This past week was an exciting one for U.S. Global Investors. If you haven’t heard, my team and I had the distinct honor of ringing the closing bell at the New York Stock Exchange on Thursday to mark the

launch of our latest ETF.

While in New York last week, I had the privilege of seeing many colleagues face-to-face. It’s always a pleasure for me to be able to talk gold with industry friends and experts. One stop during my trip that I thoroughly enjoyed was to chat with Pimm Fox and Lisa Abramowicz on Bloomberg Radio. Our discussion was dynamic as always and I shared with them my outlook for gold in the second half of the year, along with the opportunities I continue to see with royalty names.

I still find it curious that many investors don’t realize what a significant role royalty and streaming companies play in the mining business.

Last year I wrote about some of my favorite royalty names, and how I came to know about this business model in the gold mining industry early in my career. If you haven’t read that blog post, I encourage you to go back and explore the groundbreaking work done by

Seymour Schulich and Pierre Lassonde, the two founders of Franco-Nevada.

I think that now is a good time to take another look at royalty companies. Here are the top six things I believe investors should know about this specialized sector.

- What Is a Royalty Company?

Royalty companies, sometimes called streaming companies, serve a special role in the mining industry. Developing a mine property to start producing gold or other precious metal is an expensive, often time-consuming process. Infrastructure needs to be built out, permits applied for, laborers hired and more.

A royalty company serves as a specialized financier that helps fund exploration and production projects for cash-strapped mining companies. In return, it receives royalties on whatever the project produces, or rights to a “stream,” an agreed-upon amount of gold, silver or other precious metal.

- Many Gold Royalty Companies Have Still Been Outperforming Gold

When looking over the last 12 months, many of the royalty companies have outperformed gold. While this is indeed remarkable, it is important to remember that royalty companies do have a robust business model. Their ability to generate revenue in times when the gold (or other precious metal) price is both rising and falling is what makes them attractive.

- Remember Real Interest Rates

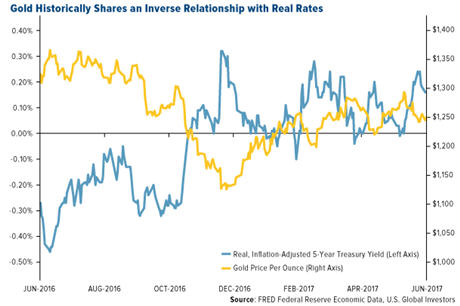

There’s no question that the gold price is volatile, and in any given 12-month rolling period, historically it’s not unusual for the price of the yellow metal to fluctuate up or down by 20 percent. It’s important for investors to remember that gold historically shares a strong inverse relationship with real interest rates. You can see in the chart that as rates rise, the price of gold falls, and vice versa.

This is another reason why I like the royalty model. Since royalty companies set fixed, lower-than-market prices for mining output, they can better manage the volatility that is inherent in the gold market. For example,

Wheaton Precious Metals’ 19 agreements in 2016 entitled the company to buy silver at an average price of $4.42 an ounce and gold at $391 an ounce.

- Speaking of Revenue

Last time I wrote about these companies, I shared with you that the three big royalty names boast impressive sales per employee. This is still true. Take a look at the 12-month revenue per employee of Franco-Nevada, Royal Gold and Wheaton Precious Metals. Wheaton has only around 30 employees, but has one of the highest rates in the world, generating $25.8 million per employee. By comparison, Newmont, which employs around 30,000 people, generated $310,000 per employee during the same period. Barrick also falls short by comparison.

- Friendly to Shareholders

Paying dividends is important to investors, as it reflects the health of a company in terms of its cash flow and profits. Even more favorable in the eyes of investors is a company that is growing its dividends. Between 2012 and 2017, royalty companies had a combined annual dividend growth rate of 17 percent. Compare that to 11 percent growth for the S&P 500 Index, and as low as negative 23 and negative 32 percent for global and North American precious metal miners.

In fact, 2017 marks Franco-Nevada’s 10

th straight year of dividend increases since the company went public in 2007.

- Less Reliance on Debt

Royalty companies are better allocators of capital than some of the biggest gold miners. Take a look at Newmont Mining, which has a 43 percent debt-to-equity ratio, and Barrick has a massive 91 percent. By comparison, many of the royalty companies have much lower debt, and Franco-Nevada has zero debt. This history of profitability and fiscal discipline is one of the main reasons I find royalty companies so attractive.

Curious about royalty companies? Click here to learn more.

Curious about royalty companies? Click here to learn more.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 03/31/2017: Barrick Gold Corp, Franco-Nevada, Newmont Mining, Osisko Gold Royalties Ltd., Royal Gold, Inc., Sandstorm Gold Ltd., Wheaton Precious Metals Corp.

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Philadelphia Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver. The S&P/TSX Global Gold Index is an international benchmark tracking the world's leading gold companies with the intent to provide an investable representative index of publicly-traded international gold companies.

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.