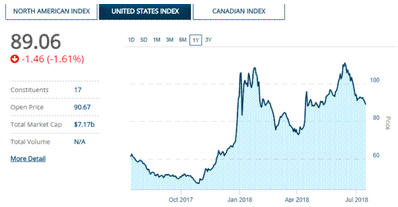

The marijuana market has been very good to us with extraordinary gains in many stocks. The Canadian Marijuana Index has been flat and commented the U.S. index was much better and that is easy to see on this chart of the U.S. index.

If there is one word I would use to describe the difference between the Canadian and U.S. indexes, it would be "California." Recreational marijuana has become legal in a number of states but California is the largest and represents about the same size as the whole Canadian market. Canada is still a few months from the legal date but California is well into it since January 1, 2018.

A report from the cannabis industry research firm BDS Analytics estimates sales of cannabis in California to hit $3.7 billion by the end of 2018 alone, and predict that number will increase to $5.1 billion in 2019 as more dispensaries come online. California is the world's sixth largest economy with a population close to 40 million, compared to 36 million in all of Canada.

The recreational industry has started off slow in California and really not a surprise, it is not like flicking a switch on the day it becomes legal. The bottleneck seems to be the slow pace that municipalities are issuing licenses. The only numbers I have seen were through February where dispensaries sold $339 million. However you must also consider the huge size of California's medical marijuana that has been in effect for 20 years. A recent Forbes article puts that at $2.75 billion, far above any other state.

I believe companies that have a road into California will gain early traction, like RISE Life Science highlighted below.

I believe I have found a unique player in the field with a competitive advantage, and the best part is that investors have not discovered it yet. I met with management in early June and went over all its business plans. I believe the company has exceptional marketing qualities that will set it above the competition and its unique products and approach will enhance its success.

RISE Life Science Corp. (RLSC:CSE), Recent Price $0.32

52 week trading range $0.13–$0.74

Shares Outstanding: 56.5 million approx.; Management/insiders: 23%

RISE is a consumer products company building high-quality cannabis derived products for the health and wellness category. RISE is not a licensed producer, which is an important distinction that underscores its unique approach. The company has adopted an operational methodology that enables it to create high-quality products while avoiding the high capex cost often associated with operating within this market. In fact, it does so with the lowest capital cost spend of any organization that I have reviewed in the space. By operating with a reduced capex cost baseline while developing and commercializing consumer products positions the company to enjoy wide profit margins. RISE does this with the intent of building a brand presence backed by a strong suite of products that can be introduced on a global scale.

RISE consumer products are based on patent-pending formulations and processes that produce specific targeted effects for both the medical and adult-use sectors. A key area of focus for RISE is the development of formulations to address sexual health and wellness for both adult men and women. To be positioned well within the most active marketplaces, the company has initially offered products based on separate formulations developed with distinct CBD-based components to the California market and will follow on with other U.S. jurisdictions. These solutions will also be presented to the Canadian market when regulatory conditions take effect.

The company will only sell THC-based products under license to third parties in the United States until federal law pertaining to cannabis is changed. The primary manufacturing and marketing focus will instead be on CBD products derived from the highest-quality CBD hemp certified as "U.S. Farm Bill compliant," enabling the company to stay completely aligned with U.S. federal law. This class of product may be sold in most U.S. states and in many countries around the world, and means that the company is not adversely affected in any way by the U.S. Department of Justice.

Products and Distribution

RISE will produce a diverse product line. A key differentiator of its sexual enhancement products will be a focus on women and couples. By utilizing U.S. Farm Bill Hemp for its cannabinoid sources, products can be sold in all 50 states and in over 20 countries internationally.

RISE has deployed a direct sales team in California to sign top-tier dispensaries, augmented by a personalized support program for customers and patients to be delivered at the store level. RISE expects to create a network of 200+ premium store locations in California within the next 12 months.

In addition, RISE has completed a previously announced acquisition of 100% of Life Bloom Organics LLC, a California-based company that produces and markets organic oral sprays containing CBD (cannabidiol), and 100% of Cultivate Kind, one of the top marketing and branding agencies for the cannabis industry in the United States.

Cultivate Kind

The acquisition of Cultivate Kind brings a deep understanding of retail marketing and enables RISE to build and manage a sales and distribution channel for all of its products in California, the largest and most sophisticated cannabis consumer market in the world. It combines brand development services, go-to-market strategies, PR and promotion, retail marketing and assisted sales, but also provides best-in-class production resources—raw material sources, formulators, lab facilities, packaging and fulfillment—to form a true ecosystem to bring brands from concept to point of sale.

Life Bloom Organics

Life Bloom Organics is based in Malibu, Calif. The company formulates, manufactures and sells a range of cannabis products that deliver effective pain relief without any psycho activity. Its product line currently includes two SKUs (stock keeping units): wellness formula and sleep formula. Both products are nanotized CBD oral sprays made with proprietary formulas. Life Bloom's proprietary process of nanotizing CBD allows for 95% absorbency in the bloodstream, making it an effective aid for chronic pain, jet lag and insomnia.

