It’s the Holy Grail of gold exploration.

Finding a so-called “elephant-sized” gold/copper porphyry deposit is what gold explorers dream of.

It assures lifelong bragging rights for the savvy geologists involved. And it offers investors a lucrative home-run win.

The problem is that fewer and fewer world-class gold deposits (at least five million ounces in size) are being found.

The current success rate is about one per year, regardless of how many companies are hunting for them and the approximately US $3 billion per year that is being spent in this quest worldwide.

This is a problem for the biggest gold miners, which are scrambling to replenish dwindling inventories. So the easiest way to do that is to gobble up much smaller would-be producers that own sizeable gold projects.

That is why there’s been a great deal of buzz lately about the recent launch of Aztec Minerals Inc. (TSX.V: AZT).

This newly-minted company appears to have a tiger by the tail. It has just started exploring a large porphyry gold/copper/molybdenum prospect in geologically-fertile Sonora State in northwestern Mexico.

In the Company of Giants

In the Company of Giants

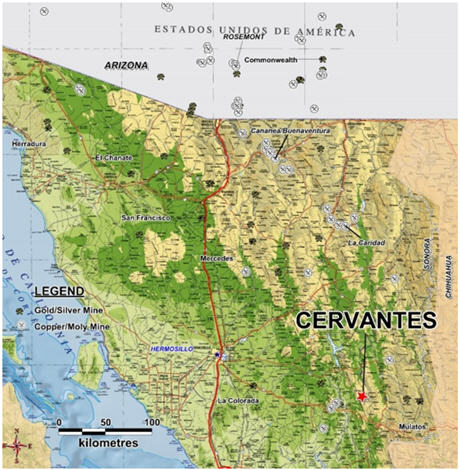

So here’s the deal: Aztec has an option to earn 100% ownership of the under-explored Cervantes Project, which is ideally located at the intersection of two prolifically-mineralized geological trends.

One is a porphyry copper belt that trends from southeastern Sonorain a northwest direction all the way intoArizona. The other trend is a high-sulfidation epithermal gold belt that runs east to west across most of Sonora State.

Of particular significance, the copper belt hosts one of the five largest copper mines in the world — the huge Cananea porphyry copper/molybdenum mine of Grupo Mexico. The gold belt encompasses Agnico Eagle Mines’ nearby, low-cost La India gold mine, as well as Alamos Gold's large, near-surface Mulatos gold mine.

How is this relevant to Aztec Minerals?

Well, the company is betting that the Cervantes Project may offer the best of both worlds. This entails a deep-seated, bulk tonnage copper deposit that is overlain by a shallow, sizeable, high-grade, oxide gold deposit (much like a jewel in a crown).

However, the development of a prospectively large gold/copper porphyry deposit at the Cervantes Project is no small endeavour.

Ultimately, it could cost more than a billion dollars to commercialize a bulk tonnage porphyry deposit at Cervantes. And Aztec would need to drill at least a couple of hundred holes to fully define the overall size of a deposit of this magnitude.

Yet that would be a relatively small price to pay to become a perfect takeover candidate. After all, each of the world’s big gold miners needs to produce as much as several million ounces of gold each year just to keep pace with its rivals. And this challenge is getting harder every year.

In fact, at least one new multi-million ounce deposit needs to come on-stream every year just to replace the major mining companies' annual output. But this has not been happening.

Consequently, the world’s biggest, deep-pocketed gold miners are scrambling to replenish dwindling inventories. And the easiest way to do that is to gobble up much smaller would-be producers that own sizeable gold projects.

In other words, this is the kind of exit strategy that some participants in Aztec’s recently-completed IPO financing fully expect to occur. In which case, it represents a very lucrative “home run” return for investors — if it happens.

The success or failure of a large exploration project has very little margin for error — especially when billions of dollars of capital expenditures and operating overheads have to be committed if a big-league mine is built.

So it becomes all the more important for any well-run gold explorer to have top-flight management at the helm.

Aztec Minerals is well-served in this regard by President and CEO Joey Wilkins. He has 20 years of experience with Kennecott, an exploration-oriented subsidiary of the global mining heavyweight, Rio Tinto PLC. That is where he gained invaluable experience running exploration projects for porphyry copper-gold deposits in northern Mexico and South America.

Obviously, he’s an ideal choice to help unlock any prolific gold and copper riches at Aztec Minerals’ much-coveted project.

Furthermore, the company’s founder and Chairman of the Board is Brad Cooke. A fellow geologist, he’s no stranger to success in Mexico’s mineral exploration and development industry.

In fact, his flagship, Toronto-Stock-Exchange-listed company Endeavour Silver Corp. (TSX: EDR) is a great example of how a shrewdly-managed Canadian mining start-up can beat the odds, going on to succeed and subsequently thrive in Mexico.

