.jpg)

You have all heard me opine about the (un)dependability of rules-based investing in a managed market environment, where it is not kosher for a financial advisor to fire off a promotional tweet about their favorite stock but it is perfectly acceptable for a sitting president to fire off twelve tweets in a morning guaranteeing a "China trade deal" with the intent of triggering a torrent of algobot buy orders. The Twitterverse is rife with people like yours truly, who make a living out of attempting, sometimes successfully and other times abysmally, to provide followers with the slightest of "edge" with which to trade and compete—and that's fine—except where the author of the newsletter or tweet or e-mail blast actually believes that the "research" or "system" or "data set" they are following or executing is in any way, shape or form responsible for the outcome.

I have a flash for all of those megalomaniacal gurus: In a managed market littered with the corpses of free market capitalists, winning trades are 99% the result of a majestic matriarch smiling down upon you while blessing your fortunes, and she goes by only one name: Lady Luck.

In my very early days as a trainee in the 1970s investment industry, I befriended a young man who had been successful in building a very respectable book of business in a very short period of time. I will refer to him as "Larry." One day, after it was determined that I was too skilled as a "communicator" to stay and work on the bond desk in favor of "sales," I aked Larry how he built his business. Now, Larry wore wonderfully tailored clothing that was at once both conservative and natty, but I had the distinct impression that the red silk bowtie he wore was a clue to his originality, because in 1977, nobody with a Bay Street job wore a silk bowtie. Probing into his formula for success, I asked him to give me his methodology for attracting clients, and this is what he told me.

"Get a list of really high-net-worth dumbass people that are terrified of gambling, typically doctors and dentists and farmers, who are too busy taking pulses or yanking molars or trudging through cow shit, and divide the list in half. Then take two of the most speculative penny resource stocks and assign the first stock to the first half of your dumbasses, then the second screamer to the second half. Get your pitch down to perfection on both stocks to the point where they both look like no-brainers. Then take the next week calling the two lists and making the pitches. Repeat this every week for a month and now you have eight groups to contact with a follow-up call."

"Brilliant!" I shouted, rising from my chair in my private "Eureka" moment. As I readied myself for departure, Larry quickly grabbed my suspenders and sat me right back down and said, "But you haven't heard the best yet. . .

"After both of your dumbass groups have heard the pitch, wait a month and then take a photocopy of the two share prices. One will be up sharply, with the other probably down the same amount. Take the list that wwas pitched the winner and separate it from the list that was pitched the loser. Take the loser list and sell it to the rookie broker in the next cubicle. Take the winner list and proceed to call them with the next 'big winner.' After they all open new accounts and give you all of their relatives' contact info, proceed to repeat the process."

All I could muster after hearing Larry's motivational lesson was a blank stare. As I struggled to try to feign awe at his message, I found myself confronting one of the great conundrums of the financial services industry. It all boils down to being a "numbers game." Whether you are a rookie stock salesman trying to woo new clients or billionaire money manager Ken Fisher describing his prowess with women and "the wealthy," if you are an average money manager but a superb marketer, you will be seen as a genius by way of your assets undermanagement as opposed to your financial acumen.

Now, if you are the chairman of the Federal Reserve Board, Jerome Powell, and you have just decided that your 2018 attempt at normalizing (shrinking) your balance sheet was a ghastly mistake, you now decide that "liquidity issues" (like Deutsche Bank' $46 trillion derivative book) demand that you inject $250 billion back into the system (after just removing it). You explain that we should not view the action as "quantitative easing” (QE), but rather as a something other than that. Now, since the commutative property of arithmetic says that if a = b, and b = c, then a = c, if "adding liquidity" = "the phony creation of money out of thin air with the wave of a magic wand," and "the phony creation of money out of thin air with the wave of a magic wand" = QE, then "adding liquidity" must equal QE. Ergo, what we have today is QE. It is not something other than QE; it is the "phony creation of money," and if you or I were to do that in our basements, we would be incarcerated for counterfeiting.

