Uranium sector - Newsletter by Ringler Research as of 17.07.2017

1: Overview & market comment

2: Our new information portal about uranium: https://www.uraniumstocks.info

3: Uranium sector statistics

4: Top 8 / Worst 8 performing stocks (30.06.17 – 14.07.17)

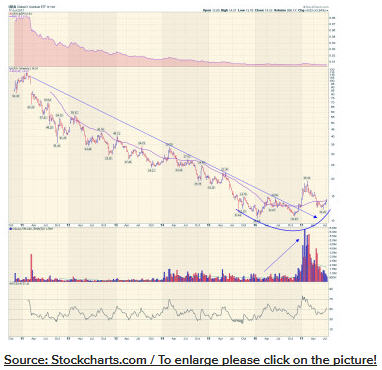

5: Chart Global X Uranium ETF (URA)

6: Overview of all Australian uranium companies in our database

7: Overview of all North American uranium producers and developers in our database

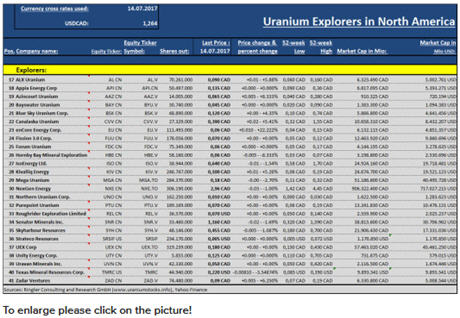

8: Overview of all North American uranium exploration companies in our database

9: Topic of the week: Nuclear fuel circuit and background information

10: Legal Notes, Disclaimer, Imprint

1.

Brief introduction / comment Ringler Research:

We are happy to present you today our first issue of our uranium sector newsletter which will be send out regulary to all followers of Ringler Research and interested people in the uranium sector. The mission of our both portals www.uraniumstocks.info and the sister-portal in Germany (www.uranaktien.info) is to support and promote the uranium mining industry by creating a “one-stop marketplace”, where investors could follow the latest sector news and learn about the companies involved in the sector. We are convinced that energy and electricity generated by nuclear power plants is a necessary and important part in a balanced energy mix of various fossil and renewable energy sources. Energy produced from nuclear power is CO2-neutral and therefore also indispensable within the framework of important climate protection and stricter climatic conditions, while at the same time a strongly rising demand for electricity.

2.

Our new information portal about uranium: https://www.uraniumstocks.info

We have noticed, the North American uranium companies performed better (up 7.2%) than the Australian ones in the last two weeks. The combined market cap for all Australian companies increased to 845 Mio. USD (up 4.6%).

To enlarge please click on the picture!

3: Uranium sector statistics

We have noticed, the North American uranium companies performed better (up 7.2%) than the Australian ones in the last two weeks. The combined market cap for all Australian companies increased to 845 Mio. USD (up 4.6%).

At the peak of the last large uranium bull market (2000-2007) about 500 companies were active in the uranium sector, currently the number with 65 titles is about 87% lower!

4: Top 8 / Worst 8 performing stocks (30.06.17 – 14.07.17)

To enlarge please click on the picture!

5: Chart Global X Uranium ETF (URA)

Uranium stocks made a big reversal between November 2016 and March 2017 – we are mid to long term bullish for the sector! Please see also the increased money inflow into the sector ETF

6: Overview of all Australian uranium company in our database

7: Overview of all North American uranium producer and developers in our database

8: Overview of all North American uranium exploration companies in our database

9: Topic of the week: Nuclear fuel circuit and background information

Uranium is a chemical element with the element symbol U and the order number 92. In the periodic system, it is in the group of actinides. Uranium is a metal, all isotopes of which are radioactive. It was found in 1789 by Martin Heinrich Klaproth. The melting point of uranium is 1,132 degrees Celsius.

Uranium has a very high energy density. Thus, 1 kg of natural uranium – after an appropriate enrichment and for the generation of electricity in light water reactors – corresponds to almost 10,000 kg of mineral oil or 14,000 kg of coal and enables generation of 45,000 kWh of electricity.

