Figure 1 (Lead photo): Chinese nuclear electricity generation, from reactors like that of the Guodian Xinjiang Hongyanchi Power Co Ltd., in Urumqi, grew 24% in 2015, according to the World Nuclear Association. Image Source: Public domain from Pixabay.

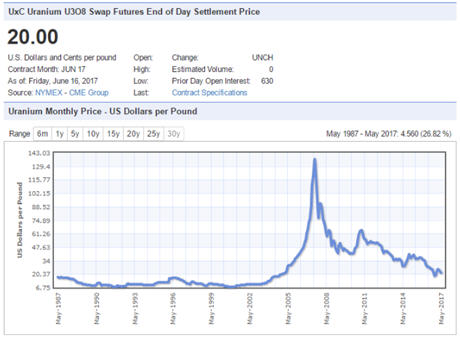

While uranium stockpiles await better spot prices, November of 2016 saw a 13-year low (See Figure 2). Many uranium companies’ stock prices hit unimpressively low prices too. Does a uranium low amid stock-market highs foretell coming change?

Uranium Spot Prices and the Stock Market

During the nuclear power brown-out of the 1970s, through 2002, few reactor orders arose. Around 2001, increased global electricity demand, increased awareness of petroleum’s environmentally unfriendly carbon footprint, and improvements in nuclear power reactor design all contributed to the ensuing uranium stock bubble (2002 through 2007). Companies like Uranium Resources, Incorporated (URRE) and Altius Minerals Corporation (ALS), outperformed the Dow Jones Industrial Index (DJI) by 3,300 and 2,900%, respectively.

While uranium stockholders enjoyed greater value on their holdings, hundreds of uranium companies arose, and production increased, accelerating from 2007 forward. Eventually growing energy metal stockpiles and the company-saturated industry diluted the value of uranium holdings. Industry prices fell.

Just as the market looked like it would recover, in 2011 (Figure 2), a major earthquake and tsunami disabled Fukushima Daiichi’s nuclear reactors in Japan. The disaster drove uranium swap future prices further downward, to the 13-year low ($18.50), during the November 2016 U.S. presidential election (see Figure 2).

Since 2004, uranium spot prices have peaked approximately every three- to three and a half- years, making 2017 - 2018 viable prospects for pattern traders. A look at the current market environment suggests that it may be time to start thinking about the next peak.

Figure 2: Uranium’s monthly (U308) Swap Futures prices reflects, within reason, uranium spot prices. From May 1987 through 2006 they stayed below $20 until 2004, peaked in 2007, and bounced downward, hitting a 13-year low (< $20.00), late last year. Source: NMMEX - CME Group data summarized on IndexMundi.com.

Uranium Among Highs and Lows

Early this year trading volume for Cameco Corporation (CCO) reached bubble market levels (Figure 3). Nexgen (NXG), just this year, has seen its largest trading volume since its 2012 inception. This burst in volume comes as the S&P 500 Index (INDEXSP:.INX) hits an all time high, and analysts ask if a market free fall waits over the next peak. With uranium trading levels peaking stock market indices, investors have begun to critically evaluate their positions.

Figure 3: Monthly trading volume consistently surpassed, from late 2016 - 2017, the 60-period average monthly moving average for Cameco Corporation’s (CCO) stock. Recent increased trading volume represents the first similar event since the bubble, more than a decade ago. Image source: TradingView.

As uranium spot prices have risen 2.33% from the recent low, stockholders have turned a questioning eye toward U.S. President Donald Trump. His advisors inquired the United States Department Of Energy concerning the status and needs of nuclear energy production in the U.S., according to Bloomberg. Trump, recently tweeted, ...

“The United States must greatly strengthen and expand its nuclear capability until such time as the world comes to its senses regarding nukes.”

Monday, Department of Energy Secretary Rick Perry reiterated the importance of nuclear energy in the Trump administration’s strategy. Have uranium and the stock companies tied to it bottomed out? Or does the future see pre-2001 brown-out levels?

Recent global nuclear energy infrastructure development activity, despite reactor closures, also prods investors awaiting market changes. According to the World Nuclear Association, “At the end of 2015 there were 66 civil power reactors under construction around the world and another 158 planned.” The Association also states that construction has been, “... led mostly by industrializing countries which have enjoyed high levels of economic growth with an accompanying increase in energy demand.”

New plants will contain newer, more efficient nuclear technology. China, with its state-owned National Nuclear Corp. (CNNC) “Nimble Dragon” small modular reactor (SMR) project, for example, aims to reduce toxic waste production and move toward reduced reactor costs. Could these developments could generate more sustainable profit margins?

The Global X Uranium ETF Tracks the Industry

The Global X Uranium ETF (URA), in the nuclear period that the World Nuclear Association calls, “an imminent nuclear revival or ‘renaissance,’” tracks the industry. Its holdings include Cameco Corporation (CCO), Nexgen Energy Ltd. (NXE), Uranium Participation Corporation (U), and Uranium Energy Corporation (UEC).

An effective indicator of overall uranium market health, the fund, since its 2010 inception, has declined 84.52%, according to the Fund Summary. During that same period it underperformed the Dow Jones by almost 90% (see Figure 4).