When stock markets smell counterfeiting, they usually rise sharply because, as you have all read here countless times, one should never underestimate the replacement power of equities within an inflationary spiral. Now, for the CNBC guest commentator that counters my argument with "but there is no inflation!", I volley back with this: The creation of $250 billion in POMO (permanent open market operations) is monetary inflation of the highest order. It is money printing and while it may be several trillion dollars less than the amount they used to bail out the criminal banks in 2009, it is still the same bubble-forming cocktail of bank-friendly "liquidity" that allowed their precious real estate collateral to recover while injecting steroids, amphetamines and hallucinogens into the global stock markets.

Most importantly, take all of the people who loves stocks and give them the "not QE" pitch, and then repeat for all of the seniors and savers and non-stock-investing citizens. Keep the former, and then sell the list of seniors and savers and non-stock-investing citizens to the rookie central banker in the next cubicle. Rinse and repeat and voila! No more financial crisis, ever. Isn't investing just grand?

Gold prices appear to be doing exactly what I feared back on Sept. 4; they are correcting. Having formed a near-perfect head-and-shoulders top in the mid-August to mid-September period, we were gradually working off the massively overbought conditions of July-August. Then the central planners swooped into action, using interventions and interference to paint an ugly tape complete with blurry images of a "blow-off top" and the dreaded "head-and-shoulders top" formation.

It only took an expansion of about 150,000 contracts to the aggregate net short position of the Commercial traders to dull the advance and turn the Large Specs from buyers to sellers. Since those contracts are really only "hedges" put on by producers, that makes the manipulation both believable and legitimate. Additionally, since the gold prices went through the roof back in 2009–2011 after the initiation of the first QE, gold cannot make the same move because Jay Powell assures you and me that this $250 billion liquidity ejaculation is really not QE. And because the algobots and the dumbass money managers believe him, the gold correction continues.

Notwithstanding the obvious sarcasm, this current backfilling in the gold chart is both a frustration for the diehard bulls, whose gnarling and gnashing of teeth are largely underappreciated, but also blessing for the patient bulls who took advantage of the mania of late-August/early September, removing a few well-earned chips from the table. Falling firmly into the latter category, I have replaced the unleveraged gold ETFs (GDX/GDXJ), while I am lining up reentry into the leveraged ETFs (NUGT/JNUG) with bids under the market. Judging from the relative strength index (RSI)/moving average convergence-divergence (MACD)/histogram setups, December gold is approaching the –30 oversold status last seen back in August 2018. If I can wager a guess, it should be later this month that we get the final flush that sets up the trade. No guarantees but a definite possibility. . .

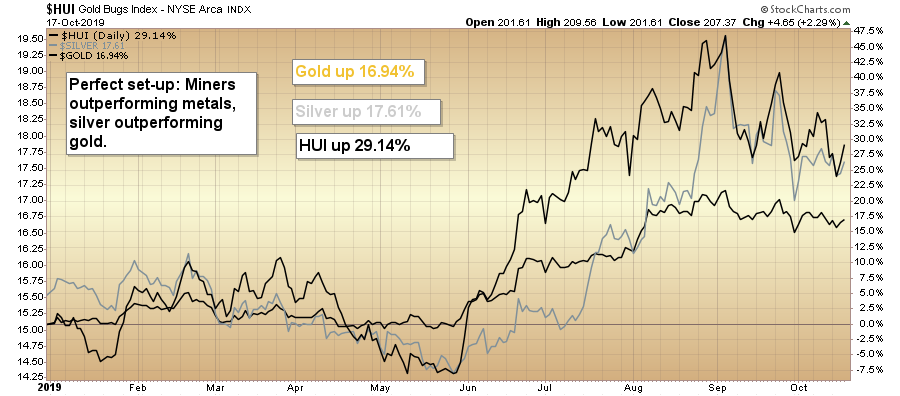

Silver is currently sitting 11.24% from the top, identified in this publication on Sept. 4 at $19.75, and is therefore solidly in correction mode. But as is normally the case with silver, it tends to have exaggerated moves once it gets "discovered" by the newbies. Despite the sharp pullback, it looks a tad healthier from a technical perspective than gold, and therefore the recommended short of the gold-to-silver ratio (GSR) from last July at 92.40 remains intact, with a 60 target some time in 2020.

