We took profits or partial profits in related stocks Enviroleach Technologies Inc. (ETI:CSE) and Mineworx Technologies Ltd. (MWX:TSX.V; MWXRF:OTCQB) about three weeks ago, in the full knowledge that theirs is a great story, because they were both heavily overbought, and we figured we could buy them back cheaper later, especially if the broad market got slammed—and both developments have come to pass. They have both reacted back sufficiently to justify our actions, have both unwound their respective overbought conditions, and both look like a strong buy again here. The extraordinary Enviroleach and Mineworx story may be read in my piece entitled THE FUTURE OF MINING: URBAN MINING, which was posted back in November.

The latest news on Enviroleach sounds very positive indeed; Enviroleach has submitted for "Innovation of the Year" at the Mining Disruption Conference contest, where the prize is a million dollars, and the company feels that it is a very strong contender. The contest takes place in the 1st week of March. What is probably of more importance is that Jabil is nearing completion of the thorough testing of the E-waste mobile plant in Tennessee. Lastly and even more importantly from the standpoint of investors is that the mood at Enviroleach is that

Jabil will take them out sooner, rather than later.

Turning to quickly review the latest charts, we see firstly that Enviroleach looks like it is at a very good entry point here as a corrective bull Flag appears to be completing within a major uptrend channel. It is truly remarkable that it has not reacted more given what has just happened to broad market—and a sign of strength. Sudden low volume yesterday may be a sign that it is now ready to advance again.

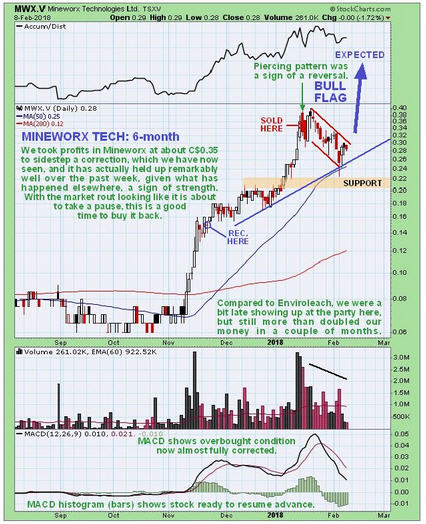

It's a similar story with the Mineworx chart, except that we could have grabbed it a bit cheaper a few days ago. It looks like a bull flag is completing here too, with the lower volume of recent days a sign that it is probably ready to break out upside from the Flag and take off higher. It is thought unlikely that the shell-shocked broad market will drop much more short-term, and if it rallies it will create a window for both these stocks to advance.

Both Enviroleach and Mineworx are regarded as strong buys again here for a new upleg.

Enviroleach Technologies website

Enviroleach Technologies Inc, ETI. CSX, EVLLF on OTC, closed at C$1.79, $1.40 on 16th January 18.

Mineworx Technologies website

Mineworx Technologies Ltd, MWX.V, MWXRF on OTC, closed at C$0.28, $0.235 on 16th January 18.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Enviroleach and Mineworx.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Enviroleach and Mineworx, companies mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction. Mr. Maund does not own securities of Lion One.