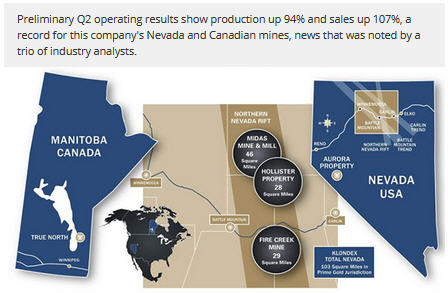

Klondex Mines Ltd. (KDX:TSX; KLDX:NYSE.MKT) released its second quarter operating results on July 18, reporting record production and sales. The company noted that it produced 66,629 gold equivalent ounces, a 94% increase from the first quarter, and sold 69,522 ounces, a 107% increase from Q1.

Mr. Paul Huet, Klondex's president and CEO stated, "As expected, the operating results for the second quarter were the best in the company's history. We processed all of the ore that was stockpiled at the Midas mill at the end of the first quarter plus we continued to execute our mine plans, mining an additional 53,248 gold equivalent ounces in the second quarter."

Analyst Heiko Ihle of Rodman & Renshaw noted in a July 19 company update that the large quarterly increase was "mainly due to a significant increase of production from Fire Creek, which we attribute primarily from the processing of stockpiled ore. . .the company plans on processing Hollister ore through the Midas mill in 2H17, and therefore remains on track to meet 2017 guidance. We highlight that our model estimates 2017 production to reach 219,000 gold equivalent ounces, in-line with management's 2017 production guidance."

Ihle also stated that at Fire Creek, production "totaled 45,773 gold equivalent ounces, a 138% increase over 1Q17 production. We note that 1Q17 production at Fire Creek was negatively impacted by heavy snowfall that limited the amount of mined ore the firm was able to transport to its Midas mill."

Rodman & Renshaw's report reiterated the firm's $6.25 per share target price. Klondex is currently trading at around $4.31.

Analyst Josh Wolfson of Eight Capital wrote in a July 19 report that "production results represent a material improvement from 1Q, and exceeded our expectations." He noted that "corporate production nearly doubles QoQ, aided by Fire Creek stockpile processing," which was 9% over Eight Capital's estimate. "Overall, production results represent a material improvement and near doubling from 1Q realized production of just 34.5 koz, which was largely impacted by ore transportation logistics issues due to weather at Fire Creek, as well as by equipment issues at True North," the report noted.

"While we believe ramp-up uncertainties remain at True North and Hollister, in our view 2Q results position the company favourably to achieve corporate full year production guidance," Wolfson stated.

Eight Capital's target price for Klondex is $5.25 per share.

PI Financial analyst Philip Ker, in a July 19 report, stated that "Klondex Mines provided a solid production beat for Q2/17 realizing 66,629 oz AuEq versus our target of 62,425 oz AuEq."

"In our view, achieving guidance is hinged on Klondex's two development assets Hollister and True North—both of which have achieved little to no production YTD. Hollister is in ramp-up mode with stockpiled ore. Both operations are anticipating increased tonnage output and head grades in the coming quarters in order to support their current guidance levels. Given the early stage of these operations, the ramp-up is a challenge but Klondex should still be able to adequately meet consolidated guidance of 210,000—225,000 oz AuEq."

PI Financial maintains a target price of $5.05 for Klondex.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or members of her immediate household or family own, securities of the following companies mentioned in this article: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Klondex Mines Ltd. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article

Disclosures from Rodman & Renshaw, Klondex Mines Ltd., Company Update, July 19, 2017

I, Heiko F. Ihle, CFA , certify that 1) all of the views expressed in this report accurately reflect my personal views about any and all subject securities or issuers discussed; and 2) no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation or views expressed in this research report; and 3) neither myself nor any members of my household is an officer, director or advisory board member of these companies.

None of the research analysts or the research analyst’s household has a financial interest in the securities of Klondex Mines Ltd. (including, without limitation, any option, right, warrant, future, long or short position).

As of June 30, 2017, neither the Firm nor its affiliates beneficially own 1% or more of any class of common equity securities of Klondex Mines Ltd.

Neither the research analyst nor the Firm has any material conflict of interest in of which the research analyst knows or has reason to know at the time of publication of this research report.

The research analyst principally responsible for preparation of the report does not receive compensation that is based upon any specific investment banking services or transaction but is compensated based on factors including total revenue and profitability of the Firm, a substantial portion of which is derived from investment banking services.

The Firm or its affiliates did receive compensation from Klondex Mines Ltd. for investment banking services within twelve months before, and will seek compensation from the companies mentioned in this report for investment banking services within three months following publication of the research report.

The Firm does not make a market in Klondex Mines Ltd. as of the date of this research report

Disclosures from Eight Capital, Klondex Mines Ltd., First Impressions, July 19, 2017

Conflicts of Interest: Eight Capital has written procedures designed to identify and manage potential conflicts of interest that arise in connection with its research and other businesses. The compensation of each Research Analyst/Associate involved in the preparation of this research report is based competitively upon several criteria, including performance assessment criteria, the quality of research and the value of the services they provide to clients of Eight Capital. The Research Analyst compensation pool includes revenues from several sources, including sales, trading and investment banking. Research analysts and associates do not receive compensation based upon revenues from specific investment banking transactions.

Eight Capital generally restricts any research analyst/associate and any member of his or her household from executing trades in the securities of a company that such research analyst covers, with limited exception.

Research Analyst Certification: Each Research Analyst and/or Associate who is involved in the preparation of this research report hereby certifies that:

• the views and recommendations expressed herein accurately reflect his/her personal views about any and all of the securities or issuers that are the subject matter of this research report;

• his/her compensation is not and will not be directly related to the specific recommendations or views expressed by the Research Analyst in this research report;

• they have not affected a trade in a security of any class of the issuer whether directly or indirectly through derivatives within the 30-day period prior to the publication of this research report;

• they have not distributed or discussed this Research Report to/with the issuer, investment banking at Eight Capital or any other third party except for the sole purpose of verifying factual information; and

• they are unaware of any other potential conflicts of interest.

The Research Analyst involved in the preparation of this research report does not have any authority whatsoever (actual, implied or apparent) to act on behalf of any issuer mentioned in this research report.

Disclosures from PI Financial, Klondex Mines Ltd., Corporate Update, July 19, 2017

Analyst Certification: I, Philip Ker, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report.

Research Disclosures:

1) PI Financial Corp. and its affiliates’ holdings in the subject company’s securities, in aggregate exceeds 1% of each company’s issued and outstanding securities. No

2) The analyst(s) responsible for the report or recommendation on the subject company, a member of the research analyst’s household, and associate of the research analyst, or any individual directly involved in the preparation of this report, have a financial interest in, or exercises investment discretion or control over, securities issued by the following companies. No

3) PI Financial Corp. and/or its affiliates have received compensation for investment banking services for the subject company over the preceding 12-month period. Yes

4) PI Financial Corp. and/or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company. Yes

5) PI Financial Corp. and/or its affiliates have managed or co-managed a public offering of securities for the subject company in the past 12 months. No

6) The following director(s), officer(s) or employee(s) of PI Financial Corp. is a director of the subject company in which PI provides research coverage. No

7) A member of the research analyst’s household serves as an officer, director or advisory board member of the subject company. No

8) PI Financial Corp. and/or its affiliates make a market in the securities of the subject company. No

9) Company has partially funded previous analyst visits to its projects. Yes

10) Additional disclosure: No