I am currently long the December $18 calls from $0.23 (currently $0.22), and have enough buying power to quadruple the position at the optimum time. I expect silver to outperform gold over the balance of 2019 and well into 2020. If there is to be a surprise in Q4/2019, it will be a plunge in the GSR, accompanied by a piercing upside probe by silver. I base this on the high levels of negative sentiment still despite the shiny metal up 13.36% year-to-date, a respectable showing by any measure.

As you all know, I let the relative performance of the assets that exist in my world do the talking. It is like the "Dow Theory" of precious metals investing, where one component either outperforms or underperforms relative to another, setting up possible confirmations or non-confirmations of the bull or bear case. In our space, the mining stocks absolutely must outperform the metals for there to be a bona fide bull market in the mining shares, but there have been rare occurrences where mining shares reacted to gold-friendly events in odd ways, such as in the 1987 market crash and the 2008 market crash, where liquidity needs sent the entire investing worlds to the sidelines in search of safety.

The absolute worst scenario of all for us is when consumer prices finally react to monetary inflation and begin spiraling upward. All inflation in every form comes as a result of reckless disrespect for savers, and arrives on sanctimonious platter of bull delivered with great fanfare by the bankers who would have us believe in their roles as saviors.

The banks are not today, nor have they ever in the past been, saviors. They have always been opportunists and they have always been an integral part of the politico-military-industrialist cabal that runs the world. Banks are exquisitely trained "middlemen," toiling in the insidious underbelly of world politics. As such, just as cockroaches fear the light, bankers fear gold, the ultimate harbinger of doom for the paperhangers.

The key to this counterfeiting exercise lies in secrecy and subterfuge. As long as the public is led to believe that inflation is "muted," then the distraction of trade wars and deficits serve to deflect the public mood away from the root problem of unresolvable debt and ultimate sovereign insolvency.

My hero in the newsletter business was the late and infinitely great Richard Russell, who always beseeched his subscribers to "follow the money," because at the end of every news event was an indefatigable trail leading to money. Just as we all learned in the pages of Atlas Shrugged, the outcome of exaggerated largesse in the form of patronage always manifests itself within the Halls of Political Crime, with the ultimate victims being the Middle Class, the ripest target in all of socio-economic history for plunder.

The irony here in 2019, soon to be 2020, is that since the 1990 release of the visionary work by John Naisbitt, Megatrends, in which he predicted the ascendancy of China's populace from poverty to the middle class status, the Western middle class, once the envy of the world and led by the American production machine, has now been replaced by a rising and far-more-powerful Chinese middle class, whose existence was largely denied through 5,000 years of history. The arrival is now not only complete, but also a definable threat to the standards of living for the rest of the non-Chinese world.

When I get into discussions with people over China, the older generation, of which I am a member, tend to fall into agreement with me in my assessment of the risks associated with allowing "invasive species" into any ecosystem. The younger generation accuse me of being a racist, intolerant of non-Caucasian immigrants to Canada and an incendiary voice in the racial debate.

Quite on the contrary, I am a historian, well learned in the outcome of unintended consequences. If a European rabbit is introduced into a Australian habitat, where no natural predators exist, vegetation will cease to thrive as the overabundance of rabbits will alter the ecosystem in a negative manner. Similarly, if you allow a culture that is the cultivator of the largest pollution machine ever created in the history of mankind (China), to spread to continents like North America, with attitudinal conditioning that carries little, if any, regard for dealing with garbage bags, you are, by default, welcoming their wealth (in selling them the $35,000 house you bought in Scarborough in 1964 for $925,000). But without conditions. When money governs the debate, there are no "conditions." And that is the problem facing us all. As Richard would say, in the China debate, were he still around, "Follow the money."

