northeast of Gowganda in Ontario, a mining-friendly town, with around 50 million ounces of high grade silver extracted in the 1900’s. The project is a 33km2 land package with three shafts and a main rehabbed adit where early in the 1900’s and then again in the 80’s, mining took place. Near term, Basa envisions this as a great cobalt exploration play. Long term, a silver + cobalt powerhouse with gold and copper kickers thrown in.

The property was picked up by Gold Bullion Development Corp. (now Granada Gold) in the mid 2000’s for only $25,000. But don’t let that figure discount the current value. When the deal was done, who gave a toss about green energy options, lithium ion batteries and electric cars? But today we sure do. “We pick up distressed assets, do a lot of work on them to add value and we drive them to the next level,” commented Basa.

Killer Interval of High Grade Silver and Cobalt

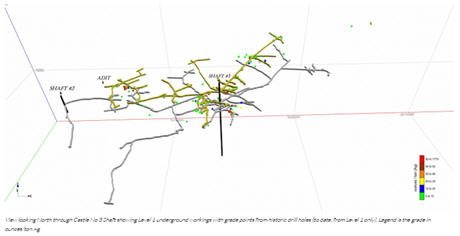

An IP survey showed that they had something juicy to drill and drill they did in 2011. This is what makes this company so exciting right now. Drill hole CA 11-08 returned 188.8 ounces/tonne silver over 3.09 metres. That is ounces, not grams. Converting to grams we have 5,850 g/t Ag over 3.09 meters. And the cobalt assays were high grade as well: CA11-09 intersected 1.44% Co over 0.12 meters. Basa says anything over a 0.5% is great, even 0.2% or 0.3% would be good, so 1.44% is really truly high grade cobalt.

Adding Value

This story screams two things. Grade and a proper team running the show. Had these properties stayed within the Granada portfolio, Basa and his shareholders would have seen little value on the market cap for their upside potential due in part to a challenging share structure at GGM.V, and mostly from a keen focus on sorting out the economic studies, permits and mill for their Granada mine.

Basa did something unusual with the spin out shares from Castle back to Granada. When Granada receives roughly 10 mill shares of CSR in tranches over four years in exchange for the cobalt/silver project portfolio, Granada is dividending the shares directly to their shareholders. He has incredible allegiance for loyal shareholders: stick with him, you will see the rewards. If you buy Granada now, you will see your dividend of CSR shares down the road.

The Granada gold mine is located in another well-known Canadian mining hood, the Abitibi Greenstone Belt. Now, Granada has gone through interesting times, spinning their wheels a bit deciding upon which toll mill situation would make the most long term sense. GGM.V has now decided to build their own mill and get producing. The Granada Gold Mine has a Measured and Indicated resource that combines to over 47 million tonnes of ore, grading 1.05 g/t gold, for over 1.6 million ounces of contained gold in the deposit. They have called in heavy weight DRA Americas Inc., a subsidiary of DRA Global, to act as a technical adviser for this next stage of building a mill. GGM.V, after the typical ups and downs of markets going haywire, is now verging on transforming from caterpillar to butterfly, with eventually 100,000 ounces of gold production per year as the goal. Sounds like a team that knows how to get things done.

CSR’s Project Portfolio

CSR has three properties, but we will touch upon the best two, Castle Silver and Beaver. Both properties boast silver and cobalt as the main metal targets and both are past producing mines.

The Castle Silver Cobalt Property

The Castle Silver camp features underground access which would cost millions of dollars and probably years and years of permitting, planning and development for another company to replicate the development, headframe and hoist etc; it has water, year round road access and diesel power. An underground access adit makes sampling, mapping and drilling all possible, giving the tech team a greater understanding of structural controls around the mineralization.

Castle produced 9.5 million ounces of silver and 300,000 lbs of cobalt back in the hayday. Underground ore grade was 25 oz/ton silver in 1923-30 and 26 oz/tonne silver in 1979-89.

Not dissing the rush into this area, but Basa clearly foresaw this opportunity years ago. He had the Agnico Eagle experience of a first hand look at the grades coming out of the Castle Mine, and also the know-how to avoid environmental and first nations’ pitfalls that others will trip over while swaths of capital go out the window. So don’t go throwing darts at these cobalt upstarts he warns, many are non-starters due to environmental liabilities in the cobalt camp, known for being brutal.

Basa and Geologist Doug Robinson, the key man with boots on the ground, are going to evaluate the results from recent geophysics, IP and MMI, and then they will decide upon the drill scope and plan. Drill permits are in place already. Basa sounds fairly confident they will end up underground diamond drilling in the adit, where it is cheaper, and visuals and past work to assist in “drilling for structure and mining for grade”.

Really great results from bench-scale metallurgical flotation and gravity test work press released January 31, 2017 showed silver and cobalt recoveries of 98.5% and 70.5% respectively, and produced an extremely high grade concentrate of 11,876 grams per tonne silver and 10.5% cobalt using a simple flotation process. Great to have a metallurgist leading the team!

Link to Castle Silver Technical Report – August 21, 2015

Grade is king as they say, and a hand-cobbed 20-kilogram geological test sample from the Beaver property averaged 7.98% cobalt and 1,246 g/t silver! You had me at “hand-cobbed”, but these are really encouraging met results here. This was reported by Granada (formerly Gold Bullion Development) in a news release dated Feb. 14, 2013. The company also released in November of last year assay results for tailings’ grab samples collected at Castle and Beaver. Highlights of the Beaver assay results include: 134.78 g/t silver and 1.124 g/t gold. Hard to not see where this is all going…

Exploration News Ahoy

There is plenty of work to be done, plenty of modern tech to deploy on this old Castle Silver mine yet. Mining has come a long way since the Castle property was last in production and it has never really been evaluated as a cobalt play because cobalt was $6-7 a pound in the late 80’s. In 1988 silver was only $6.53 per ounce. Today cobalt is riding at $24.61 and silver $17.55. (Interesting side note, Agnico’s name is derived from Silver = Ag, Nickle = Ni and Cobalt = Co…)

CSR has IP results pending, follow up MMI (Mobile Metals Ion) sampling to do in order to prioritize their IP targets, leading to a drill campaign to really get us excited. They also have easily accessible tailings and waste rock at both Castle and the Beaver property. What once was waste, now could be mineable ore that just might help the capex on the way to commercial production.

Share Structure

Insiders of CSR own approximately 6 million shares and here is the current capital structure:

| Shares Outstanding |

35,038,208 |

| Warrants (0.10-0.20) |

13,151,045 |

| Options ($0.05-0.24) |

3,150,000 |

| Fully Diluted |

51,339,253 |

Marketing

Another reason why we have faith in this team’s ability is that Basa is out on the road telling the story, religiously to the street. Every two weeks he’s off to somewhere, meeting new potential shareholders, getting the story out there to make it a well-known success. When technical background meets hot commodity meets capital markets savvy, sometimes you hit it big.

Stay tuned for more on Castle Silver, including their gold and copper target called the “Golden Corridor”.

~Disclaimer~

This is not in any way investment advice or any sort of stock recommendation. Please do your own due diligence and talk to a qualified investment advisor.

The contents of this article are for informational purposes only. Nothing in this article, in any way whatsoever, should be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy, hold or sell any security. Note the inherent risks when investing in microcap stocks.

Castle Silver Resources Inc. is a marketing client to an arm’s length company controlled by one of the owners of StockSyndicate.com. One or more of the Stock Syndicate owners does own shares in Castle Silver Resources Inc.