A ROTH Capital Partners report relayed the key points from the company's quarterly update.

In an Aug. 12 research note, Joe Reagor, analyst with ROTH Capital Partners, reported that near-term upside exists in two of Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) projects and that the company's Q2/18 results were "slightly better than expected but generally uneventful."

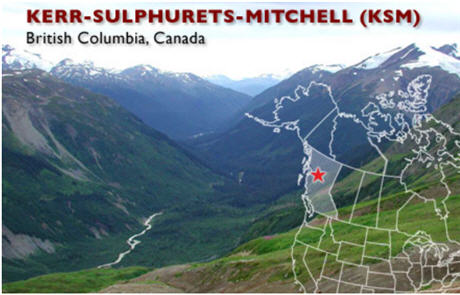

Reagor noted the market responded favorably to comments by Seabridge's management about the exploration potential at its Kerr Sulphurets Mitchell (KSM) and Courageous Lake projects, where "we continue to believe there is significant room for value creation." Drill results from KSM's Iron Cap are expected to be catalysts, later in 2018. Also, drill results from recent Courageous Lake findings "could lead to significantly improved project economics."

The analyst highlighted that ROTH views the market's reaction as warranted. "We base this belief on the company's potential for resource growth through exploration and a lack of a response to prior announcements regarding discoveries at Courageous Lake," he added.

As for Seabridge's Q2/18 financial result, it was a $0.04 per share loss, which compares to ROTH's estimate of a $0.06 loss. "We do not view this as a meaningful beat as the company remains a pre-revenue company," Reagor qualified.

He reiterated ROTH's Buy rating and US$17 per share price target on Seabridge, which is trading currently at around US$12.90 per share.