I want to own the mining shares for the majesty of bull moves such as the one we experienced in the middle part of 2019, but I do not want to own them when "majesty" turns to "mimicry," and hundreds of cannabis and crypto bloggers descend upon the Twitterverse claiming to be the first to have "called the bottom." You want to wait until their Ritalin runs out and they flip on to their next deal, so that you can buy at the bottom what they bought at the top. Pretty easy stuff. . .

Before I launch myself into an invective concerning the U.S. equity markets, let me state for the record that I am the walking embodiment of the "anti-Kudlow"; I love gold and I hate stocks. However, Larry Kudlow is far more important than I could ever dream to be. Therefore, he has the innate ability to tell Donald Trump to "press the button," and by that I do not refer to the nuclear button so popularized in the Cold War movies such as Dr. Strangelove and Fail Safe.

The United States National Security Agency has been empowered to ensure that stocks remain a key component of the U.S. citizens' "security" and, as such, they must remain elevated at all times. Rather than drop cash from helicopters, the American banking cartel has trained the American investor class in the well-honed art of "Buying the Effing Dip." By doing so, they have turned the socialist habit of wealth distribution—an inverse financial Robin Hood of taking from the poor and giving to the rich—into a capitalist video game where no matter what happens, you are going to be handed a windfall by the government.

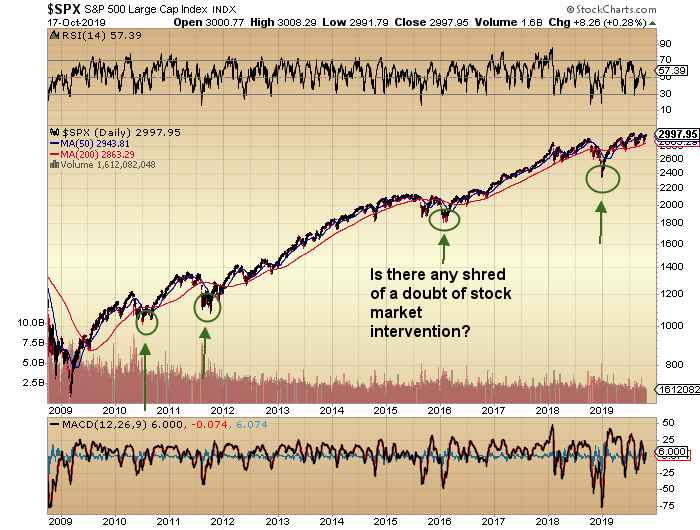

The "button" is the Working Group on Capital Markets, and the finger is the Secretary of the Treasury, Stevie Mnuchin, who openly admitted last Dec. 22 that he was calling a meeting of the Working Group (otherwise known as the "Plunge Protection Team" or PPT) in order to "calm" the markets, which had been in a kamikaze dive of terrifying proportion. Needless to say, that was with the S&P at 2,346 and here we are, a mere ten months later, at 2,977.95 despite the global economic slowdown, emergency REPO actions, POMO, impeachment proceedings and astronomical debt levels everywhere.

Now that strikes me as somewhat bizarre. Before you allow your intractable bearish leanings to play out in the form of "getting short," think twice.

Maniacal rants set aside, history would show that purchases of common stocks during the last two weeks of October have proven to be the most timely of purchases for the investor class. Going into an election year, you can bet that DJT will be wearing out the Tweet button with stock-friendly color commentary on a par with Kudlow and Cramer (or any regional Fed governor).

So, for a gold bull and stock bear, the evidence is ample enough to trigger a put-buying extravaganza, along with a basket of shorts on your favorite growth (pumped) stocks, especially for the Millennials out there whose terminal case of recency bias has them planning for the same air pocket that they experienced this time last year.

