Ximen Mining Corp. made an announcement today that is poised to draw the attention of the big boys.

Ximen’s option partner for the Gold Drop Property, GGX Gold Corp. (TSX.V: GGX), is mobilizing to drill test a newly discovered high-priority target at a depth of at least 400 m and up to 764 m – the deepest ever to be drilled on the Gold Drop Property and, according to my research of public records, the deepest ever to be drilled in the entire Greenwood Mining Camp.

When you drill that deep, you are obviously looking for something big, such as a multi-million ounce gold deposit. Otherwise it would not make any sense as mining at such depths require large volumes of strongly mineralized material.

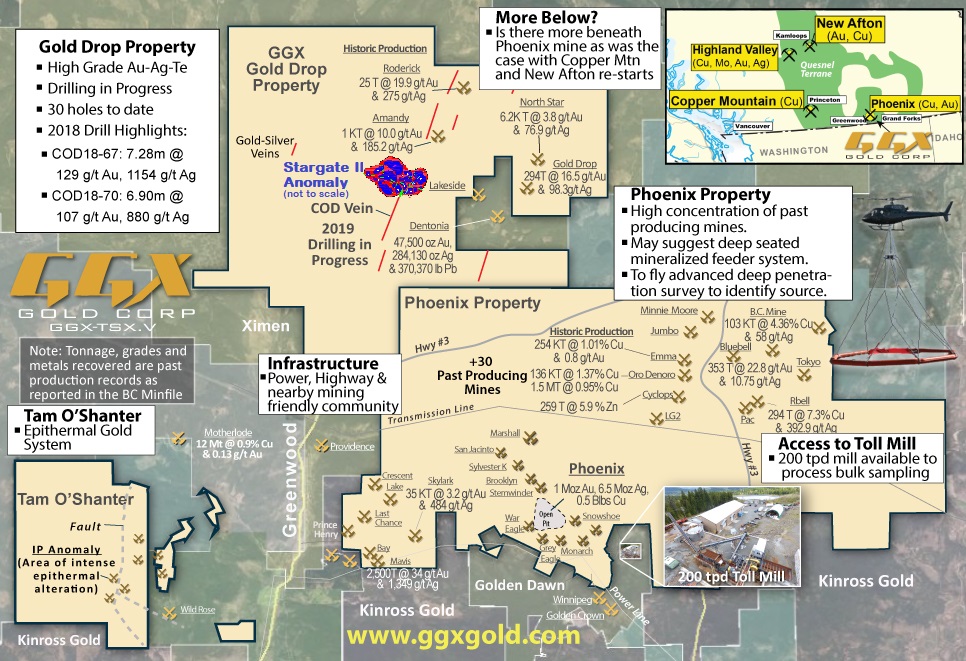

Since mid-April 2019, GGX completed 32 holes for a total of 1,923 m (60 m per hole on average) at the C.O.D Vein on the Gold Drop Property. Assays are pending and expected shortly, however, no matter how good the results may be, such a near-surface gold vein would likely not draw the attention of senior mining companies because really large gold deposits are most often at depth.

Don’t get me wrong! There is nothing wrong with drilling the C.O.D Vein in an effort to delineate a smaller resource near surface as they could be targeting small-scale mining in case a milling opportunity evolves at the near-by Greenwood Processing Facility (212 t/day capacity) owned by Golden Dawn Minerals Inc. (TSX.V: GOM). Such a mining venture still provides potential to create significant shareholder value along the road.

On the other hand, the proposed deep drilling at Gold Drop is a completely different ballpark. It’s going after big gold – “hunting for elephants” as they say in the exploration and mining industry.