At the beginning of the value chain is the mining of the raw material uranium, which is obtained either in open pit mining, in underground mining or by solution mining industry (ISR method). The method of extraction depends on the characteristics of the ore body. These include, for example, the depth, the type of rock and the ore grades. Typically, the uranium content of the mined ores is about 0.2%. The uranium present in the mined ore is separated from the rest of the rock by various chemical and physical processes. When uranium is spoken, the term „yellow cake“ often comes to mind. This so-called „yellow cake“ contains about 70 to 75% of uranium. The uranium contained in the „yellow cake“ has a natural isotope composition of 0.7% U-235 and 99.3% U-238. However, most nuclear power plants require uranium with a fraction of 3 to 5% of the cleavable isotope U-235. Therefore, the uranium component U-235 must be enriched. Since the enrichment is possible only in the gas state, the uranium is converted into the chemical compound UF6 (uranium hexafluoride). In the fuel assembly, the UF6 is then converted into UO2 (uranium dioxide). The UO2 powder is used for pressing pellets, which are sintered at temperatures of more than 1700 ° C, filled into seamless drawn casing tubes made of a zirconium alloy and gas-tight sealed. Thus, individual fuel rods are obtained, which are then arranged in fuel elements. The fuel elements of a pressurized water reactor contain about 340 kg of uranium, while a boiling water reactor contains about 190 kg of uranium.

The Swiss 1,000 megawatt nuclear power plant in Goesgen consumes 20 tons of enriched uranium or 200 tons of naturally uranium (or approximately 441,000 pounds) every year, producing around 8.5 billion kilowatt hours of electricity. In order to produce the same amount of electricity with other energy sources, one would need either:

• 9,100,000 tonnes of hard coal (equivalent to 180,000 rail cars);

• 4,250,000 tonnes of natural gas;

• 220 square kilometers of solar panels;

• 5,500 state-of-the-art wind turbines with two megawatts each and 4.5 million kilowatt-hours of annual production

In other words, there is much more electricity generated from uranium than from all other energy sources. With only three to four fuel tablets of the size of a glass marble, a four-headed family can be supplied with electricity for one year.

10: Legal Notes, Disclaimer, Imprint

Important Notes, Disclaimers and Other Information:

This newsletter (hereafter “the document”) was created to the best of knowledge and belief. It is for information purposes only by persons resident in Federal Republic of Germany, Switzerland and Austria. Neither the document nor any copy thereof may be made available, transmitted or distributed in nations where local laws would be violated (for example, the United States of America, Japan, England, Australia, Canada and their territories). The distribution of this document and the information contained therein to persons resident in countries other than the Federal Republic of Germany, Switzerland and Austria may be restricted by law, and persons into whose possession this document comes should obtain information about and observe any such restrictions, if any. Any failure to comply with this restriction may constitute a violation of Canadian securities laws or those of the US or the laws of another country.

The object of this newsletter could include companies which are engaged in a risky market. Capital investments of any kind, including those in shares in high-risk markets, such as mining companies, are also exposed to some significant risks or even a total loss. The object of this newsletter could be stocks and financial products which have a low market capitalization. Especially for companies with a low market capitalization, investors must often expect a high volatility and/or low market liquidity. The object of this newsletter / document could involve stocks, financial products, indices and commodities which could be associated with major price risks and is therefore unsuitable for inexperienced or risk-averse investors. This is especially true for all Over The Counter (OTC), i.e. the so-called outside of a monitored stock exchange or a regulated market. The same applies to shares that are traded on the Australian Stock Exchange (ASX), on Canadian stock exchanges (i.e. Toronto or Vancouver) or on the Alternative Investment Market (AIM), a segment of the London Stock Exchange. The bespoken shares and financial instruments are frequently traded on any of these markets in which they are segments of the highest risk category. Instruments which are traded there, are threatened at any time by the possibility of a total loss, high volatility and the possibility of reduced liquidity and marketability in particular due to low trading volumes. High price opportunities are faced with enormous risks. All of the information contained in this newsletter / document neither constitutes a solicitation nor an offer to sell or purchase any investment or for making other transactions. It is not also not a recommendation as part of investment advice. Any forecasts or opinions expressed reflect the personal, subjective and current views of the publisher and are for guidance and information only. This newsletter / document does not take into account particular investment objectives, the financial situation or the particular needs of individual users. The securities, financial instruments, indices and commodities presented in this newsletter / document may not be suitable as an investment instrument for every user. This newsletter / document contains only a non-binding opinion of the investment instruments and market conditions at the time of publication of the document. All assessments of bespoken companies, financial instruments and commodities, in particular price targets, may change without prior notice. No guarantee is given for the correctness of the charts, prices, data and information on the commodity, foreign exchange, interest rate and stock markets presented in the newsletter / document. All data and information obtained are from sources the publisher considers to be trustworthy and reliable at the time of the preparation. Despite all due care and attention in the preparation of the newsletter / document the publisher / the author assumes no liability or responsibility whatsoever for the correctness, completeness and accuracy of the information contained in the newsletter / document and for losses that could arise from any errors, omissions or inaccuracies. Liability claims against Ringler Consulting and Research GmbH or the author which refer to damages of a material or immaterial nature caused by use or disuse of information are generally excluded, unless it is due to intentional or grossly negligent behavior by the author or Ringler Consulting and Research GmbH. In particular, Ringler Consulting and Research GmbH does not guarantee that said projections prove to be accurate, or that price targets / possible future company values will be reached. Furthermore, neither this newsletter / document nor the information contained in it form the basis for any contract or obligation of any kind. Neither by downloading the document nor from the information contained in the document does a broking or investment advisory agreement with Ringler Consulting and Research GmbH come into being. Neither Ringler Consulting and Research GmbH nor the author are registered financial or investment advisors. Any investment decision should therefore take place after previous consultation with a professional investment advisor as well as personal research, for example, all information's published by the bespoken companies. All statements expressed in this newsletter / document should be construed to be forward-looking statements that involve substantial risks and could not be true. The positive performance of a financial product in the past can in no way be an indication of future performance. This newsletter / document, including all of its parts are protected by copyright. Any use outside of the narrow limits set by copyright law is not permitted without the consent of Ringler Consulting and Research GmbH. This is particularly true for copying, microfilming, translating and storing, distributing and processing in electronic systems.

