The Gold Report: Frank, thanks for joining us today. Gold has been trading within a fairly narrow range over the last six months or so. What is your outlook for the near to mid term?

Frank Holmes: Gold has its own DNA of volatility. It's a non-event for gold to go up or down 20% in a rolling 12-month period. So, we could easily see gold run to $1,500 over the next 12 months.

There are two drivers for that: fear and love. The fear trade is what dominates most of the psyche of Europe and America. The biggest driver in the short term is the real interest rate: that is what a government is offering to pay you to buy their government bonds, deducting the consumer price index (CPI) number, which recalibrates every month.

Right now, two-year and five-year U.S. Treasury bonds are offering negative rates of return, so that's still attractive for gold. However, the 10-year bond has now gone positive because the CPI number fell, from 2.2 to 1.9. I think the CPI will probably trough here, and then we'll get negative rates again for those time periods.

Every time we've had negative interest rates for 2-year, 5-year and 10-year Treasury bonds, gold started a big rally.

TGR: That's the fear side. What's happening on the love side?

FH: The love trade is all about giving gold to those you love. You give it for weddings, anniversaries, birthdays. History also has many examples of the role of gold in tragedies that happen in countries, for instance, the Vietnamese boat people—those who got out had gold. More recently, in Syria the first people who got out were those who owned gold. They could buy their way out. So, not only can you wear gold on your wrist and your arms and your neck but, also, it can save your life if there's a turmoil in your country.

The love side had little love this time last year because India was going through turmoil, which particularly accelerated in the fall. But India is now back on the market and has been buying gold in very big buckets. The rising GDP per capita in China and India are highly correlated to gift giving for gold.

TGR: You have been in the gold investing field for many years. How has the world of gold investing changed since you started in the industry?

FH: The biggest macro factor is the tectonic shift of China going from being a price taker to price maker: the shift of big bricks of gold going from North America to Switzerland, being melted down into smaller bricks and showing up in China. China is buying gold for its central bank and China is buying with massive savings programs like the Dollar Cost Averaging program, where millions of people, with every paycheck, buy a gram of gold. That is a significant shift.

Also, the manipulation of bond prices is now more exposed. In fact, governments are doing it right now; by buying back 5-year bonds or 30-year bonds, they can manipulate the yield curve. And brokers and banks have been involved with manipulating gold and silver prices.

Gold is money, and it is the fourth most liquid asset in the world. So naturally, banks, especially central banks, are going to do anything to manage the price of gold because otherwise it exposes their runaway money printing. That's what we have to deal with, but it's a matter of time that it pops to a higher level.

TGR: How do individual investors fit into this market? How can they find the best opportunities?

FH: They have to do their homework on some of the smaller gold names. It's always shown that if you have five really great stocks, and you really know them on fundamentals, and management has a disciplined track record, you can get the best alpha. But when it comes to funds, you have to have at least 21 names.

TGR: How do the gold exchange-traded funds (ETFs) fit in?

FH: The GDX (VanEck Vectors Gold Miners ETF) and GDXJ (VanEck Vectors Junior Gold Miners ETF) have been extremely disruptive to the capital markets. In the beginning, it was a positive note; they were aggregating money. All they had to do was put out names and a market cap, and it became self-fulfilling that billions of dollars rolled into these ETFs. They just kept buying their own names. It didn't matter if it was a poorly run company or a fantastic company, they just bought it on market cap and liquidity.

And what we saw last year, which was disruptive, was that active gold fund managers got very little money, and $5 billion went into the GDXJ. The GDXJ realized that it had grown faster than the capital markets, the public companies. In fact, there's a shrinkage of public companies in the past 20 years, historically by 50% overall. So, you have money going into a category that's not growing as rapidly and the index ends up owning more than 20% of a company. That puts them in jeopardy with the Canadian regulatory rules by triggering takeover rules. So, the GDXJ did a price reversal; after a year of accumulating $5 billion worth of gold stocks, in six weeks they blew out $3 billion. It's been very disruptive to the gold sector in Australia and Canada.

That bruises good quality companies. Crappy companies shouldn't rebound. But the better-quality companies, like Wesdome Gold Mines Ltd. (WDO:TSX) and Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT), they're the ones that are hitting the ball out of the park: high grade, big discoveries, production, free cash flow. I think that those ones just don't repair themselves, but offer buying opportunities.

U.S. Global Funds came up with an intelligent quant ETF because we saw money wasn't coming into our funds even though we had the performance. The fund flows weren't there because they were going into the GDX and GDXJ.

We are using a quant approach because quant stock traders have been a big player in the gold space in the past year in identifying what factors they use to pick stocks. They're different from what the research analysts write.

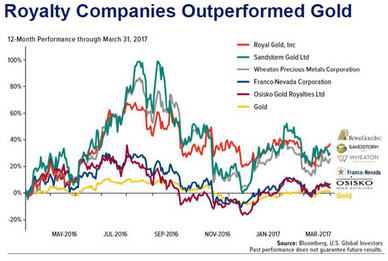

We came up with this unique product, the U.S. Global GO GOLD and Precious Metal Miners ETF (ticker symbol: GOAU). It's 28 names. Thirty percent are the three big royalty companies—Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE) and Royal Gold Inc. (RGLD:NASDAQ; RGL:TSX). Those three are 30% of the portfolio. They rebalance each quarter.

