Cannabis Sector Overvalued, but Strong Takeout Candidates Could Soar

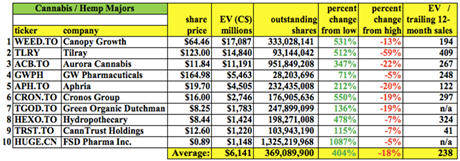

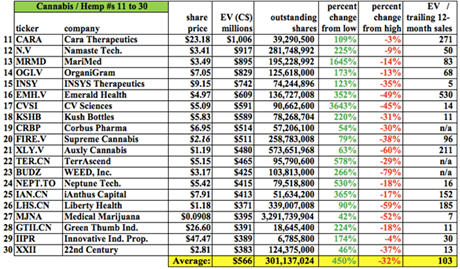

Most of the top 50

#cannabis (#weed / #hemp / #marijuana)– related stocks are overvalued, some wildly so. I’m tracking 198 Canadian & U.S.-listed companies. As of Friday, September 21st, the top 10 had a combined Enterprise Value

(“EV”) [market cap + debt – cash] of

C$61.4 billion, or

C$6.1 B per company! The 50 largest had a combined

EV of

C$78.6 B, an average

C$1.6 B per company.

Make no mistake, there’s a bubble in this sector. Look at

Tilray, Inc. (NYSE:

TLRY). Shares closed on Friday at

US$123, (after briefly touching US$300 on Wednesday!). Its

EV is

C$15 B. That’s C$15 B for a company that had quarterly revenue of ~

C$12.6 M (~C$50 M annualized). It’s trading at an

EV/Sales ratio of

292x and a trailing 12-month

EV/Sales ratio of

409x! Readers should note, it’s not just Tilray that’s overvalued. There are 15 others in the top 50 trading at >

100xEV/Sales, those 15 sport an average trailing 12-month

EV/Sales multiple of

310x.

The bull argument for the cannabis / hemp sector is that since sales (revenues) have barely begun flowing, one needs to look towards 2019 or 2020 operations to assess a company’s investment merits. However, even if revenues soar for the Majors, forward

EV/Sales multiples would remain quite stretched. For Tilray — if sales were to jump from the current annual run-rate of ~

C$50 M to

C742 M(up ~1,372%), the

EV would still be

~20xprospective sales.

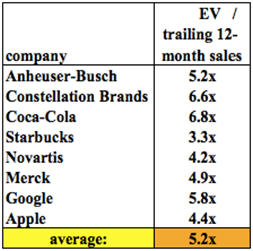

At what

EV/sales multiples do global world-class Food & Beverage, Retail, Technology and Pharmaceutical companies trade at? About

5x. I believe that cannabis Majors will likely end up trading at

5x-10x sales in the next 2 or 3 years.

A Massive Wave of M&A is Coming

Clearly, internal sales expansion alone will not propel Tilray to an attractive

EV/Sales ratio. Only a massive wave of M&A will save the top players from remaining massively overvalued. As a thought experiment, consider Tilray’s valuation if it were to acquire the 10 companies in the top 50 with the lowest trailing

EV/Sales ratios. In that scenario, its

EV/Sales multiple of

409x would fall to

~30x. From a pro forma

30x multiple, a more realistic case could then be made for internal growth leading to a

EV/Sales ratio under

10x.

I argue that an aggressive, industry-wide, M&A strategy will be deployed by all overvalued cannabis companies. That means there could be an appetite by the Majors to acquire dozens of smaller peers. The Majors, not just the top 10, but at least the top 20-30, have ample access to cash and banks offering them lines of credit.

Canopy Growth alone will have

C$5 billion in cash after it receives an investment from

Constellation Brands.

But the problem is there are

not dozens of companies with solid growth prospects and reasonable risk profiles to choose from! Of the 198 names I’m monitoring, many have been riding the cannabis wave for a few years, but are now suffering from stalled revenue growth and/or weak or nonexistent profitability. Others have blown out their capital structures

(14 of the top 50 have > 250 M shares outstanding).

