Source:

Zacks

Vanadium is used in redox flow batteries, which are superior to lithium batteries in storage capacity, discharge duration, and battery life. I have written extensively about this.

Vanadium articles by John Lee

Ride The Vanadium Wave After Lithium Dec 2016

When Robert Friedland Talks Vanadium, I Pay Full Attention May 2017

U.S. Energy Storage Surges 46% In Q3; 2018 Could Be A Breakout Year For Vanadium Batteries Jan 2018

Vanadium and lithium are comparable in unit price and annual production.

Annual production of vanadium pentoxide is

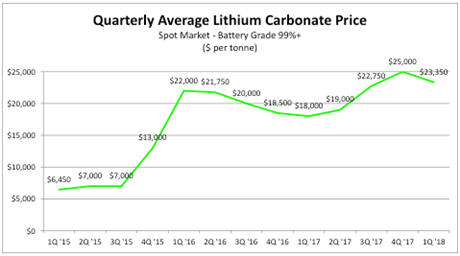

136,000 tonnes at $30,000/t ($4 billion). By contrast, lithium carbonate annual production is

186,000 tonnes at $25,000/t ($4.6 billion)

As for cobalt, the price is now $88,000/tonne, with an annual production of

110,000 tonnes ($9.7 billion).

1 vanadium = 1.79 vanadium pentoxide

The following January

BMO note is as relevant today as it was in January.

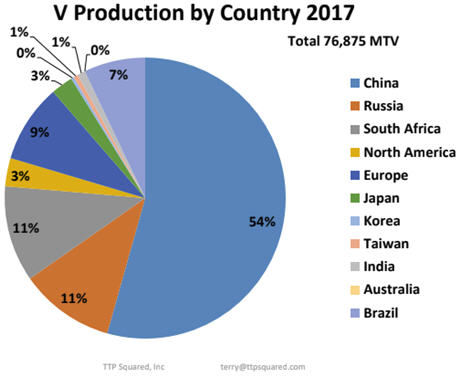

“We see a situation where over the coming months Chinese exports of ferrovanadium could drop sharply on the back of increased domestic demand and raw material constraints.

Chinese vanadium supply is also under pressure. As with many other commodities, China's vanadium mine supply has already been impacted by more stringent environmental monitoring. Moreover, as of January 1 this year imports of vanadium slag have been banned, cutting ~6% of China's raw material supply

According to following notes by

Metal Bulletin on March 14, the European and US vanadium markets surged on significant supply concerns:

Metal Bulletin has learned that major V2O5 producers including Tranvic Group, Jianlong Group and Desheng Group are fulfilling long-term orders and claimed to have no stock to sell into spot market.

There were very few export offers for V2O5 last week, with only one source concluding a deal for two containers of the material at $14.60 per Ib

] ”

Persistent demand, restrained supply, and limited available inventory could drive vanadium prices further upwards well beyond the current eight-year high of $14.2/lb

While lithium and cobalt mining stocks have been benefiting from an investor frenzy, the valuation of vanadium mining companies has been laggard.

The stock chart of First Cobalt Corp, a Cobalt mineral exploration company.

The stock chart of Prophecy Development Corp, a vanadium mineral exploration company.

Prophecy (TSX: PCY, OTCQX: PRPCF), of which I am the executive chairman, is developing the Gibellini vanadium project in Nevada, USA. Gibellini has independently verified vanadium resources in the ground, and Prophecy aims to make Gibellnii the 1

st vanadium mine in North America. My recent radio interview about Gibellini and the vanadium market can be

heard here.

Anthony Milewski is a managing director at Pala Investments Ltd. in Switzerland. He runs one of the few funds investing in battery metals. He made these comments in a January 2018

Bloomberg interview:

“I don’t think anyone would dispute that it’s superior to lithium-ion in large-scale grid applications.”

The Chinese government is promoting the technology. Among the projects under construction is a backup power facility in Dalian. It will be twice the size of Tesla’s plant in Australia.

The industry also lacks a high-profile champion such as Elon Musk. “Vanadium flow has yet to have its Tesla moment, and therefore it still flies under the radar,” Milewski said.

To me, with vanadium making new eight-year highs daily, the vanadium story may soon be too compelling to ignore.

John Lee, CFA

jlee@prophecydev.com