Today, Ximen Mining Corp. reported the completion of an 11 hole drill program at its Gold Drop Property near the historic mining town of Greenwood in southern British Columbia. Lab results are pending and expected in the next weeks.

Based on the observations of the drill core, some high-grade gold intercepts are possible.

The strongly mineralized COD Vein could turn out bigger, and of higher grade, than previously thought and would mark a significant success for Ximen and its optionee.

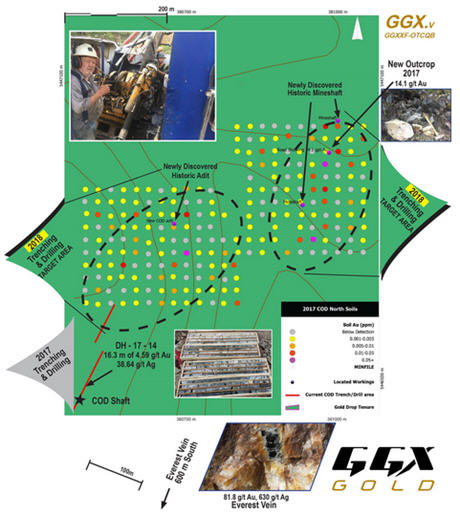

According to today’s news, drilling targeted the southern extension of the COD Vein within 25 m of the previously drilled holes COD18-45 and COD18-46, both intersecting high-grade gold, silver and tellurium:

• “COD18-45 intersected of 50.1 grams per tonne (g/t) gold and 375 g/t silver over 2.05 meter core length including 167.5 g/t gold, 1,370 g/t silver and 500 g/t tellurium over 0.46 meter core length

• COD18-46 intersected 54.9 g/t gold and 379 g/t silver over a 1.47 meter core length including 223 g/t gold, 1,535 g/t silver and greater than 500 g/t tellurium over a 0.30 meter core length”

Tellurium is an extremely rare (comparable to that of platinum in the earth‘s crust), silver-white metalloid, chemically related to selenium and sulfur. Its primary commercial use is copper and steel alloys (improving machinability), whereas a considerable portion of tellurium production goes into semiconductors and CdTe (cadmium telluride) solar panels.

Today’s press-release included a highly interesting table (copied above) describing some of the drill core and intervals of quartz veining and/or mineralized host rock from the recently drilled 11 holes testing the COD Vein located in the Gold Drop Southwest Zone.

Remarkably, hole COD18-63 hit 3.46 m of a mineralized zone including a 1.57 m quartz vein intercept.

Moreover, hole COD18-67 intercepted a 8.51 m mineralized interval including a 7.32 m quartz vein intercept. In case favorable assays are reported, this extension of the COD Vein could mark a great success.

Hole COD18-69 impresses me with 9.65 m of quartz separated by mineralized wall rock.

Hole COD18-71 hit a whopping 12.04 m of mineralization.

Note that true widths cannot be accurately determined from the information available, thus the core lengths are reported.

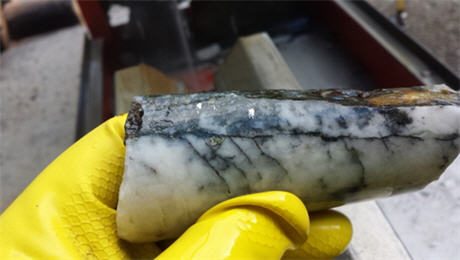

Core from the recent drill program targeting the gold-bearing COD Vein located in the Gold Drop Southwest Zone (source: GGX Gold):

Full size

Full size

Highlights from the surface trenching and sampling program across the COD Vein North Target, which has yet to be drill tested, include “a grab sample of 15.45 g/t Au, 159 g/t Ag, and 114.5 g/t tellurium and a chip sample across 0.4 m of 21.7 g/t Au and 216 g/t Ag and 149 g/t tellurium”. Drilling of this area is already fully permitted and scheduled to start in 2019.

