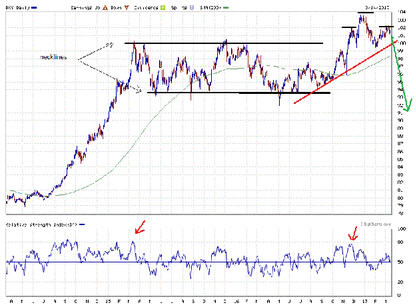

My last update on gold was the break out above $1300 in late August. I commented that I believed the next target was $1360 to $1400 where there would be some resistance in that area. We seen a test of $1360 last week and since my call of a bottom in early July, gold has moved up nearly $150. Now is the time to make some adjustments to our positions, raising stops and some part profits, in stocks we bought back in June and July.

This is a chart of December Comex Gold and I will be using this until year-end as it is most active. If we can break above $1375 we could see a very big move in the gold stocks, but we have to consider the downside here to, because an almost $150 run to the upside is significant. We will soon arrive at the annual weakness or take down in gold during November/December. Therefore, we will likely see the best prices here in September or October. Also note the managed money long position and Commercial short position are around levels where we often see price corrections.

Gold still has upside momentum and the longs are in control. There are a few bullish factors that are working for gold that could result in more upside in the next two months:

• North Korea tensions: Kim Jong Un seems determined to provoke the U.S. into something.

• General equity markets are overpriced and have seen some weakness, Gold often moves higher as money flows out of stocks into alternatives.

• The US$ has broken down and further weakness is likely.

The US$ Index has broken down further to a new low of 91.32 last Friday. I expect the 93 area will now be resistance on the up side and technically there is little support for the US$ until around 80 on the index. I have been bearish on the US$ since March and this is a chart I used then outlining a possible top and the green arrow is today's update to this chart. I was concerned and watching for a break below 100 to signal a violation of the bottom of uptrend line and after that it was key for 93 area to hold and it has not. My comments have been nicknaming the rise since the election as the "Trump bump," and since then, the "Trump thump."

There are several bearish factors that could plague the US$ with more weakness. As I have been commenting, the Trump honeymoon is over and he is becoming a lame duck president. The old establishment and media are so focused on stopping and hindering anything he tries to do that little will get done. They will probably let him proceed with any of the dirty deeds like renegotiating NAFTA and, of course, the elite will be fine with their tax rate being lowered.

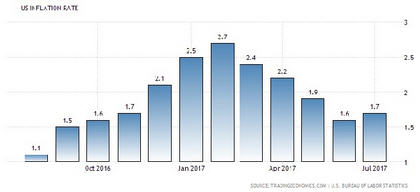

Further increases in interest rates will be a lot later than was expected, if at all. Fed members have been hawkish with comments about their concern with the inflation rate falling steadily this year. In July, Fed Chair Janet Yellen reiterated statements that Fed Governor Lael Brainard gave, namely that rates are close to a "neutral" level and not in need of rising much more. Recent economic numbers have been weaker as well.

Employment numbers have been missing expectations and generally so so under the Trump administration, averaging just over 170,000 per month since last October. Retail sales have been weak all year except for the 0.6% last reported for July. U.S. sales of new cars and trucks fell 2% in August, according to Autodata Corp, making it eight monthly declines in a row, the positive point is about one-half million flooded cars from Harvey will get replaced.

The Debt: Debt ceiling issue has only been put off until December 15th and Trump's tax cuts and budget is another issue of uncertainty for the markets.

Some of my Canadian readers have been commenting that the gold stocks have not done that well, and in some cases that is correct, but another factor at play here is the drop in the US$. The loonie has gained about 11% on the US$ since June, so Canadians have lost 11% of gold's gain and same with the gold stocks.

On the HUI (Gold Bugs Index) I pointed out the wedge formation in late June that I expected a break out to the up side and in late August a higher high on the index and just above 220 as my next target. We are now at that 220 level and about 225 up from the July low.

Updates

Raising stop/loss on Kinross Gold Corp. (K:TSX; KGC:NYSE) from C$3.90 to $5.10. OceanaGold Corp. (OGC:TSX; OGC:ASX) from $3.40 to $3.60. Argonaut Gold Inc. (AR:TSX) from $1.80 to $2.25

In July I suggested Call options on these three gold stocks:

Kinross Jan 5 Call $0.74 - now $1.12

Goldcorp Inc. (G:TSX; GG:NYSE) Jan 17 Call $1.47 - now $1.44

Yamana Gold Inc. (YRI:TSX; AUY:NYSE; YAU:LSE) Jan $3 Call 0.47 - now $0.95

Goldcorp has not done much but Yamana and Kinross have seen a decent move, up about 100% and if you bought on the US$ side you did much better. There is still lots more time on these but I would consider booking half profits now.

Jaxon Minerals Inc. (JAX:TSX.V) Recent Price $0.27

Entry Price $0.10 Opinion: Buy

The 1 to 1.25 share splits is complete so you now have 25% more shares. I reduced our entry price on the stock by 25% to reflect the split and rounded up to an even 10 cents.