Information pursuant to Section § 34b of the German Securities Trading Act [WpHG] and to Regulation (EU) No 596/2014 of the European Parliament and of the Council of April 16, 2014, on market abuse (market abuse regulation) (as of 17.07.2017)

Ringler Consulting and Research GmbH or employees of the Company may at any time conduct buy or sell transactions in the shares of the featured companies (i.e. long or short positions). This also applies to options and derivatives, based on these securities. Those transactions may affect the respective company's stock price under certain circumstances. Published information on the "web pages", the newsletter or the Ringler Research Reports, recommendations, interviews and company presentations are paid by the respective company or third party (so-called "third parties"). The "third parties" include, for example, Investor Relations, Public Relations, Brokers and Investors. Ringler Consulting and Research GmbH may partly directly or indirectly pay for the preparation and electronic distribution and for other services discussed by the company or might be compensated with an allowance of a so-called "third party”. Even if we create each analysis to the best of knowledge and belief and professional standards, we advise you to involve further external sources, such as your local bank or a consultant you trust regarding your investment decisions.

Ringler Consulting and Research GmbH, the author or employees are holding a net long position (in form of stocks or derivative products eg. CFD’s, options) of the following bespoken companies, financial instruments and commodities in this newsletter publication: Aura Energy, Berkeley Energia, Boss Resources, enCore Energy Corp., Energy Fuels Inc., Marenica Energy Ltd., Peninsula Energy, Uranium Energy Corp, Uranium Resources Inc., Western Uranium.

Mandatory information as well as information to be disclosed. Declaration of the company responsible for preparation, the responsible person and issuer:

Company responsible for preparation of this newsletter / document is Ringler Consulting and Research GmbH. Person involved in the preparation of this document / publication: Carsten Ringler, Managing Director of Ringler Consulting and Research GmbH. Person responsible for forwarding or distributing of this document / publication: Carsten Ringler

Important sources of information: The main sources of information used for the compilation are published in relevant information services (e.g.www.bloomberg.com, www.reuters.com, Google Finance, www.sedar.com, www.sec.gov, www.asx.com.au), publications of the analyzed companies as well as interviews with management.

Publisher / Imprint:

Ringler Consulting and Research GmbH

Schwalbacher Straße 14

65307 Bad Schwalbach / Germany

Authorized Representative (Managing Director): Carsten Ringler

Telephone: +49 6124 7263564

Telephone: +49 172 6918274

E-Mail:contact@uraniumstocks.info or kontakt@mining-research.de

Responsible for content in accordance with §5 TMG [German Telemedia Act]: Managing Director Carsten Ringler (Address as above)

VAT ID – Number DE297028261

Registered Office / Register court: Wiesbaden District Court

Register number: HRB 27983

Regulatory Authority:

Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) [German Federal Financial Supervisory Authority], Marie-Curie-Straße 24-28, 60439 Frankfurt

Website: www.bafin.de

Information about the sensitivity analysis, statement of the Ringler Research stock rating system, the assessment methods and IMPRINT / LEGAL NOTES / DISCLAIMER are available at: www.mining-research.com/disclaimer

Ringler Research, the information portals www.uranaktien.info and www.uraniumstocks.info are brands of Ringler Consulting and Research GmbH based in Germany.

Our Research-Boutique offers a wide range of consulting services for mining companies and institutional capital market participants. This includes the generation of bank-independent research reports, specialist articles and interviews, which are made available to hundreds of thousands of capital market participants through a variety of channels.

More information about Ringler Research can be found at: www.mining-research.com