I believe that there are probably 20 or 30 highly desirable small cap names that the most overvalued players will be desperate to grab. There will be bidding wars for the best of the bunch.

Valuations to Fall While Top Takeout Candidate Share Prices Soar?

Readers should be looking for the companies most likely to be acquired in this cycle– those trading at low forward

EV/Sales multiples, with clean balance sheets, attractive capital structures, strong growth prospects and reasonable risk profiles. These select names could enjoy very substantial share price appreciation, even in the face of declining valuations from among the Majors.

That’s why I’m focused on company #106 on my list of 198 names. A company that has substantial blue-sky potential,

albeit an investment opportunity that’s high risk (

see risk factors below). The Company’s name is

Crop Infrastructure Corp. (

“CROP”) [CSE:

CROP] / [OTC:

CRXPF].

CROP operates like a REIT, investing, constructing, owning

(typically 30% to 49% Interests) and leasing greenhouse projects by providing turnkey real estate solutions for hemp & cannabis producers & processors.

The Company’s portfolio of projects includes cultivation properties in California, Washington State, Nevada, Italy & Jamaica and a JV on 2 California dispensary applications.

CROP has an active near-term revenue generating portfolio, including the development of Cannadrink, a cannabis-infused functional beverage, plus U.S. & Italian distribution rights to over 55 cannabis topical products and a portfolio of 16 cannabis brands.

Why do I like CROP?

- Enterprise Value = C$65 M vs. an average EV of C$846 M of the top 100 names on my watchlist

- Multiple, diversified business segments, structured like a REIT, 100% non-Canadian operations (most opportunities in the U.S.) – California, Washington & Nevada are 3 of the best markets in the world

- Meaningful commercial sales to begin soon (4th qtr. 2018)

- Proprietary growing technologies & sophisticated methods will be used by CROP’s partners, leading to consistent, high-quality products produced at attractive and sustainable low cost

- Trading at less than a 5x EV/2019 Sales ratio

- Risk sharing business model entails working with multiple, diversified industry players

- Substantial exposure to the U.S. hemp market, a market poised to go crazy if/when the Hemp Farming Act of 2018 is passed (as part of a larger Bill)as soon as this month…. Management believes that CROP is #1 in hemp in the State of Nevada.

- CROP has NOT already returned 500%+ to investors this year [12 of top 50 are up > 500%, those 12 are up an average of 1,116% from respective 52-week lows]

- Moderate # of shares: 112 M outstanding, vs. an average of ~251.5 M shares in my list of 198 peers

- Exposure to International markets: (Italy & Jamaica so far)

Due to the above mentioned attributes,

CROP is a very attractive takeover candidate.

Let me flesh out some of the above mentioned reasons why I like

CROP. First, the market cap. This is important because there’s a lot more room for a

C$65 MEV to double or triple than for a

C$400 M+ company

(the top 25 companies have EVs > C$400 M) to soar. And, since a takeout is my stated endgame, there are many, many more suitors with the financial wherewithal to take out a

C$65 M company than a much larger one.

CROP’s commercial sales are expected to commence next quarter, while a large number of peers are still 2, 3 or 4 quarters from meaningful sales. Overvalued companies, wildly outperforming the market, without any sales…. a recipe for disaster. At the very least, one should fear material equity dilution in those cases.

Hemp Could be the Biggest Winner of 2019, CROP Well Positioned

Industry pundits, most notably

Chris Parry and his team at

Equity.Guru are very bullish on hemp. In fact, Equity.Guru is also bullish on

CROP and on M&A picking up in the sector. Blockbuster uses of hemp are coming from human & pet consumption in an ever growing list of medical and wellness applications.

