Current Price: C$0.13

Shares Outstanding: 59.0 million

Market Capitalization: C$7.7 million

52-Week Range: C$0.115-C$0.31

Cash: ~C$0.5 million

Total Liabilities: ~C$0.5 million

The hottest province for mining exploration is not Ontario, Quebec, or even the Yukon. It is actually Newfoundland, where a staking rush has quietly taken over the province.

Until now, Newfoundland has largely been overlooked, but definitely not for its geology. Much of the island was simply inaccessible, accompanied by an archaic concession system that locked up much of the land until the 1980s.

Most of the roads in Newfoundland was limited to the coastal areas where the majority of the population lived. This is true with the railroad as well, built in the late 1800s, it followed the coast with the occasional cut across a peninsula where it was easier to build.

The Reid Newfoundland Company, founded by Sir Robert Gillespie Reid of Scotland, built Newfoundland’s railroad in 1890. As a condition of operating the Railway, Reid was compensated with 5,000 acres of Crown Land per mile operated. In 1896, Reid was commissioned to build another railway, and similar to the first contract, was compensated 5,000 acres of land for every mile he built.

The railway opened up vast tracts of land, spurring interest in Newfoundland’s natural resources. Reid was the primary benefactor, eventually owning 4,160,000 acres, including the timber, mineral and surface rights. These “Reid Lots” were akin to modern day patented claims, and made the Reid Newfoundland Company the largest landowners in the province. He became a pulp and paper, as well as mining tycoon.

Until the mid-1970s, the Newfoundland concession system granted companies large areas of land that included exclusivity. Companies can only explore so much, thus, the majority of the land under the concession system remained untouched and unexplored.

It was not until the mid-1980s the last of the concessions was finally released, including the “Reid Lots”, which were taxed away or converted to claims with the other concessions. With such a small group holding onto the majority of the prospective land for decades, its no wonder Newfoundland remained under-explored through the various gold cycles.

Richmont Mines – Leaving A Lot Of Gold Behind

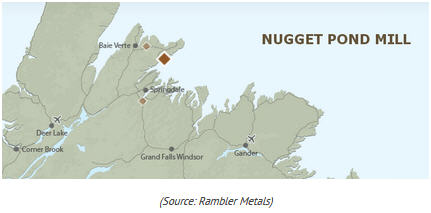

In May 1995, Richmont Mines (TSE:RIC, Mkt Cap: C$695.9M) made its foray into Newfoundland, first acquiring a 60% interest in the Nugget Pond gold project, then the remaining 40% in January 1996 after spending $3 million in development work. The Nugget Pond gold mine is located on the Baie Verte Peninsula of Newfoundland, spanning 4,900 acres. On December 31, 1995, the ore reserves totaled 430,000 tons at a grade of 10.5 g/t.

Nugget Pond began commercial production in April 1997, and produced a total of 168,748 ounces, depleting its reserves by 2001. Having a perfectly good mill, Richmont Mines simply needed more feed. In anticipation of the depletion at Nugget Pond, Richmont acquired the nearby Hammerdown property in March 2000 for $6 million.

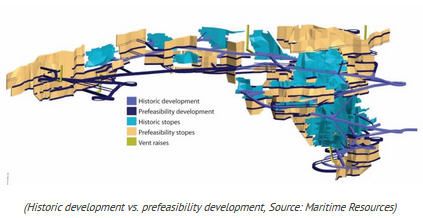

Including work performed by Richmont, Hammerdown saw close to 600 drill holes over 63,000 meters. A trenching program led to the discovery of another deposit in Rumbullion. Hammerdown was subsequently mined between 2001-2004, during which a total of 291,400 tonnes of ore were mined and milled at an average grade of 15.74 g/t Au, recovering a total of 143,000 ounces of gold. Richmont opted to cease production due to low gold prices ($285 per ounce), even with mineralization remaining.

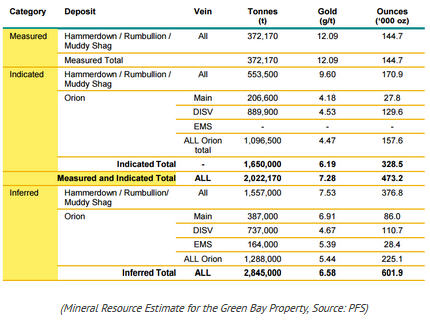

Fast forward to present day, the ore and mill still remain, and Maritime Resources is poised to re-start production and further explore the Green Bay Gold property, which in addition to Hammerdown, is home to three more deposits and over 1 million ounces of gold resources.

Hammerdown – After-Tax NPV of $44.2 Million – Optimization & Exploration Upside Coming

Maritime originally acquired 50% of the Green Bay Property from Commander Resources in 2010 through the issuance of 12 million shares and by spending $750,000 on the property. In 2012, Maritime exercised its option to acquire 100% through the issuance of 5 million more shares.

