Excelsior Mining continues to hit permitting milestones, says

The Critical Investor, who profiles the company.

Johnson Camp Mine

Excelsior Mining Corp. (MIN:TSX; EXMGF:OTCQB) continues to amaze me on its permitting, as the company received a draft Underground Injection Control (UIC) permit for its Gunnison Copper Project on October 25, issued by the United States Environmental Protection Agency (EPA). After finalizing its Aquifer Protection Permit (APP) on October 11, as no appeal came in during the 30-day appeal period; this is another important milestone for Excelsior. The UIC draft permit now awaits a 30-day comment period and a decision period by the EPA, and if this permit can be granted after this, there will be another 30-day appeal period, just like the APP permit encountered. The APP permit took four months from draft to final permit, and management expects to receive a positive decision on the UIC permit before year end, which then would go into appeal. If all goes well, I expect the final UIC permit to be granted in January or February 2018. I have a few reasons to expect this will go well, more on this later.

I again feel I briefly have to highlight the role of VP Sustainability Rebecca Sawyer, who has been leading the permitting process from the beginning, and is a real asset to the company, as permitting a greenfield ISR copper project in Arizona isn't an easy feat to pull off.

There hasn't been much price action the last few days since the news, which kind of surprises me, as the UIC draft permit in the current situation seems a done deal for about 90% (as I will elaborate a bit more on later), this derisks the project and inherent US$1B NPV7.5 (6 fold current market cap) considerably, capex financing seems to be a done deal as well with major shareholder and multibillion dollar fund Greenstone willing to help out, and copper remains strong. Here is the chart, showing only 1 day of elevated volume on the day of the news itself, but nothing special:

It is difficult for me to pinpoint to clear causes for this lack of price action. Maybe a select audience which knows the story is already invested and confident, but another factor might be the quiet positioning of Excelsior in the markets, as it still flies below the radar of many investors. I don't think this is warranted at all, as Gunnison could be in production before the end of 2018 as the first greenfield ISR copper project in the Americas, with a significant NPV7.5 as mentioned.

Copper has been holding its ground lately above the $3.00/lb Cu mark, currently trading at $3.10/lb, and I must say to my surprise, as I envisioned China to slow down a few gears regarding infrastructure and buildings, impacting copper demand. But China keeps buying, and the latest outlook on the Chinese economy is healthy as well, basically in concert with US and EU GDP growth. The long-term outlook for copper is very strong, as large deficits are forecasted in a few years. So, this means that the copper price could even end up much higher, increasing the upside potential, which is already significant for Excelsior shareholders, even further. More on this later.

Let's have a look first at the UIC draft permit, and more specific why I think the commenting- and appeal periods will not present obstacles along the way. When I go to the EPA website and look at the of the Excelsior UIC draft permit, there are basically two reasons why I believe the case for Excelsior is very strong. Key here is that the Gunnison project is eligible for the requested Aquifer Exemption according to the EPA, and its reasoning is motivated by these two criteria as mentioned in the summary:

1. 40 CFR § 146.4(a): It does not currently serve as a source of drinking water.

The document explains:

"These reviews demonstrate that the aquifers identified for exemption do not currently serve as a source of drinking water because there are no identified current drinking water supply wells, public or private that currently would draw water from the aquifer proposed for exemption, the formation/portions of formations are vertically and laterally contained (separated) from other USDWs, and no aquifers that serve as sources of drinking water are hydraulically connected to the aquifer."

And:

"The EPA evaluated the modeling approach and the site-specific geologic and hydrogeologic information and planned operational data that served as inputs, in connection with other information in the Class III UIC permit application (including geologic maps, logs, hydrologic information, etc.). Based on this, the EPA determined that the model accurately represents the extent of fluid movement and demonstrates that the aquifer to be exempted is not in contact with any formations that serve as a drinking water supply within one-half mile of the aquifer exemption boundary."

