- Highly prospective for large Copper & Gold discovery in a prolific mineral belt, among world-class neighbors.

- As robust data pours in from exploration efforts over the second half of 2018 on Fortuna, evidencing large gold and copper potential, we expect shares of LJ.V to rise.

Lucky Minerals Inc. (TSX-V: LJ) (OTCQB: LKMNF) is highly prospective for major gold and copper discovery as it advances its 100%-owned Fortuna Project in Ecuador, located in a prolific mineral belt ~40km from Lundin Gold's Fruta del Norte (9.48 M oz Au I+Inf) deposit and the Mirador (2.7 M oz Au and 5.9 B lbs Cu M+I) deposit. Lucky's Fortuna concessions are newly acquired from a private company that essentially sat on coveted prime ground for well over a decade as discoveries were made surrounding it. The project is ripe for discovery of significance having received no modern exploration or drilling; geological interpretation and historical sampling (up to 10,5 g/t Au + numerous Cu anomalies in stream sediment) suggest potential for massive Gold & Copper system beneath. A major NNE-trending geological structure laden with calderas cuts through Lucky's Fortuna Project, similar NNE-trending structures intersect neighboring Fruta del Notre, Mirador, Loma Larga, and others.

Lucky Minerals is the subject of a Mining Journal Review, of which full copy may be viewed at

https://miningmarketwatch.net/lj.htm online.

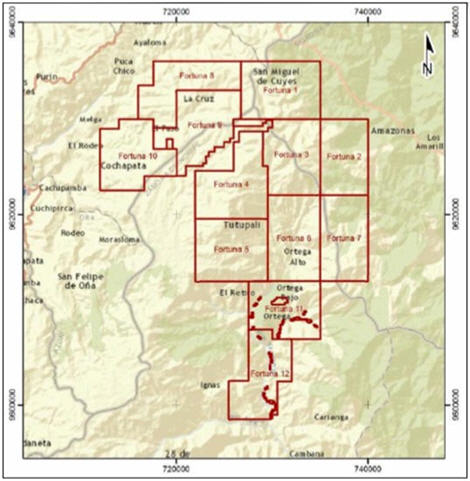

Figure 1. (above) Location map of Fortuna

Figure 1. (above) Location map of Fortuna proximal multi-million oz neighbors, superimposed orange color represents geological NNE-trending structures.

Historically, only limited sporadic rock sampling with no follow-up on anomalies has occurred on the property.

Using a proven systematic exploration approach (geophysics, remote sensing, alteration and volcano features mapping, structural analysis, and soil sampling over selected anomalies

) Lucky Minerals Inc. expects to take the property to target-ready drill status in short order (see 2018 Phase I and 2019 Phase II exploration plans further below

), highly prospective for discovery -- the board and technical team are actively hunting elephant deposits here in Ecuador.

Completely new high-caliber board and skilled technical team: The decision to acquire Fortuna was made by the new board of directors and technical team following a complete restructuring/changing of the guard (~1 year ago) at Lucky Minerals. The new board and technical team was first attracted to LJ.V because of the geologically compelling nature of the Company's other flagship asset, the 100%-owned Emigrant Creek Cu-Au-Mo Project in Montana, which has multi-million oz gold potential in ~2 billion+ Tonne porphyry system target. To date 10 highly mineralized breccia-pipes have been located. The Montana property is a significant asset that adds inherent value on its own as it is potentially amenable to bulk underground mining; compelling drilling results include 132m of 2.1 g/T gold and 50m of 14.37 g/T gold. It was decided that with the long road to permitting in Montana and seasonal aspect, it was best to diversify the Company and focus to take advantage of the unique opportunity presented in Ecuador, which allows for year-round advancement and will expose shareholders to incredible upside share price appreciation potential when the technical team first drills to expose targets it is expected to delineate this coming H2-2018 exploration session.

A high-quality board was assembled along with a strong technical team; e.g.: The head of the technical committee is Guy Lauzier, B. Eng who is the General Manager of Nemaska Lithium's Whabouchi Mine. On the board are notable names such as Joao Caêllo, who was the COO of Lundin for several years, and Stuart Greene; a geo and former Director of RMB Resources, which is essentially First Rand Bank's investment arm in London.

The following is an overview of the Lucky's two flagship projects, of which the Fortuna Project is the immediate focus of exploration efforts.

1) Fortuna Gold-Copper Project, Ecuador - 100%-owned

The Fortuna project exhibits many similarities with significant epithermal gold and Cu-Mo porphyry deposits.

