Technical analyst Clive Maund explains why he believes this company with projects in Thailand and Indonesia is about ready to start another upleg.

Pan Orient Energy Corp. (POE:TSX.V) presents an overall positive picture of a stock that is probably on the verge of breaking out of a large base pattern. On its 6-month chart we can see that it is definitely in an uptrend, within which it has been consolidating for about 10 weeks now. The sharp intraday drop about a week ago, which left behind a bullish "dragonfly doji" on the chart, marks the likely end of the correction / consolidation phase, and with the 200-day moving average pulling up beneath the price, it looks about ready to start another upleg. The recent volume pattern is favorable, with good upside volume that drove the accumulation line to new highs, a positive sign.

The 10-year chart reveals that a large Double Bottom formed in Pan Orient from early 2016 through late 2018, and the price now appears to be consolidating ahead of an attempt to break out of the entire base pattern which will be signified by a breakout above the resistance level shown which extends up to a little above C$2.50.

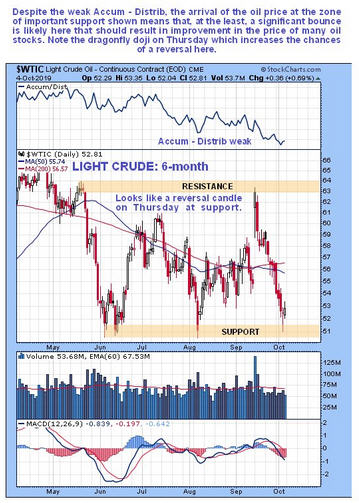

It is regarded as a good sign that Pan Orient has only reacted back modestly as the price of oil has reacted back quite sharply to an important support level shown on the 6-month chart for Light Crude below that has a good chance of generating at least a temporary reversal in the oil price, which will of course, should it happen, have a beneficial effect on the price of many oil stocks.

Pan Orient is therefore viewed as being at a favorable entry point here, and a stop may be placed just below the intraday low of the dragonfly candle at, say, $2.08.

Pan Orient Energy website.

Pan Orient Energy Corp. POE.V, POEFF on OTC, closed at C$2.26, $1.73 on 4th October 2019.

Originally posted on CliveMaund.com at 1.25 pm EDT on 6th October 2019.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.