I wrote about Silver Bull Resources Inc. (SVB:TSX; SVBL:NYSE.MKT) back in November. The stock was unloved and hovering at $0.11 a share. I suggested potential investors watch for news releases because the company has totally changed direction. Since then the price of silver has been pretty much unchanged but Silver Bull has doubled.

We found a new young writer recently who has been generating some valuable information about various investing issues. Recently he wrote a piece about silver that uses a different approach to say what I have been trying to say for a year. Silver is cheap and as I said in my book, you should buy cheap and sell dear.

As I write, the ratio between silver and gold is 81.23 ounces of silver to buy one ounce of gold. In Kevin's article he clearly shows how the return on silver is far higher if you buy silver when the ratio is above 80:1. Silver is cheap and Silver Bull is even cheaper.

While the "Experts" are mumbling about how JPM is manipulating silver with the biggest short position since Christ was a Corporal, my readers are making money. The "Experts" have been wrong with everything they have said about silver for 20 years that I have followed them. If you are a real "Expert" you really should get something right once in a while. These idiots have no idea of what JPM is doing with silver any more than you or I do.

On March 14th Silver Bull released assays from the last three drill holes at their Sierra Mojada project in Northern Mexico. The best hole was 10 meters of $964 rock. That's a home run hole and the other three holes were shorter but almost the same grade.

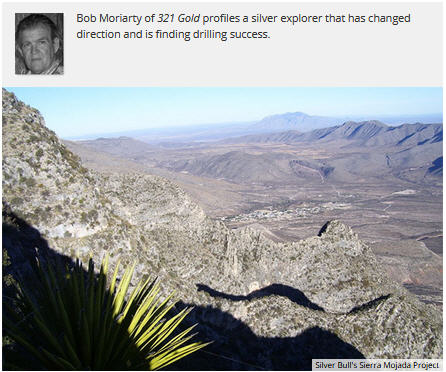

Sierra Mojada has an existing 43-101 showing 90 million ounces of silver and 4.67 billion pounds of zinc but there is serious environmental and safety issues working oxide zinc and especially lead. The market didn't like that so SVB lost 80% of its value between 2011 and today.

Company president and CEO Tim Barry changed direction in 2017 and began to drill the sulfide resource that he knew was underneath the oxide mineralization. His aim was to delineate a high-grade sulfide resource that works with current processes of working sulfide silver, lead, zinc deposits. His theory worked and the market moved the Silver Bull shares from a low of $0.035 in January up 550% to today's price.

In 2018 Silver Bull intends to step out and drill the Paloma Negros prospect 9 km along strike from the main Sierra Mojada deposit. Historical drill results from the 1950s from Penoles show sulfide mineralization up to 10 meters with similar +18% combined lead and zinc.

Drill results will continue to be released and I expect the market to revalue Silver Bull as more sulfide assays are released. The next giant step forward will naturally be a revised 43-101 showing the sulfide resource but that could be up to a year down the road.

Silver is very cheap now and with the increasing chaos both politically and financially, I expect all of the precious metals to go higher. But especially silver and platinum. They are very cheap. A tailwind from the price of silver will return SVB to the higher market cap it once enjoyed.

The company is a pleasure to work with and certainly they do a wonderful job of keeping me up to date. They have an excellent presentation all potential and actual investors should read. They do what they say they are going to do and I value that a lot.

Silver Bull is an advertiser and I do own shares. Please do your own due diligence.

Silver Bull Resources

SVB-T $0.225 (Mar. 23, 2018)

SVBL-NYSE 200 million shares

Silver Bull website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.