The Nugget Pond Mill is now owned and operated by Rambler Metals, a company Maritime has an Engineering and Evaluation study agreement with. That agreement includes the First Right for toll milling. It is important to note that Rambler acquired 4.5 million shares of Maritime in February 2012 and owns 12% of the company; it is in the best interest of Rambler to see Maritime to production.

The company recently released a PFS study on Hammerdown, which was headlined by an after-tax IRR of 34.8% and NPV of $44.2 million (producing 35,000 ounces per year for 5 years). The study confirms that Hammerdown is not just viable, but very economic in today’s gold environment. Due to the existing mill, there is low upfront capital and a very short ramp-up to gold production. And since the operation is scheduled to run at 400 tpd over a five-year period, permitting for the re-opening will be straightforward. It will not require Federal Government’s blessing.

Hammerdown currently has 179,400 ounces of gold in reserves, but also has another 376,847 ounces of inferred that can be converted with more drilling. As mentioned earlier, the Green Bay property has three other deposits that will be utilized in the future:

The Rumbullion deposit remains open for at least 800 meters to the northeast, with gold veins exposed and tested on surface. The Hammerdown deposit is faulted-offset to the southwest, and is untested at 500 meters at depth. Lastly, the Orion deposit is dipping to the northeast and has at least 1,500 of untested ground. We believe there can be as much as 1 million ounces in between Orion and Hammerdown, and this exploration upside is just one factor to consider in the valuation of Maritime.

The value-add in the near-term will be mine optimization. While the PFS validates the profitability of Hammerdown, the consultants, WSP, were overly conservative, using capital costs that only incorporated ~25% of the existing infrastructure built by Richmont.

When the mine plug is pulled, Maritime will be able to fully assess how much of the existing substructure is intact. WSP also used pricing for brand new equipment and surface infrastructure – this as well can be significantly improved upon. Lastly, Maritime will be buying back 1% of the 2% NSR on Green Bay (with the exception of production from the Orion deposit) for C$1 million from Commander Resources. This move will further tighten up economics and generate more value for shareholders.

Proven & Established Veterans Of The Mining Game

Maritime Resources is led by Douglas Fulcher, who brings over 30 years of mining exploration experience. Mr. Fulcher has worked with both junior and senior mining companies, most notably as the President and CEO of Abacus Mining and Exploration from 2003 until 2010, where he was instrumental in the development of the Afton-Ajax project, a copper-gold project located in South Central British Columbia, with an after-tax NPV8 of $215.6 million.

Maritime recently appointed Andrew Pooler as the company’s COO. Mr. Pooler was brought over to manage the prefeasibility study and the development and operations of the Hammerdown project. He brings over 30 years of experience as a mining engineer, his most recent role was the COO of Esperanza Resources, which was acquired by Alamos Gold for $69.4 million in 2013.

Moving Forward – Under The Radar But Not For Long

Maritime Resources currently has $500,000 cash in the treasury, and has allocated $100,000 to the portal, and another $100,000 to the de-watering operation, both scheduled to commence in Q2-3 2017. The company has also engaged Stantec Engineering to complete the EA permitting.

A surface exploration program is in the works that will aim to extend the gold vein system along trend, and to drill some step-outs to test for that treasured blue-sky potential. Nevertheless, the main focus of the campaign will be to prove up the inferred resources so that it can be considered for the inclusion in the optimized mine plan.

Maritime just acquired an option on the Whisker exploration stage property, just a 10 kilometer drive away from Hammerdown. The project exhibits the same high-grade gold encountered at Hammerdown and Orion, including nine grab samples that assayed 13.3 to 30.5 grams per tonne gold with silver values ranging from 11.8 to 37.2 g/t Ag. Maritime plans on exploring Whisker while Hammerdown is in full development.

The PFS estimates a total capital cost of $67.8 million. Once again, we see this number lowering as the mine plan is further enhanced. Opening the portal will reveal a lot, and this will be a significant catalyst for Maritime in the near future. Doug has already been approached by many groups to provide the debt financing for the project. If everything goes according to plan, Hammerdown is expected to commence production within 18 to 24 months.

One qualm investors may have is the longer than expected timeframe it took for the PFS, originally slated for Q4 2016. Speaking with management, this was a misalignment of expectations, as the PFS was revised several times. It included a comprehensive study on the different methods of small vein mining, and a dispersed consultancy team that only added to the schedule creep. As a result, MAE’s share price floundered, even with the confirmed economics.

Maritime Resources’ current share price is C$0.13, with 59.0 million shares outstanding for a market cap of C$7.7 million. We believe there is a strong disconnect between its assets and the current market price. MAE wholly-owns a proven mine and is on the cusp of a re-start. It also enjoys significant potential upside in resources not accounted for in the PFS; blue-sky exploration potential; and likely mine plan optimization. With a clean and tight share structure, we believe Maritime Resources is one of the last development brownies on the platter.

Palisade Global Investments Limited holds shares of Maritime Resources. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.