Last week, Drone Delivery Canada Corp. (FLT:TSX.V; TAKOF:OTCQB) (DDC), announced the completion of a high-tech Commercial Operations Center (COC), in Vaughan, Ontario. The COC is open and ready for business. This is a very important milestone for DDC.

The state-of-the-art COC is a 16,000-square-foot (~1,486-square-meter) facility that, when at full capacity, can manage up to 1,500 drones at once. With the COC complete, and in partnership with Air Canada's (AC:TO; $12 billion market cap, $6 billion in cash) Air Canada Cargo (ACC), DDC hopes to announce multiple customer wins in the coming months.

Michael Zahra, company president and CEO, was quoted in last week's press release: "Our operations center, the first of its kind globally, will be scalable to 1,500 drones and routes. On average, we anticipate charging a licensing fee of $10,000 per drone, per route, per month. With the high level of technical automation, our patented FLYTE system and new operations center, we will lower customer logistics costs, resulting in a high-margin business segment with predictable, recurring revenue."

Over nearly six years, DDC has earned widespread trust and support of key regulatory bodies and community leaders. In addition, management has made a great leap forward in proving its business model's technical and economic viability with tremendous stamps of approval from AC and Transport Canada.

All of this, while maintaining its first mover advantage, expanding its sights to international markets, pursuing lucrative software licensing deals, maintaining a strong balance sheet and hiring world-class talent.

Air Canada Agreement a game changer

As a reminder, DDC entered into an agreement with AC whereby ACC will market and sell DDC's drone delivery services using ACC's marketing and sales platforms. This is perhaps the biggest news in the company's six-year history.

Securing AC, a leading North American airline, as an exclusive partner (exclusive for Air Canada; DDC can work outside of the agreement) is an outstanding achievement. For ACC to outsource drone delivery really goes to show how difficult and time-consuming it is to plan, develop and operate a drone delivery logistics platform.

DDC will build and operate up to 150,000 delivery routes in Canada. DDC's services will be marketed as a premium offering. ACC has agreed not to use any other drone delivery service providers. ACC has agreed to sell, market and promote DDC's services on agreed routes, leveraging ACC's expertise in the cargo world, brand presence and sales network.

DDC, with these crucial stamps of approval, can save companies and government agencies years and tens of millions of dollars in getting to market with drone delivery logistics.

First commercial customer announced

On Sept. 10, DDC announced that, with the assistance of its sales agent ACC, it entered a commercial agreement with manufacturing company Vision Profile Extrusions (Vision; private) to deploy a drone delivery solution between Vision's properties in Vaughan, Ontario. This sounds like DDC's depot-to-depot service.

DDC will deploy drone flight infrastructure at the Vision sites and use its proven Sparrow cargo drone on defined routes already approved by Transport Canada. Flights will be remotely monitored from the new COC. Services to Vision are expected to begin in the fourth quarter.

CEO Zahra commented: "We are pleased to be working with Vision and our sales agent ACC to roll out our first commercial project using our Sparrow model drone, patented FLYTE system, and newly built commercial operations center. We expect this to be the first of many agreements to come globally."

Major logistics companies and retailers want drone delivery

Multibillion dollar logistic companies like UPS, retailers like Walmart, and pharmacy giants like Walgreens have so much to gain, at negligible upfront cost, from drone delivery logistics. Fast, reliable, safe, green—delivery will be a distinct competitive advantage for those who can offer it.

If speed to market is critical, partnering with, or simply retaining DDC's services, might be the very best way to gain access to commercial drone delivery logistics in Canada. The AC agreement clearly demonstrates this important point.

Management's goal is to win 200 (20%) of the ~1,000 remote communities in Canada over the next five years. So far, one community has signed on for an estimated $2.5 million per year. That implies a run-rate of hundred(s) of millions per year from 2023 or 2024 on.

Remote communities are just one of at least three revenue streams

Yet DDC is not just a one-revenue-stream company, in fact, it's not a two revenue stream company. There are at least three ways DDC will generate revenue and (eventually) profits.

First is the remote communities already mentioned. Second is DDC's share of the economics from the DDC/ACC agreement. Third is licensing DDC's patented software to multinational companies and foreign government agencies.

Management has not revealed much about global licensing opportunities, but that segment could have the highest margins. I don't know how large a portion of revenue that DDC could demand in a licensing deal, but I bet it's more than 5%. Five or ten percent of drone delivery (logistics) revenue from another country's FLYTE system users could become material over time.

Combined, these three revenue streams are poised to soar. I think revenue growth could be north of 100% per year for four or five years from 2020, as DDC rolls out in up to 200 remote communities plus 1,500 initial "railway in the sky" routes with ACC. Importantly, success in any segment will serve as a valuable marketing tool to cross sell delivery logistics around the world.