Figure 4: From 2011 through 2017, uranium stocks, as represented by the Global X Uranium ETF (URA) (green line on the chart), have underperformed the Dow Jones Industrial Index (DJI) (red line) by nearly 90%. Source: TradingView.

Four Small Cap Stocks to Watch

A semester after pre-U.S. presidential election flurry, the price of large cap and mid cap uranium stocks, Cameco (CCO) ($9.30, +0.43%), BHP Billiton Limited (BHP) ($34.62, -7.81%), and Rio Tinto PLC (RIO) ($39.25, +3.48%), have returned to early December 2016 levels.

Uranium small cap companies, in general, have reduced operations to, as UEC stated in its Form 10-Q Third Quarter Report for 2017, “... align ... to a weak uranium market in a challenging post-Fukushima environment.” Last week’s highest price volume, as of 16 June 2017, small cap stocks included (Figure 5) …

Figure 5: Chart showing the price of the Global X Uranium ETF (URA - red), Uranium Energy Corp. (UEC - mustard), Uranium Resources, Inc. (URRE - green), Altius Minerals Corporation (ALS - blue), and Uranium Participation Corp. (U - orange). Inset chart shows relative performance (%) of each instrument. Source: TradingView.

-

Uranium Energy Corp. (UEC),

… at a price volume of $1,738,228.60 and a share price of $1.34, up +52.52%, from its price six months ago, explores, conducts pre-extracts, mines, extracts, and processes uranium. Based in Texas, the company owns assets in the western and southwestern United States and in the South American country of Paraguay, at its Palangana Mine. From Palangana, UEC ships triuranium oxide (U3O8) retrieved through in-situ leaching (ISL … also known as in-situ recovery [ISR] or “solution mining”) to its Hobson Processing Facility.

There, it generates the company’s only sales product and revenue, stored and sold by a third-party facility, according to UEC’s Form 10-Q Third Quarter Report for 2017. Despite sales, it, like much of the uranium industry, “... has yet to achieve profitability and has had a history of operating losses resulting in an accumulated deficit balance since inception.” UEC holds a licensed in-situ recovery (ISR) production facility in South Texas.

-

Uranium Resources, Inc. (URRE),

… at a price volume of $586,221.30 and share price at $1.45, up +19.83%, from 6 months ago, and based in Colorado, holds lithium and uranium exploration properties in Nevada and Utah and uranium development and idled production properties in Turkey, according to its 2016 Annual Report to Stockholders. URRE recently presented at the ROTH Investment Conference in California, its focus “on expanding its energy metals strategy, … [including] ... developing its new lithium business … [and] ... maintaining optionality on the future rising uranium price.” It plans to re-start in-situ recovery (ISR) production, but was not producing any metals at the time of its May stockholders report, noting a need to ...

“... monetize ... existing assets, partner with another company that has cash resources, find other means of generating revenue other than producing uranium or lithium and/or access additional sources of private or public capital … [to] ... remain in business.”

It had no sources of operating cash as of filing its Form 10-Q Third Quarter Report for 2017, and its reported net income, as of that filing, came from “the disposal of the Churchrock and Crownpoint projects of $4.4 million and decreases in interest general administrative expense, and commitment fees.” Like UEC the potential value of its assets awaits a resurgence of uranium demand.

-

Altius Minerals Corporation (ALS),

… with price volume at $497,390.40 and shares selling at $39.30, and down -2.53% from six months ago, works from Canada and has holdings there and in Brazil. It “directly and indirectly holds diversified royalties and streams that generate revenue from 15 operating mines,” according to the company’s website. Mines in its holdings involve copper, zinc, nickel, cobalt, iron ore, potash, uranium, and thermal and metallurgical coal. Projects include pre-development stage royalties.

A look at the company’s price behavior (Figure 5) reflects the company’s diverse holdings. Since 2010, it has steadily bumped along just above $10 per share, unlike the other uranium industry stocks that depend so strongly upon the price of a single commodity. Its modest fluctuations, relatively steady revenue, and stability make it attractive to hedge against more volatile uranium small caps.

-

Uranium Participation Corp. (U),

… having a price volume at $443,055.44 and a share price of $3.89, up +7.89% from six months ago, focuses on investing in uranium concentrates, (U3O8 and UF6), says its webpage. It invests by buying and holding “... physical uranium inventories for long-term appreciation,” according to its May 2016 “Investor Update.” It stores its uranium at third party facilities licensed to convert, enrich, or fabricate fuel from uranium. Just as investors long URRE and UEC, have bet on rising spot prices investors long U also await uranium’s turn upward.

These small cap uranium stocks tell only part of the upcoming market dynamics. A new pro-nuclear administration in the U.S. presidency, stock market indices hitting all-time highs, uranium spot prices hitting all-time lows, and uranium stock trading volume climbing to new highs all suggest that these and other uranium small caps might be set to explode.

____________________________________________________________________________

Jeffrey R. Bacon invests in stocks and trades forex, stocks, and index and commodity futures.

____________________________________________________________________________

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, the author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which any reader may incur as a result of the use and existence of the information provided within this Report. The author does own shares of UEC and does not currently own or intend to accumulate shares of other equities mentioned in this text.