After that, we look at factors like: Is revenue for the last quarter above the average for four quarters? Is cash flow for the last quarter above the average for four quarters? How cheap is it on a Selling, General and Administrative expense (SG&A) basis? What are the overall costs for running their business—not capex but salaries and rent—per revenue? We took these factors and came up with a unique ratio.

We found that if you had the lowest SG&A-revenue ratio in 10 names and that's all you had as a portfolio, rebalanced every quarter, you could far outperform the GDX or GDXJ. It became one of the factors we use in our index to identify very efficient companies.

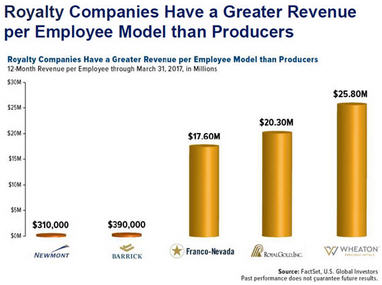

Royalty companies show the highest on another factor, revenue per employee. Goldman Sachs is about $1 million revenue per employee. But more interesting is that the revenue per employee for Newmont Mining Corp. (NEM:NYSE) and Barrick Gold Corp. (ABX:TSX; ABX:NYSE) is around $300,000 and $400,000 per employee. Franco-Nevada, which has royalties on both Newmont and Barrick's properties, has revenue of around $17 million per employee. So, it's much more efficient. If you take a look at the revenue when gold fell from $1,900 to $1,100, Franco's revenue line did not fall as much compared to Newmont or Barrick.

It's a unique approach. The fund rebalances every quarter. We have 25% turnover every quarter, especially when we're looking at South African names that are listed in New York, Canadian names and Australian names.

TGR: Why are you going to an ETF model and away from a mutual fund model?

FH: Money is not going into mutual funds. The ETF model is what people want to trade.

For anyone who trades gold stocks, this is the most intelligent way to pick these stocks. The fund has a robust track record even though it's hypothetical. We've gone back and analyzed this. We spent 8,000 hours making sure that this works. And then we had a third party come in and audit our rules and look at our data.

TGR: You mentioned royalty and streaming companies and their high revenue per employee. Would you talk about more advantages you see these companies having?

FH: Royalty and streaming companies are the "smart money' of the gold space. You always have an advantage in running your business if you have big revenue per employee. They have the smartest people—metallurgists, engineers, physicists, financial engineers, legal counsel, accountants. They run all these intense financial models, so they're very lean. And the business model lends itself to when they finance a company, they basically look for a 4% rate of return over 10 years. And after that, it's the optionality. For instance, a lot of these deposits need more money for drilling. But they're not going to drill today, so they get their production up. Then in five years they may do that drilling. What's happened mathematically is that these 10-year mine lives end up being 20-, 30-year mine lives.

TGR: Any final thoughts for our readers?

FH: The gold asset class is not going away; it's evolving with technology. Just as the energy space has evolved with new technologies, such as 2D and 3D seismic, so is mining.

What we're trying to do is apply quant modeling, similar to artificial intelligence, to this mechanism, and the price for doing it is cheaper. It helps you make better risk-adjusted returns. It helps you look at data faster, quicker, and better and be more informed of who's creating value and who's destroying value.

TGR: Thank you for your insights.

Frank Holmes is CEO and chief investment officer at U.S. Global Investors, which manages a diversified family of funds specializing in natural resources, emerging markets and gold and precious metals. In 2016, Holmes and portfolio manager Ralph Aldis received the award for Best Americas Based Fund Manager from the Mining Journal. In 2011 Holmes was named a U.S. Metals and Mining "TopGun" by Brendan Wood International, and in 2006, he was selected mining fund manager of the year by the Mining Journal. He is also the co-author of The Goldwatcher: Demystifying Gold Investing. More than 30,000 subscribers follow his weekly commentary in the award-winning Investor Alert newsletter, which is read in over 180 countries. Holmes is a much sought-after keynote speaker at national and international investment conferences. He is also a regular commentator on the financial television networks CNBC, Bloomberg, BNN and Fox Business, and has been profiled by Fortune, Barron's, The Financial Times and other publications.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new interviews and articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, shares of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this interview are billboard sponsors of Streetwise Reports: Wheaton Precious Metals Corp. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Frank Holmes: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I, or members of my immediate household or family, are paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this interview: None. Funds controlled by U.S. Global Investors hold shares of the following companies mentioned in this article: Klondex Mines Ltd., Franco-Nevada Corp., Osisko Gold Royalties, VanEck Vectors Gold Miners ETF, VanEck Vectors Junior Gold Miners ETF, Wesdome Gold Mines, Royal Gold Inc., Wheaton Precious Metals, Newmont Mining Corp. and Barrick Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Wheaton Precious Metals Corp., a company mentioned in this article.