Life Bloom products utilize organic, non-GMO (genetically modified organism) hemp (sourced from Kentucky through the Department of Agriculture Hemp program) and are compliant with Section 7606 of the 2014 Farm Bill. Life Bloom products are currently available at chiropractic offices, natural health food markets, specialty retailers and medical marijuana dispensaries across California, as well as sold online via the brand's e-commerce website.

This gives RISE an added advantage to commercialize sexual health and wellness formulations in other jurisdictions around the globe. Life Bloom brings a strong chemistry-based product development and nano-emulsification expertise that will benefit the development of all RISE products.

Marquee Brand - Karezza

Karezza represents RISE's premier sexual health and wellness brand and is inspired by ancient Tantric sexual pleasure practices. The first suite of these sexual health supplements includes three oral sprays, "In the Moment," "Women's Daily," and "Men's Daily," which support the performance of sexual body systems. The product suite will be sold at retail stores across California starting next week and will also soon be available via the brand's e-commerce website, karezza.love. The line will be expanded to include sublingual, quick-absorb tablets and a topical lubrication for enhanced erogenous sexual experience. Each Karezza product contains full-spectrum CBD from organic, U.S. Farm Bill hemp and an FDA-compliant synergistic blend of herbs, adaptogens and essential oils formulated from botanical traditions to enhance sexual experience. This first suite of Karezza products is non-psychoactive.

THC Brands – coming soon

To expand the product line and enter into the THC-based market where regulatory conditions permit, RISE also plans to import iconic Jamaican cultivars to develop additional formulations that will be used in a future product line currently under development.

Beverages – coming soon

RISE is also working on multiple manufacturing and product partnerships for a launch of beverages in 2019. Prospective products include CBD and THC-infused zero alcohol wine, beer, sparkling and regular water products. Beverages like zero alcohol wine with Karezza inspired infused formulations would complement the Karezza suite of sexual arousal products.

The RISE Report on Cannabis and Sexual Health and Wellness

Another aspect that will enhance product development, sales and the company's visibility is their launch of a longitudinal study to investigate sexual function and health concerns, and, how cannabis products designed for sexual enhancement and health affect sexual behaviors and performance. This is a first-of-its-kind study in such depth on sexual behavior and Cannabis. Data and key observations derived from the study will be published via the RISE Report on Cannabis and Sexual Health and Wellness (The RISE Report).

The study will be significant in its long-term open-ended focus, overall scope and the value of the data it is designed to capture. It will uncover key behavioral trends that will inform RISE of the best possible product development decisions to meet the needs of its customers and help RISE to maintain a competitive advantage in the marketplace. Importantly, it will also put RISE in the middle of the conversation with an expanding consumer community.

Dr. Regina Nelson, a behavioral scientist and one of America's leading cannabis educators, will lead the study. Dr. Nelson is supported in these efforts by Dr. Christopher J. Smith, a social science expert, and Dr. Jon Ross, a healthcare and public policy expert.

"As cannabis evolves into widespread medical and mainstream commercial use, the benefits of cannabis products and their relation to sexual health are particularly important to every stakeholder, from public health officials to companies making cannabis-based products, and especially for the general consumer," commented Dr. Nelson, study designer and principal researcher. "To date, no scholarly investigation of the physiological connection between cannabis and sexual health has ever been undertaken at this scale. This study presents the opportunity to expand our collective knowledge, increase our understanding and create a critically important data set regarding sexual behavior, health and wellness."

The study and key facts:

- This is a long-term observational study collecting quantitative and qualitative data, exploring cannabis usage as an aid for sexual performance and collection of experiential data related to the use of RISE sexual health and wellness products.

- No gender bias: The company will look at specific differences in effect across genders, as its study will extend beyond heterosexual participants.

- Real user experiences: In addition to clinical and statistical data, the RISE study will collect consumer stories and experiences.

The study will focus on many critical areas in need of review:

Research will range beyond smoking and vaping and include other important forms of consumption such as oral sprays, oils, sublingual tablets, concentrates, edibles and topical solutions. Given the topic and increasing privacy concerns, the company is protecting personally identifiable information. The study is designed to generate rich profile data and outcomes directly related to cannabis product use. It is expected to initially enroll approximately 200 participants during its beta test phase that started earlier this year, with the official study launch tentatively scheduled for September of 2018. As the study continues to expand over time, the long-term goal is to engage with thousands of participants.

Management

Anton Mattadeen, CEO, has over 30 years of experience as an entrepreneur, inventor, technology and communications professional for global companies like IBM and Sony. For the past several years he has been developing strategic initiatives in the cannabis market with a specific focus on the creation of mainstream consumer products.

Chris Dollard, COO, has over 30 years of leadership experience in operations, IT and communications with companies such as Deloitte, Accenture, IBM and Best Buy/Future Shop. He led the factory build out of one of the first wave Licensed Producer applications in 2013. Since then he has been developing mass consumer products using infused cannabis and botanicals.