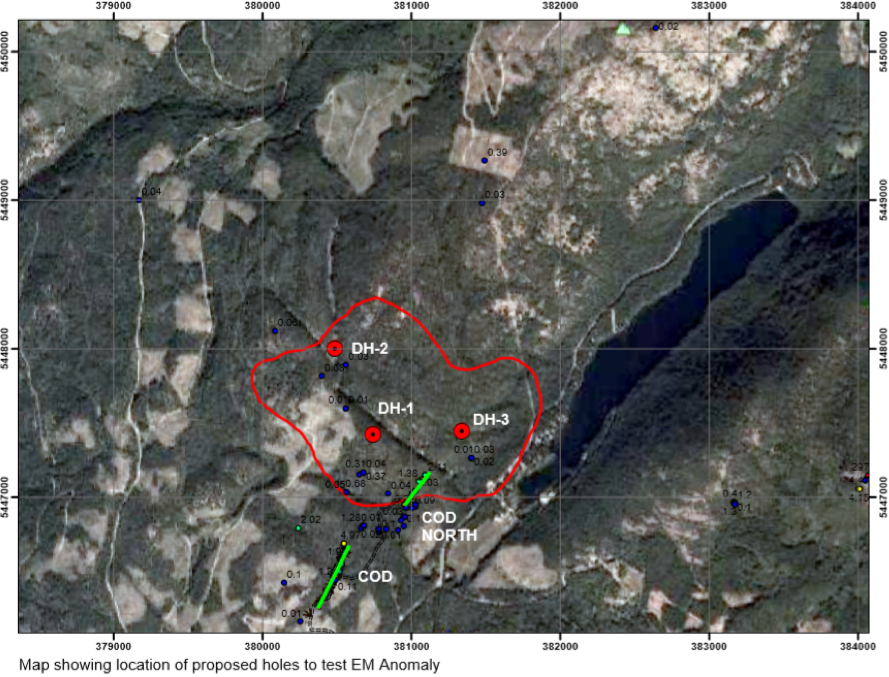

Full size / Stargate II surveys were performed by ESSCO over the Republic Graben trend in Washington and B.C. in 2014/2015 at 1 km and 500 m line spacings. A resultant geophysical anomaly on the Gold Drop Property was supplied by Glenn Galata of ESSCO. The anomaly measures 1,834 by 1,377 m, is centered at the intersection of 3 interpreted major fault conduit structural traces and is located along strike and to the north of the C.O.D. Vein trend.

Full size / Glenn Galata of ESSCO suggested 3 holes within the anomaly as shown above. If the first hole (DH-1) is a success, he recommends to not drill more around that hole but to step out and drill test other orientations with DH-2 and DH-3, because senior mining companies want to see multiple axis orientations of gold mineralization – that’s the high criteria they have, which is somewhat different from the criteria of a junior miner.

This fairly large (1,834 x 1,377 m) geophysical anomaly was discovered using a new technology – the proprietary Stargate II Drill Target Modeling System – which incorporates Acoustic EM analysis, an enhanced, deep-penetrating ultra-sonic AMT (Audio-MagnetoTellurics) geophysical survey. It was developed by Earth Science Services Corp. (ESSCO) of Oshawa, Ontario, Canada.

The Stargate II system is in developmental / pre-commercial stage and as such the effectiveness of this technique is not fully known. For this reason, I wanted to dig deeper so I called Glenn Galata of ESSCO, who is currently in Grand Forks near Greenwood, B.C.

During the 2-hour call with Glenn, I learned about the drawbacks of conventional geophysical surveys and what sets Stargate apart, and most importantly, why Glenn strongly believes that the proposed deep drilling at Gold Drop provides tremendous potential to discover something big: e.g. the source – aka the feeder system – of the many small occurrences historically mined near surface surrounding Gold Drop.

Full size / “There are enormous volumes of data suggesting that the anomaly beneath Gold Drop is one of the primary sources of all of the widespread historical gold occurrences, which have been mined in the Greenwood Camp for hundreds of years.” (Glenn Galata of ESSCO in a phone call with Rockstone)

Full size / “There are enormous volumes of data suggesting that the anomaly beneath Gold Drop is one of the primary sources of all of the widespread historical gold occurrences, which have been mined in the Greenwood Camp for hundreds of years.” (Glenn Galata of ESSCO in a phone call with Rockstone)

In essence, I can only recommend to sit tight, fasten your seatbelts and watch closely. This single hole is hoped to be a game-changer for Ximen, GGX and the entire Greenwood District.