The problem remains, for the bears, that sentiment is really not that ebullient, with AAII reporting only 20.3% bulls versus 44% bears. In terms of sentiment, this is not a setup where puts and shorts will be rewarded. What we bears need is a rip-roaring breakout to all-time highs that swings the AAII needle to 50-60% bulls, after which valuations will be in nosebleed territory and the probability of winning vastly improved.

As I wrote in September, I have the feeling that the PPT, with DJT at the helm, is going to go all-out in making damn sure that we have a booming stock market going into 2020, so that his re-election chances don't suffer from the "It's the economy, stupid" misfortune suffered by George Bush in his reelection run against Bill Clinton. This time, DJT will be in the "It's the S&P, stupid" frame of mind, as he waves the magic wand of presidential authority over the American stock indices and also over the metals markets. Rampaging gold and silver will be a distraction for the voting public, and that is not good, with The Donald screaming and shouting and waving his arms as he points to the all-time high on the S&P.

Lastly, I have recently invested in two juniors that have defined resources of gold and/or silver, Aftermath Silver Ltd. (AAG:TSX.V) and Goldcliff Resource Corp. (GCN:TSX.V) I did so because, in addition to their exploration potential, their properties had defined resources of either gold or silver or both.

As I wrote about last summer, to have called the gold and silver rally as accurately as I did this year, with enormous gains in the miner ETFs, GLD and SLV call options, and the physical metals themselves—only to see the junior explorcos in the portfolio (Getchell Gold Corp. [GTCH:CSE] and Stakeholder Gold Corp. [SRC:TSX.V]) stay absolutely dead in the water despite breathtaking advances in companies like Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTCQX) ($2.33 to $9.04)—was for me, a sore point. To be so right, and at the same time so wrong, because I was right in theory but wrong in execution, is maddening.

Markets rewarded every miner on the board except those looking for metal. Accordingly, it is with great delight that Getchell Gold yesterday announced the acquisition of the Fondaway property in Nevada, which brings over one million ounces of gold to GTCH for less than 20% dilution and a manageable cash cost. Getchell management must have been reading my words of frustration last summer, because after they drilled their #1 target (Hot Springs Peak) and discovered that the massive IP anomaly was devoid of gold and/or silver, they put the drills away and focused totally on securing an asset that will serve to underpin GTCH's share price to the movement of the gold price.

Now, unlike last year, the company can see upside from three areas: 1) gold price advances; 2) exploration success; and 3) reclassification of the resource. At CA$0.11, assuming 20% dilution on top of the 52 million shares (f.d.) already issued, Getchell is priced at $7.21 per ounce of gold (Kitco uses $40/ounce as the benchmark). Therein lies the opportunity for value-driven gold bulls.

This transaction is reminiscent of the late '70s, when I was shown a little silver company that had a small resource in the Yukon but with a production cost around $15 per ounce of silver. In 1978, with silver at $6 per ounce, nobody dared take a stab at the little junior, but at $0.25 per share, my grey-haired, cigar-chomping, whiskey-drinking mentors were inhaling the stock for a four-month period (as was I). After that, silver did a funny thing: it took off. In late '79 with the Hunt brothers trying to corner the silver market, prices exploded into the $20s, then $30s and finally $50, during which time, we were serving up steaming helpings of our little silver deal at prices north of $20 per share.

You see, that sub-economic silver deposit in 1978 got "skated onside" by the underlying commodity, and that is doubly exciting for Getchell and the Fondaway property, because it is already advanced far enough that a preliminary economic assessment will be just around the corner, with only a smattering of drilling required.

The setup is ideal for the gold bull, because GTCH offers tremendous leverage to the gold price, along with a tremendous land package, all within the Getchell Trend of Nevada, which will be important when sentiment goes "crypto-weed" and explorcos finally become the darlings of the Millennials.

I'll have another portfolio update after month-end with a few significant changes, so until then, you can follow my vitriolic rampages on Twitter (@Miningjunkie), which provide, from time to time, equal dollops of humor and trading ideas, as well as exotic recipes for self-medication and recreational delight.

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.