Earlier in the week

I wrote about one of my main themes for 2018, a rising inflation/interest rate environment. In this post I will lay out which sector I believe will do well against a backdrop of rising inflation and rising bond yields (including offering some stock picks), and I will also specify which sectors and asset classes you will want to avoid in 2018. Let's start with what to avoid...

AVOID:

- Utilities - The utilities sector performs poorly during periods of rising interest rates because utilities stocks are treated similar to bonds by investors (due to their high dividend yields). We have already begun to see investors flee utilities as yields spiked higher this week:

XLU (Daily - 1 Year)

- REITs - For essentially the same reason you want to avoid utilities, REITs are also on the avoid list. Real estate valuations are also affected by interest rates, not only because the price of debt (mortgage rates) goes up but also cap rates increase which usually means the denominator (property values) decreases. The market has also begun to dump REITs this week after a relatively strong year for the sector in 2017:

- Bonds - This is a no brainer but many people may not realize how much exposure they have to bonds in long term retirement accounts (401Ks, IRAs, etc.). My recommendation is to reduce your duration (a measure of bond price sensitivity to changes in interest rates) and reduce your overall portfolio exposure to fixed income.

GET INTO:

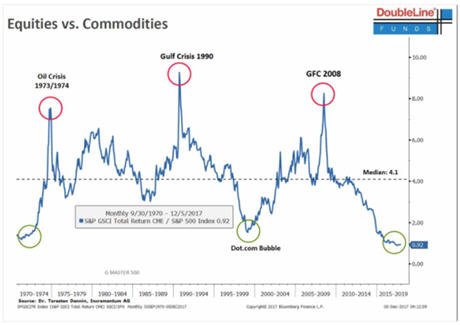

Gundlach believes that investors should hold a basket of commodities including copper, gold, oil etc. Not only are commodities cheap relative to stocks but they also act as an inflation hedge which could prove to be valuable over the coming years.

We have also begun to see investors pile into mining and oil stocks during the last couple of weeks:

FCX (Daily)

XLE (Daily)

A diversified basket of commodity producers such as BHP, FCX, RIO etc. is a solid way to play the commodities theme. For the more aggressive investor who wants to allocate a small portion of their portfolio to stocks that could become 10-baggers (instead of "just" doubles or triples) there are dozens of beaten down and out of favor junior miners that could see enormous gains in 2018 if the commodity theme takes hold of investors' consciousness. Three weeks ago I

highlighted 5 stocks that I think are attractive values at these levels, and I will offer a few more small/mid cap names that I like right now:

- Excelsior Mining (TSX:MIN, OTC:EXMGF) - I wrote about Excelsior last week and I am very bullish on this name heading into 2018.

- Kutcho Copper (TSX-V:KC, OTC:DSRRF) - I am very bullish on copper and Kutcho is another emerging North American copper producer (targeting production in 2021). Kutcho shares just resumed trading after a multi-month halt in order to consummate the Kutcho Project acquisition. I wrote about Kutcho last week and I am excited to watch Kutcho's progress in the new year.

- Jericho Oil (TSX-V:JCO, OTC:JROOF) - My favorite junior oil play. Jericho is a mid-continent (Oklahoma) focused oil exploration & production company with the strongest financial backing i've ever seen for a sub-$100 million market cap company. 2018 is set to be the year Jericho enters the big leagues after spending the last couple of years building a strong foundation; the company is drilling its first wells and continues to refurbish legacy wells while increasing production.

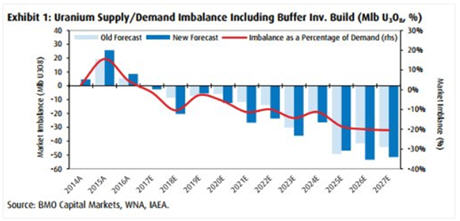

- NexGen Energy (TSX:NXE, NYSE:NXE) - The preeminent uranium exploration name. There are mounting signs that the uranium market is finally turning a corner; as the global supply/demand balance moves into undersupply sooner than previously expected due to recent supply cuts from Cameco and Kazatomprom:

Copper may not seem too sexy to most people, however, make no mistake that copper is a great way to play the looming electric vehicle boom while remaining underpinned by a strong long term supply/demand dynamic (declining mine ore grades and strong global growth):

While I don't care much for politics and rarely use it as part of an investing thesis, I cannot ignore the fact that the current political backdrop in the US couldn't be much more favorable for the mining, nuclear energy and oil industries. The commodity sector might just have found its sweet spot as we enter 2018 and investors have just begun to catch on to this notion.

Disclosure: Author is long MIN.TO, KC.V, NXE.TO and JCO.V at the time of publishing and may buy or sell any of these stocks at any time without notice.

Disclaimer:

The article is for informational purposes only and is neither a solicitation for the purchase of securities nor an offer of securities. Readers of the article are expressly cautioned to seek the advice of a registered investment advisor and other professional advisors, as applicable, regarding the appropriateness of investing in any securities or any investment strategies, including those discussed above. Some of the stocks mentioned are high-risk venture stocks and not suitable for most investors. Consult the companies’ SEDAR profile for important risk disclosures.

EnergyandGold.com, EnergyandGold Publishing LTD, its writers and principals are not registered investment advisors and advice you to do your own due diligence with a licensed investment advisor prior to making any investment decisions.

This article contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “forward-looking statements”). Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “expects”, “believes”, “aims to”, “plans to” or “intends to” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed by such forward-looking statements or forward-looking information, standard transaction risks; impact of the transaction on the parties; and risks relating to financings; regulatory approvals; foreign country operations and volatile share prices. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Actual results may differ materially from those currently anticipated in such statements. The views expressed in this publication and on the EnergyandGold website do not necessarily reflect the views of Energy and Gold Publishing LTD, publisher of EnergyandGold.com. Accordingly, readers should not place undue reliance on forward-looking statements and forward looking information. The Company does not undertake to update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDAR.com for important risk disclosures. It’s your money and your responsibility.