On Monday, a newly listed junior miner started its first trading day on the Canadian Securities Exchange under the symbol (CSE: TGC), Taiga Gold. Taiga is a junior exploration company focused on the search for gold in Northern Saskatchewan. The company is a spin out of its parent company Eagle Plain Resources (TSX-V: EPL).

Taiga is not so much a new company but a new vehicle to allow one asset to take precedence. In finance, the main rationale for a spin out is two-fold. First, it is a way to unlock the value of an internal asset, which might be traveling a different growth plan than the overall company or the asset is underappreciated amongst a parent company’s portfolio of projects. Second, it allows the parent company to focus on its core assets.

Usually, the proposed asset for the spinout shows near-term potential and would be better appreciated and understood as its own listing. Second, the spinout allows the parent company to focus on its core operations without the diversion of resources to a segment that could have different needs in various aspects such as marketing, finance and human resources.

Parent companies often provide support for their spinouts by retaining equity in them or signing contractual relationships for the supply of products or services. In many cases, the management team of the spinout firm is drawn from the parent company as well.

Investors generally favour spins outs, as it makes business sense for a segment that has different needs and growth prospects. The sum of the separated parts typically improve share price valuations over time.

In this case, it is too unlock the value for shareholders of the company’s Fisher, Chico, Orchid and Leland properties next to SSR Mining Inc.’s (TSX: SSRM) Seabee gold operation and allow Eagle Plains to develop other assets in its portfolio.

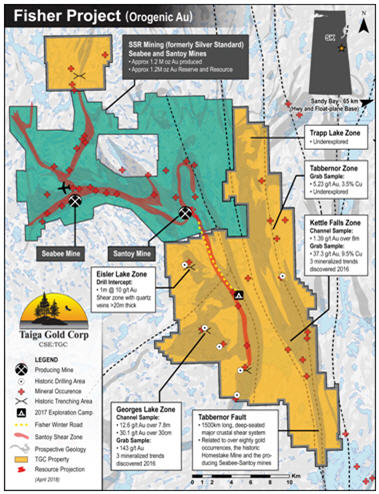

Taiga's projects are located near the Seabee Gold Operation, with its flagship Fisher project currently under option to SSR Mining Inc., the operator of the Seabee and Santoy mines.

SSRM is currently in the second year of a four-year option agreement whereby SSRM may earn up to an 80-per-cent interest in the 34,000-hectare property by completing $4-million in exploration expenditures and making $3.3-million in cash

The Fisher project is contiguous to the north, south and east with SSRM's Seabee gold operation. SSRM began its 18,000-metre diamond drilling program on March 20.

The 46-hectare Chico project is located 125 kilometres east of La Ronge, Sask., 40 kilometres south of SSR Mining's Seabee Gold Operation and six km south of the Fisher project. Aben Resources Ltd. (TSX-V: ABN) may earn up to an 80-per-cent interest in the property by completing $3.5-million in exploration expenditures, issuing 2.5 million shares and making cash payments of $150,000 to Eagle Plains over four years.

Eagle Plains' shareholders received one share of Taiga for every two Eagle Plains shares held. Eagle Plains will transfer $300,000 cash to Taiga to provide initial working capital and exploration financing. On completion of the arrangement, Eagle Plains will hold 19.9 percent of the outstanding shares of Taiga.

With drilling results expected soon, shares in Taiga Gold Corp. (CSE: TGC) will be a stock to keep an eye on.

About the author: Nicholas LePan is a seasoned writer covering the metals and mining sector with a keen interest for mineral exploration. You can find his work published in Miningfeeds, Goldseek.com, and here on Stockhouse