I found it impressive to see that Excelsior managed to convince the EPA based on their modelling of hydro-geological processes, without needing more test wells etc. When I compare this to the relatively nearby Florence project, the only other comparable ISR project, this had been testing and monitoring for many, many years, from pre-Taseko/Curis times until very recently if I'm correct, but of course in a very different and locally more difficult setting, close to the community of Florence. Fortunately, Excelsior's Gunnison project isn't anywhere near a community.

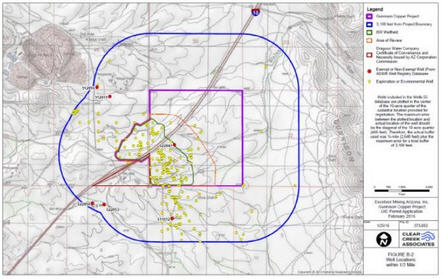

Excelsior Mining searched within a one-mile radius of the boundary for sources of drinking water:

Fortunately for the company, there are no public water supply wells:

"The closest water production wells to the AE boundary are located more than 2 miles northeast of the project property, providing an operating water supply for the Johnson Camp Mine. The nearest public drinking water wells operated by the Dragoon Water Company are more than 3.3 miles southeast of the project, near the town of Dragoon. EPA believes that an evaluation of the capture zone for these wells is not necessary because EPA's review of hydrogeologic conditions (i.e., groundwater elevations, groundwater flow direction and velocity) and the wells' considerable distance from the project boundary supports that groundwater from the project 8 would not be captured by the Dragoon public drinking water wells. (Sources of information: The Excelsior’s UIC Class III permit application Attachment A-2, Groundwater Modeling Report, and Attachment B, Table B-1 lists all well locations in the area.)"

2. 40 CFR § 146.4(b)(1): It cannot now and will not in the future serve as a source of drinking water because it is mineral, hydrocarbon, or geothermal energy producing, or can be demonstrated by a permit applicant as part of a permit application for a Class II or III operation to contain minerals or hydrocarbons that considering their quantity and location are expected to be commercially producible.

The Feasibility Study of Gunnison showed that the existing Reserves can be mined extremely economically, based on very conservative assumptions, so this will be hard to contest. The EPA itself took a very conservative stance itself, by including the upper 200 feet of the sulfide zone into the exemption area of the UIC draft permit:

"The bottom of the exempted zone is within the low-permeability sulfide zone that occurs below the Class III injection zone. The upper 200 feet of the sulfide zone is incorporated into the exemption area. This is based primarily on poor hydraulic conductivity and aquifer characteristics and on the depth to the bottom of the transition zone (where copper oxide deposits transition to primarily copper sulfide deposits). The sulfide zone is less fractured; therefore, its use as a public water supply is not considered feasible. However, there is a possibility of fracture connections between the oxide and sulfide zones that were not identified by aquifer testing, and such connections would make portions of the sulfide zone a USDW. For this reason, the upper 200 feet of the sulfide zone are proposed for exemption."

So, the two main arguments for the EPA to grant the draft UIC permit are rock solid in my opinion, as there are no public water supply wells in the project area and buffer zone, and the copper in situ is expected to be economic.

As I mentioned in my last update, I am convinced that negotiations on any financing package will significantly pick up speed when the UIC permit is finalized and all major permits are in hand. Initial capex is very low at $47M as ramping up is staged, and management foresees a need for $25M working capital, so I don't expect any problem here as a total capex sum of $72M is very modest, and easy to finance. Especially with Greenstone as a major backer, who wants to bring Gunnison into production. I believe that at current, and certainly at higher copper prices, there is a clear incentive for Greenstone to ramp up to full production much quicker than set out in the Feasibility Study, as there is money to be made in that case. Even a double initial production scenario seems very realistic and economic in my view, and easy to finance in my view. The post-tax IRR would still come in well above 30% at current copper prices, which is very good for any base metal project.