After nearly 50 years as a “

Schedule I federally controlled substance“ in the U.S.,

hemp is set to become a legal crop. If passed, the 2018 omnibus farm bill

(which includes the Hemp Farming Act of 2018) would allow cannabidiol (CBD) products to be legally sold in all 50 states. If readers remember nothing else, remember this, it’s a BIG DEAL… Management believes that

CROP is #1 in hemp in the State of Nevada.

Crop Infrastructure Likely Trading at Under 5x 2019 Sales

Based only on

existing business opportunities in California, Washington & Nevada, I believe that sales in CY 2019 could be well into the tens of millions of C$,

(compared to an EV of C$65 M). This suggests

(my opinion only) that

CROP is trading at

< 5x next year’s sales. Importantly, the sales figure for 2019 could be quite large, perhaps much larger than the

EV of the Company — but it depends on management execution and the timing of a number of corporate initiatives, especially

CROP’s hemp opportunities in Nevada.

What makes me so optimistic about Nevada? Simple math. Based on the number of controlled acres, typical yield/acre and current hemp flower pricing for high-quality CBD strands,

(CBD content 10% to 18%) the upper range of sales possibilities gets really crazy. While not a sure thing, this type of blue-sky upside should not be taken for granted, not every cannabis / hemp play has it.

I will have a lot more to say next month as events unfold. CROP has been active on the news front, press releases,

(5 in September through Friday)…. I’m watching closely for ongoing corporate updates, but mostly I’m interested in management’s ability to generate revenue next quarter. I never expect smooth sailing in the cannabis / hemp space, it’s a very volatile place, but if/when meaningful revenue starts flowing, I expect new investors

(including institutions) might take a closer look at the

Crop Infrastructure (

“CROP”) [CSE:

CROP] / [OTC:

CRXPF] story.

Risk Factors

**

CROP is thought to be on the cusp of significant commercial sales,

(4th qtr. 2018), but the Company has no sales to date.

Delays in revenue generating activities is a substantial risk.

** A large portion of revenues in 2019 are slated to come from hemp operations in the State of Nevada. These operations are not yet up and running.

** Numerous industry dynamics are undergoing seismic changes. The situation in the U.S. is quite different than conditions in Canada. A considerable amount of risk & uncertainty is beyond the control of even the best management teams.

** In the U.S., growing/selling cannabis & hemp are

illegal at the Federal level, but legal in select States like California, Nevada & Washington. In some States it’s legal to use cannabis & hemp recreationally, in some States such use is only permitted for medical purposes. Selling across State lines is not permissible at this time.

** Each State has its own set of laws, regulations, procedures, protocols to understand and comply with. Failure to follow the rules could cause

severe delays (or worse) in reaching meaningful commercial sales.

** Entire indoor or outdoor crops

(2-3 crop cycles per year) can be rendered worthless if they fail to pass stringent tests confirming high quality (

no mold, low impurities).

** There’s a great deal of debate about cannabis & hemp pricing going forward. Risks are most likely to the downside.

** There are hundreds of public & private cannabis & hemp-related companies, as well as illegal (

black market) operations. As such, it’s very difficult to analyze or truly understand potential new supply into the market. If an unexpectedly large amount of cannabis or hemp comes online, pricing could more than just decline, pricing could collapse.

** Cannabis & hemp related companies are highly speculative and the stocks are highly volatile. For example, industry giant Tilray stock touched US$300/shr. in intraday trading on September 19th, but closed the week at US$123. Bad news from one or more industry players could have a materially adverse impact on many other industry participants.

Disclosures: The content of this interview is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER]

, (

together, [ER])

about Crop Infrastructure Corp.

, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER]

is not responsible under any circumstances for investment actions taken by the reader. [ER]

has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER]

is not directly employed by any company, group, organization, party or person. The shares of Crop Infrastructure Corp.

are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares and/or stock options in Crop Infrastructure Corp.

and the Company was an advertiser on [ER]

.Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER]

is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER]

is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic.