Goliath Resources Ltd. (GOT:TSX.V)released an interesting press release on August 15th that doubled the price of the shares in the next week. The company drilled a 718-meter hole, limited only by the constraints on the drill, that hit mineralized material right from surface for the entire length of the core. If it runs the expected gold/copper/silver/moly that they were finding on surface, it will go a lot higher.

I wrote about the company a little over a year ago. The shares were new then and twice what they are now even with the latest results.

Goliath is drilling the Lucky Strike property. So far they have completed one hole and are in the midst of drilling the 2nd hole. The 2nd hole is planned for about 700 meters. This initial drill program will have three holes.

They are paying the vendor $989,000 over a five year period and have a $6.5 million work commitment to own 100% of the project.

The company has 68 million warrants outstanding at an average exercise price of $0.19 so any initial success will cash up the company with over $13 million in cash so the work commitment will be no problem.

From a technical point of view, it would appear the initial hole at Lucky Strike was a home run. The core is being cut and will be off for assay shortly. Results will be back by mid-October so until then the grade is an interesting mystery.

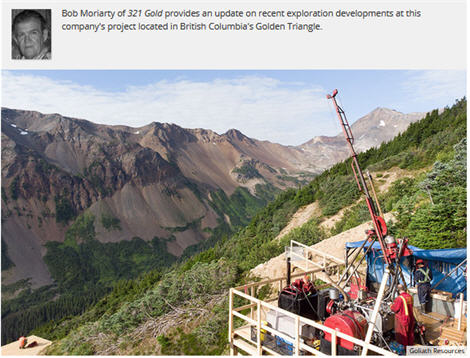

The Lucky Strike project is surrounded by porphyry and lies near the Golden Triangle of Northern British Colombia. While it is greenfield exploration, the intercept shows good understanding of the technical issues. Soil samples taken in 2018 and earlier this year support the potential for a massive system.

Goliath is not intending to take anything to production. They want to do the initial geochemical and soil samples to support the drill program and with any success joint venture the project to any interested major.

I would guess the majors would be looking real hard at the core to think of doing a deal. Since Goliath has to spend $6.5 million anyway, I would expect any initial success to be followed up with a lot more drilling prior to doing a deal.

Goliath was an advertiser before but is keeping all their cash for the drill program so are not currently an advertiser. Based on what seems to me to be an excellent start to the drill program, I have gone out into the market to buy shares so I am biased. They are doing an excellent job of communication so I would encourage any potential investor to spend a lot of time researching the company and the project.

Goliath Resources

GOT-V $0.11 (Aug 21, 2019)

GOTRF OTCBB 110.4 million shares

Goliath Resources website.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Goliath Resources. Goliath Resources is a former advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.