And the beauty is that if the deep drilling is not successful in discovering high-grade mineralization over significant intercepts, Ximen and GGX can continue pursuing their mutual goal of becoming junior mining companies. The only downside of not finding an “elephant” at depth is for GGX to have wasted an estimated $250,000 for drilling this hole. However, in light of the potential to find something big, I think its well worth the bet to give Stargate II a shot.

In a few weeks, we will know how effective Stargate II really is and what difference it could make to modern exploration, and juniors deploying capital in a meaningful way. For both Ximen/GGX and Stargate, this hole could be history in the making.

According to ESSCO, one of the first test holes in Ontario by a public company using Stargate II was undertaken by St. Andrew Goldfields Ltd. (TSX: SAS) on their Hislop North Project. It was a deep vertical hole to test for the extension of the adjacent Primero Gold 147 Zone. St. Andrew Goldfields had drilled several unsuccessful holes in search of the elusive mineralized extension. When the Stargate II model was used, the deep vertical hole, although not drilled in exactly the recommended spot identified by Stargate II, still intercepted 10.38 g/t gold over 25 m. The hoped for results were achieved, predicted geological structures were confirmed, and the resource base was increased. Kirkland Lake Gold Ltd. (TSX: KL) subsequently acquired St. Andrew Goldfields.

Glenn mentioned that he also looked at the Dixie Gold Property in the Red Lake District of Ontario owned by Great Bear Resources Ltd. (TSX.V: GBR), which company has a current market capitalization of $184 million CAD with 39.4 million shares issued. Based on the data set generated from Stargate II over the Gold Drop Property, he believes that the anomaly could be twice as big as what at Dixie has been outlined thus far. If that turns out to be true, Ximen/GGX would do very well to follow Great Bear’s success since its August 22, 2018 announcement of a significant discovery.

Full size / Stock price performance of Great Bear Resources Ltd. following its discovery hole on August 22, 2018. Note that neither Glenn nor I am saying that such a success will also happen at Gold Drop as the identified anomaly still has to be tested with drilling and is merely a theory based on a new technology still under development and as such it may not be successful.

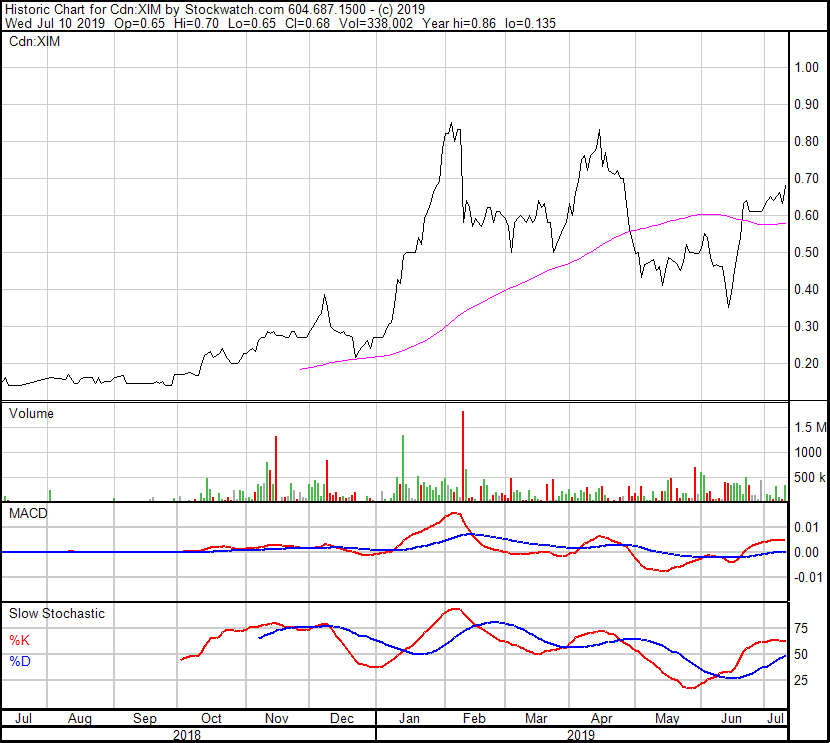

Technical Perspective

Link to updated chart (15 min. delayed): https://schrts.co/nVvegNqV

Company Details

Ximen Mining Corp.

