Technical analyst Clive Maund charts the longer term picture for silver.

Like gold, silver has been in a corrective downtrend following its peak early in September, and it looks like it has further to run before its done, partly of course because we have a downside target for gold in the $1360–$1400 area before it turns up.

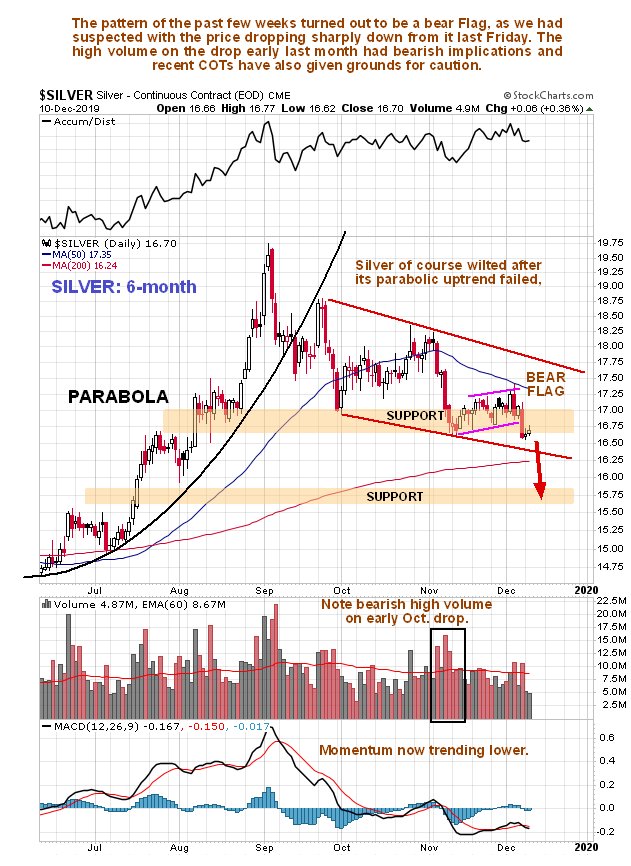

On the 6-month month we can see how it has been stumbling lower within a downtrend and it looks like it will break down through the lower boundary of this downtrend to drop to a final downside target probably at support in the $15.30–$15.60 area. It outperformed gold during the summer run up and has underperformed on the subsequent reaction, which is normal, and as we know, silver is weaker than gold during the early stages of a bull market, so this near-term downside target seems reasonable.

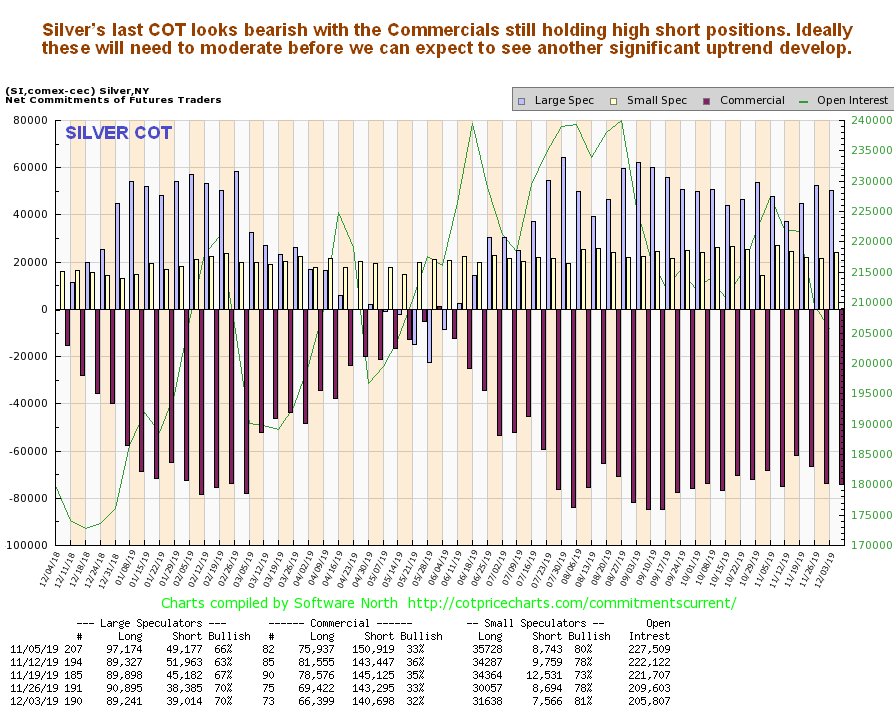

The last COT chart suggests that further losses are on the cards for the near term. Commercial short positions are still high and ideally these will need to moderate before another significant uptrend can develop.

Click on chart to pop-up a larger, clearer version.

The 10-year chart, like that for gold, presents a positive picture, While weaker than gold in the recent past of course, this chart shows silver rallying off the second low of a giant Double Bottom on strong volume in the summer, which is bullish, before reacting back. This reaction should present another good opportunity to load up on silver investments before the next major upleg starts.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.