To show upside through a quick sensitivity analysis on Gunnison, I compared the current 183M F/D number of shares without any dilution vs. for example a 210M F/D share count, assuming in both cases a fully financed and constructed project, ready for commencing commercial production. In that case I estimate the market cap to be equal to full post-tax NPV7.5, but this is only hypothetical, as the project will be ramping up to full production over 7 years according to the FS. As Gunnison starts out based on 1/5th of final nameplate production, it is actually quite complex to calculate a target NAV or market cap. When in production, valuations are better generated based on operational cash flow ratios instead of NPV or NAV ratios, but the future internal growth has to be taken into account. In the following table I still used the full NPV to show long-term potential, MM means million, F/D fully diluted shares and PPS price per share:

After giving it some thought, I do believe it is realistic to use half the NPV at the moment of commencing of production in this case, which would halve the targets as well. Management foresees first production at the end of 2018, which I deem to be pretty fast but doable as they already have the Johnson Camp plant etc. A necessary condition for this would be that they need to arrange their capex financing package directly after the UIC permit is finalized early 2018. I am not sure of any long lead items with a ISR operation, but my best guess is there aren't any as drilling and constructing wells doesn't require long lead, huge and custom engineered items as far as I know.

Since I have tried to come up with targets when commencing production in one year, it is also a possibility to estimate near term targets, although this is even more difficult. I frequently use the method of derisking a project in several stages, and I developed my own 10-stage derisking tables, for different metals. The concept is derived from John Kaisers 9- stage uncertainty/probability ladder system, which I tweaked here and there, based on my experience since 2010. For copper this resulted in this table:

If I would use a halved NPV scenario when going into production, and applied for example a derisking percentage of 30%, the outcome would be very close to the current share price. However, as capex is small, copper pricing is very healthy and the financial backing is extremely strong for Excelsior, I'm not hesitant to use a 50% derisking number when the UIC permit will be finalized in January or February 2018, generating a target range of C$1.50-1.75 by then. When capex financing could be arranged very soon afterwards as management thinks is possible and I believe very much so, a solid C$2.00 target should come within reach.

To close this update, I had a few specific questions for Excelsior management, on different aspects, so here we go:

First I wanted to know how much the state royalty actually accounts for in total. According to management, the financial model reflects 5.9% estimated royalty rate (which is in turn based on the $2.75/lb Cu assumption.

Another question of mine was if Excelsior needed more permits besides the UIC permit. They answered that the UIC permit is the only permit of significance still required prior to going into production. There were a large number of other smaller permits (e.g., a Sewage System Permit from the county) but these have all been obtained by now.

Furthermore, I do feel that Excelsior is still flying under the radar as mentioned earlier, and I wanted to know if management is planning to do something about this. Here is their answer: "We are working on obtaining further analyst coverage. There is certainly growing interest from the investment bankers and analysts as we get closer to crossing the permitting finish line."

Always relevant is the question of cash in the treasury: "As per our financial statements filed in June 30, 2017, we had US$7.5 million in cash and cash equivalents."

And last but not least I wanted to know how soon Gunnison could ramp up to full production. According to management, the earliest they could ramp up to full production of 125 million pounds per annum would be Year 4.

I believe this isn't much different from a 125M lbs scenario from the start, as financing and constructing the new 100M lbs SX-EW plant would take more time, just like constructing/ramping up much more production/injection wells. All in all, this could take up to three years altogether in my view as larger operations always take more time.

Excelsior Mining is definitely on the right track, and after years of slow but thorough progress it seems things could accelerate pretty quickly in the first part of Q1 2018, if the UIC permit can be finalized. I am looking forward to this, and the following capex financing package, in the current, strong copper environment. A re-rating should be realistic by then, especially if management can arrange more coverage to create more investor awareness. I like the risk/reward ratio here, in fact it is the best I know of any copper junior.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website https://www.criticalinvestor.eu, and follow me on Seeking Alpha, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Excelsior Mining is a sponsoring company. All facts are to be checked by the reader. For more information go to https://www.excelsiormining.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images and charts provided by

The Critical Investor