Full size

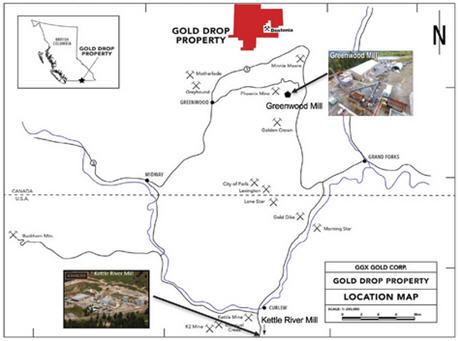

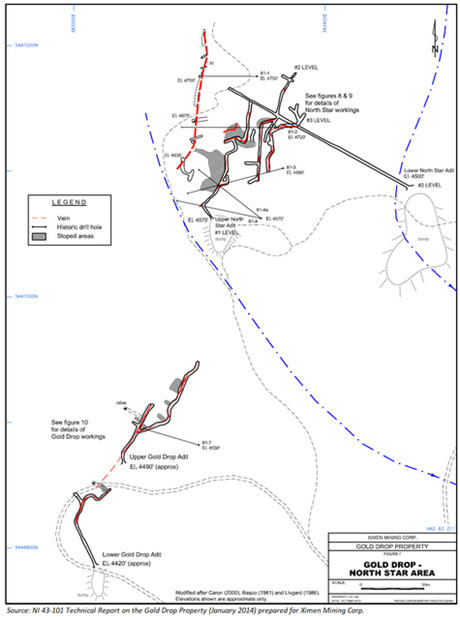

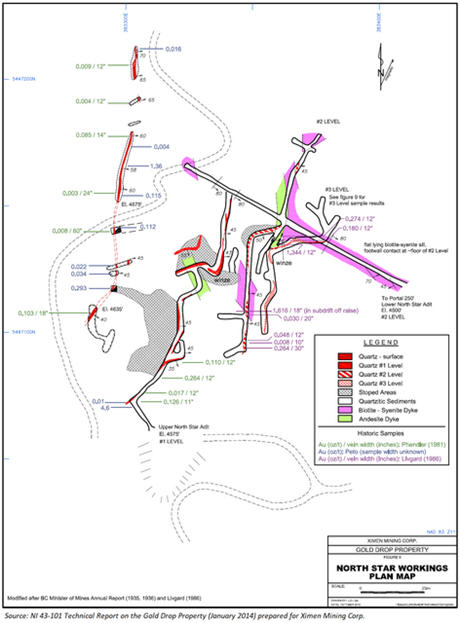

According to the NI 43-101 Technical Report on the Gold Drop Property (January 2014):

“The Gold Drop property covers geologically prospective ground in the well mineralized Greenwood District, and hosts 8 or more known gold-bearing veins or vein systems. On the adjoining Dentonia property, significant historic production has come from similar veins. There has been little effective modern exploration on the Gold Drop property, and in the author’s opinion, the property is unique in this respect.

Good opportunities remain untested on this property while most properties in the area that host showings of similar quality have been more thoroughly explored. Since custom milling opportunities exist in the district, the property does not necessarily need to support a stand-alone mine/mill operation to be viable. Even a small or modest tonnage of high grade ore could potentially be profitable to extract, given the excellent infrastructure of the region and the property itself...

It is reasonable to expect that veins on the Gold Drop property have similar strike/depth ratios as the nearby Dentonia vein, yet the limited drilling done on the property has generally failed to trace the veins to depth...

Total historic production from the Dentonia vein is approximately 125,000 tonnes at an average grade of 10.8 g/t Au and 64.6 g/t Ag (Minfile 082ESE055).”

Note: The historical information is relevant only as an indication that some mineralization occurs on the property, and no resources, reserve or estimate is inferred. A qualified person has not done sufficient work to classify the historical information as current mineral resources or mineral reserves; and neither Rockstone nor Ximen Mining is treating the historical information as current mineral resources or mineral reserves.

Full size

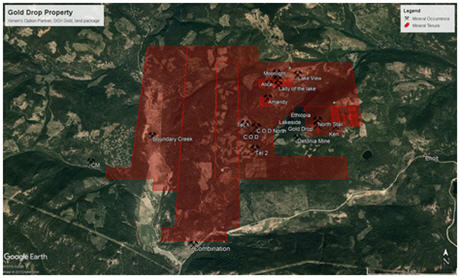

The Gold Drop Property (approximately 5,600 hectares) hosts at least 8 low-sulfide, gold-silver bearing quartz veins or quartz vein systems, 4 of which were mined. These B.C. MINFILE gold-silver occurrences are the North Star and Gold Drop veins in eastern region of the Project and Amandy, Alice, Lady of the Lake, Roderick Dhu, Moonlight and Lake View veins in the northwest region of the Project. All have reported underground workings varying from shallow shafts to extensive underground workings (North Star). Other gold (plus or minus silver) bearing quartz veins are reported within the Property.

Full size

Option Agreement: The Gold Drop Property is currently under option agreement to GGX Gold Corp. To date, Ximen has received the first 2 of 4 option payments, which consists of stock and cash, from GGX Gold. Once all the payments and work commitments have been completed, Ximen will have a 2.5% NSR and the right for 9 months thereafter to elect to form a joint venture with GGX Gold by paying to GGX Gold the amount of money equal to 30% of the total amount expended on the property by GGX Gold. If Ximen exercises this joint venture right, Ximen and GGX Gold will enter into a joint venture for the exploration and development.

GGX 2018 Work: The 2018 drill program aims to further delineate the quartz veins at depth and strike. Several exploration holes were planned in the COD North and the high-grade Everest vein areas.

Infrastructure: Power is available on the property. Water is available, seasonally, from a small pond or several small creeks on the property, or from Jewel Lake. Services, including room, board and fuel, are available in Greenwood (population < 600), located about 9 km from the Gold Drop Property. Grand Forks (population about 8,000) is a major supply center. Most services needed for exploration are available in Grand Forks, located 40 km east along Highway 3 from Greenwood. The closest full-service airports are located in Kelowna, Penticton or Castlegar.

Full size

Full size

Full size

Company Details

Ximen Mining Corp.

#888 – 888 Dunsmuir Street

Vancouver, BC, Canada V6C 3K4

Phone: +1 604 488 3900

Email: office@ximenminingcorp.com

www.ximenminingcorp.com

Shares Issued & Outstanding: 23,138,187

Chart

Canadian Symbol (TSX.V): XIM

Current Price: $0.35 CAD (12/10/2018)

Market Capitalization: $8 Million CAD

Chart

German Symbol / WKN (Frankfurt): 1XMA / A2JBKL

Current Price: €0.221 EUR (12/10/2018)

Market Capitalization: €5 Million EUR

Previous Coverage

Report #1: “Ximen Mining: Hunting for Multi-Million Ounces in British Columbia“

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Ximen Mining Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Ximen Mining Corp.´s and Zimtu Capital Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Ximen Mining Corp.´s and Zimtu Capital Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Zimtu Capital Corp. and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of the report, which company holds a long position in Ximen Mining Corp. The author currently does not hold any equity positions or other kind of interest in Ximen Mining Corp., GGX Gold Corp. or any other mentioned company.