Jaxon Mining Inc. has entered into a binding letter of intent (LOI) to acquire the historic Cronin silver-zinc-lead- gold mine, located 27 kilometres north of Smithers, B.C., in British Columbia's Skeena Arch.

Summary

Jason Cubitt, Jaxon's president and chief executive officer, comments: "The Cronin occurrence represents what we suspect to be the southern extent of our targeted mineralized trend. The type of mineralization and grade we see here is similar to our target silver mineralization at our Hazelton property and offers further evidence of the potential existence of a high-grade mineralized system of significant scale in this district. We look forward to applying modern technologies to the assessment of resource potential at Cronin and the rest of our landholdings in the area."

Cronin Mine Background

The Cronin mine is located 15 kilometres southeast of Jaxon's Hazelton property. First discovered in 1905, the Cronin occurrence has seen numerous periods of exploration, development and production. The mine comprises underground workings from which historical production from 1917 to 1974 yielded 262,668 ounces silver, 1,517,881 kilograms zinc, 282 ounces gold, 10,394 kilograms copper, 1,367,178 kilograms lead and 18,012 kilograms cadmium, according to B.C. Minfile 093L 127*.

The stock chart shows good support around $0.25 and I would continue to hold positions and consider buying on dips near that 25 cent level.

Garibaldi Resources Corp. (GGI:TSX.V) Recent Price $1.25

Entry Price $0.21 Opinion: Take part profits

The stock has been on a tear and despite drill news being a ways off we cannot ignore these profits. The stock is now up over 800% on the year and 500% form our buy level. You could sell 1/3 of your position and still have lots to ride any further gains risk free.

The latest move was spawned by news on visual observations of the drill core. that intersected two long intervals of nickel-copper sulphide mineralization totalling 176 meters and consisting of pyrrhotite-pentlandite-chalcopyrite in the first drill hole GGI's E&L project at Nickel Mountain near Eskay Creek.

Significantly, borehole EL-17-01 was drilled away from the historical mineralized zones into a previously untested area in order to provide the best immediate platform for SJ Geophysics' Volterra borehole EM (electromagnetic) survey as it gauges the orientation of conductor D. This new discovery convincingly expands the scale of the mineralizing system eastward from the high-tenor E&L mineralization and beyond the historical estimates from 12 shallow holes drilled by Silver Standard in the 1960s.

Additional highlights of the first drill hole:

• EL-17-01 entered mineralized gabbro beginning at a depth of 51 meters with disseminated sulphides continuing to 169.5 meters. A second section of disseminated sulphides started at a depth of 274.5 meters and continued to 332 meters.

• EL-17-01 remained in the E&L intrusive complex from the collar to the end of the hole at a depth of 441 meters. Core is being processed and assays will be reported as soon as possible.

Dr. Peter Lightfoot, an internationally recognized nickel sulphide expert and a technical adviser for Garibaldi, commented: "The first borehole encountered a sequence of rock types varying from ultramafic through chaotic-textured olivine gabbro and leucogabbro. Magmatic-textured sulphides with blebby disseminated sulphides occur in association with all rock types, except for the leucogabbro.

"The range in rock types, including the chaotic-textured rock types at E&L, are similar to those found in other global examples of nickel sulphide deposits hosted by small intrusions that provided very efficient magma highways from the mantle," Dr. Lightfoot concluded.

True widths of the mineralized zones intersected in the first hole are unknown at this time.

Sanatana Resources Inc. (STA:TSX.V) Recent Price $0.045

Entry Price $0.045 Opinion: Buy

Sanatana released news on the first exploration results on their Jackfish property and they are off to a very promising start. The stock has really not moved at all yet so is still around our entry level and a good buy here on drilling speculation.

The channel samples were cut directly from the exposed bedrock surface at intervals of one meter in a continuous pattern traversing the trends of quartz veining present within the outcrop. All the samples were submitted to Actlabs in Thunder Bay, Ont., for fire assay analysis for gold.

The nine best channel samples on North zone ranged from 0.51 g/t to 16.2 g/t

Rudy No. 7 seen four very good channel samples at 3.38 g/t, 6.22 g/t, 10,9 g/t and 12.2 g/t

The North zone was previously stripped over a roughly rectangular area 12 meters wide and 24 meters long oriented north-south. From a total of 75 channel samples, seven samples across the North zone main mineralized quartz vein returned significant levels of gold, including an interval of two meters at 8.82 g/t (grams per tonne) gold and others around it of one meter at 0.51 g/t gold to the west and three meters at 0.55 g/t gold, three meters at 0.55 g/t gold and two meters at 1.12 g/t gold to the east, separated by a three-to-four-meter spacing along the vein.

The Rudy No. 7 showing was previously identified as a minor gold result hosted in iron formation that has now been exposed by the newly completed outcrop stripping as a ferruginous gold-bearing quartz vein. Three sets of channel samples cut across the quartz vein separated two to three meters apart along the vein returned assay results of one meter at 3.38 g/t gold and one meter at 12.2 g/t gold in the northern part and a best result of two meters at 8.56 g/t gold from four samples out of a total of 18 samples. This showing has been added to the drill target list for further testing at depth.

The Hematite zone proved too difficult to cut effectively due to the steep and undulating slope to the outcrop; however, washing down of the previous stripping revealed much more detail of the gold-mineralized quartz veining, and the Hematite zone remains a high-priority drill target for the upcoming drill program.

Significantly, the exploration permit for drilling has been granted, paving the way for the initial round of drill testing all priority targets: North zone, Hematite zone and the Cliff on the Richards et al property and showings No. 5 and No. 7 on the Wahl property. Drilling is expected to commence in mid-September.

Peter Miles, president and chief executive officer, commented: "We are pleased that Sanatana's exploration program to date has confirmed and enhanced our understanding of the gold-mineralized occurrences on the Jackfish property. We are still in the very early exploration stages of the 3,664-hectare Jackfish property, and we look forward to beginning our initial drill program. This program will test five different targets, but it should be noted that exploration work continues to uncover new and potentially interesting showings."

In addition to the geochemical work outlined above, the company has undertaken geophysical programs, including a 14-line-kilometre VLF-EM (very-low-frequency electromagnetic) survey, from the area of Cliff and North zones northward to cover much of the Wahl property for a total of 29 line kilometers at 200-metre line spacing over an area of approximately 4.5 square kilometers. The data are currently being processed and are expected to be available soon. A UAV (unmanned aerial vehicle)-platform-based airborne magnetic survey is planned to cover the same area of 6.3 square kilometers with a total of approximately 150 line kilometers at a line spacing of 50 meters. The survey will get under way soon and is expected to only take a matter of days to complete.

Channel samples provide a much better representation of mineralization than grab samples, they are like a surface drill hole. So we have very good zones on surface, the question is whether drilling will prove them up a depth and give some decent size.

Newrange Gold Corp. (NRG:TSX.V; CMBPF:OTCMKTS) Recent Price $0.53

Entry Price $0.08 Opinion: Hold, buy on weakness

Newrange will commence the second phase of drilling at its Pamlico gold project by Thursday this week. The drill rig, most support vehicles and equipment are on site. Principal objectives of this second phase of drilling are:

• Drill test and expand recently discovered high-grade gold mineralization in holes P17-08 and P17-10, situated approximately 54 metres from the high-grade Merritt zone;

• Drill test newly identified structural targets developed from recent detailed surface mapping and channel sampling between the Merritt zone and holes P17-08 and P17-10;

• Drill two deep stratigraphic test holes to assess potential for stacked favorable horizons that could be receptive for additional high-grade mineralization at depth. Additionally, important information about depth of oxidation and depth of water table will likely be obtained from these holes as well;

• The company is already preparing for a third phase of RC (reverse circulation) drilling that will target both stepout extensions and entirely new areas of the property based on continuing mapping and sampling programs. Geologic information related to gold mineralization obtained from the upcoming second phase program will be used to guide this third phase as well.

Last drill results from July were very good. Hole P17-17 intersected 0.8 meter assaying 244.3 g/t gold from 10.6 meters to 11.4 meters. This is the company's second-highest-grade drill intercept to date and is included within a broader interval of 4.6 meters averaging 43.8 grams per tonne gold from 8.4 meters to 13.0 meters.

Hole P17-17 also intersected a second high-grade zone assaying 35.4 grams per tonne gold over 0.8 meters from 22.8 metres to 23.6 metres.

Hole P17-12 intersected 4.6 meters averaging 14.5 g/t gold within a broader interval of 13.7 meters at 6.0 g/t gold. Hole P17-18 intersected 2.3 meters averaging 58.5 g/t gold from 56.4 meters to 58.7 meters, within 9.9 meters averaging 15.27 grams per tonne gold from 54.1 meters to 64 meters.

The stock has come back and filled the gap when it popped from $0.45 to $0.65, something you will often see a stock do. If you did not buy back when it was a dime, dips below $0.50 would be a good entry level.

Victoria Gold and Zonte Metals

Victoria Gold Corp. (VIT:TSX.V) has been releasing drill results, with the latest today.

Highlighted results from exploration drilling at the Olive target this year include

• 33.3 meters of 1.54 grams per tonne gold returned from drill hole DG17-849C;

• 9.1 m of 3.14 g/t gold in drill hole DG17-856C;

• 13.9 m of 1.56 g/t gold in drill hole DG17-889C.

At Olive, 2017 diamond drilling activities totaled 2,428 meters from seven drill holes and were designed to target areas south and west of the Main Olive zone, areas that had received limited or no previous exploration drilling.

Zonte Metals Inc. (ZON:TSX.V) has completed its drill program on the adjacent McConnells Jest property and it is about 10 kilometers east of where Victoria was drilling. Victoria's results might give an idea what we could see from Zonte.

I did a more detailed update last week on the Yukon explorers here.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Kinross Calls, Yamana Calls, Jaxon Minerals, Newrange Gold, Sanatana Resources, Garibaldi, Victoria Gold, Zonte Metals. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None My company has a financial relationship with the following companies mentioned in this article: Jaxon Minerals, Sanatana Resources. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Victoria Gold. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goldcorp, a company mentioned in this article.

Charts provided by the author.

(c) Copyright 2017, Struther's Resource Stock Report

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.