From a standing start, Cooke developed Endeavour into a mid-tier silver miner that operates three mines and has at least two more advanced-stage projects in the pipeline.

This is only the third exploration company that he’s taken public in the last 30 years —which says a lot about his enthusiasm for the Cervantes Project.

Building on Early Exploration Successes

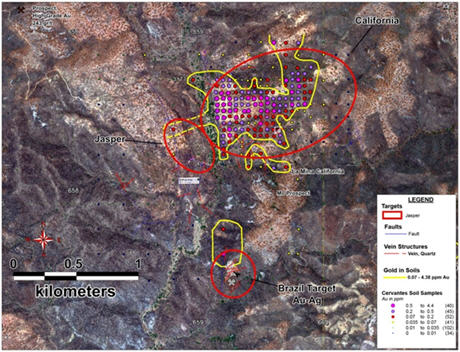

Aztec Minerals completed an extensive gold-in-soil sampling program last year that identified a large anomalous gold target, measuring 900 metres by 600 metres, which also revealed anomalously high copper values, known as the California zone.

What’s really interesting about the California gold-in-soil target is that its prospects are corroborated by a large underlying geophysical signature that extends in several directions, most notably at depth.

Solving the puzzle as to what lies beneath the surface at the California target area is made a little easier with the benefit of some past drill results. In fact, the project was briefly explored in the late 90s by Mexico’s big mining company, Penoles.

This drilling confirmed the presence of ore grades over mineable thicknesses and that the near-surface mineralized is oxidized, which means that itshould beamenable to low-cost heap leach mining.

I will go into further detail about the findings from Aztec Minerals’ 2016 exploration season in a subsequent news feature article.

For now, it’s important to note that the mining industry’s best exploration tools — namely geology, geochemistry, geophysics, and exploratory drilling — have all corroborated one another to point to the existence of something big at the California target zone.

As yet, it’s too early to say whether a world-class gold/copper/molybdenum bulk tonnage deposit is lurking within the California target and several other outlying target areasthat have been identified.

Regardless, there’s good reason to believe that what’s emerging here is a textbook, bulk-tonnage porphyry deposit, involving a gold/copper/molybdenum system that is outcropping at surface.

So what’s next?

Aztec Minerals’ team is now hard at work interpreting all of the company’s exploration results to date to identify and prioritize upcoming drill targets at the California prospect. (The company acquired the property in 2015.)

Drilling is expected to get underway in late summer when conditions are optimal. Subsequent to drilling, Aztec Minerals hopes to complete an initial resource estimate, followed by a preliminary economic assessment (PEA) — two big catalysts for higher share price valuations.

Investment Summary

Aztec Minerals just competed an over-subscribed $4 million IPO, in which Coeur Mining Inc. subscribed for a 9.99% stake in the company.

This suggests that Coeur Mining, which is already established as a gold and silver miner in Mexico, wants to get in earlyby having “skin in the game” in the eventuality that Aztec Minerals strikes pay dirt.

Coeur is certainly deep-pocketed enough to buy-out Aztec Minerals if a world-class discovery emerges.

Regardless of how big much gold and copper may yet be revealed, there is also considerable intangible value in the project’s geographic location. A mining-friendly nation, Mexico is very attractive to North American miners due to its low geopolitical risk.

Furthermore, Mexicohas long been supportive of mining, especially since this well-financed industry supports some of Mexico’s more economically under-developed regions.

Hence, Mexico is very supportive of foreign investment and offers attractive business incentives to North American mining companies like Aztec Minerals.

Drilling over the next two years will go a long way towards determining the overall size potential of a prospective large-tonnage gold/copper/molybdenum discovery at Cervantes.

To this point, all the exploration tools that have been used to date seem to indicate that a prospectively world-class discovery is waiting to be unearthed.

It also seems like Aztec Minerals has the right leadership. They certainly have the necessary experience and track record for developing gold, silver, and copper discoveries into commercial success stories in Mexico.

On a technical note, the company now has about 27.9 million shares outstanding (38.9 million fully diluted) and a market cap of less than CA$10 million. Such a well-structured company typically acts as a catalyst to high share price evaluations in the advent of positive exploration results.

All in all, 2017 should offer investors an exciting ride. So buckle up and hold on to your seats.

About the Author: Marc Davis has a deep background in the capital markets spanning 25 years. He is also a longstanding financial journalist, having worked for leading digital financial news agencies in North America and in London’s financial centre. He is also a former business reporter for CBC Television.

Over the years, his articles have also appeared in dozens of digital publications worldwide. They include USA Today, CBS Money Watch, Investors’ Business Daily, the Financial Post, Reuters, National Post, Google News, Barron’s, China Daily, Huffington Post and AOL.