Dr. Regina Nelson, who is leading the cannabis and sexual behavior study is a published author of several books and earned her PhD in ethical and creative leadership at Union Institute and University. Her doctoral studies concentrate on the issue of medical cannabis. In 2012, Dr. Nelson published her first peer-reviewed article, "Framing Integral Leadership within the Medical Cannabis Community." She has gone on to publish and present in 20 peer-reviewed forums, including events hosted by the International Leadership Association, the International Cannabinoid Research Society and the Integral European Conference. In addition to her role as chief executive officer of Integral Education and Consulting LLC, she is also a founding officer of the eCS Therapy Center, a 501C3 organization building awareness of the endocannabinoid system (eCS) and championing community-based education via the Plant a Seed for Cannabis Education Tour.

Financial

Last financial statements as of February 28, 2018, reveal $435,000 in cash. They also reveal liabilities on the balance sheet (most of which are in a subsidiary and not the operating business). The significant liability, which is approaching $3 million, and which is composed of both principal and interest pertaining to the previous operating entity Luminor Medical, has been spun off into the company's recently formed, wholly owned subsidiary, Scout Assessment Corp. (Scout Corp.). All revenue related to the company's Scout DS® diabetes screening device, including current contracts and future contracts will flow through Scout Corp. The debt is secured through a general security agreement against Scout Corp. The security interest against the former Luminor (now RISE Life Science) has been discharged. The liabilities are tied to funding and sales of the legacy business and its technology and should it not proceed, will become a zero-value divesture.

Since then, RISE has closed two funding tranches of previously announced, non-brokered private placement through the issuance of an aggregate of 12,192,565 units at a price of $0.30 cents per unit for gross proceeds of $3,657,170. Each unit is composed of one common share of the company and one-half of one common share purchase warrant. Each warrant entitles the holder thereof to purchase one common share for a period of 24 months from the date of closing at a price of $0.45 cents per common share.

RISE is well funded for its product launch.

Summary

"Wellness" has become one of the leading consumer trends, with categories from physical fitness to alternative medicine and emotional self-care growing exponentially in consumer awareness, priority, and sales.

RISE is focusing CBD product lines for sexual health and wellness where there is very limited competitive products. You have probably heard the phrase 'Sex sells' and this makes RISE unique in the sector and a chance to distinguish itself and its brand. The curiosity alone will attract a lot of sales.

I believe the company's product focus on women and couples is also an advantage. It helps to empower women as it is something for them as well as their significant others. Their sexual health and wellness study (RISE Report) will also be a unique marketing tool as the study results will be published in scientific, cannabis related journals and universities. This will also enhance the credibility of its product line. The company has also launched RISE Mag, a digital magazine publication which will bring awareness to the company and its particular market sector.

RISE will begin its first product launch using CBD hemp certified as "U.S. Farm Bill compliant" enabling the company to stay completely aligned with U.S. federal law. This will differentiate RISE from many other marijuana products and importantly allows it to sell across the U.S. as well as numerous countries internationally.

The acquisition of Life Bloom will immediately expand RISE's portfolio of CBD products, along with allowing access to Life Bloom's existing channels of distribution and production in the U.S.

The acquisition of Cultivate Kind will further enhance RISE's marketing and distribution in the U.S. The acquisitions will also bring immediate, best-in-class product production expertise to RISE. Nothing speaks like successful experience, so it's important to note that Cultivate Kind recently brought Life Bloom Organics to market with great success in California.

The acquisition adds decades of experience and makes RISE an integrated company. This makes for very good odds for successful products and strong, growing revenues for RISE.

RISE products are expected to be available in California retail locations by the end of July and will be offered through dispensaries initially, followed by health food retailers and natural wellness boutiques.

I believe this is an important message by their COO, Chris Dollard, in the last press release: "Addressing sexual health and wellness is a deeply personal decision that requires both excellent communication protocols and discretion. We want the retail experience to be comfortable, enlightening, and above all—fun. Communicating the right information in the right way is a key process for us and the main reason why we are so selective about our retail partnerships."

I have a few observations on the stock chart. It has seen its first life on news of the acquisition of RISE by the predecessor company, Lumimor Medial. Since then the stock pulled back some in January and has built a very good base between CA$0.27 and CA$0.37. Also notice the low volume that signifies the company/stock is not well known in the investment community so is under-owned and inexpensive compare to many in the field with a market cap of only CA$18 million. There is some mild resistance around CA$0.45 and a break above that would be a strong signal of a new uptrend.

I participated in the $0.30 recent financing and currently own 50,000 shares.

For 27 years, Ron Struthers, founder and editor of Struthers' Resource Stock Report and Playstocks.net, has consistently beat the comparable benchmarks selecting stocks in the precious metals, oil and gas, clean-tech and disruptive technology sectors. In 2017, 35 stocks in the precious metals sector saw an average gain of 62% and energy clean-tech an average gain of 65%. In disruptive technology, 16 picks saw an average gain of 55%. Past performance is no guarantee of future gains. Struthers leverages his vast network of contacts, approaches investments from a value perspective seeking several 100% gain potential and uses technical analysis to aid in buy and sell levels.

Disclosure:

1) Ron Struthers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: RISE Life Science. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: RISE Life Science is an advertiser on playstocks.net. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by the author.

c. Copyright 2018, Struther's Resource Stock Report

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.