888 Dunsmuir Street – Suite 888

Vancouver, BC, Canada V6C 3K4

Phone: +1 604 488 3900

Email: office@ximenminingcorp.com

www.ximenminingcorp.com

Shares Issued & Outstanding: 38,008,700

Chart

Canadian Symbol (TSX.V): XIM

Current Price: $0.68 CAD (07/10/2019)

Market Capitalization: $26 Million CAD

Chart

German Symbol / WKN (Tradegate): 1XMA / A2JBKL

Current Price: €0.454 EUR (07/10/2019)

Market Capitalization: €17 Million EUR

Previous Coverage

Report #13: "Ximen is pressing ahead aggressively with its goal of becoming a gold producer: Mining plan now revealed"

Report #12: "Ximen frees Kenville Gold Mine from royalty burden, making it more attractive for development"

Report #11: "The Beauty of High-Grade Gold (and Silver!): Ximen Cuts to the Chase, Expands Work Efforts on Multiple Properties in Southern British Columbia"

Report #10: “Ximen Mining: Paving the road(s) to success“

Report #9: “Ximen takes a shot at history, focuses on acquiring the Kenville Gold Mine“

Report #8: “Industry inquiries persuade Ximen‘s partner to re-assay drill core for tellurium“

Report #7: “Ximen Hires B.C. Mining Expert Dr. Mathew Ball“

Report #6: “Location is Key for Ximen‘s Treasure Mountain Project in Southern British Columbia“

Report #5: “The Unprecedented Gold-Silver-Tellurium Strikes in the Historic Greenwood Mining Camp Continue“

Report #4: “Record-Breaking Gold Hit in Southern British Columbia“

Report #3: “Strong drill results and appreciating precious metals prices may herald golden times for Ximen Mining“

Report #2: “Ximen Mining reveals striking drill core observations ahead of assays“

Report #1: “Ximen Mining: Hunting for Multi-Million Ounces in British Columbia“

Disclaimer: This report contains forward-looking information or forward-looking statements (collectively "forward-looking information") within the meaning of applicable securities laws. Forward-looking information is typically identified by words such as: "believe", "expect", "anticipate", "intend", "estimate", "potentially" and similar expressions, or are those, which, by their nature, refer to future events. Rockstone Research, Ximen Mining Corp. and Zimtu Capital Corp. caution investors that any forward-looking information provided herein is not a guarantee of future results or performance, and that actual results may differ materially from those in forward-looking information as a result of various factors. The reader is referred to the Ximen Mining Corp.´s and Zimtu Capital Corp.´s public filings for a more complete discussion of such risk factors and their potential effects which may be accessed through the Ximen Mining Corp.´s and Zimtu Capital Corp.´s profile on SEDAR at www.sedar.com. Please read the full disclaimer within the full research report as a PDF (here) as fundamental risks and conflicts of interest exist. The author, Stephan Bogner, holds a long position in Ximen Mining Corp., Golden Dawn Minerals Inc. and Zimtu Capital Corp. and is being paid by Zimtu Capital Corp. for the preparation, publication and distribution of this report, whereas Zimtu Capital also holds a long position in Ximen Mining Corp. and Golden Dawn Minerals Inc. Ximen Mining Corp. has paid Zimtu Capital Corp. to provide this report and other investor awareness services.

Contact:

Rockstone Research

Stephan Bogner (Dipl. Kfm.)

8260 Stein am Rhein, Switzerland

Phone: +41-44-5862323

Email: info@rockstone-research.com

www.rockstone-research.com