Consulting group Research & Markets forecasts that the overall commercial drone market will reach CA$38 billion in 2027. Assuming a 5x enterprise value to revenue (EV/Rev) multiple, each 0.1% (1 out of 1,000) of the estimated CA$38 billion in industry revenue that DDC can capture would be worth about $1 per share.

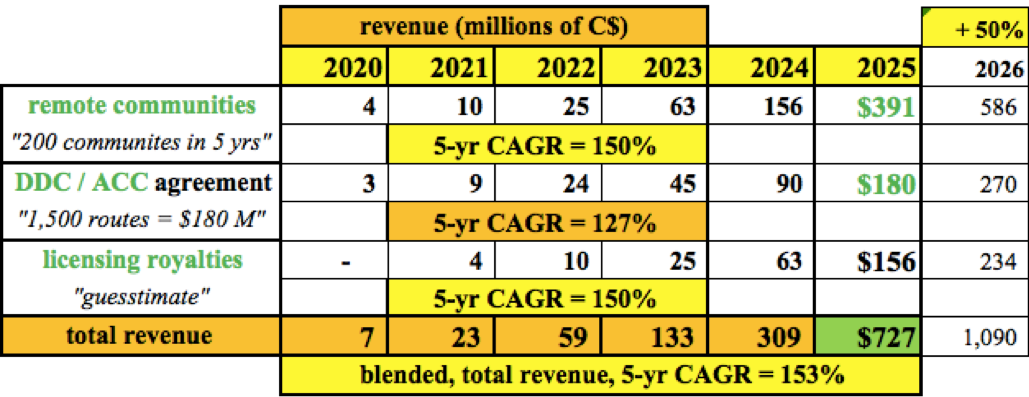

In the chart I show, for illustrative purposes only, possible revenue ramp-ups over the next several years. Management is targeting 20% penetration of roughly 1,000 remote communities by about 2025 or 2026. The first announced community is expected to generate $2.5 million per year once fully up to speed.

The DDC/Air Canada Cargo agreement contemplates an initial 1,500 routes, but with no timelines attached. I assume the 1,500 routes are operational in 2025, generating an estimated $180 million that year. Finally, I estimate licensing revenue (royalties) to grow at a 150% compound annual growth rate (CAGR) starting in 2021, reaching $156 million in 2025.

Total revenue in this hypothetical scenario, is $727 million. Even if revenue growth is more than halved in 2026 to 50%, one can see that the numbers could be quite substantial as soon as 2024. Even if everything gets pushed out a year, $309 million in 2025 would still be larger than that of any cannabis player to date. (Canopy Growth had trailing 12-month revenue of $291 million, it has an EV of $12 billion.)

Can DDC be compared to cannabis sector opportunities?

I'm tracking 310 cannabis- and hemp-related names. The top 20 have an average enterprise value (EV; market cap + debt – cash) of $3.1 billion and trade at an average EV to trailing 12-month revenue ratio of 33 times. Only six of the top 20 were EBITDA-positive (earnings before interest, taxes, depreciation and amortization) over their respective trailing 12-month periods.

It's highly uncertain how many cannabis and hemp companies will thrive next decade. Costs are unquestionably going up, while most product prices are clearly going down. There will be winners and losers, but far more losers.

By contrast, DDC is one of a handful (albeit few, if any, public companies) with a fully integrated drone delivery logistics software platform. Readers should recognize that almost all other publicly traded drone companies are either hardware/components manufacturers or (non-delivery) service providers. These categories have minimal barriers to entry; they're ultra-competitive, cutthroat businesses.

If DDC could generate $12 million in revenue next year, it would be trading at ~15x revenue. Unlike drone hardware and (non-delivery) service providers, DDC is expected to enjoy fat margins and recurring revenue. The market handsomely rewards companies with those attributes.

Consider precious metals royalty and streaming companies like Franco-Nevada Corp. (FNV:TSX; FNV:NYSE), Wheaton Precious Metals Corp. (WPM:TSX; WPM:NYSE), Osisko Gold Royalties Ltd. (OR:TSX; OR:NYSE) and Sandstorm Gold Ltd. (SSL:TSX; SAND:NYSE.MKT). That sector is trading at an average ~36x trailing 12-month EBITDA.

Conclusion

The Drone Delivery Canada story has been substantially, but never entirely, de-risked. Potential deep-pocketed competitors like Amazon have failed to dominate drone delivery like everyone thought. Previous potential competitor Air Canada Cargo has joined forces with DDC. Commercial revenue is at hand, but ramp up with take time.

Significant revenue appears on the horizon (not beyond visual line of sight!). At some point, three revenue streams will come together, each potentially growing at >100% per year. A tipping point will occur, perhaps in 2022 or 2023, when revenue and EBITDA start to soar. No one knows when this might happen, and it's not a sure thing, but it's looking increasingly likely.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Drone Delivery Canada, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Drone Delivery Canada are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock options in Drone Delivery Canada, and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.