Figure 2. (above) Location map

Figure 2. (above) Location map - surrounded by multi-million ounces gold and billion lbs polymetallic properties.

Fortuna is an early stage exploration project strategically located in the South-Central part of Ecuador, about 50 km South-East of the major town of Cuenca. The project is comprised of 12 contiguous concessions totaling ~54,985 Ha (550 km2).

In the Heart of Elephant Country

Fortuna is surrounded by many multi-million ounces gold and billion lbs polymetallic properties:

•

Lundin Gold (V-LUN) Fruta del Norte

(9.48 M oz Au I+Inf)

•

Sol Gold (T-SOLG) Cascabel

(7.4 M tonnes CuEq)

•

Lumina Gold (V-LUM) Cangrejo

(8.8 M oz Au +1.1B lbs Cu Inf)

•

INV Metals (T-INV) Loma Larga

(3.09 M oz Au +125 M lbs Cu I+Inf)

•

China National Rail Mirador

(2.7 M oz Au and 5.9 B lbs Cu M+I)

This is not a story of a rehashed project, the Fortuna Property is untapped in exploration potential, and one of the most exciting ventures unfolding in South America.

The Fortuna concessions have had placer mining for gold since the Inca times, however have never seen modern exploration applied, only being sporadically explored for gold since the 1990’s.

Reconnaissance work and basic geochemistry surveys have identified many geological features associated to large epithermal gold and porphyry deposits.

The concessions have never seen any drilling.

Region

Figure 3. (above) map of Ecuador

Ecuador -- stable and mining-friendly

Figure 3. (above) map of Ecuador

Ecuador -- stable and mining-friendly

A new stable geopolitical environment since 2015 has spurred investments from major companies and revived interest in the country. FX controls were eliminated in January 2016 and in 2017 Ecuador was named “Country of the Year” at Toronto Mines & Money Show. Ecuador's new President, Lenin Moreno, has reconfirmed the governments support of mining in 2018. The Mirador copper project commenced construction in 2015. Lundin Gold reached an agreement with the government in December 2016, allowing for the Fruta del Norte project to proceed. Several public companies are actively advancing projects at various stages of development; e.g...

• Lundin Gold Inc. TSX:LUG Fruta del Norte; construction on track with first gold pour anticipated in Q419.

• SolGold TSX:SOLG Cascabel in exploration, the Company is systematically exploring Cu-porphyry opportunities (Alpala, Aguinaga) and other priority and highly prospective targets. A PEA is expected in H218.

• Lumina Gold Corp. TSXV:LUM Condor/Cangrejos at resource. Finalizing significant earn-in agreements with First Quantum and Anglo American on exploration concessions. Cangrejos PEA is anticipated Q218.

• Cornerstone Resources TSXV:CGP Cascabel in exploration.

• Aurania Resources Ltd. TSXV:ARU Cutucu in exploration & announced a $4 million PP this June-2018.

• INV Metals TSX:INV Loma Larga in construction, permitting anticipated 3Q18, 1.3 km of development to provide access to mineralization.

• Core Gold Inc. TSXV:CGLD Dynasty in operation/development.

• Salazar Resources Ltd. TSXV:SRL Curipamba in exploration.

• Toachi Mining TSXV:TIM La Plata in exploration.

• Lucky Minerals Inc. TSXV:LJ Fortuna in exploration.

A June 1, 2018 field report by PI Financial mining analysts, regarding their recent (Q2-2018) site visit to several Ecuador mining projects prompted the following take-aways about Ecuador in a synopsis entitled "

Turning the Corner Offering Untapped Potential":

• Fast finding favour as an attractive mining investment destination in South America, offering untapped exploration upside.

• Majors (Newcrest Mining, Anglo American, Fortescue Mining, First Quantum, and BHP) actively seeking investment opportunities in juniors with significant land packages along mineralized trends.

• US$4B in mining investments expected by 2021.

• Good Infrastructure, cheap power and a willing workforce.

The Fortuna Concessions

Figure 4. (above) - The Fortuna Concessions.

Infrastructure:

Figure 4. (above) - The Fortuna Concessions.

Infrastructure: The area is basically uninhabited with trails running throughout the concessions. A paved road runs up to the property. Power lines are within 10km of the property border. There is abundant water available for exploration, and a readily available workforce nearby.

History

1992-2017 Exploration work

- 1992-2000

? Reconnaissance prospecting of property.

? Discovery of extensive mineralization and alteration zones.

?

Up to 10,5 g/t Au in stream sediment.

- 2007-2017

? Identification of major structures.

? Reconnaissance geochemistry sampling.

?

Numerous Cu anomalies reported in stream sediment.

Figure 5 (above) High potential to host porphyry CuAu deposits

Figure 5 (above) High potential to host porphyry CuAu deposits -- Seen in the image above is an area (Culebrillas-El Buitre) which has seen a small amount of preliminary exploration work. There is pervasive hydrothermal alteration, Cu & Mo geochemical anomalies, younger felsic porphyry intrusives, Cu oxides in the different units and the presence of secondary pyrite in the altered rocks, important structures as a shear zone have been identified, and there is the existence of hydrothermal breccias.

Figure 6 (above) Highly anomalous gold in geochem samples

Figure 6 (above) Highly anomalous gold in geochem samples -- There exists strong potential to host sulphidation epithermal gold deposits. Historic work recognized many high stream sediment gold anomalies (up to 10.5g/t Au) and anomalous Au values in rock and soil sampling. Several clusters of stream pan concentrate samples identified fine gold. Gold placer mining activity is taking place in neighboring concessions.

Lucky Minerals' Fortuna Project checks all the right boxes for similarity with other systems

? Cu Porphyry:

Caldera like structures

Multiple intrusions and dykes of diorite to quartz monzonite

Inner Quartz-Sericite alteration

Outer Epidote-Chlorite alteration

Fractures filled with sulphides

Hydrothermal breccia

Copper and Molybdenum minerals

?Epithermal Gold:

Volcanic pyroclastic rocks

Advanced argillic alteration

Pervasive silicification

Pyrite

NNE-trending geological structures that controlled mineralization

The line of fire of development of volcanoes are along this NNE trend. The majority of actual deposits are located along these structures. The Fortuna concessions represent the most hotly anticipated new development in Ecuador’s prolific gold and mineral belt.

Figure 7. (above) - Exploration targets on Fortuna

Figure 7. (above) - Exploration targets on Fortuna -- Using satellite imagery and remote sensing, a series of major structures cut through the Fortuna concessions. The technical team has software able to identify major structures. The targets are related to caldera, dome, and vent volcanic structures.

FYI: Ecuador has the second largest concentration of volcanoes per square foot than any other country in the world (second only to Iceland).

Lucky Minerals' Plans at Fortuna

2018

Near term financing of US$1M for the delineation of major targets on the property (airborne geophysics, exploration targets prospecting and identification of drilling targets).

2018 goals include 1) Social and community activities, 2) Airborne magnetics geophysical survey to be realized in July 2018 on the entire property, 3) Structural interpretation and soil sampling (August 2018), 4) Delineation of promising exploration targets (October 2018), 5) DDH targets definition (December 2018), 6) Report filing.

Phase I Exploration, 2018 Budget

• Airborne Geophysical Survey - 5,600km - US$450,000

• Structural Study - US$25,000

• GIS, Maps, Drone Survey - US$90,000

• Base Camp (6 to 8 people) - 3 Months - US$60,000

• Personnel - Geologists and Technicians - US$225,000

• Assays (Soil and Rock) - US$50,000

• Equipment - US$35,000

• Environment & Contingencies - US$65,000

• TOTAL PHASE I - US$1,000,000

2019

Mid-term financing of US2$M for drilling in 2019/2020.

Phase II Exploration, 2019 Budget

• Drilling Infrastructure Access - 100 km - US$500,000

• GIS and Maps - US$90,000

• Lodging at Nabon - 6 people - US$90,000

• Drilling - 3,000m - US$600,000

• Assays - 3,500 samples - US$175,000

• Equipment - US$30,000

• Contingencies - US$115,000

• TOTAL PHASE II - US$1,600,000

Once the Fortuna Project is de-risked and brought to the next level there is no shortage of players that will partner to take the Project to fruition.

##

James O’Rourke

James is a freelance information services professional for various media relation firms and financial publications. He monitors and invests in the resource, technology, consumer staples, healthcare, agriculture, financial, energy, utilities, and biotechnology/pharmaceutical sectors.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. The author has based this document on information obtained from sources he believes to be reliable but which has not been independently verified. The author makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of the author only and are subject to change without notice. The author assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Technical mining terms used by the writer may be used/expressed in simplified layman terms and should not be relied upon as appropriate for making investment decisions unless the reader contacts the company directly for independent verification. The author assumes no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report. James does not currently own shares of Lucky Minerals Inc. – LJ.V however intends to accumulate.